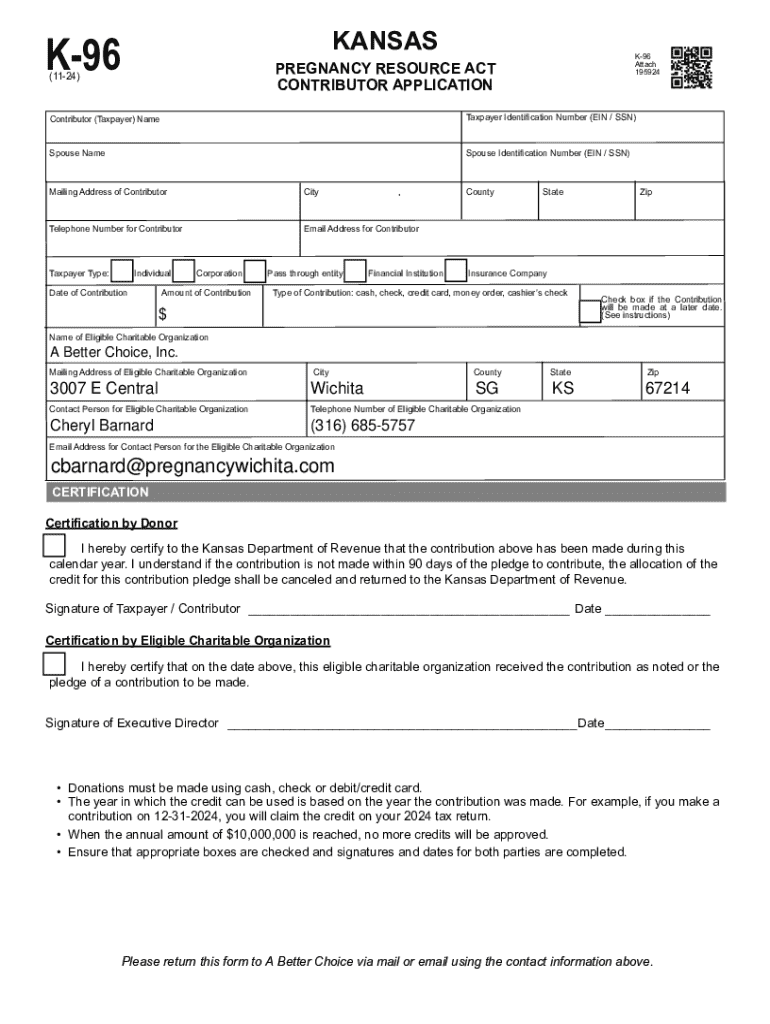

Get the free K-96 Tax Credit Application

Get, Create, Make and Sign k-96 tax credit application

How to edit k-96 tax credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out k-96 tax credit application

How to fill out k-96 tax credit application

Who needs k-96 tax credit application?

Everything You Need to Know About the K-96 Tax Credit Application Form

Understanding the K-96 tax credit

The K-96 Tax Credit aims to provide financial support to eligible individuals and families, particularly those facing economic challenges. This credit can dramatically reduce your state tax obligations, making it a crucial resource for many households. By redistributing financial resources, the K-96 tax credit not only alleviates immediate financial burdens but also contributes to broader economic stability.

Qualifying for this tax credit is an essential first step to accessing its benefits. The K-96 Tax Credit is available to a diverse range of applicants, primarily low to middle-income families. Understanding the eligibility criteria ensures you can take advantage of this opportunity without unnecessary detours.

Eligibility criteria for the K-96 tax credit

Eligibility for the K-96 Tax Credit hinges on specific financial criteria and residency requirements. Income limits vary based on family size and other factors, and documentation proving residency is required. It's essential to gather these documents ahead of time to streamline the application process.

Common eligibility scenarios include families with children, single parents, or individuals on fixed incomes such as Social Security. For instance, a family of four with a combined income under a certain threshold in Kansas may qualify for substantial tax credits under K-96.

Credit amount and limits

The K-96 Tax Credit offers varying credit amounts based on the applicant's income bracket. This tiered structure is designed to provide more substantial support to those who need it most, with a maximum credit available for the lowest income brackets. Understanding these limits is critical for applicants to gauge what they can expect to receive.

While the maximum allowable credit may change yearly based on state budget allocations, applicants should also be mindful of the conditions that could lead to denial of their credit claims, such as incorrect information or failure to meet deadlines.

