Get the free Returned Check Notice Template

Get, Create, Make and Sign returned check notice template

Editing returned check notice template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out returned check notice template

How to fill out returned check notice template

Who needs returned check notice template?

Returned Check Notice Template Form: A Comprehensive Guide

Understanding the returned check notice

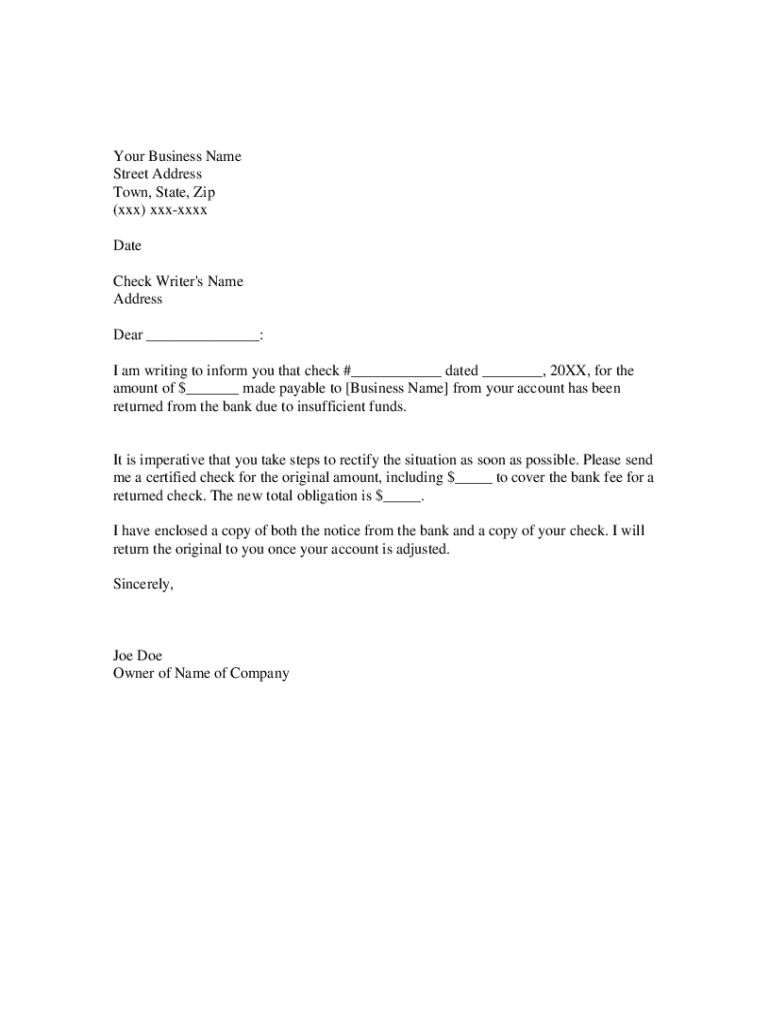

A returned check notice is a notification sent to an individual or business when a check they issued has bounced, meaning it could not be processed due to insufficient funds or other reasons. The primary purpose of this notice is to formally inform the recipient about the issue, request payment, and outline the necessary steps for resolution. It is a critical financial communication that ensures both parties understand the implications of the returned check.

Utilizing a standard template for a returned check notice is vital for ensuring consistency and professionalism in communication. By doing so, you can avoid misunderstandings and establish a clear path for debt recovery. Moreover, this form plays a crucial role in the legality of the transaction, making it essential for both individuals and businesses to handle such documents with care.

