Get the free Business Closure Form

Get, Create, Make and Sign business closure form

Editing business closure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business closure form

How to fill out business closure form

Who needs business closure form?

Business Closure Form: A Comprehensive How-to Guide

Understanding the business closure process

Closing a business is not just an emotional or financial decision; it's a formal process that requires careful planning and specific documentation. Official documentation is crucial in ensuring that the closure is recognized legally and avoids potential liabilities. The business closure form plays a central role in this process. It provides a formal way to notify authorities about the cessation of operations, helping to clarify your business's future, whether you are ceasing completely, selling off assets, or transitioning to another model.

Various circumstances can necessitate the need for a business closure form. Common situations include a complete shutdown, selling business assets, or shifting to a different business framework. Each of these scenarios requires different considerations and documentation, but the foundational aspect remains: proper communication through official forms.

What is a business closure form?

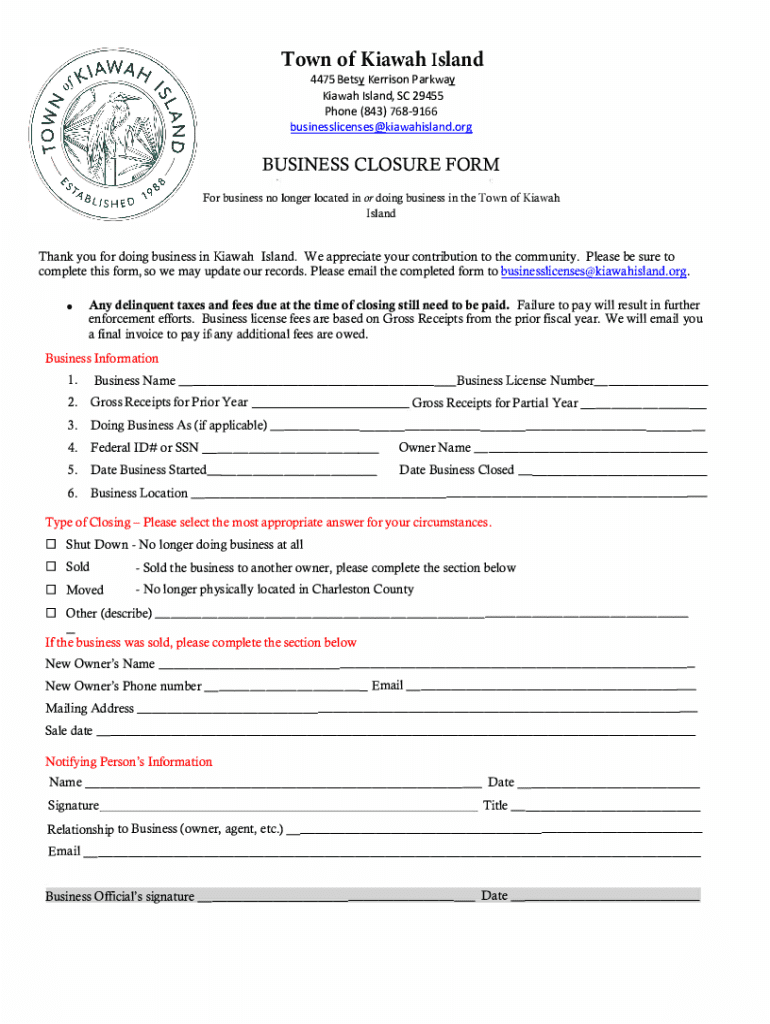

A business closure form is a legal document submitted to authorities to officially declare the cessation of business activities. Its primary purpose is to ensure all stakeholders—such as creditors, employees, and tax authorities—are informed of the closure. This form often includes critical information about the business, including assets, liabilities, and the reason for closure.

It is crucial to understand the legal implications of submitting this form. Filing a business closure form formally indicates that a business is no longer operational, which can affect taxation, personal liabilities, and any ongoing contracts. Differentiating between a business closure form and other documents like a business dissolution form is essential. While both serve to notify authorities of business changes, the dissolution form typically indicates legal disbandment of the business entity, while the closure form may not necessarily entail that.

