Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

How to edit tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

Tax Organizer Form: A Comprehensive How-to Guide

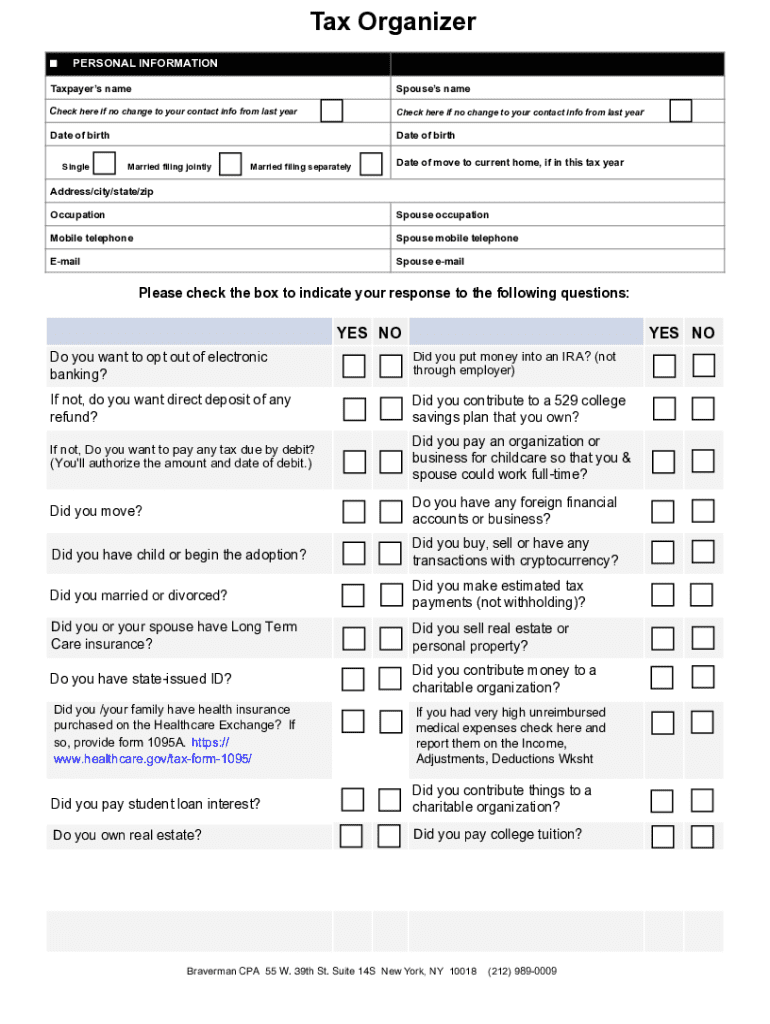

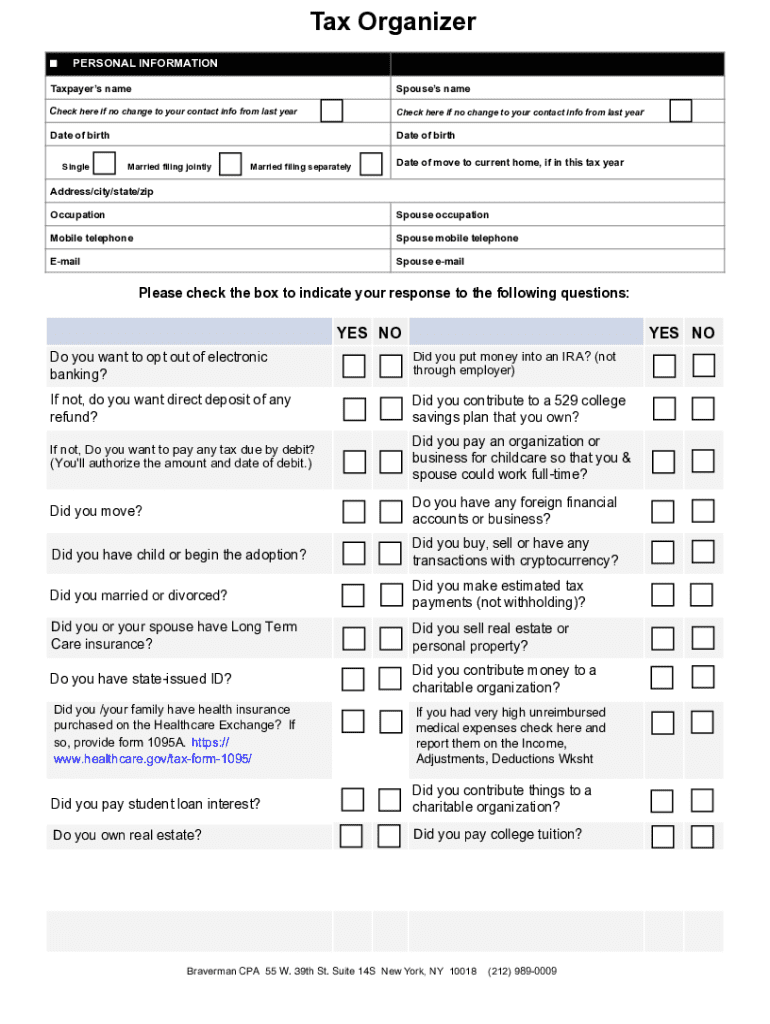

Understanding the tax organizer form

A tax organizer form is a vital document used to facilitate the tax preparation process for both individuals and businesses. This form typically provides a structured way to collect financial details, summarizing essential information such as income, deductions, and credits. The primary purpose of a tax organizer is to ensure that no crucial information is overlooked during the filing process, making it easier for accountants and tax professionals to prepare accurate tax returns.

For individuals, a tax organizer form helps to streamline financial data gathering, ensuring all necessary documentation is organized and easily accessible. Entrepreneurs and small business owners also benefit significantly from these forms, as the complexity of tax filings often requires meticulous documentation of business expenses and income. Common uses of tax organizer forms include tax season preparation, year-end financial reviews, and assisting tax professionals in understanding one's financial situation.

Benefits of using pdfFiller for tax organizer forms

pdfFiller stands out as a premier platform for managing tax organizer forms, offering unique features that enhance the user experience. One major advantage is its seamless editing capabilities, which allow users to modify their tax organizer forms effortlessly. Collaboration is equally easy, as multiple users can work on the document simultaneously, making it perfect for teams of accountants or families preparing taxes together.

Accessibility is another significant benefit; pdfFiller's cloud-based solution allows users to access their tax organizer forms from any device, anywhere. This flexibility ensures that users can quickly update or review their forms as they gather new financial information throughout the year. The platform also integrates eSigning capabilities, so approvals and signatures can be obtained swiftly without needing to print, sign, and scan. Lastly, pdfFiller’s comprehensive document management tools allow users to store, retrieve, and organize their tax forms conveniently.

