Get the free Ag990-il

Get, Create, Make and Sign ag990-il

Editing ag990-il online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ag990-il

How to fill out ag990-il

Who needs ag990-il?

A Comprehensive Guide to the AG990- Form

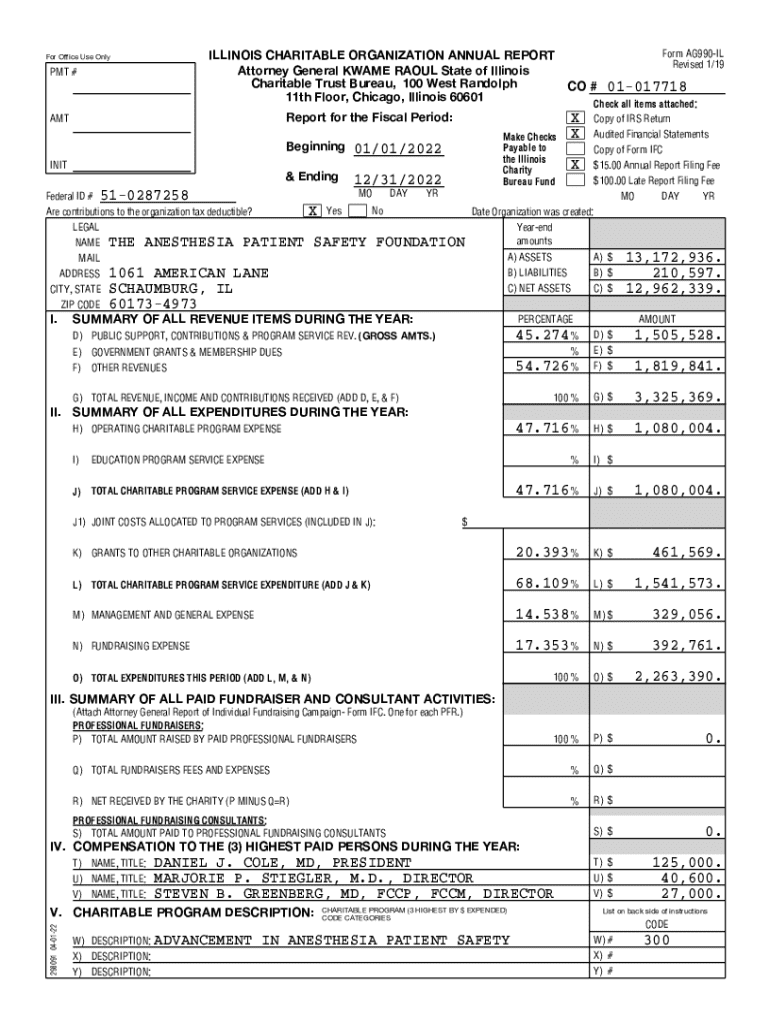

Understanding the AG990- form

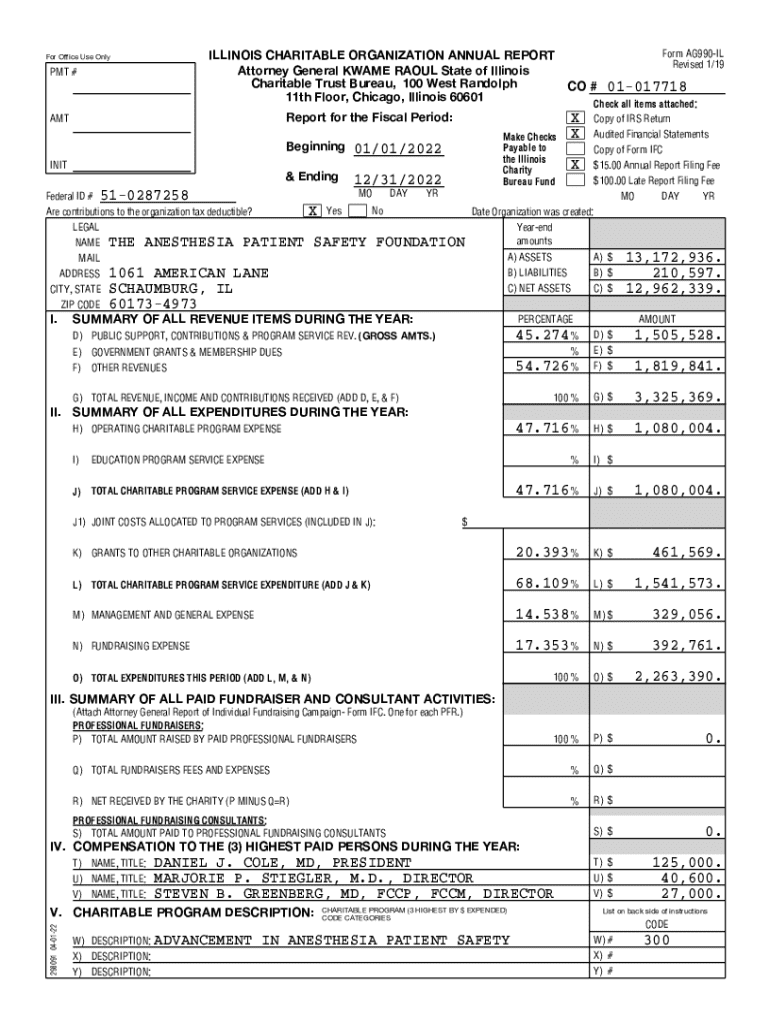

The AG990-IL form serves as a critical financial disclosure document for nonprofit organizations operating within the state of Illinois. Its primary purpose is to promote transparency and accountability in the nonprofit sector by requiring organizations to report their financial activities, governance, and programmatic impact. This form is particularly significant as it helps both the state and the public gauge the integrity and effectiveness of nonprofit operations.

