Get the free Money Insurance Policy Proposal Form

Get, Create, Make and Sign money insurance policy proposal

How to edit money insurance policy proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out money insurance policy proposal

How to fill out money insurance policy proposal

Who needs money insurance policy proposal?

A Comprehensive Guide to Money Insurance Policy Proposal Forms

Understanding money insurance

Money insurance protects individuals and businesses against financial losses related to cash and securities. It serves as a crucial layer of security against theft, loss, or damage, ensuring that you are not left vulnerable. The policy can cover various forms of monetary assets, providing peace of mind in both personal and professional environments.

The importance of money insurance cannot be overstated. It plays a vital role in safeguarding assets, especially for businesses that handle significant cash transactions. For individuals, it helps mitigate the risk related to personal finances, enhancing overall security.

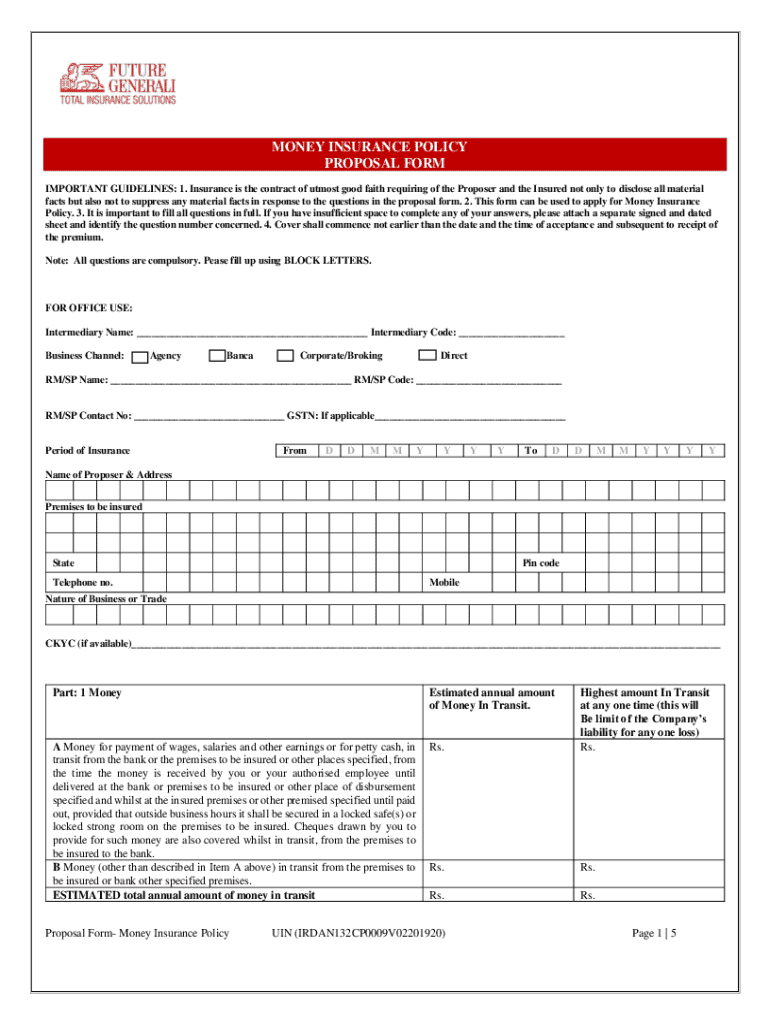

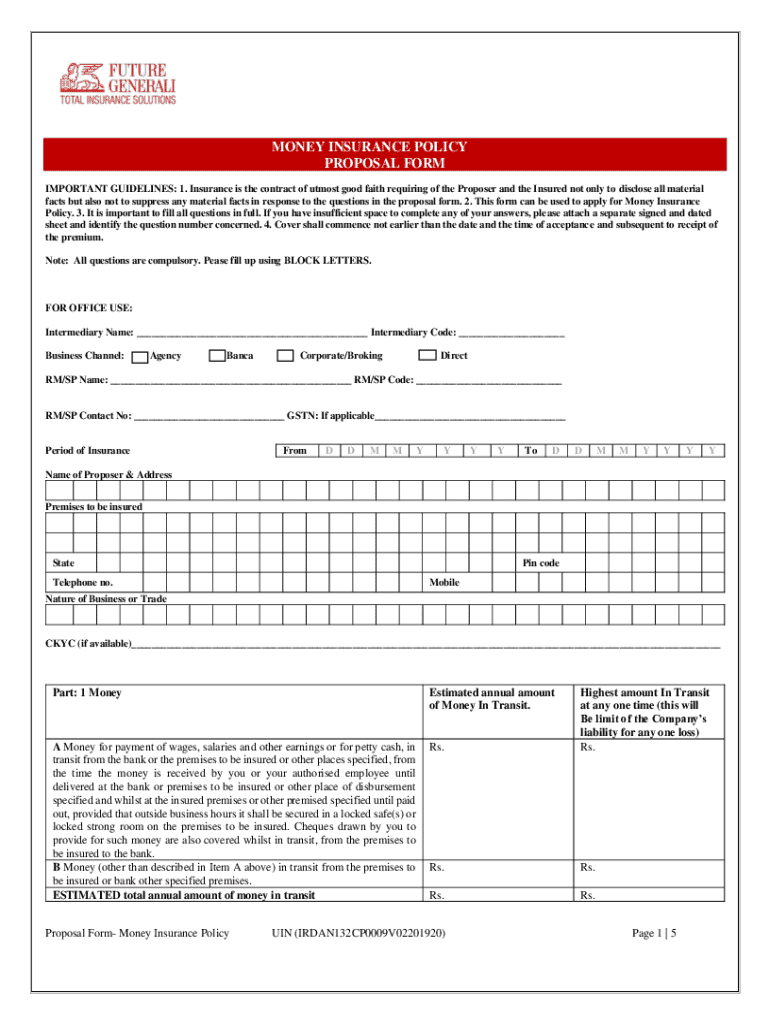

Overview of the money insurance policy proposal form

The money insurance policy proposal form is a fundamental document required to apply for coverage. Its purpose is to gather essential information needed to assess risk and determine appropriate coverage options. This initial step in securing insurance ensures that the insurer understands your unique needs and can provide tailored protection.

Key components of the proposal form generally include personal details, financial history, existing policies, and desired coverage amounts. Each section of the form prompts you to disclose specific information that enables insurers to customize coverage, ensuring you receive adequate protection.

Preparing to fill out the proposal form

Before you fill out the proposal form, it's essential to gather required information. Collect personal details such as your full name, contact information, and identification number. Additionally, compile your financial history, including details about any previous insurance policies, assets, and liabilities. Assess how much coverage you wish to secure, as this will significantly affect premium calculations.

Evaluating risk factors is another crucial step. Understand what needs protection—be it cash in your business, securities in an investment portfolio, or personal valuables. Consider your previous claims history to provide a comprehensive view of your coverage needs, as this data can influence your proposal’s outcome.

Step-by-step guide to completing the money insurance policy proposal form

Filling out the money insurance policy proposal form is straightforward when you follow these steps carefully.

Each section is critical and contributes to crafting a policy that best suits your needs. Take your time and ensure accuracy throughout.

Editing and customizing the proposal form

Once you have filled out the money insurance policy proposal form, consider using pdfFiller to edit and customize it further. With pdfFiller’s intuitive platform, you can make changes easily, ensuring your document accurately reflects your requests.

Use interactive tools for personalization, such as dropdown menus and checkboxes, to make your proposal form more visually appealing and easier to understand. Utilize the saving and version control features to manage different drafts effectively, thereby streamlining your documentation process.

