Get the free Mortgage and Home Equity Research Request

Get, Create, Make and Sign mortgage and home equity

How to edit mortgage and home equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage and home equity

How to fill out mortgage and home equity

Who needs mortgage and home equity?

Mortgage and home equity form: A how-to guide

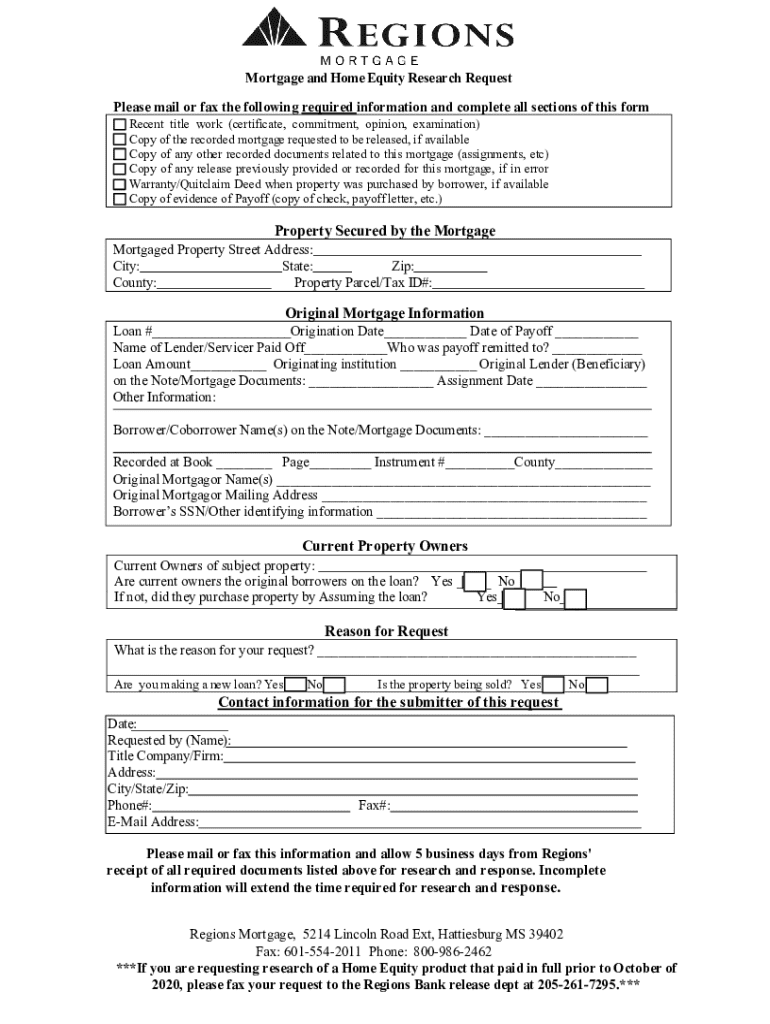

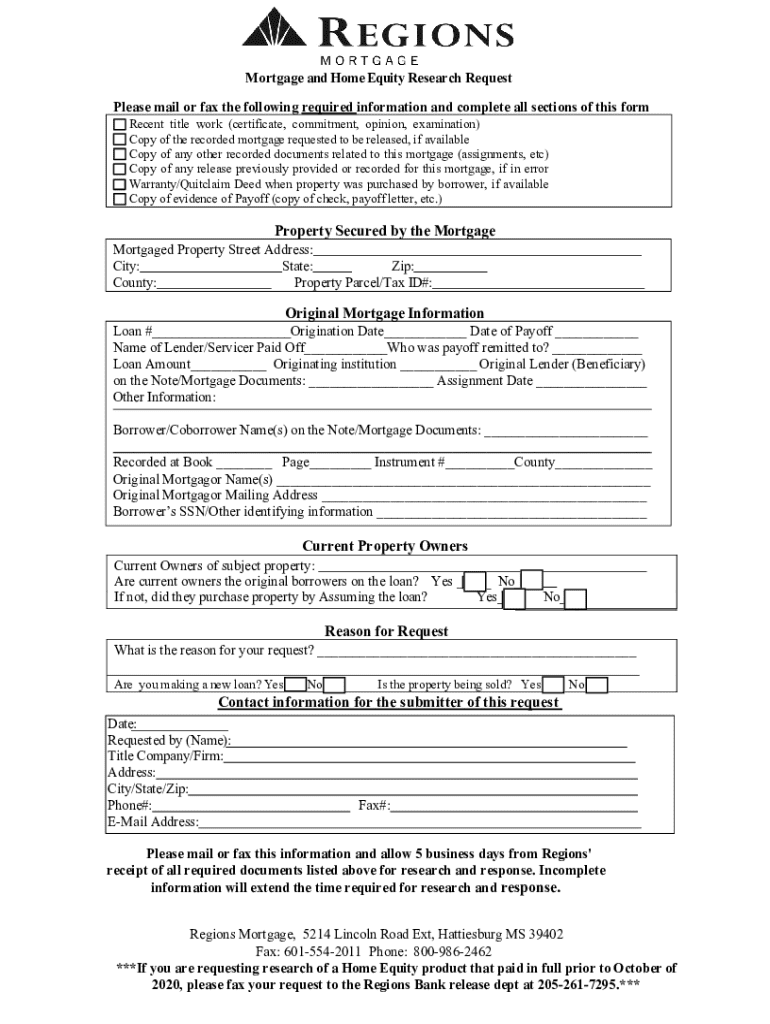

Understanding mortgage and home equity forms

Mortgage forms are essential documents used in the borrowing process for purchasing a home. Their design can vary based on the type of mortgage or lender.