Types of tax organizer forms

Tax organizer forms can vary significantly depending on the user's needs. For individuals, a personal tax organizer will typically include key sections such as income from various sources, deductible expenses, and personal information. Common personal deductions include medical expenses, mortgage interest, and charitable contributions. These sections ensure that individuals accurately capture the data required to maximize their tax deductions and credits.

For businesses, a business tax organizer demands detailed information about revenue, expenses, and operational costs. It is crucial for tracking deductions and credits, such as business-related travel, supplies, and other expenditures. Additionally, specialized tax organizers like those for freelancers and contractors focus on income streams and related expenses common in such work patterns. Non-profit organizations may also utilize tailored organizers to capture their unique financial reporting requirements and maintain compliance with regulatory standards.

Step-by-step guide to filling out a tax organizer form in pdfFiller

Filling out a tax organizer form in pdfFiller is straightforward and user-friendly. The first step is to access the template by navigating the extensive library of tax-related forms available on the pdfFiller platform. Users can search for a specific tax organizer template or browse through categories to find the most suitable one for their needs.

Once you have selected the right template, the next step is to input personal and business information. It’s essential to provide detailed sections, including income sources, deductions, and any relevant financial data that would affect your taxes. Tips for accurate data entry include double-checking financial records and referring to last year's tax documents for consistency.