How to apply for the K-96 tax credit

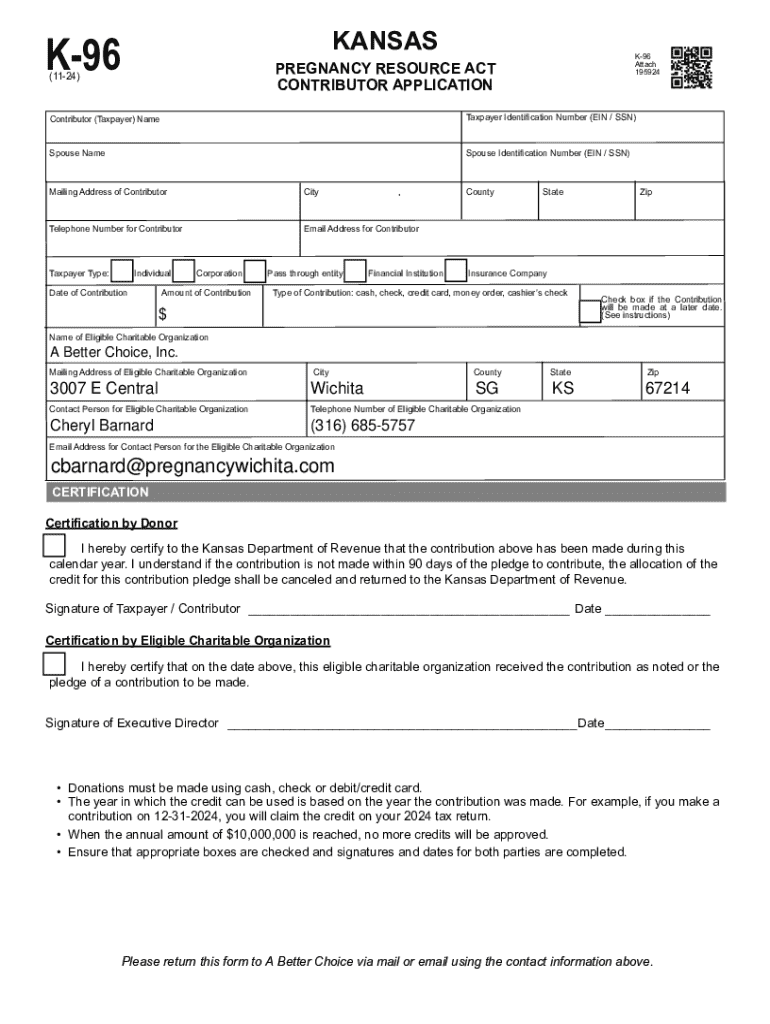

Applying for the K-96 tax credit requires completing a specific application form. First, access the K-96 tax credit application form on the Kansas Department of Revenue website or utilize pdfFiller for a streamlined process. Once downloaded, follow the detailed instructions to fill out the application accurately, ensuring to double-check required fields to avoid common mistakes.

pdfFiller provides excellent tools for easy editing, signing, and collaborating. These features allow multiple team members to work together on the application if necessary, ensuring that all input is correctly reflected before submission.

Procedures for claiming your K-96 tax credit

Once your application is completed, the next step is submission. The K-96 tax credit application can be submitted online or via traditional paper methods. Knowing the submission deadlines ensures that your application is processed in time, as late submissions could disqualify you from receiving the credit. Be diligent about checking the status of your application afterward.

If there are issues with your claim, such as delays or errors, knowing how to contact the right department can help resolve these problems swiftly. Regularly checking your application status through the state portal or following up with customer service is recommended.

Important definitions related to the K-96 tax credit

To navigate the K-96 Tax Credit effectively, familiarizing yourself with essential tax terminology is crucial. Understanding the difference between a tax credit and a tax deduction, for example, is fundamental. While a tax credit reduces your tax bill dollar-for-dollar, a deduction reduces the amount of taxable income.

Equally important is clarifying which expenses are considered eligible versus disqualified, as misunderstanding can lead to erroneous claims. Being well-informed can prevent complications in your application process.

Related tax implications and advisory

Understanding the K-96 Tax Credit’s position within Kansas state tax regulations is essential for effective financial planning. Utilizing this credit can affect your overall tax situation, especially when anticipating future taxes. Consulting with a tax professional can provide tailored advice based on your unique financial situation.

Your tax advisor can guide you regarding the interplay between the K-96 credit and other potential deductions, ensuring that you maximize your financial benefits while remaining compliant with tax laws.

Tips for a successful application process

Avoiding common pitfalls is critical for a successful application process. Many applications are denied due to incomplete information or failing to provide necessary documentation. To mitigate these risks, a thorough review of your application before submission can save you time and frustration.

Best practices involve gathering all necessary documents, checking for accuracy, and submitting on time. Organizing your paperwork in a clear order can also facilitate easier review by the authorities.

Resources and tools for applicants

Applicants can utilize various tools to optimize their K-96 Tax Credit application experience. Features on pdfFiller allow users to edit and sign documents effortlessly, making the process more efficient. The interactive tools available on the platform help track and manage your documents, ensuring that everything you need is at your fingertips.

Additionally, an ongoing FAQ section specifically related to the K-96 Tax Credit will help address concerns as they arise, providing immediate answers to common questions.

Engagement and community support

Staying informed about updates regarding the K-96 Tax Credit is imperative. Regular engagement with community resources and official announcements can enhance your understanding and ensure compliance with any changes that may occur. This allows you to make timely applications and adjustments to your financial planning.

Community testimonials also provide valuable insights. Hearing success stories from individuals who have benefited from this credit can inspire and motivate others to explore available options and navigate the application process confidently.

Interactive features on pdfFiller

pdfFiller offers a user-friendly experience tailored to your needs when navigating the K-96 Tax Credit application form. Utilizing its various editing tools can optimize the way you manage your documents, from eSigning to collaborating with others to ensure accuracy.

In addition, pdfFiller’s online support options provide quick access to assistance for any questions or technical difficulties you may encounter during the application process. This ensures that you're never stranded, even if challenges arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my k-96 tax credit application in Gmail?

How can I get k-96 tax credit application?

How can I edit k-96 tax credit application on a smartphone?

What is k-96 tax credit application?

Who is required to file k-96 tax credit application?

How to fill out k-96 tax credit application?

What is the purpose of k-96 tax credit application?

What information must be reported on k-96 tax credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.