Get the free Ej-130

Get, Create, Make and Sign ej-130

Editing ej-130 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ej-130

How to fill out ej-130

Who needs ej-130?

Understanding the EJ-130 Form: A Comprehensive Guide

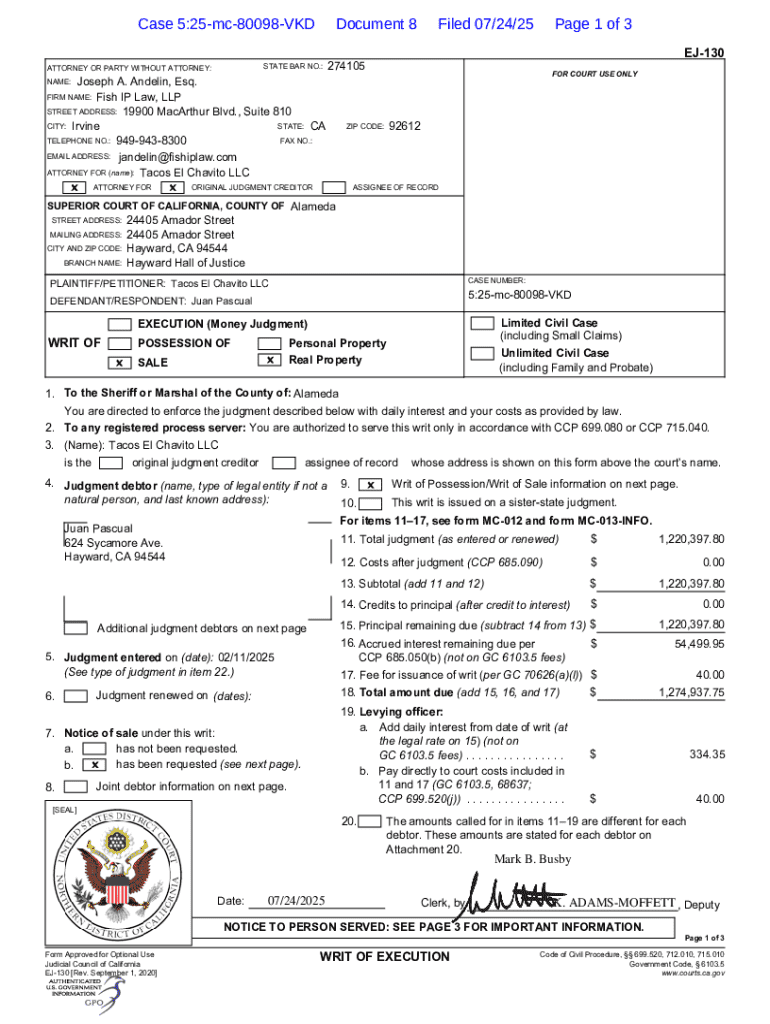

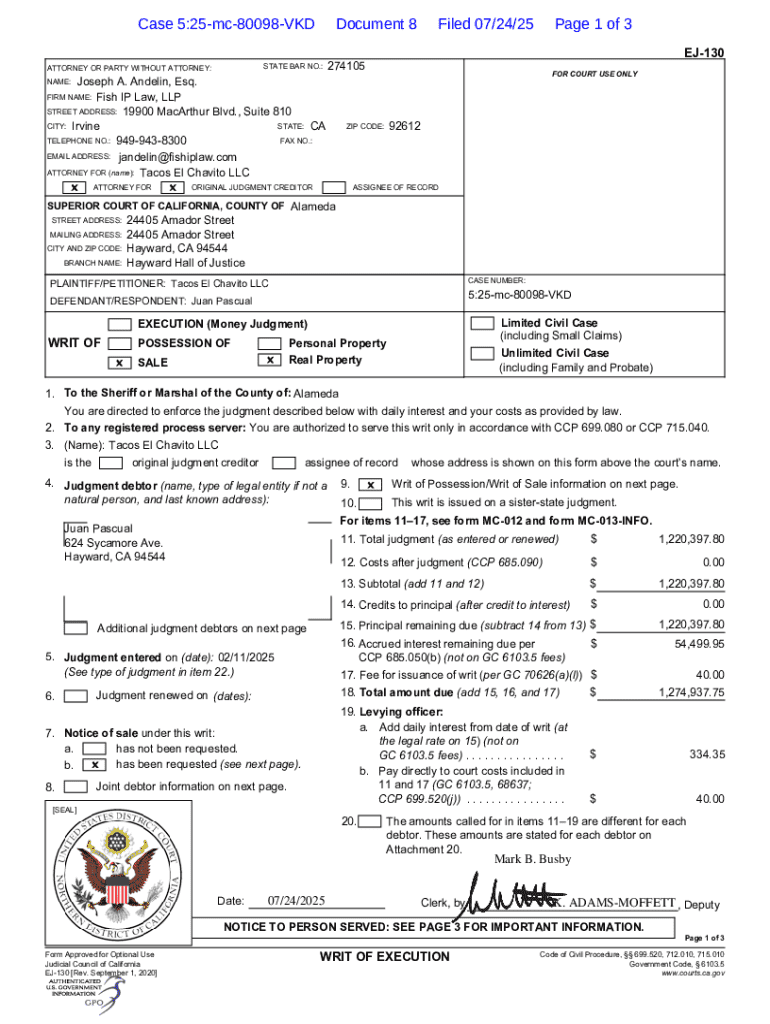

Overview of the EJ-130 Form

The EJ-130 form, officially known as the 'Application for and Order for Appearance,' plays a pivotal role in legal proceedings, particularly in debt collection cases. This form serves as a formal request to the court for a writ of execution, enabling the creditor to enforce a judgment against a debtor.

Individuals or entities that have obtained a judgment in their favor may need the EJ-130 form to collect the debt owed. It is commonly utilized in instances where the debtor has failed to fulfill their payment obligations, providing a structured process to secure the funds rightfully owned to the creditor.

Understanding the legal context

The EJ-130 form is particularly crucial in the context of debt collection cases. When a creditor wins a judgment, the next step often involves collecting that debt through legal means. The EJ-130 form serves as an essential document that initiates this collection process, granting the necessary permissions for the creditor to seek payment.

In legal terms, several statutes govern the use of the EJ-130 form, primarily focusing on the enforcement of civil judgments. California's Code of Civil Procedure outlines the processes creditors must follow to collect debts, ensuring that both creditors and debtors' rights are protected throughout the process.

Detailed instructions for filling out the EJ-130 form

Filling out the EJ-130 form accurately is critical for ensuring that your application is processed without delays. Here’s a step-by-step guide to help you through the process.

Filing the EJ-130 Form

Once the EJ-130 form is filled out, the next step is to file it with the court. It's critical to know where and how to go about this process. The form typically needs to be submitted to the court that issued the original judgment.

Filing fees may apply, which can vary depending on your jurisdiction and the specifics of your case. Generally, these fees are essential for processing your application, and it’s advisable to check with the court beforehand regarding acceptable payment methods.

After filing: Next steps

After you have filed the EJ-130 form, it’s important to understand what will happen next. The court will review your application, and you can typically expect a response within a specific timeline, which may vary based on the court's workload.

Once the writ of execution is granted, you are responsible for ensuring that it is served on the debtor. This involves delivering the writ to the appropriate law enforcement agency or authorized process server who can carry out the execution.

Handling common issues and questions

