Get the free Mas Kiwisaver Scheme Life-shortening Congenital Condition Withdrawal Application Form

Get, Create, Make and Sign mas kiwisaver scheme life-shortening

How to edit mas kiwisaver scheme life-shortening online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mas kiwisaver scheme life-shortening

How to fill out mas kiwisaver scheme life-shortening

Who needs mas kiwisaver scheme life-shortening?

Understanding the MAS KiwiSaver Scheme Life-Shortening Form

Understanding the KiwiSaver scheme

The KiwiSaver scheme is a government-backed retirement savings initiative in New Zealand, designed to help residents accumulate funds for their retirement. Launched in 2007, it incentivizes saving through employer contributions, government grants, and tax benefits. Participation in KiwiSaver is crucial as it not only fosters long-term financial growth but also offers members various investment options tailored to different risk profiles.

This scheme allows individuals to save a portion of their income towards retirement, making it an essential element of financial planning. KiwiSaver accounts are managed by various providers, offering differing fees, investment strategies, and performance. Engaging with KiwiSaver is a proactive approach towards securing a financially stable future.

Eligibility criteria

To join KiwiSaver, individuals must meet specific eligibility criteria. You need to be a New Zealand resident and have a valid IRD number. Age-wise, there’s no upper limit; however, you must be 18 or older to open your own account. Employees are automatically enrolled in KiwiSaver by their employers unless they choose to opt out.

This automatic enrolment ensures that a significant number of New Zealanders are saving for their retirement, promoting a healthier national economy and reducing the future reliance on government assistance.

Types of KiwiSaver accounts

KiwiSaver comprises two primary account types: default schemes and choice schemes. Default schemes are designed for individuals who do not select a specific fund, automatically placing them in a suitable option based on their age and investment goals. In contrast, choice schemes provide greater flexibility, allowing members to select from a variety of investment funds tailored to their risk appetite and financial aspirations.

The key difference lies in the investment mix and level of control – choice schemes often encompass higher-risk investments that can yield greater returns over the long term.

Introduction to the life-shortening form

The life-shortening form is a critical component of the KiwiSaver framework for members facing serious health issues that may significantly limit their lifespan. This form serves as a formal declaration that enables individuals to access their KiwiSaver funds early due to their circumstances.

The completion of this form illustrates the member's intent to withdraw savings on the grounds of health-related challenges, which could facilitate financial management during a crucial period.

Why is the life-shortening form important?

Completing the life-shortening form is essential for members who need to draw upon their KiwiSaver savings ahead of retirement age. The implications of this form extend beyond immediate withdrawals; it reflects the member's engagement with their financial landscape amid life-altering events. For many, these funds are pivotal in managing healthcare costs or securing financial stability for family members.

In addition, filling out this form accurately can greatly influence an individual's financial planning, enabling them to assess their long-term needs and adjust their remaining KiwiSaver investments post-withdrawal.

Step-by-step guide to completing the life-shortening form

Filling out the life-shortening form requires careful attention to detail and the collection of specific documentation. Proper preparation ensures a smoother submission process and diminishes the risk of delays.