Following data entry, users can utilize interactive tools within pdfFiller for automatic calculations, simplifying the process and minimizing errors. These tools can help assess estimated taxes owed or refunds expected, allowing for better financial planning. Finally, it's crucial to check for errors and make corrections, as accuracy is vital for successful tax filing and avoiding potential audits.

Editing and customizing your tax organizer form

One of the standout features of pdfFiller is the ability to edit and customize your tax organizer form. Users can add notes and comments directly to the form, facilitating collaboration with accountants or family members who may also be involved in the tax preparation process. This feature is invaluable for clarifying specific entries or highlighting any items that need further review.

Additionally, pdfFiller enables users to attach supporting documents, such as W-2s, 1099s, or receipts, which ensure that all relevant information is compiled in one place. Customizing sections of the form based on individual needs may include adding unique income sources or specific deductions that relate to particular life situations, such as education costs or medical expenses.

Saving, signing, and sending your tax organizer form

After completing your tax organizer form, the first step is to save the organized document. PdfFiller provides various saving options, allowing users to store their forms securely in the cloud or download them directly to their devices for offline access. This flexibility is crucial during tax season when you may need to access your documents across different platforms.

Using the eSignature features, users can add signatures and initials easily, expediting the final steps of document approval. Once signed, sharing with accountants or team members can be done effortlessly through direct emailing or by sharing links, ensuring everyone involved has the information they need to complete tax submissions.

Managing tax organizer forms with pdfFiller's tools

Managing tax organizer forms effectively is essential, especially during tax season. PdfFiller offers robust document storage solutions that allow users to organize and retrieve forms easily. By categorizing documents with tags, users can quickly find their tax organizer forms when needed, saving valuable time and reducing stress.

Moreover, pdfFiller provides version control and history tracking, meaning users can monitor changes made to their forms over time. This feature is particularly useful if multiple individuals are collaborating on the same tax organizer form, preventing confusion and ensuring clarity on edits or updates made throughout the tax preparation process.

Frequently asked questions (FAQs) about tax organizer forms

Addressing common concerns about tax organizer forms can assist users in preparing for their filings. A common question is, 'What happens if I forget to include information?' In this case, it's important to amend your tax filing as soon as possible to avoid penalties. Another frequent inquiry is about updating forms after submission; users can often modify filed returns via amended returns, although each situation varies depending on local tax laws.

Users also express concerns about common mistakes to avoid, such as not accurately reporting income or miscalculating deductions. An effective strategy for minimizing errors is to review the completed tax organizer form thoroughly and consult with a tax professional before finalizing submissions.

Related forms and templates

Tax organizer forms can sometimes be confused with standard tax forms. However, they serve distinctly different purposes. Unlike standardized government forms that require specific information under regulatory guidelines, a tax organizer form is more flexible and tailored to an individual’s or business's unique needs. Other useful templates include income reports, expense tracking sheets, and financial statements, all of which can complement the tax organizer to further streamline the tax preparation process.

User testimonials and success stories

Users have shared numerous positive experiences utilizing pdfFiller for their tax organizer forms. For instance, one small business owner reported significant improvements in efficiency during tax season, with reduced errors and faster turnaround thanks to the platform's collaborative features. Testimonials often highlight the ease with which documents can be edited and signed, allowing for quick updates and necessary adjustments without the usual headache that tax preparation can entail.

Success stories illustrate that using pdfFiller has simplified complex tax preparation processes. Users have expressed gratitude for the clear layout and accessible tools, which have made navigating their financial information easier than ever before, resulting in a more organized approach to annual filing.

Final tips for effective use of tax organizer forms

To maximize the benefits of a tax organizer form, it’s advised that users employ best practices for yearly updates. Keeping income and expense records current throughout the year will dramatically simplify the filling process come tax time. Equally important is to utilize pdfFiller's customer support and training resources. These tools can provide additional guidance on maximizing the platform's features and ensuring that users are fully equipped to handle their tax obligations efficiently.

Staying proactive about tax organization plays a vital role in successful annual filings. By getting familiar with the tax organizer form and embracing digital tools, such as those offered by pdfFiller, users can effortlessly navigate their financial documentation and ensure they capture every deduction and credit available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax organizer?

How do I make changes in tax organizer?

Can I edit tax organizer on an Android device?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.