Common types of mortgage forms include fixed-rate, adjustable-rate, VA loans, and FHA loans. Each type has unique features and serves different borrower needs. Key components of these forms typically involve the loan amount, interest rate, repayment terms, and borrower details.

Home equity forms, conversely, focus on leveraging the existing equity in a homeowner’s property to secure additional financing. These forms can include home equity loans and lines of credit, allowing homeowners to tap into their asset value for financial needs.

Understanding both document types is crucial for any homeowner or prospective buyer, as they play a significant role in managing personal finances and maximizing property potential.

Key differences between mortgage and home equity forms

The first significant difference lies in the loan types and purposes. Mortgages are primarily used to purchase property, while home equity loans enable homeowners to borrow against their property's value. Essentially, mortgages help buyers enter the property market, whereas home equity loans assist homeowners in accessing funds without selling their property.

In terms of application processes, mortgage submissions typically involve more rigorous assessments, including credit checks and income verification, as lenders want to ensure borrowers can repay their loans. Home equity applications, although less stringent, still require property appraisal and credit evaluations to gauge the amount of equity that can be drawn.

Preparing to fill out your mortgage form

Before starting to fill out your mortgage form, gather all necessary documentation. This typically includes recent income statements, tax returns, and statements of assets. Lenders will analyze this information to determine your eligibility.

Additionally, understanding your credit history is imperative. Your credit score plays a pivotal role in your application, affecting both the approval chances and the interest rates available to you. A higher credit score translates to better loan terms.

Step-by-step: filling out your mortgage form

Begin by filling out the basic information section, which usually requires personal details such as your name, address, and Social Security number. Ensure all information is accurately reported to avoid delays.

Next, move to the financial information section. This part covers your employment history and income sources, alongside any debts or assets you hold. Be honest about your financial situation; lenders appreciate transparency.

Continuing, provide thorough details about the property you wish to purchase, including its description and estimated value. Ensure that you also clarify the loan details, including desired amounts and specific loan terms that best suit your financial goals.

Step-by-step: filling out your home equity form

Before you begin, evaluate how much home equity you have available. Calculating home value minus outstanding mortgage balance will give you a comprehensive picture of your equity. This step is crucial to determine how much you can consider borrowing.

When completing the form, focus on key sections that detail your current mortgage information, the amount you wish to borrow, and the intended use for the funds. Many applicants falter by either undervaluing their equity or by misrepresenting the intended purpose for borrowing, which could lead to processing delays.

Interactive tools for managing your forms

Utilizing document editing tools can simplify the process of filling out mortgage and home equity forms. With features that allow for easy modifications and adjustments, these platforms enhance user experience and accuracy. Look for tools that offer templates specifically for mortgage and home equity forms, saving you time.

pdfFiller provides robust tools for document collaboration, making it easy to share forms securely. With eSigning capabilities, you can quickly finalize documents without the hassle of printing or scanning. Such functionalities not only streamline the process but also ensure you remain organized at every step.

Reviewing and submitting your forms

Conducting a final review of your filled forms is essential before submission. Look out for any discrepancies in your information, including typos or missing details, as these can lead to significant delays in processing.

The submission process can vary by lender but generally involves submitting your forms electronically through their portal. Ensure you keep a copy of all submitted documents for your records, as they may be needed for follow-up inquiries.

Common questions about mortgage and home equity forms

Many borrowers find themselves confused after a denial. If you’re denied, review the reasons provided by the lender. It's essential to address these issues before reapplying, as many common problems stem from credit scores or incomplete information.

Appealing a decision is possible, and understanding the lender’s criteria will help in formulating a robust case. Additionally, it’s important to know how to make updates or corrections to your forms after submission; generally, this process involves contacting your lender and providing the necessary documentation.

Managing your mortgage and home equity loans post-submission

After submitting your applications, it's essential to track their status actively. Many lenders provide online tools to check the progress of your application, which can significantly reduce anxiety during the waiting period.

Understanding the closing process is equally crucial. Once your application is approved, the process will typically lead to closing, where you'll finalize the details of the loan agreement and sign the necessary paperwork. Keep communication lines open with your lender during this period to facilitate a smooth closing process.

Best practices for future home equity loans

Maintaining good credit is vital if you intend to apply for future home equity loans. Regularly monitor your credit score, pay bills on time, and keep your debt-to-income ratio low. These practices not only improve your chances of approval but also ensure you secure favorable interest rates.

When utilizing your home equity, approach it with caution. Use funds wisely for worthwhile investments or necessary expenses to avoid putting your home and financial future at risk. Remember, it’s crucial to ensure that your borrowing aligns with your long-term financial plans.

Leveraging pdfFiller for a seamless document experience

pdfFiller stands out as a premier choice for document management, particularly for mortgage and home equity forms. Its platform enables users to create, edit, and manage documents efficiently from anywhere. The intuitive interface ensures that even those less familiar with technology can navigate through the document creation process seamlessly.

To maximize your experience with pdfFiller, use its collection of templates tailored for mortgage and home equity forms. This can significantly enhance your workflow, allowing you to focus on critical tasks without the hassle of formatting or design. With built-in tools for eSigning and collaboration, pdfFiller empowers users in their document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage and home equity directly from Gmail?

How do I edit mortgage and home equity in Chrome?

Can I sign the mortgage and home equity electronically in Chrome?

What is mortgage and home equity?

Who is required to file mortgage and home equity?

How to fill out mortgage and home equity?

What is the purpose of mortgage and home equity?

What information must be reported on mortgage and home equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.