Get the free L-1040

Get, Create, Make and Sign l-1040

How to edit l-1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out l-1040

How to fill out l-1040

Who needs l-1040?

How to Fill Out the -1040 Form: A Comprehensive Guide

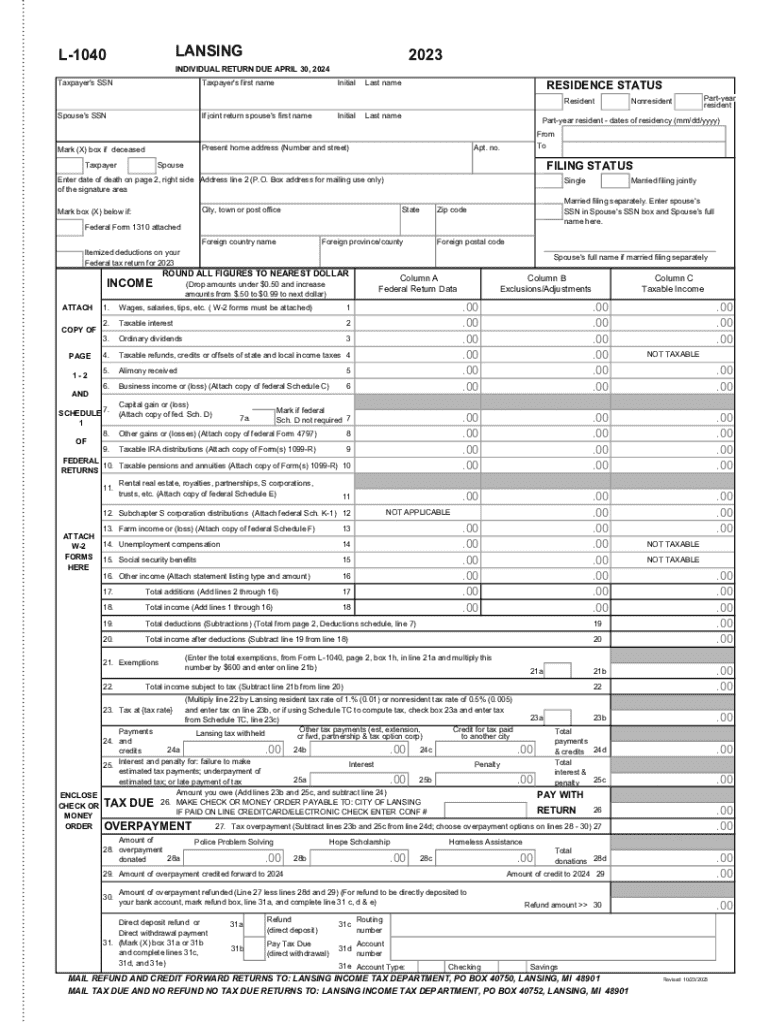

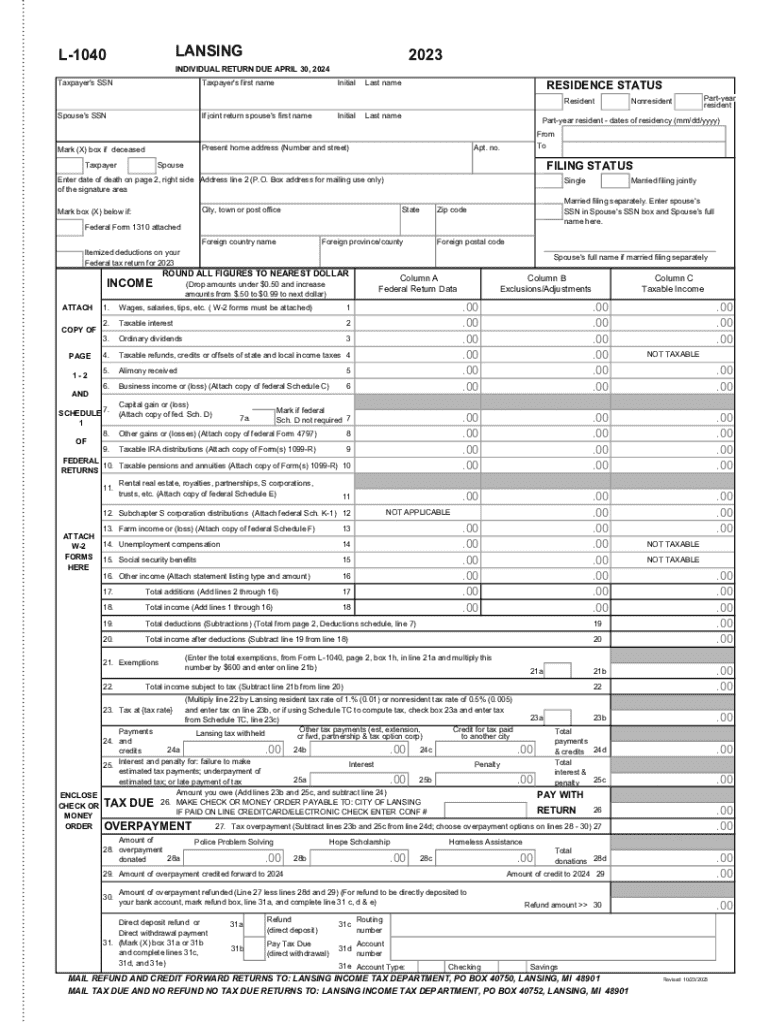

Overview of the -1040 form

The l-1040 form is a pivotal document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form serves as the foundation for individual tax filings, capturing essential financial information such as income, deductions, and credits that determine tax liability. Accurate completion is crucial not only for compliance but also to ensure taxpayers retain any eligible refunds. Many individuals and families utilize the l-1040 form, especially those who do not have overly complex tax situations, making it a versatile tool in the financial toolbox.

It’s particularly important during tax season to be diligent and precise when filling out the l-1040 form to avoid common pitfalls that can lead to delays or audits. Common scenarios for using the l-1040 include standard wage earners, retirees, students with part-time jobs, and individuals who only have traditional income sources. Regardless of your situation, understanding the workings of the l-1040 form can help ensure a smooth filing experience.

Key features of the -1040 form

The l-1040 form offers several key features that taxpayers need to be aware of. Firstly, the form accommodates various types of income, including wages, salaries, interest, dividends, and some other income sources. Furthermore, it also allows for a range of deductions that can lower your taxable income. Eligibility to file the l-1040 varies; typically, individuals with uncomplicated tax situations qualify. In contrast, those with more complex financial situations may need to file different forms such as the l-1040A or l-1040EZ.

Understanding the differences between the l-1040 and other tax forms is essential for taxpayers. For instance, the l-1040 form is generally comprehensive, whereas l-1040A and l-1040EZ cater to simpler scenarios. Taxpayers should thoroughly assess their financial situation to choose the correct form and maximize deductions while minimizing tax liability.

