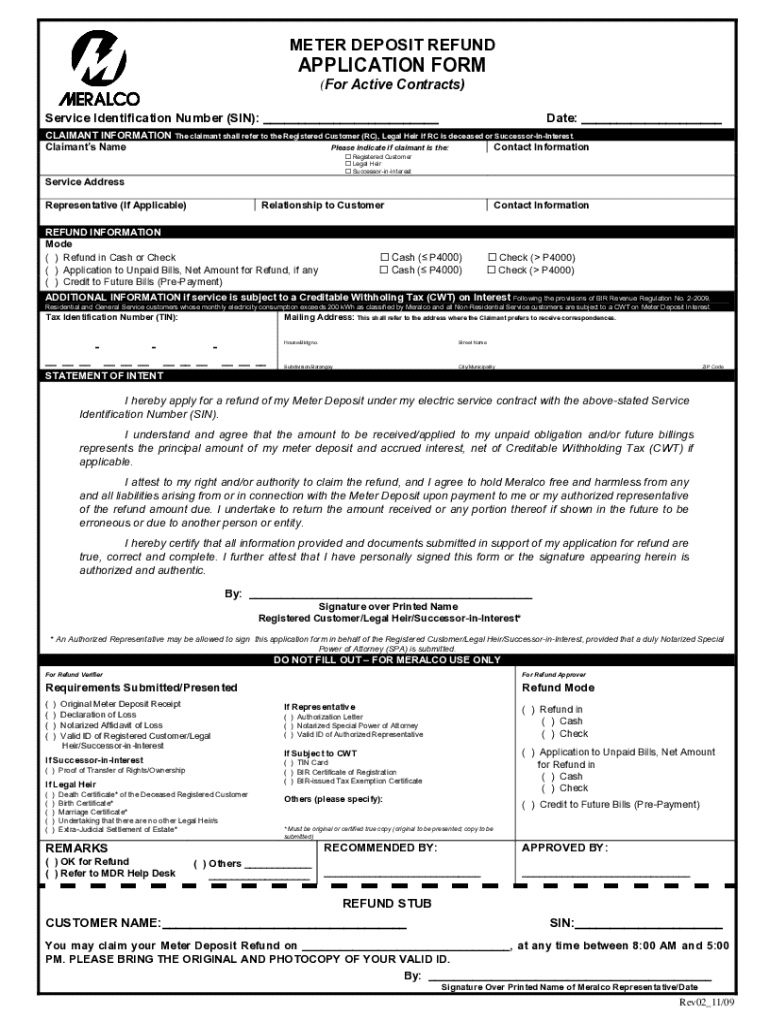

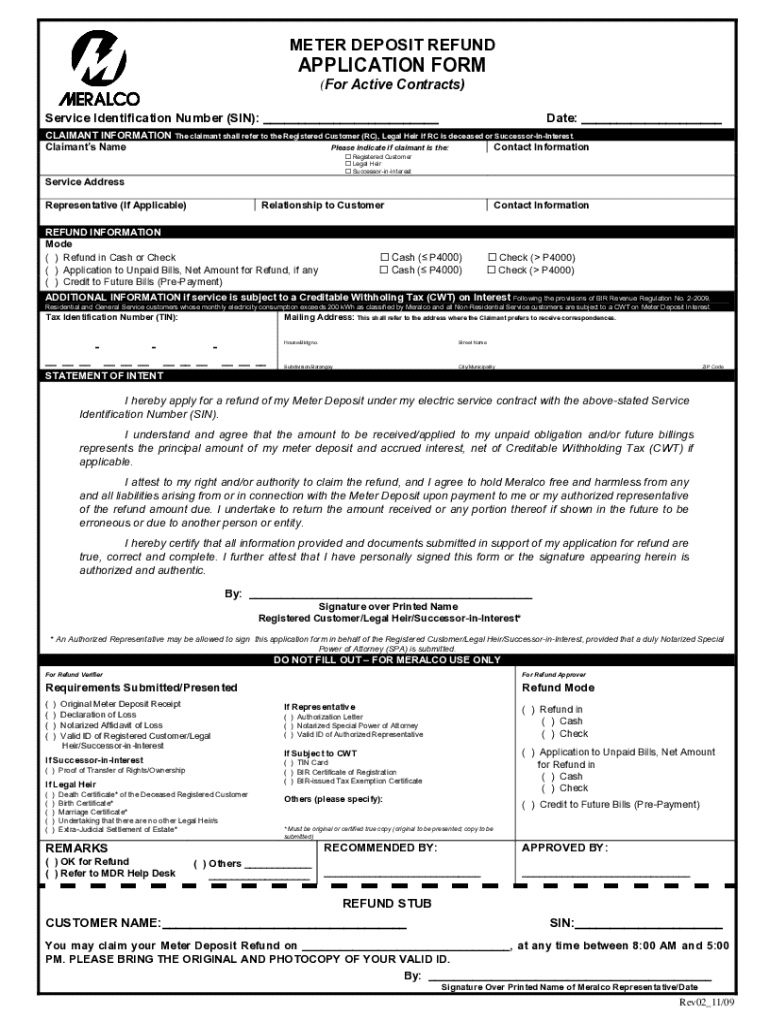

Get the free Meter Deposit Refund Application Form

Get, Create, Make and Sign meter deposit refund application

Editing meter deposit refund application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out meter deposit refund application

How to fill out meter deposit refund application

Who needs meter deposit refund application?

