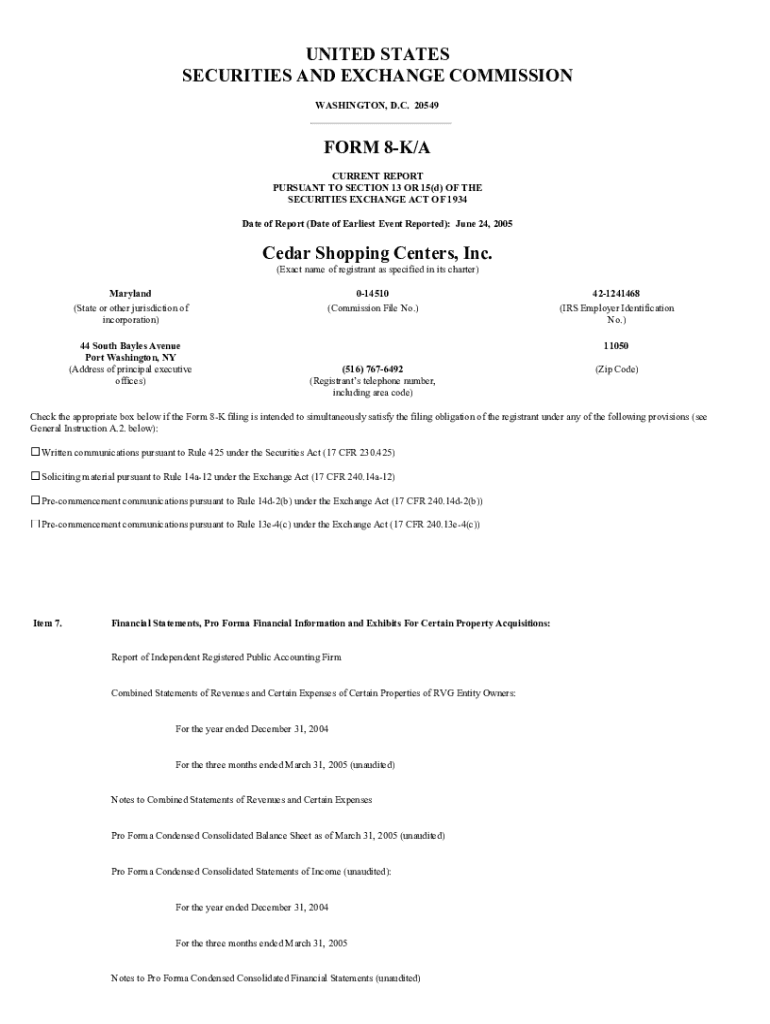

Get the free Form 8-k/a

Get, Create, Make and Sign form 8-ka

Editing form 8-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-ka

How to fill out form 8-ka

Who needs form 8-ka?

Understanding Form 8-K: A Comprehensive Guide

Overview of Form 8-K

Form 8-K is a critical document required by the Securities and Exchange Commission (SEC) for public companies in the United States. This form serves the primary purpose of informing investors and the public about significant corporate events that may affect a company's financial position or operations. The significance of Form 8-K lies in its role as a tool for corporate governance, ensuring transparency and timely communication with stakeholders.

Key stakeholders involved in filing Form 8-K include corporate executives, legal advisors, and compliance officers. These individuals work collectively to ensure that disclosures are accurate and timely, reflecting any material changes that could impact investor decisions.

When Form 8-K is required

Certain triggering events necessitate the filing of a Form 8-K. These events include, but are not limited to, mergers and acquisitions, changes in control of the company, and significant management decisions. Each of these scenarios bears potential consequences for shareholder value, warranting immediate transparency.

Examples of common scenarios requiring Form 8-K include the completion of a merger (Item 2.01), bankruptcy filings (Item 1.03), or significant changes in management (Item 5.02). Understanding how Form 8-K compares with other SEC filings, such as Form 10-K or Form 10-Q, is essential for stakeholders. While Form 10-K provides an annual overview and Form 10-Q covers quarterly results, Form 8-K captures significant, immediate changes.

Detailed structure of Form 8-K

Form 8-K consists of several items, each pertaining to different types of events. Each item must be completed based on the specific circumstances of the filing company. A breakdown of key items includes:

Reading and interpreting Form 8-K

Effectively analyzing Form 8-K filings requires a keen understanding of the document's nuances and the potential implications of its disclosures. Investors should focus on the nature of events reported and how they may affect the company’s stock performance or long-term sustainability. For example, a report detailing cybersecurity breaches can induce significant concern among investors due to implications for company reputation and future profitability.

Common pitfalls to avoid include misinterpretation of the disclosures or overlooking the context in which they were made. Therefore, obtaining expert advice or analyzing multiple filings can help gauge the company's health and future prospects.

Historical context and changes in Form 8-K filing requirements

Over the years, Form 8-K regulations have evolved significantly. Initially, the form comprised fewer items and primarily addressed corporate governance. However, following the corporate scandals of the early 2000s, regulatory bodies mandated more stringent requirements to bolster transparency and protect investors.

Major amendments, such as those introduced by the Sarbanes-Oxley Act, expanded the scope of disclosures required under Form 8-K, ensuring that companies report material changes more comprehensively. This evolution underscores the need for public companies to maintain rigorous disclosure policies that adhere to the latest SEC guidelines.

Tips for filing Form 8-K

Ensuring compliance during the Form 8-K filing process is paramount for public companies. Best practices include appointing a dedicated compliance team responsible for monitoring potential triggering events and implementing standardized reporting procedures. Proper training for those involved in the filing process can also mitigate errors.

Common mistakes to avoid include failing to file timely reports, omitting necessary disclosures, and providing vague descriptions of events. Utilizing tools like pdfFiller can streamline the filing process, offering features for document editing, eSigning, and archiving, which can greatly improve efficiency.

Interactive tool: Form 8-K filing checklist

An effective way to prepare for a Form 8-K filing is using a structured checklist tailored to the specific circumstances of the company. This checklist helps ensure that all essential components are captured and reviewed prior to submission. Users can customize their checklist, selecting items relevant to their situation and ensuring that no critical details are overlooked.

Interactive tools available through pdfFiller can provide templates, reminders, and tips, enhancing the filing experience across various scenarios and ensuring compliance with regulations.

Case studies of Form 8-K filings

Analyzing notable Form 8-K filings can yield insights into best practices and potential pitfalls. For instance, a well-executed Form 8-K filing might involve a major acquisition announcement, clearly outlining the strategic rationale and anticipated benefits for shareholders. Conversely, problematic filings can arise from vague disclosures surrounding management changes, leading to confusion and stock price volatility.

By examining several real-world examples, stakeholders can learn how thorough documentation and precisely communicated information facilitate trust and confidence with investors, thereby optimizing market reactions.

Frequently asked questions about Form 8-K

Having clarity on Form 8-K is essential, as misunderstandings can lead to non-compliance and legal issues. Common concerns include which events mandate a filing, who within the company is responsible for the filing, and the implications of failing to file accurately.

Addressing misconceptions—such as the belief that only CFOs should file—is vital. In reality, multiple stakeholders play a part in ensuring the filing reflects the company’s most current developments accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8-ka online?

How do I edit form 8-ka straight from my smartphone?

How do I complete form 8-ka on an Android device?

What is form 8-ka?

Who is required to file form 8-ka?

How to fill out form 8-ka?

What is the purpose of form 8-ka?

What information must be reported on form 8-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.