Get the free Monthly Transportation Log

Get, Create, Make and Sign monthly transportation log

Editing monthly transportation log online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly transportation log

How to fill out monthly transportation log

Who needs monthly transportation log?

Monthly Transportation Log Form: A Comprehensive How-to Guide

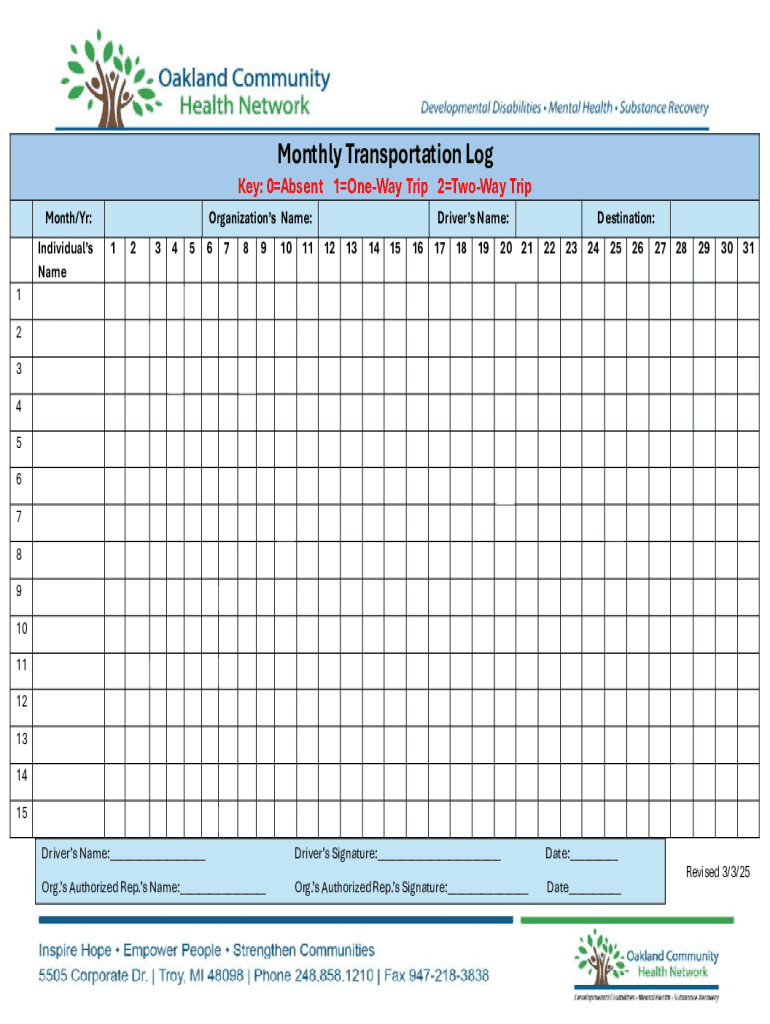

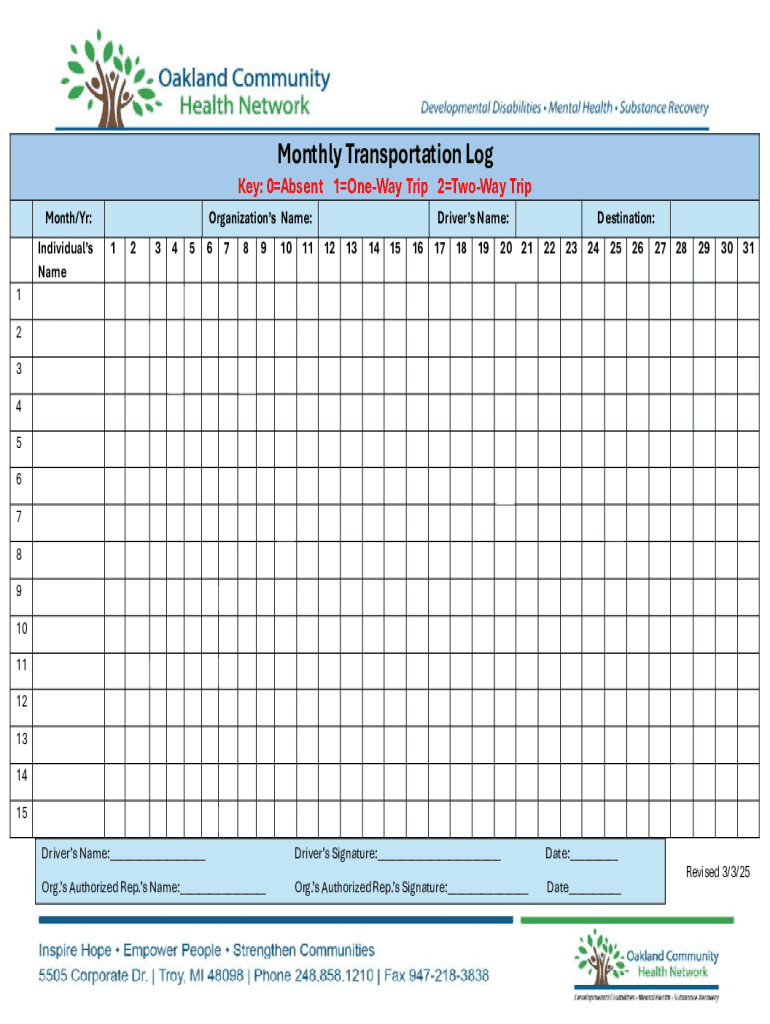

Overview of the monthly transportation log form

A monthly transportation log form is a structured document used to track travel expenses incurred during a specific month. This log not only facilitates accurate reimbursement processing for employees but also serves as an essential tool during tax preparation. Keeping a detailed log is vital for financial accuracy and compliance, ensuring that all possible deductions are captured.

By maintaining a thorough monthly transportation log, individuals and businesses can simplify the reimbursement process for transportation costs incurred, whether related to business meetings or client visits. Accurate logging aids in the assessment of travel-related expenses, directly impacting tax filings and financial audits.

Selecting the right monthly transportation log form

When it comes to selecting the right monthly transportation log form, users can choose between standard logs and specialized templates tailored for various purposes, such as remote work or corporate travel. Standard logs typically cover general mileage, expenses, and any included tolls or parking. Specialized forms, however, may include fields specific to corporate policies or regulations required for compliance.

Factors such as the frequency and type of travel — whether by car, public transport, or other means — should be considered when selecting your form. It's crucial to ensure that the log can integrate seamlessly with other documents like receipts and invoices for a comprehensive financial overview.

Step-by-step guide to filling out the monthly transportation log form

Filling out a monthly transportation log form can seem daunting, but breaking it down into manageable steps makes the process straightforward. Begin by gathering all necessary information, such as trip dates, destinations, purpose, and distances. Accurate documentation of expenses is also essential; therefore, retaining all related receipts and tracking mileage ensures nothing is overlooked.

Once the requisite information is collated, access your chosen form on pdfFiller. When customizing your Monthly Transportation Log Template, consider the specific needs of your travels. Inputting data is simplified with fields that allow for easy entries, such as start and end points, total miles traveled, and more, alongside dropdown menus for convenience.

eSigning and sharing your monthly transportation log

Completing your monthly transportation log also includes securely signing it electronically. Using pdfFiller, creating an eSignature is a simple process, and it's essential for legal validation of your documents. The adoption of eSignatures accelerates the sharing process, allowing you to send completed logs directly to employers or clients without delays.

