Get the free N-342a

Get, Create, Make and Sign n-342a

Editing n-342a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out n-342a

How to fill out n-342a

Who needs n-342a?

Understanding the N-342A Form: A Comprehensive Guide

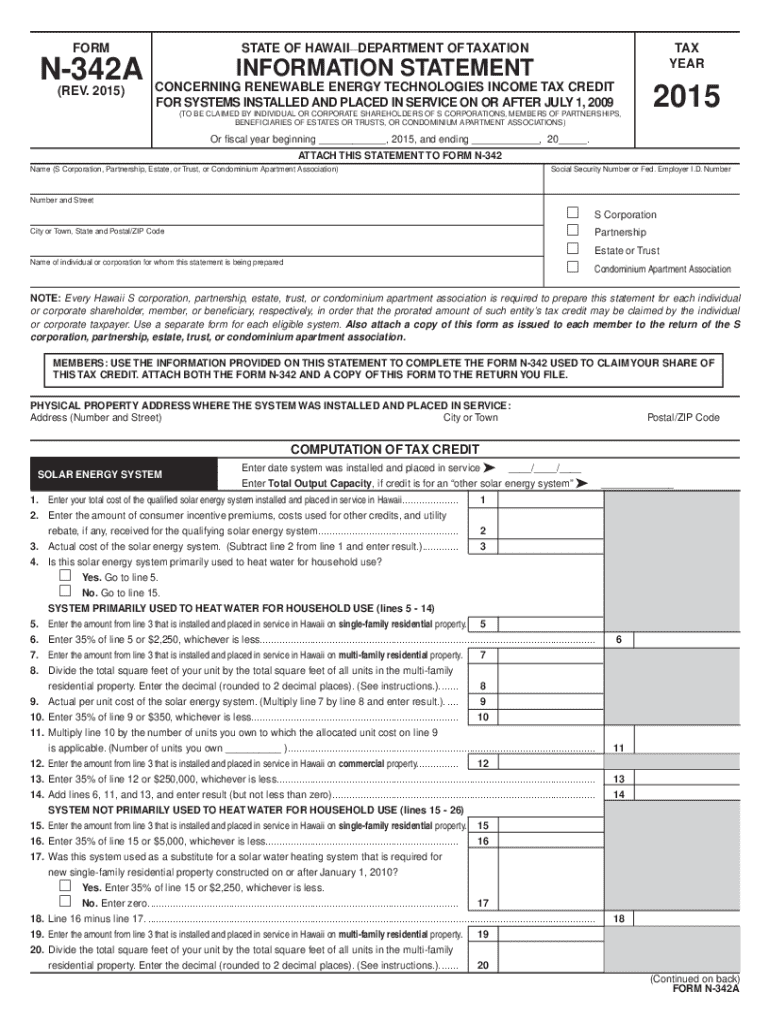

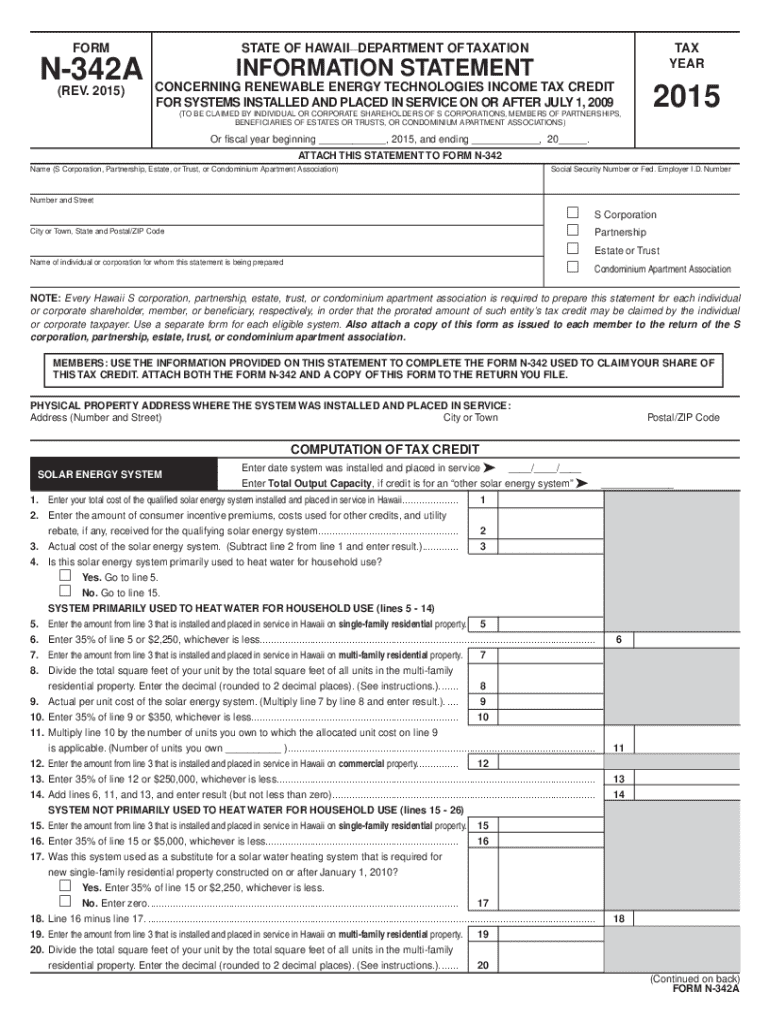

Overview of the N-342A Form

The N-342A form is a crucial document used for reporting various financial details pertinent to income tax submissions. It serves as a structured template for individuals and teams to accurately convey their financial situation to tax authorities. By providing a clear format, the N-342A form ensures compliance with established guidelines, which simplifies the process of documenting income, credits, and deductions.

Understanding its purpose is essential, as it helps taxpayers avoid common pitfalls associated with tax reporting. The N-342A form captures essential information that not only facilitates accurate calculations but also ensures the maximization of eligible deductions and credits.

Key components of the N-342A form

The N-342A form comprises several key sections that work together to provide a comprehensive overview of the taxpayer's financial status. Each section is designed to capture specific information needed for tax purposes.

Step-by-step instructions for filling out the N-342A form

Filling out the N-342A form may seem daunting, but breaking it down into steps can simplify the process significantly. Below are the essential steps to accurately complete the form.

Tips for efficiently managing and editing the N-342A form

Managing the N-342A form can be streamlined through various digital tools. pdfFiller offers a platform that enhances the efficiency and effectiveness of editing, signing, and collaborating on forms.