Meter Deposit Refund Application Form: A Comprehensive Guide

Understanding the meter deposit refund

A meter deposit serves as a security measure that utility companies require from their customers—typically those newly establishing service. The deposit acts as financial protection for the utility against non-payment or late payment. The amount varies by utility provider and is generally a predetermined fee, often equivalent to a few months' estimated service charges.

Utility companies collect these deposits when a customer first opens an account, and they are often refundable under certain conditions, such as if the account is closed or if payment history has been satisfactory over a specific period.

Claiming your meter deposit refund can be beneficial. Many customers remain unaware that deposits are reclaimable, assuming incorrectly that they sacrifice those funds permanently upon closing their accounts. By pursuing a refund, you can reclaim money tied up unnecessarily.

Eligibility criteria for meter deposit refund

To qualify for a meter deposit refund, customers generally must have met specific conditions during their utility service. Primarily, individuals must have maintained a solid payment history, typically involving consistent on-time payments for a predetermined duration—often one to three years. The exact criteria depend on the utility company’s policies.

In cases where the original account holder has passed away, close relatives or beneficiaries may claim the deposit. This process typically requires submitting a death certificate and proof of relationship to the deceased, as set by the utility's guidelines.

For customers whose accounts have transferred to a new address or utility provider, particular guidelines apply, ensuring that claims can still proceed without complications even amidst account changes.

The application process explained

Filing a meter deposit refund application is often straightforward. The first step is to obtain the necessary application form. For most utility providers, this form is accessible online through their customer service portal or as a downloadable PDF. Alternatively, many companies still offer print copies available at offices.

When completing the meter deposit refund application form, ensure all details are accurately filled out. Key information typically required includes your account number, name, address, and the specifics regarding the deposit being refunded. Online applications allow for direct submission, while paper submissions should be mailed to the specified address.

Be mindful of deadlines for submitting your application. Most companies enforce a timeframe, often several months post-closure of an account, in which claims must be made. Thus, it’s crucial to act quickly to avoid missing potential refunds.

Refund amount and payment methods

Customers may wonder how much they can expect from their meter deposit refund. Generally, the refund amount equals the initial deposit amount paid, possibly subject to deductions for any unpaid balances or fees. Variability occurs depending on factors like the customer's length of service, payment history, and whether the deposit covers unpaid utility bills.

Refunds are typically issued in the same manner as the original payment—either as a direct bank transfer, check, or credit to the utility account. Customers should check their preferences with the utility company when submitting the refund application.

Tax implications on meter deposit refunds

Many customers are unaware that meter deposit refunds may have tax implications. In general, if a utility deposit is returned without any deductions, it is non-taxable. However, if the deposit is applied against an outstanding balance or if there are additional fees deducted, the net refunded amount may be subject to income tax.

For clarity on how to handle your refund in terms of taxes, consider consulting a tax professional. They can offer guidance, especially when nuances related to state or local income tax laws may come into play.

Addressing common issues and concerns

It’s common for customers to misplace their official meter deposit receipts. If this occurs, contact your utility provider promptly to receive guidance on verifying your account. Utility companies often accept alternative documents as proof of prior service, such as billing statements, account confirmations, or online account summaries printed from their website.

Failing to make a claim before the deadline can lead to unclaimed funds being forfeited. Each utility company usually has a firm policy regarding unclaimed deposits, often leading to forfeiture after a set period. Therefore, ensure compliance with submission timelines and stay updated through direct communication with your provider.

FAQs about meter deposit refunds

As customers proceed with their application requests, various questions often arise. Common queries include, "How long does it take to receive my refund?" and "What if my application gets denied?" Generally, refund processing times vary by utility company, but it may take anywhere from a few weeks to several months to receive the determination.

In the event of an application denial, contact customer service for detailed feedback on the reason for the denial, and inquire about possible actions for appeal or reapplication. This knowledge allows users to act towards rectifying issues raised.

Leveraging pdfFiller for your meter deposit refund application

pdfFiller streamlines your meter deposit refund application experience. With its user-friendly interface, users can easily fill out, edit, sign, and store their application forms securely. The platform's tools ensure clarity and organization throughout the process, facilitating faster and more efficient submissions.

Additionally, the cloud-based nature of pdfFiller allows users to access their files anywhere, ensuring uninterrupted access while managing their documentation. Whether in the office or on the go, seamless collaboration and document tracking become effortless.

Tips for a smooth refund experience

To enhance the likelihood of a successful refund experience, follow best practices when submitting your meter deposit refund application. Begin by meticulously reviewing your form for accuracy and completeness before submission. Ensure all necessary documents are attached, and confirm that your contact details are correct to avoid potential delays.

In addition to thorough preparation, stay updated regarding any policy changes or new requirements that may impact your application process by regularly checking your utility company’s official website or portal. Developing a schedule to follow up on your application can be helpful in maintaining proactive communication with the provider.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send meter deposit refund application for eSignature?

How do I edit meter deposit refund application straight from my smartphone?

How do I fill out meter deposit refund application using my mobile device?

What is meter deposit refund application?

Who is required to file meter deposit refund application?

How to fill out meter deposit refund application?

What is the purpose of meter deposit refund application?

What information must be reported on meter deposit refund application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.