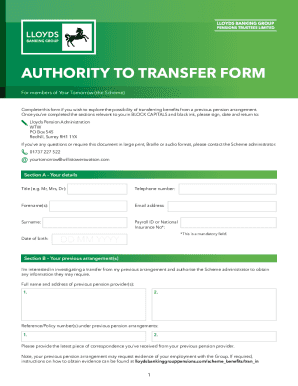

Get the free this document is a request form for annuity blackout data for discretion add comments and more

Get, Create, Make and Sign this document is a

How to edit this document is a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this document is a

How to fill out annuity proposal request form

Who needs annuity proposal request form?

Annuity Proposal Request Form: A Comprehensive Guide

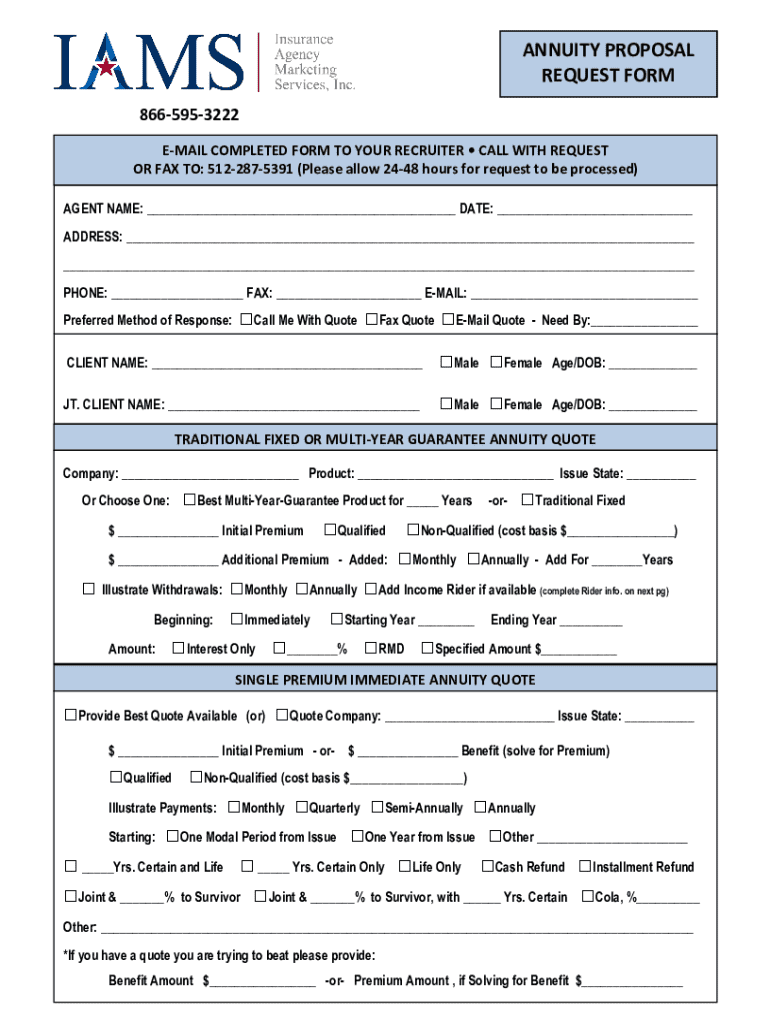

Understanding the annuity proposal request form

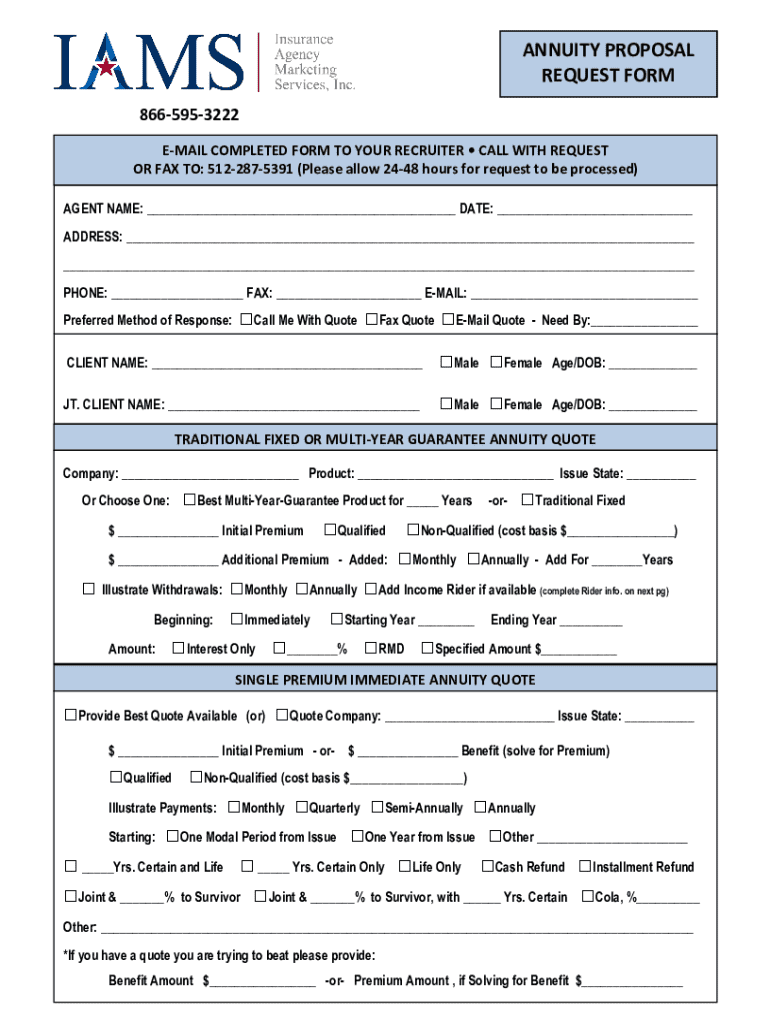

The annuity proposal request form is a crucial document for individuals and financial professionals working towards securing a stable and predictable income stream for retirement. It formalizes a request for an annuity proposal, allowing clients to specify their financial situations and retirement goals. Understanding this form is vital, as it enables both individuals and advisors to align their expectations with the products available in the market.

Key components of an annuity proposal request form

An effective annuity proposal request form comprises several essential components that provide a comprehensive picture of the applicant’s financial situation and preferences. By carefully filling out each section, clients can enhance their chances of receiving appropriate proposals.

Steps to complete the annuity proposal request form

Completing the annuity proposal request form requires careful attention to detail to ensure accuracy and completeness. Following a systematic approach can simplify the process.

Editing and customizing your annuity proposal request form

Accessing the annuity proposal request form through pdfFiller offers users a straightforward editing experience. The platform equips users with various interactive tools tailored to facilitate personal adjustments to the form.

Submitting the annuity proposal request form

Once the annuity proposal request form is completed and reviewed, it’s important to know the submission options available. Different methods can affect processing times, so understanding these options is beneficial.

Managing your annuity proposal request documentation