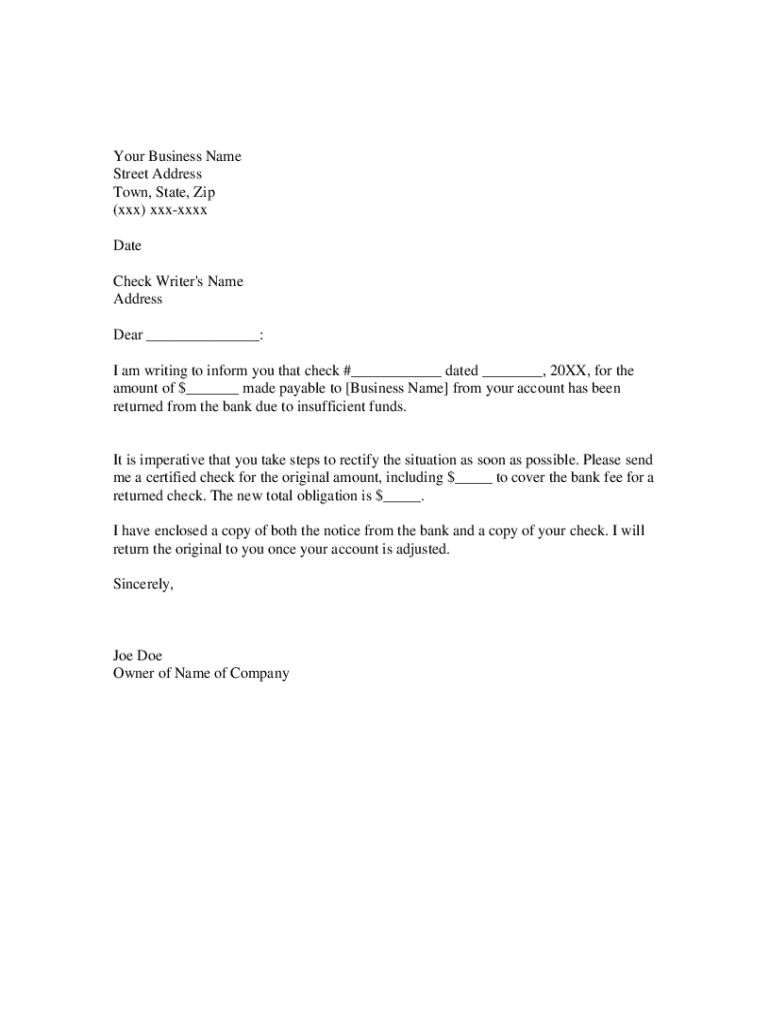

Key components of a returned check notice template

A well-constructed returned check notice template should include several essential elements to ensure it serves its purpose effectively. These components are crucial for clear communication and legal validation, thus making it easier for the recipient to understand their obligations.

Some key elements to include in your returned check notice template are detailed sender and recipient information, the date of the notice, specific check details (such as the check number, the amount, and the date issued), and the stated reason for the check return. Payment instructions must be clear, indicating how the recipient should rectify the issue, while a warning about the consequences of non-payment can serve as a motivation for prompt action.

Customization is also essential, depending on whether the notice is for personal or business use. Different states may have specific requirements that should be adhered to in order to ensure legality.

How to fill out the returned check notice template

Filling out a returned check notice template can be a straightforward process if you follow a step-by-step approach. Start by downloading the template from pdfFiller, where you can find an easily editable version. The first step is to fill in the sender's information, clearly indicating who the notice is coming from.

Next, you will detail the recipient's information, ensuring correct names and addresses are provided. Be meticulous when specifying relevant check details, including the check date, amount, and number, as inaccuracies can lead to confusion or ineffective communication.

Once you've filled out the template, review it for any errors, ensuring that all information is accurate and complete. An example of a completed returned check notice can serve as a helpful guide throughout this process.

Editable features of the template

The returned check notice template available at pdfFiller is equipped with interactive editing tools, allowing users to customize their documents according to their specific needs. You can easily modify the layout and design of the template to fit your personal or brand style, ensuring that your notice reflects a professional appearance.

Additionally, the platform offers a robust feature for adding personal signatures quickly. This not only enhances the authenticity of your notice but also hastens the communication flow. Furthermore, pdfFiller supports collaboration options that let team members work together in real-time, making it especially useful for businesses.

Managing returned check notices with pdfFiller

Managing returned check notices can often be a complex task, but pdfFiller provides an organized and efficient way to handle this process. All notices can be securely stored in the cloud, allowing for easy access and retrieval while ensuring data safety. This feature helps maintain an organized record of all transactions, making it easier to track payments and notice statuses.

Additionally, pdfFiller facilitates effective tracking of both sent and received notices. Users can monitor payment responses and conduct follow-ups as necessary, allowing for a proactive approach to debt recovery. With built-in analytics, users can gather insights on their document management processes, identifying trends and opportunities for improvement.

Frequently asked questions about returned check notices

It’s not uncommon for questions to arise when dealing with returned checks. Some concerns may involve the legality of sending a returned check notice or the specifics surrounding what to do next. Many people wonder how this document affects their obligations and whether additional actions are needed to resolve the situation.

Addressing these common concerns is critical for both parties involved in a returned check scenario. Providing clarity around legal questions can help all parties understand their rights and responsibilities, ensuring compliance with state laws and regulations. Furthermore, tips for navigating this process foster smoother interactions and minimize conflicts.

Additional tools and resources from pdfFiller

PdfFiller is not just limited to returned check notices; it offers a comprehensive suite of document management tools that can streamline various office needs. You may integrate other document types into your workflow to create a more holistic approach to document management.

The eSignature feature enables fast processing, allowing parties to sign documents electronically without the hassle of printing and scanning. Furthermore, pdfFiller’s mobile version ensures that you can manage documents on-the-go, providing accessibility whenever you need it. Learning from case studies showcases the successful resolution of returned check issues, offering real-world insights that enhance understanding.

Importance of timely communication regarding returned checks

Timely communication is paramount in the situation of returned checks. Engaging in effective conversation not only addresses the issue directly but also can significantly influence the rate at which payments are recovered. Clearing up any misunderstandings quickly allows recipients to take appropriate action, thereby minimizing potential fallout.

Moreover, a quick reaction can prevent escalation, maintaining a professional and trust-building atmosphere between parties. Communicating with professionalism through a well-structured notice demonstrates respect for the recipient and encourages positive responses, which is essential for effective financial management.

Conclusion: Streamlined document management with pdfFiller

Managing returned checks and the associated documentation doesn't need to be a daunting task. With pdfFiller, the process is simplified, driving efficiency and enhancing user experience. The extensive tools and features available empower users to create, edit, and manage returned check notices seamlessly from a single cloud-based platform.

By utilizing pdfFiller, individuals and teams can navigate the complexities of document management with ease, ensuring that they are equipped with every resource needed for successful financial communication and recovery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the returned check notice template electronically in Chrome?

How can I edit returned check notice template on a smartphone?

How do I edit returned check notice template on an Android device?

What is returned check notice template?

Who is required to file returned check notice template?

How to fill out returned check notice template?

What is the purpose of returned check notice template?

What information must be reported on returned check notice template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.