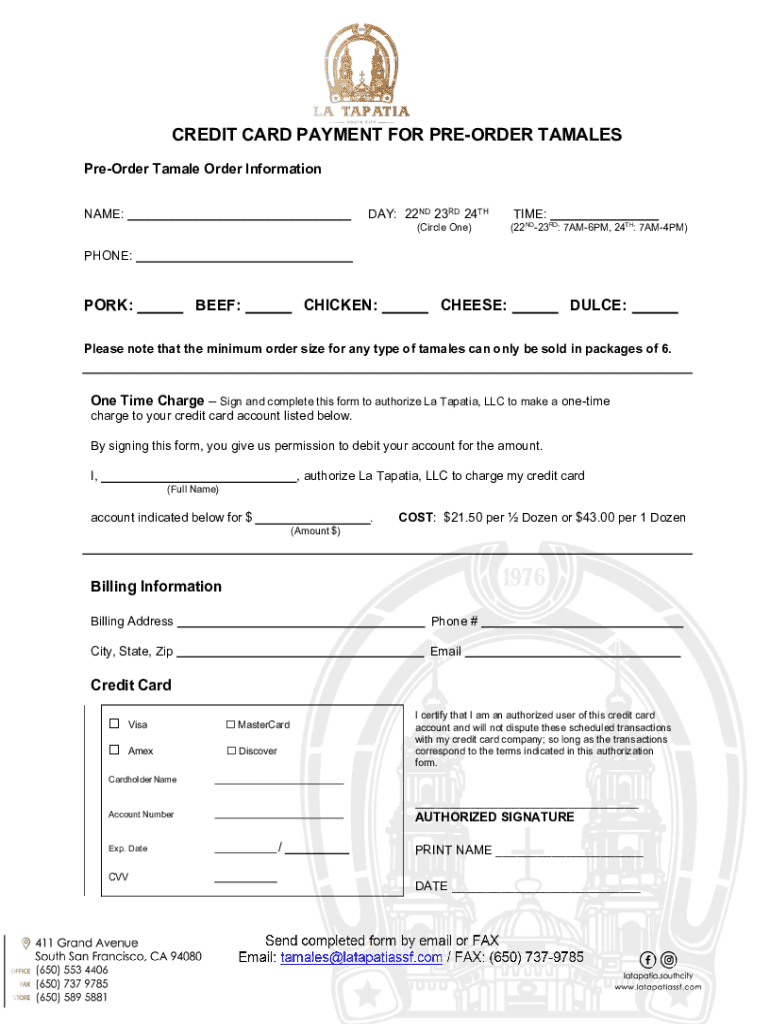

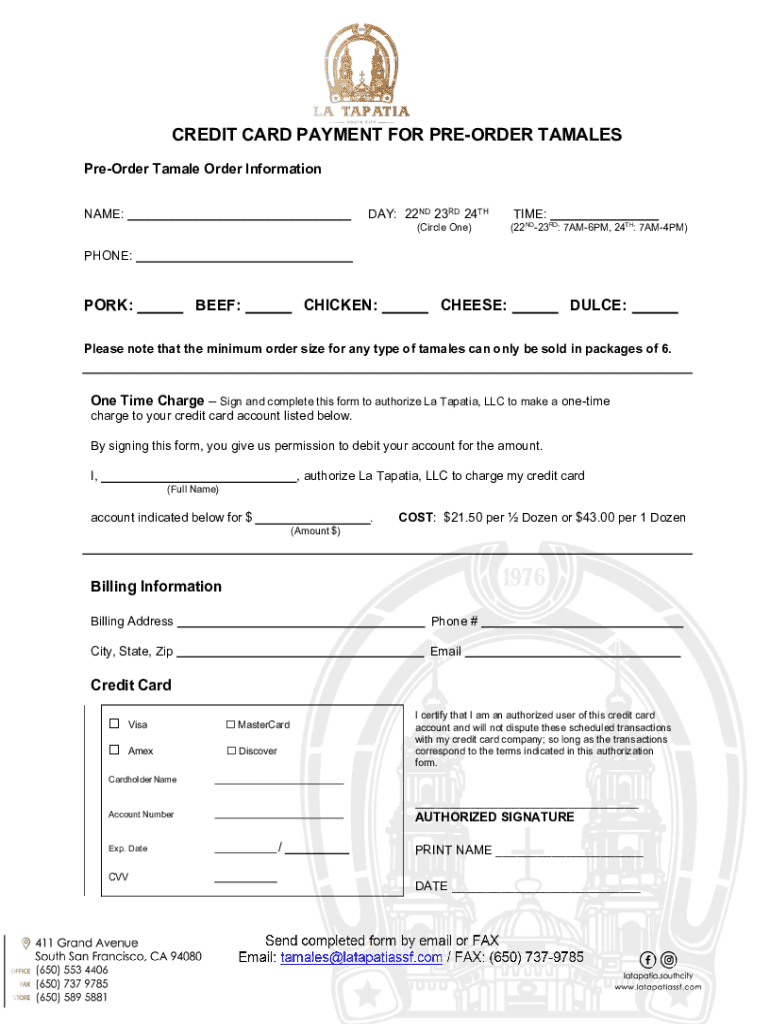

Get the free Credit Card Payment for Pre-order Tamales

Get, Create, Make and Sign credit card payment for

How to edit credit card payment for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment for

How to fill out credit card payment for

Who needs credit card payment for?

Comprehensive Guide to Credit Card Payment for Forms

Overview of credit card payments for forms

Credit card payments in the context of forms refer to the online processes that enable users to securely input their credit card information to complete a transaction. This method is crucial for businesses and organizations aiming to facilitate seamless online payments. By offering credit card payment forms, companies can enhance customer satisfaction and streamline their sales processes while reducing the hassle often associated with traditional payment methods.

