Get the free Financial Aid Student Withdrawal Authorization Form

Get, Create, Make and Sign financial aid student withdrawal

Editing financial aid student withdrawal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid student withdrawal

How to fill out financial aid student withdrawal

Who needs financial aid student withdrawal?

Navigating the Financial Aid Student Withdrawal Form: A Complete Guide

Understanding financial aid and withdrawal

Financial aid encompasses a variety of funding sources designed to help students pay for their education, including grants, scholarships, work-study programs, and loans. For many students, these resources can be the lifeline needed to achieve academic goals and secure a brighter future.

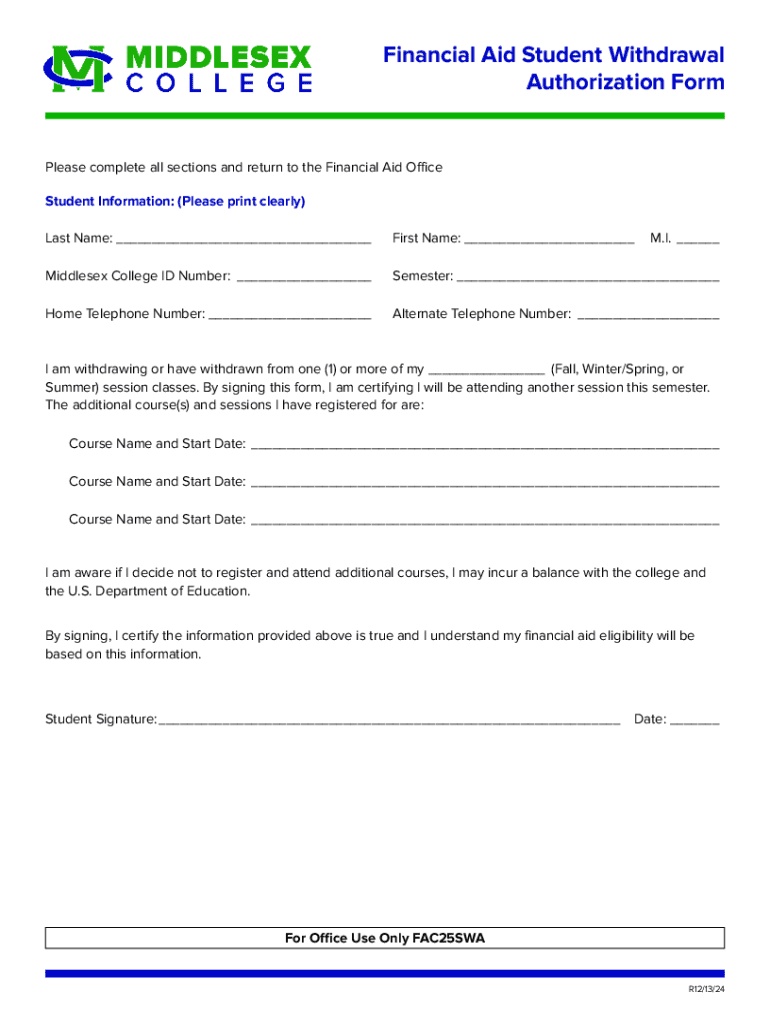

When circumstances arise that challenge a student's ability to continue their education, such as personal health issues or financial difficulties, understanding the financial aid student withdrawal form becomes essential. This form is more than just paperwork; it is a critical component of the withdrawal process that ensures students properly manage their responsibilities regarding financial aid.

A complete understanding of the withdrawal process is paramount for financial aid recipients. It involves knowing how to approach a withdrawal while maintaining compliance with institutional policies and safeguarding future financial aid eligibility.

When to use the financial aid student withdrawal form

Determining when to withdraw from school is a significant decision and depends on weighing various criteria. Key considerations include personal circumstances, academic challenges, and financial concerns.

If any of these apply, students must recognize the importance of the financial aid student withdrawal form to formally document their reasons and ensure compliance with financial aid regulations.

Implications of withdrawing as a financial aid recipient

Withdrawing from classes triggers significant implications for financial aid recipients, primarily concerning the adjustment of financial aid packages. The distinction between earned and unearned Title IV funds plays a crucial role in this process.

Understanding how institutions calculate these adjustments is essential. Students who withdraw before completing more than 60% of a term may be required to return a portion of the funds disbursed, which can have long-term impacts on financial aid eligibility.

In addition to financial ramifications, withdrawal can also affect a student's academic standing, potentially damaging GPA and overall academic progress — a factor that must be considered before making this critical decision.

The withdrawal process: step-by-step guide

Approaching the withdrawal process should be systematic and thorough. Here’s a step-by-step guide to navigate the financial aid student withdrawal form.

What happens after you withdraw?

Once the withdrawal process is complete, it’s crucial to understand the financial aid implications. The Return of Title IV Funds calculation will occur, determining how much aid you must return. This process can be complex, so navigating it carefully is essential.

Additionally, students should consider possible scenarios after withdrawal, such as returning to school in a future term. Knowing the appeal processes for financial aid reinstatement is vital for maintaining access to funding when re-enrolling.

Special considerations in the withdrawal process

Timing matters significantly during the withdrawal process, particularly concerning whether students withdraw before or after 60% of the term. Each scenario presents different financial implications and governs relevant institutional policies.

Students must also pay special attention to summer classes or short sessions, where policies may differ. Understanding these nuances can help students maintain sound financial and academic standing.

Addressing common concerns and questions

Students often have pressing questions about the withdrawal process. Understanding what happens if all courses are not completed is crucial; typically, students must notify a financial aid office promptly.

Students should proactively seek clarity on these concerns to avoid confusion during the withdrawal process.

Utilizing pdfFiller for document management

Using pdfFiller can greatly enhance the experience of completing and managing the financial aid student withdrawal form. This platform simplifies the editing, signing, and collaboration process, making it easier for students to handle critical documents.

Moreover, pdfFiller allows users to access and manage all related documents efficiently, providing a centralized hub for managing financial aid paperwork. Such an approach can save time and reduce stress during the withdrawal process.

Navigating complex situations during withdrawal

In specific cases, a Return of Title IV calculation may not be necessary, or students might not have received all earned Title IV aid. Understanding how these scenarios operate can make a significant difference.

Moreover, maintaining open communication with your institution can facilitate a smoother withdrawal process, helping to clarify any uncertainties that might arise.

Additional resources and support

Students looking for more information or assistance should consult financial aid offices directly for guidance. Various forms and templates available online can help facilitate the withdrawal process. Moreover, establishing contact with support channels can aid in navigating any challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get financial aid student withdrawal?

How do I edit financial aid student withdrawal online?

How do I complete financial aid student withdrawal on an Android device?

What is financial aid student withdrawal?

Who is required to file financial aid student withdrawal?

How to fill out financial aid student withdrawal?

What is the purpose of financial aid student withdrawal?

What information must be reported on financial aid student withdrawal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.