Proper organization and management of annuity proposal request documentation is essential for future reference and overall financial planning. Here, we outline some best practices.

Common FAQs about the annuity proposal request form

Several frequently asked questions arise around the completion and submission of the annuity proposal request form. Addressing these can provide clients with greater clarity and control over their retirement planning.

Legal and compliance considerations

Understanding the legal and compliance aspects associated with the annuity proposal request form is critical for ensuring that all actions taken are within regulatory guidelines. It’s essential to maintain the security of sensitive information throughout this process.

Leveraging pdfFiller for enhanced document experience

pdfFiller stands out as the ideal platform for managing your annuity proposal request form. Its features cater to individual users as well as teams, ensuring an efficient document workflow that meets modern needs.

Conclusion: Final steps toward your financial future

Completing an annuity proposal request form is a significant step toward solidifying your financial future and ensuring a comfortable retirement. By carefully understanding the requirements, leveraging tools like pdfFiller, and keeping documentation organized, you empower yourself to make effective financial decisions.

A well-crafted proposal can lead to the ideal annuity solution that fits your unique financial profile. Emphasizing improved document management through pdfFiller will not only streamline your initial request but also support you in ongoing financial planning efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in this document is a?

How do I edit this document is a in Chrome?

How do I fill out the this document is a form on my smartphone?

What is annuity proposal request form?

Who is required to file annuity proposal request form?

How to fill out annuity proposal request form?

What is the purpose of annuity proposal request form?

What information must be reported on annuity proposal request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.