Step-by-step instructions for filling out the -1040 form

Preparing your documentation

Before filling out the l-1040 form, ensure you have all necessary documentation. This includes your W-2 forms from employers, 1099 forms for freelance work or interest income, and any receipts for deductible expenses. Additionally, you will need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) along with your spouse’s information if filing jointly. This preparation not only speeds up the process but also helps in accurately reporting your financial record.

Section breakdown

Personal information

The personal information section requires that you accurately input your name, address, and filing status, which will impact your tax rates. For those who are married, you'll need to detail your spouse's information, and if you have dependents, their details must be included as well. It's essential to double-check spelling and numbers to avoid mismatches with IRS records.

Income reporting

In the income reporting section, it's crucial to be thorough. Report all sources of income accurately; this includes wages reported on your W-2, any interest and dividends from your bank statements, and proceeds from freelance work reflected on your 1099 form. Each income source must be documented carefully to ensure complete transparency.

Adjustments to income

Adjustments to income can include contributions to retirement accounts like IRAs, student loan interest, and tuition fees. Be sure to understand what adjustments apply to your situation to decrease your taxable income legitimately. The IRS provides worksheets and guides to help calculate these adjustments, ensuring you maximize your deductions effectively.

Deductions and credits

This section differentiates between standard and itemized deductions. The standard deduction is a fixed amount that varies depending on your filing status, while itemized deductions allow you to deduct specific expenses such as medical expenses, charitable donations, and mortgage interest, if they total more than the standard deduction. Tax credits, on the other hand, directly reduce the taxes owed and can significantly impact your overall tax liability.