Organizations required to file the AG990-IL include those that hold tax-exempt status under Section 501(c)(3) of the Internal Revenue Code and operate in Illinois. Understanding the nuances of this form can be invaluable for ensuring compliance and maintaining public trust.

Eligibility criteria for filing AG990-

Specific eligibility criteria must be met for an organization to file the AG990-IL form. All nonprofits operating in Illinois that have gross revenues of more than $100,000 per year generally need to complete this annual report. However, organizations with income below this threshold may be exempt from filing, but may still choose to do so for transparency purposes.

Exceptions to the filing requirement can apply to certain small organizations or those classified under specific statutes, such as churches and certain government entities. Identifying your organization’s standing is crucial in determining filing obligations.

Filing deadlines and important dates

Adhering to filing deadlines is essential for maintaining compliance with state regulations. Nonprofits must file their AG990-IL form annually, no later than the 15th day of the fifth month following their fiscal year-end. For those with fiscal year-ends on December 31, this translates to a May 15 deadline.

Late filings can incur penalties, with potential fines that vary based on how overdue the submission is. Organizations facing unique circumstances can sometimes request extensions by demonstrating extenuating factors affecting their ability to file on time.

Preparing to complete the AG990- form

To efficiently complete the AG990-IL form, organizations should gather essential documentation beforehand. Key documents include previous years’ financial statements, budget reports, and any supporting materials that outline programmatic activities.

pdfFiller offers a range of useful tools that allow users to prepare their AG990-IL form seamlessly. Utilizing their platform enables organizations to access templates, collaborate with team members, and ensure all necessary information is organized prior to finalizing the submission.

Step-by-step guide to filling out the AG990- form

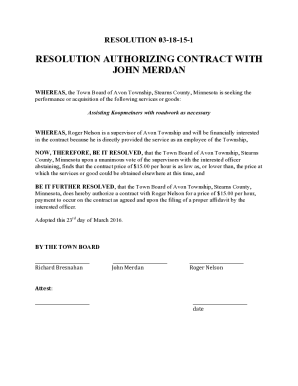

Completing the AG990-IL form requires careful attention to detail, as the document is divided into structured sections reflecting various aspects of the nonprofit’s operations. The first section involves entering basic identifying information, such as the organization’s name, address, and EIN.

Following the initial section, nonprofits must summarize their financial status, reporting total income, expenses, and net assets. Additional questions delve into operational details, looking at program effectiveness and governance practices. Accurate completion of each section is vital to avoid delays in processing and to ensure the information accurately reflects the organization’s activities.

Editing and managing your AG990- form

Once the AG990-IL form is filled out, maintain an error-free document using pdfFiller’s editing features. The platform’s interactive functionalities allow users to easily make modifications, ensuring accuracy before final submission.

Digital document management is pivotal not just for compliance but also for maintaining organized records. Employing best practices for managing these documents can simplify re-filing in subsequent years and prevent confusion.

eSigning your AG990- form

The process of collecting electronic signatures for the AG990-IL form enhances efficiency and expedites the submission process. Through pdfFiller, users can easily implement electronic signature workflows, ensuring all required approvals are obtained promptly.

Security measures are paramount when dealing with sensitive information. pdfFiller employs encryption and secure access protocols to protect signed documents, giving organizations confidence in their electronic submissions.

Submitting the AG990- form

Organizations have several options for submitting the AG990-IL form. While online submission is the preferred method for its convenience, traditional mailing remains available. Ensuring that all required attachments — like payment information, if applicable — are included is critical for preventing delays.

After submission, tracking the status can offer peace of mind. This can usually be accomplished through the State of Illinois’ online portal or by following up directly with the appropriate regulatory body.

Post-submission follow-up

Confirming receipt of the AG990-IL form is an important step in the process. Nonprofits should maintain correspondence records and any confirmation numbers provided upon submission for future reference.

After submission, organizations may be contacted for follow-up inquiries from regulatory bodies, requiring prompt attention to resolve any ongoing discussions or clarifications.

Common mistakes to avoid when filing AG990-

Organizations often run into common pitfalls when filing the AG990-IL, which can include misreporting financial figures, failing to answer specific questions, or neglecting to include necessary supplementary documents.

To increase the likelihood of successful filing, organizations should carefully review all sections, ensure consistency in reported figures, and double-check the completion status of all required fields.

Enhancing your nonprofit’s compliance strategy

Incorporating AG990-IL filing into your organization’s annual strategy is pivotal for financial integrity. Establish a timeline for gathering necessary documents and completing the filing to promote proactive compliance.

Utilizing tools like pdfFiller can ensure that teams are consistently updated on filing processes and requirements, facilitating smoother annual submissions and long-term organizational health.

Frequently asked questions (FAQ)

To assist organizations in navigating the submission landscape, here are some frequently asked questions regarding the AG990-IL form:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ag990-il without leaving Google Drive?

Can I create an electronic signature for signing my ag990-il in Gmail?

How can I fill out ag990-il on an iOS device?

What is ag990-il?

Who is required to file ag990-il?

How to fill out ag990-il?

What is the purpose of ag990-il?

What information must be reported on ag990-il?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.