While navigating the EJ-130 form process, you may encounter several challenges. Common issues include rejected forms due to incomplete information or not following the prescribed format. To mitigate these issues, ensure that you double-check your application before submission.

Additionally, it's vital to be prepared for potential claims by the debtor. They might assert exemptions or oppose the execution. In such cases, understanding the legal implications and gathering documentation to counter any claims will be critical for a successful outcome.

Utilizing interactive tools on pdfFiller

pdfFiller provides a suite of interactive tools designed to simplify the process of handling the EJ-130 form. With its editing features, users can easily fill out the form, making necessary adjustments to ensure all information is accurate.

eSigning the EJ-130 form is also straightforward with pdfFiller. Users can follow step-by-step instructions to electronically sign the document, eliminating the need for printing and scanning. Additionally, collaboration features enable sharing and teamwork on the form, ensuring that all parties involved can contribute efficiently.

Additional templates and resources

In the realm of debt collection, a variety of legal documents might be required alongside the EJ-130 form. For instance, Wage Garnishment Forms and Earnings Withholding Orders are often associated with enforcing judgments as well.

Having access to a sample filled EJ-130 form can be invaluable for users seeking guidance. It provides a clear reference point for how to complete the form correctly, alleviating fears of errors during this important process.

Next actions after successful execution

Once the court has issued the Writ of Execution, it's essential to know how to proceed in order to recover the funds owed. This may involve working closely with law enforcement or process servers who will execute the writ and facilitate the collection of the debt.

Recordkeeping plays a crucial role in this phase. Keeping accurate and organized records of all filings, communications, and proceedings will be vital for any future legal actions and for tracking the status of the debt collection.

Seeking further assistance

When complexities arise during the debt collection process, it may be necessary to consult legal professionals for guidance. Understanding when to seek assistance can save considerable time and stress, especially when dealing with evasive debtors or legal technicalities.

Additionally, pdfFiller offers a range of support options to accommodate users' needs. Their customer service team is equipped to help with any inquiries related to the EJ-130 form, ensuring that navigating the debt collection process is as smooth as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ej-130?

How do I complete ej-130 online?

How do I edit ej-130 in Chrome?

What is ej-130?

Who is required to file ej-130?

How to fill out ej-130?

What is the purpose of ej-130?

What information must be reported on ej-130?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.