The importance of integrating credit card payment forms into business operations cannot be overstated. They not only provide convenience for customers wanting to pay quickly and effortlessly, but they also allow organizations to modernize their payment processes. By embracing this technology, businesses can keep pace with consumer expectations and trends in e-commerce, ultimately leading to increased sales, donor transactions, and membership sign-ups.

Understanding credit card payment forms

A credit card payment form is an online document that captures essential payment details required for processing a credit card transaction. These forms play a pivotal role in ensuring that the necessary information is collected in a structured way that prevents error and fraud.

Several key components are typically present in a credit card payment form, which include cardholder information fields, payment details fields, and robust security features. Cardholder information fields usually collect personal data such as the customer's name, billing address, and contact information. Payment details fields collect credit card number, expiration date, and the security code (CVV). To secure sensitive information, many forms incorporate security features such as SSL encryption and other fraud prevention technologies.

The role of credit card payment forms in transactions

Credit card payment forms streamline transactions by allowing users to enter and submit their payment information in a single, organized interface. This minimizes the chance for errors that can occur when payments are manually processed. The variety of sectors relying on these forms is extensive, ranging from e-commerce to subscription services and even donations for charitable events.

For e-commerce businesses, credit card payment forms are indispensable, serving as the gateway for online sales. Subscription services leverage them for recurring payments, ensuring a consistent revenue flow. Nonprofits utilize payment forms for fundraising efforts, allowing for easy and transparent donation processing, thereby enhancing trust and engagement with donors.

Features to look for in a credit card payment form

Selecting the right credit card payment form can significantly impact your operations. Key features to look for include customization options that allow businesses to tailor the form to their brand aesthetics, as well as integration capabilities with existing systems like CRM or accounting software. Moreover, security protocols such as SSL encryption and PCI compliance are essential, ensuring that customer data is protected at every step of the transaction.

User experience also plays a critical role; forms should have a clean and user-friendly interface that minimizes friction during the payment process. Designing forms that are both functional and visually appealing can enhance customer satisfaction, leading to higher conversion rates.

How to create a credit card payment form

Creating an effective credit card payment form is straightforward with the right tools. This step-by-step guide serves as a roadmap:

When building your form, it’s also essential to ensure it is responsive across devices. A mobile-friendly design can significantly improve the user experience, making transactions easier for customers accessing from various devices.

Best practices for securing credit card payment forms

Protecting customer data is paramount when handling credit card information. The implementation of SSL certificates helps encrypt data during transmission, securing sensitive information against prying eyes. Regular security audits should be conducted to identify and rectify vulnerabilities.

Staff training on secure practices when handling payment information helps reduce the risk of breaches. This includes understanding the importance of not sharing sensitive information and recognizing potential phishing attempts.

Managing and storing credit card payment forms

After completion, managing and securely storing credit card payment forms is crucial. Implement best practices for securely storing forms, employing encrypted databases if necessary. Knowing how long to retain these forms varies depending on regulatory requirements; typically, it is advised to keep them for no longer than necessary to accomplish the initial transaction.

Compliance with regulations such as GDPR and CCPA will safeguard your business against potential legal issues while fostering trust with customers. Regular reviews of your data retention policies will ensure that you are aligned with changing regulations.

Enhancing user experience with credit card payment forms

A well-designed credit card payment form can significantly enhance user experience leading to higher completion rates. Simplifying forms by minimizing the number of required fields can help alleviate user frustration, resulting in fewer abandoned transactions.

Incorporating features such as progress indicators can also make the payment process clearer to users, keeping them informed of how many steps they have left until completion. This transparency fosters a sense of control, which can encourage users to finalize their transactions.

Frequently asked questions (FAQs)

When dealing with credit card payment forms, questions may arise about compatibility with different payment methods. Many forms accept not only credit cards but also debit cards, e-wallets, and even cryptocurrencies depending on the payment processor's capabilities.

It's essential to clarify whether credit card payment forms are considered legally binding, as they typically serve as a record of authorization for a transaction. Handling declined transactions requires specific protocols to inform customers clearly, maintaining transparency throughout the process. Additionally, businesses may encounter common issues such as payment gateway downtime or discrepancies in entered data that require prompt attention.

Integrating credit card payment forms with other tools

Integration of credit card payment forms with tools such as customer relationship management (CRM) and accounting software enhances operational efficiency. This synchronization allows for a seamless flow of information, minimizing discrepancies and reducing manual entry errors.

Benefits of automated workflows through integrations include increased productivity as tasks are streamlined, and users can access real-time data for informed decision-making. Adopting integrated systems ensures businesses remain agile in responding to customer needs and market changes.

Case studies of effective credit card payment form implementation

Businesses that have optimized their credit card payment forms often report increased transaction completion rates and enhanced customer satisfaction. A notable example includes an e-commerce retailer that redesigned its payment form to be more user-friendly and mobile-responsive, which resulted in a 30% reduction in cart abandonment rates. Another case involved a nonprofit using streamlined forms for donation processing which saw a 50% increase in online donations post-implementation.

Key lessons from these implementations often revolve around the importance of customization, testing different layouts, and gathering user feedback to refine forms over time. Businesses can implement these strategies to ensure their credit card payment forms not only collect necessary information but also provide an optimal user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card payment for directly from Gmail?

How do I make edits in credit card payment for without leaving Chrome?

How do I fill out credit card payment for on an Android device?

What is credit card payment for?

Who is required to file credit card payment for?

How to fill out credit card payment for?

What is the purpose of credit card payment for?

What information must be reported on credit card payment for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.