Get the free Missouri Standard Unsecured Promissory Note

Get, Create, Make and Sign missouri standard unsecured promissory

How to edit missouri standard unsecured promissory online

Uncompromising security for your PDF editing and eSignature needs

How to fill out missouri standard unsecured promissory

How to fill out missouri standard unsecured promissory

Who needs missouri standard unsecured promissory?

Missouri Standard Unsecured Promissory Form: A Comprehensive Guide

Understanding Missouri unsecured promissory notes

A promissory note is a legal document that contains a written promise from one party to pay a specified sum of money to another party under agreed-upon terms. In Missouri, unsecured promissory notes are particularly relevant for personal loans where no collateral is provided to secure the debt. Understanding the purpose and implications of these notes is crucial for both borrowers and lenders.

One key difference between secured and unsecured promissory notes is the presence of collateral. Secured notes are backed by an asset, like property or a vehicle, whereas unsecured notes do not have this safety net. This distinction impacts both the risk involved for lenders and the potential legal remedies available in case of default.

Types of promissory notes in Missouri

In Missouri, different types of promissory notes serve varied purposes. Understanding these can help you choose the most suitable option for your financial transaction.

The choice of promissory note type can greatly influence loan terms and borrower obligations. For instance, unsecured notes may be preferable for private loans due to their simplicity, while secured notes are better suited for larger loans involving substantial assets.

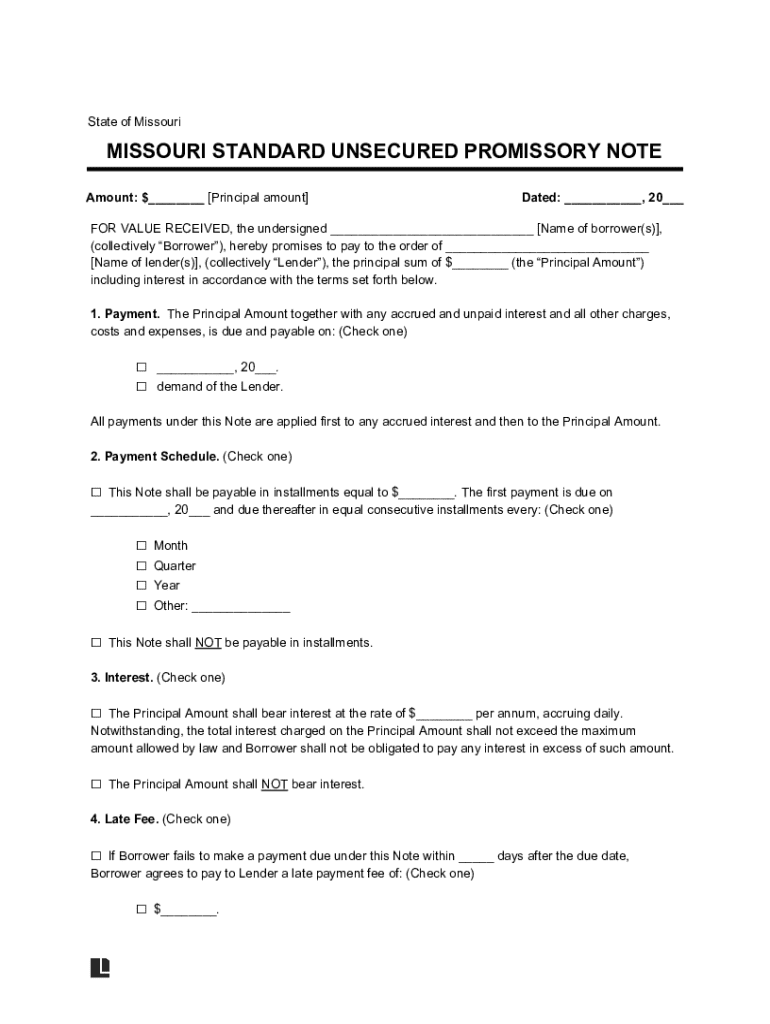

Missouri standard unsecured promissory form: An overview

The Missouri Standard Unsecured Promissory Form is structured to comply with state regulations and outlines the necessary components for enforcing a loan agreement without collateral. Its importance lies in its standardized approach to creating a clear and legally binding document.

Key components included in this form are essential for its validity. This includes the names of both parties, the loan amount, interest rate, repayment schedule, and any additional stipulations that the lender and borrower agree upon.

How to fill out the Missouri standard unsecured promissory form

Filling out the Missouri Standard Unsecured Promissory Form correctly is crucial for its enforceability. Here’s a step-by-step guide to ensure all necessary information is captured accurately.

To avoid common mistakes, review the completed form before signing. Pay close attention to the accuracy of the names, amounts, and dates to prevent invalidation of the note.

Interactive tools for form management

Utilizing technology can simplify the process of filling out and managing the Missouri standard unsecured promissory form. Numerous tools are available for enhancing efficiency.

Implementing these interactive tools not only speeds up the process but also enhances accuracy, making the documentation process smoother and more efficient.

Legality and enforceability of unsecured promissory notes in Missouri

The legality of unsecured promissory notes in Missouri is governed by state-specific laws, which dictate how these notes must be structured to be enforceable in court. It's vital for both lenders and borrowers to understand these legal frameworks.

Factors such as interest rates must also comply with local usury laws. Missouri legal stipulates specific limits on interest rates, which, if exceeded, can lead to the invalidation of the note. Furthermore, provisions must be in place detailing the consequences of default, which may include legal action to recover the owed amount.

Practical applications of the Missouri standard unsecured promissory form

Unsecured promissory notes can be valuable in various scenarios. Understanding when to use this form can enhance financial interactions.

Real-life applications showcase the flexibility and utility of unsecured promissory notes in diverse financial relationships, providing helpful frameworks for both lenders and borrowers.

Sample unsecured promissory note for reference

Here is a comprehensive sample of the Missouri Standard Unsecured Promissory Form, which can serve as a reference when creating your own notes.

Each section of the form delineates specific aspects, ensuring that all necessary information is captured. Reviewing a sample allows users to gain insights into what to include.

By reviewing the structure and components of a sample form, users are better equipped to create their own legally sound promissory notes.

Frequently asked questions (FAQ)

Addressing common inquiries can clarify the purpose and functioning of unsecured promissory notes, making the process easier for both borrowers and lenders.

Utilizing FAQs helps demystify the process, allowing users to approach promissory note agreements with greater confidence.

Final thoughts on managing your promissory notes

Successfully managing your promissory notes is essential for maintaining clear financial relationships. Keeping accurate and organized records of transactions fosters transparency between parties.

Furthermore, ensuring clear communication during negotiations is equally important. Detail every term in the note to avoid misunderstandings. As the financial landscape continues to evolve, remaining informed about best practices in creating and managing unsecured promissory notes will aid both borrowers and lenders in navigating their financial agreements confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send missouri standard unsecured promissory for eSignature?

How do I edit missouri standard unsecured promissory on an iOS device?

How do I complete missouri standard unsecured promissory on an iOS device?

What is missouri standard unsecured promissory?

Who is required to file missouri standard unsecured promissory?

How to fill out missouri standard unsecured promissory?

What is the purpose of missouri standard unsecured promissory?

What information must be reported on missouri standard unsecured promissory?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.