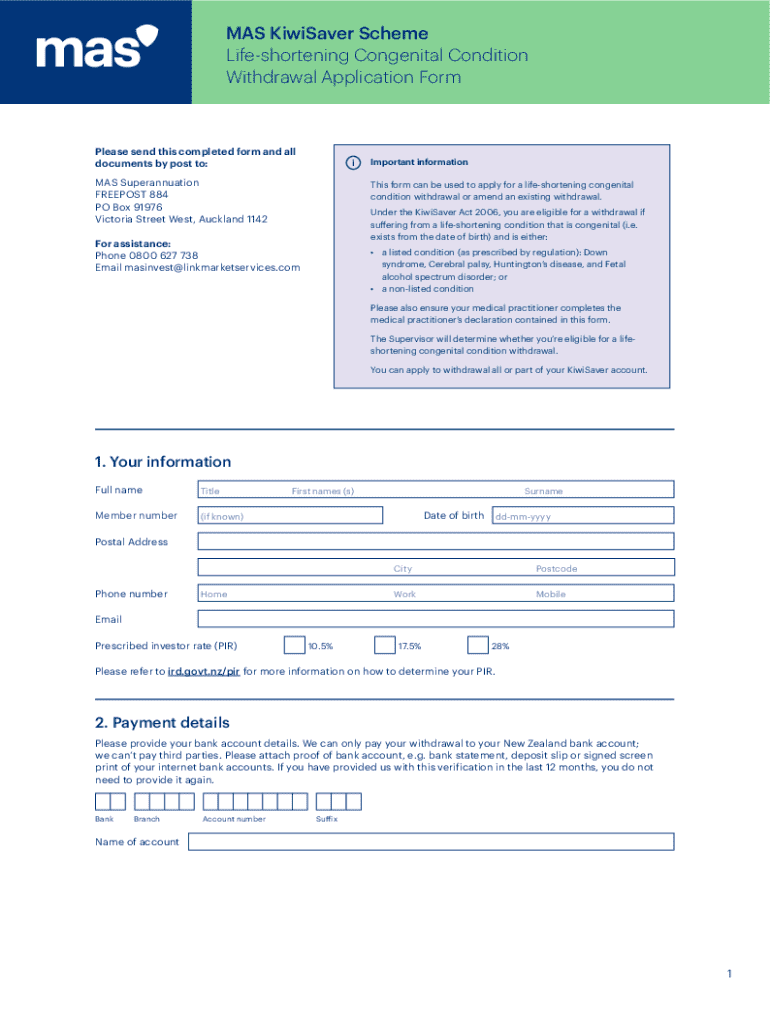

Collecting necessary documentation

Filling out the form: a detailed walkthrough

The life-shortening form consists of several sections that require your personal information and medical history. Start by accurately providing your personal information in Section A, making sure all details match your identification documents.

In Section B, you will need to include relevant medical history. Prevent miscommunication by providing a comprehensive view of your condition, supported by your doctor’s statement. Section C allows you to explain how your health status affects your financial situation, highlighting the urgency of your withdrawal request.

Finally, Section D requires your declaration and signature. Honesty is paramount here; any discrepancies could lead to delays or complications in processing your request.

Common mistakes to avoid

Many applicants make mistakes when completing the life-shortening form. Common errors include inaccurate personal details, insufficient medical documentation, or unclear financial impact descriptions. Double-checking information and ensuring clarity can be crucial in avoiding delays during processing.

Submitting the life-shortening form

Once your form is completed and all documents are gathered, it’s time to submit. This can be done either online through your KiwiSaver provider's portal or via traditional mail. Ensure that you keep a copy of everything for your records.

Where to submit your form

Submit your completed form to your chosen KiwiSaver provider. Each provider has its specific submission process, so follow the instructions provided on their website. Some offer an online submission feature for convenience, while others may require postal submissions.

Expected processing time

Upon submission, processing times can vary, typically ranging from a few weeks to several months depending on the provider and the completeness of your application. Always follow up with your provider if you haven't received communication within a reasonable timeframe.

What to do after submission

After submitting your life-shortening form, stay proactive. Check in with your KiwiSaver provider periodically to monitor the status of your application and ensure all necessary documentation has been received. This will help address any potential issues early on.

Managing your KiwiSaver account after submission

Post-approval of your life-shortening request, it is essential to manage your KiwiSaver account thoughtfully. The early withdrawal of funds will inevitably affect your account balance; understanding these implications is crucial for future financial planning.

Understanding your account balance and withdrawals

Withdrawals will reduce your account balance, potentially impacting your retirement savings in the long run. It's advisable to consult a financial advisor to gauge how the withdrawal fits into your overall retirement strategy.

Reevaluating your investment fund

Given your new circumstances, it may be necessary to reassess your KiwiSaver investment strategy. Understanding when and why to change your investment fund post-form approval will help you align your financial goals with your newly adjusted situation.

Continuing eligibility and participation

Utilizing the life-shortening form does not automatically disqualify you from future KiwiSaver contributions. Being knowledgeable about maintaining eligibility for contributions ensures you can continue benefiting from this valuable retirement savings scheme.

Additional support and resources

As you navigate the complexities of the life-shortening form and your KiwiSaver account, seek personalized assistance whenever necessary. Contacting your KiwiSaver provider is an excellent way to receive tailored guidance suited to your situation.

Contacting KiwiSaver providers

Providers typically have dedicated support teams to assist members going through this process. Reaching out for clarifications and guidance can prove invaluable.

Utilizing interactive tools on pdfFiller

pdfFiller offers a range of interactive tools that can assist in editing and signing your life-shortening form online. Utilizing these tools will enhance your experience and ensure all documentation is completed correctly.

FAQs about the life-shortening form

Addressing common concerns regarding the life-shortening form is essential. Many individuals may have questions regarding eligibility criteria, documentation required, processing times, and how withdrawal impacts future KiwiSaver contributions.

Community perspectives

Hearing from people who have successfully navigated the life-shortening form process can provide encouragement and guidance. Community forums and support groups often serve as excellent platforms for sharing experiences and advice.

Testimonials from users

Individuals who have faced similar challenges and successfully completed their life-shortening forms can provide invaluable insights and encouragement. Their real-life stories often highlight the importance of thorough preparation and understanding what to expect during the process.

Forums and online support groups

Connecting with others through online forums and support groups allows users to seek advice, share concerns, and gather tips on managing the life-shortening form. Such community engagements create an essential support system for those in need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mas kiwisaver scheme life-shortening?

Can I edit mas kiwisaver scheme life-shortening on an iOS device?

How do I complete mas kiwisaver scheme life-shortening on an Android device?

What is mas kiwisaver scheme life-shortening?

Who is required to file mas kiwisaver scheme life-shortening?

How to fill out mas kiwisaver scheme life-shortening?

What is the purpose of mas kiwisaver scheme life-shortening?

What information must be reported on mas kiwisaver scheme life-shortening?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.