eSigning and submitting the proposal form

To finalize your money insurance policy proposal form, you must eSign the document. pdfFiller allows you to electronically sign the form easily, offering a quick and secure method to authenticate your application.

After signing, explore the various submission options—whether via email or directly through the pdfFiller platform. It's crucial to track the progress of your submission and confirm receipt with the insurance provider, ensuring your application is being processed smoothly.

Managing your money insurance policy

Once your money insurance policy is approved, managing it effectively is paramount. Access your policy online through pdfFiller, allowing you to monitor key details and make necessary adjustments with convenience.

Regularly monitor and document any claims you wish to file. Be proactive in updating your policy to reflect changing needs, such as increased cash flow or new assets. A well-maintained policy will provide continual protection in alignment with your current financial situation.

Common mistakes to avoid when filling out the proposal form

Filling out the money insurance policy proposal form requires attention to detail. Many applicants make common mistakes that can delay coverage. One prevalent issue is providing incomplete information, which can lead to misinterpretation of your needs.

Another frequent mistake is misunderstanding coverage options available. Each insurance policy has unique terms, and failing to grasp them can result in suboptimal protection. Always ensure you double-check for accuracy before submitting your proposal, as discrepancies can have significant repercussions.

FAQs about money insurance policy proposal forms

Navigating the money insurance policy proposal form might bring up several questions. It's common to wonder about the types of coverage available, how claims are processed, or what happens if you need to make changes post-approval.

For additional support, refer to the customer service or claims department of your insurance provider. Many insurers offer online resources and FAQs to assist you in understanding the specifics of your policy and the proposal process.

Leveraging pdfFiller for document management needs

pdfFiller stands out by offering a suite of features tailored for document creation, editing, and management. This cloud-based platform provides users with the ability to streamline workflows, collaborate on documents, and manage essential paperwork seamlessly.

Benefits of this platform include easy access from any device, efficient document storage, and a user-friendly interface that facilitates collaboration among team members. By leveraging pdfFiller, you can ensure your money insurance policy proposal form is not only accurate but also well-managed throughout its lifecycle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit money insurance policy proposal online?

How can I edit money insurance policy proposal on a smartphone?

How do I complete money insurance policy proposal on an Android device?

What is money insurance policy proposal?

Who is required to file money insurance policy proposal?

How to fill out money insurance policy proposal?

What is the purpose of money insurance policy proposal?

What information must be reported on money insurance policy proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.