Integrating eSignature functionality in the N-342A form

As transactions continue to move online, the legitimacy of digital signatures is becoming increasingly important. Integrating e-signature functionality into the N-342A form not only expedites the signing process but also ensures compliance with legal requirements.

Common mistakes to avoid when filling out the N-342A form

Filling out the N-342A form can lead to errors if one is not careful. Avoiding common mistakes can save you time and effort in the long run.

How to submit the N-342A form

Submitting the N-342A form can be performed through two primary methods: electronic submission and paper submission. Understanding these methods can streamline the process.

FAQs surrounding the N-342A form

Questions often arise surrounding the N-342A form, and addressing these can aid in a smoother submission process. Clear answers to common queries can assist in avoiding potential issues.

Related forms and documents

Understanding the N-342A form in the context of other related documents is vital for comprehensive tax reporting. Recognizing similar forms can also enhance your tax preparation strategy.

Additional support and resources

Providing additional support options can significantly enhance user experience when dealing with the N-342A form. pdfFiller is dedicated to ensuring users are well-equipped to manage their documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my n-342a in Gmail?

How can I send n-342a for eSignature?

How do I fill out n-342a using my mobile device?

What is n-342a?

Who is required to file n-342a?

How to fill out n-342a?

What is the purpose of n-342a?

What information must be reported on n-342a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.