Calculating your tax liability

After calculating your total income and applicable deductions, the next step is determining your tax liability. This can be done using the tax tables provided by the IRS that correspond with your taxable income. Ensure to include any additional taxes, such as self-employment tax, if applicable. It's advisable to check your calculations, as errors in this section can lead to unwanted penalties.

Tools for filling out the -1040 form

Interactive calculators

Various online interactive calculators can significantly simplify the process of estimating your taxes. These tools allow you to project various tax outcomes based on the figures you input, helping you assess potential credits and deductions before filing. Utilizing these calculators can help in planning for any tax payments due, ensuring your financial situation remains stable.

pdfFiller's features for the -1040 form

pdfFiller offers unique features specifically designed to streamline the completion of the l-1040 form. With the ability to edit the form online, users can make real-time adjustments and add notes as needed. The advantages of eSigning also cannot be overstated; it allows for seamless submission without the need for physical paperwork. Furthermore, pdfFiller includes document management features that help keep your tax documents organized and readily accessible, which is particularly beneficial during audits.

Common mistakes to avoid when filling out the -1040 form

Many taxpayers fall into common traps when completing the l-1040 form. One frequent error is reporting income inaccurately, whether by omitting a 1099 form or miscalculating W-2 earnings. Additionally, miscalculations in deductions and credits are prevalent, often due to misunderstanding eligibility criteria or requirements for substantiation. It’s crucial to double-check every entry to minimize the potential for costly mistakes.

Being cautious during the filing process can save you time and potential audits. Simple checks, such as ensuring all numbers match your financial documents and double-checking math, can lead to a smoother tax submission process.

Submitting the -1040 form

When it comes to submitting your l-1040 form, you have the option of electronic submission or mailing it to the IRS. E-filing is typically faster and allows for quicker refunds if you’re expecting one. However, if you choose to mail your form, ensure that you send it to the correct address depending on your state and whether you’re enclosing a payment. Important deadlines to remember include the tax filing deadline, typically April 15, unless this date falls on a weekend or holiday, in which case it may be adjusted.

Tracking your submission status can also be done online, allowing you to ensure the IRS has received your form without unnecessary delays. Whether filing electronically or through traditional means, staying organized and aware of deadlines will help keep your tax process on track.

Post-filing actions and what to expect

After submitting your l-1040 form, expect communication from the IRS regarding your filing status. If there are discrepancies or questions regarding your submissions, the IRS may contact you for clarification or initiate an audit. Understanding these processes can help ease anxiety during tax season. It's advisable to keep all documentation related to your tax filing for at least three years, as this information may be required in subsequent communications or in the event of an audit.

Being informed about what comes next helps you navigate any IRS inquiries effectively and avoid potential missteps. Establishing a good record-keeping habit post-filing will facilitate future tax seasons and reduce stress.

Resources for further assistance

Should you require additional help when dealing with the l-1040 form, there are numerous resources available at your disposal. The IRS website features a wealth of information on forms, interactive tools, and guidelines that can assist you in understanding your filing obligations. Furthermore, consider seeking professional tax services if your financial situation is complex or you feel uncertain about certain aspects of the filing process. Many tax preparation services offer affordable options tailored to individual needs, providing peace of mind and reducing any potential filing errors.

Additionally, numerous online platforms and communities exist where taxpayers share their experiences and tips for handling the l-1040 form and other tax-related matters.

Keeping your tax records organized

Maintaining organized tax records is essential for effective financial management. This begins with keeping all documentation related to your l-1040 form in a designated tax folder, whether digitally or physically. It's important to regularly update this folder with any new forms or receipts throughout the year to prevent the rush as tax deadlines approach.

Digitally, consider using secure cloud storage solutions that range from Google Drive to pdfFiller, which allows for easy access and retrieval when needed. By investing a little time in organizing your tax records yearly, you will ensure that your financial information is readily available, streamlined, and manageable for years to come.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my l-1040 directly from Gmail?

Where do I find l-1040?

How do I complete l-1040 on an Android device?

What is l-1040?

Who is required to file l-1040?

How to fill out l-1040?

What is the purpose of l-1040?

What information must be reported on l-1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.