Who needs a business closure form?

The need for a business closure form extends across various types of entities. Small business owners, corporations, and partnerships are all subject to the requirement to file this form under specific circumstances. Each group faces unique considerations regarding liabilities, asset distribution, and tax obligations.

For instance, small business owners may find themselves in situations where a market downturn forces them to close. Corporations may need to file this form when transitioning to another business model or selling off assets. Partnerships may seek closure due to changes in partnership dynamics or financial struggles. Awareness of these scenarios can guide businesses toward proper closure procedures.

Preparing to fill out your business closure form

Preparation is key when filling out your business closure form. Start by collecting all necessary documentation. Essential items typically include financial statements to showcase the business’s standing, articles of incorporation for legal reference, and tax identification numbers to ensure all obligations are met before closure.

In addition to collecting documentation, certain essential information must be provided on the closure form. This includes the business name and ownership details, the reason for the closure, and any pertinent tax considerations. Accuracy in this section is paramount, as incorrect information can lead to complications or delays in the closure process.

Step-by-step guide to filling out the business closure form

Filling out your business closure form can seem daunting, but breaking it down into clear steps makes the process manageable. Here’s a guide to help you through the steps.

Post-submission: What comes next?

After submitting your business closure form, the next steps involve awaiting confirmation from the relevant authorities. Typically, you should receive notifications informing you of the acceptance of your form or if further details are required.

However, the closure process doesn’t end there. You may need to undertake follow-up actions such as securing tax clearance, notifying clients and customers of your closure, and addressing any outstanding contractual obligations to ensure a smooth transition out of business.

Utilizing pdfFiller for smooth document management in closure processes

Using pdfFiller simplifies the document management aspect of closing a business. This platform offers users the ability to edit, eSign, and collaborate on documents seamlessly. Its intuitive interface ensures that users can navigate through the business closure form effortlessly, making the process much more efficient.

In addition to managing the business closure form, pdfFiller provides interactive tools that can assist businesses in their ongoing management. These features streamline the documentation processes for all business-related activities and foster better collaboration among team members.

Frequently asked questions about business closure forms

Clients and business owners often express common concerns regarding the legal requirements of business closure forms. Questions about how to handle potential disputes that may arise between partners or creditors are frequently raised. Additionally, it's essential to clarify the expected timelines for closure—knowing when operations should cease and when final notifications should be sent to stakeholders can prevent confusion.

Another pressing concern involves responsibilities that remain after submitting the closure form. Oftentimes, owners wonder if they need to continue operating until the form is processed, or if they are immediately absolved of responsibilities post-submission.

Additional tips for business closure success

Successfully closing a business extends beyond just filing a form. Engaging a legal professional to navigate the complexities of business closure is a wise move. They can provide guidance tailored to your specific situation, helping mitigate any legal risks associated with the closure.

Moreover, preparing your employees and clients for the closure is vital. Clear communication can minimize misunderstandings and ease transitions for everyone involved. Lastly, maintaining organized records throughout the closure process is paramount to ensure that any future legal or financial inquiries can be managed effectively.

Real-life examples and case studies

Understanding the business closure process through real-life examples can provide valuable insights. One case study highlights a small business that utilized pdfFiller to manage its closure process efficiently. The user was able to navigate the complexities of filling out the closure form, leveraging pdfFiller’s collaborative tools to communicate effectively with partners and streamline documentation.

Additionally, testimonials from other users express satisfaction with their experiences, noting the ease of use and the efficiency of submitting their business closure forms using pdfFiller’s platform. These examples not only illustrate the potential complexities of closing a business but also shed light on how effective tools can facilitate a smoother closure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business closure form from Google Drive?

Can I create an electronic signature for the business closure form in Chrome?

How do I fill out business closure form on an Android device?

What is business closure form?

Who is required to file business closure form?

How to fill out business closure form?

What is the purpose of business closure form?

What information must be reported on business closure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.