Furthermore, pdfFiller provides various options for saving and exporting your documents, including formats like PDF and DOCX. This flexibility ensures that your transportation logs can be sent via email or printed according to your requirements.

Managing and storing your monthly transportation log

Managing your transportation logs efficiently is key to maintaining both organization and accuracy. Utilizing cloud-based storage solutions offered by pdfFiller not only ensures that your logs are securely stored but also makes them easily accessible from anywhere at any time. This convenience is particularly beneficial during tax season, as all documents are ready for review.

To further facilitate retrieval, implement recommended naming conventions, like including the month and year in the document title. Maintaining an organized, yearly archive of logs is advisable for tax purposes. This helps in audits and simplifies the review of expenses over time.

Common challenges and solutions

While filling out the monthly transportation log, users often face common challenges, such as errors in mileage calculations or missing receipts. To avoid these mistakes, it is essential to double-check entries before submission and have a systematic method for recording receipts, such as taking photos immediately after they are obtained.

Technical issues with pdfFiller can also arise, ranging from problems with file uploads to difficulties in using specific features. In the event of such complications, users should familiarize themselves with common troubleshooting steps and consult the extensive support resources available through pdfFiller for assistance.

Case studies and examples

Exploring real-life applications of monthly transportation logs can provide inspiration and guidance. For instance, one case study demonstrates an individual using their log effectively to claim tax deductions efficiently. Each recorded trip, with its purpose and costs, directly contributed to maximizing their deductible expenses.

Additionally, teams that utilize pdfFiller for their travel expense tracking have reported streamlined processes and improved compliance. The ease of access and specific formatting options allows team members to stay organized and effectively communicate travel needs and expenses.

Best practices for maintaining your monthly transportation log

Establishing consistency in your logging habits is crucial. Setting reminders to fill out your transportation log regularly can drastically reduce the amount of work at the month’s end and ensure accuracy in recording. Regular updates also minimize the risk of forgetting important details, such as miles traveled or business purposes for trips.

Additionally, reviewing and auditing your logs should occur monthly. This will help spot errors and ensure compliance with your company’s travel policies. Regular checks encourage diligence and promote enhanced accuracy in your travel documentation, paving the way for smoother reimbursement processes.

PDF Filler tools to enhance your monthly transportation log experience

pdfFiller offers robust interactive tools designed to enhance the experience of managing transportation logs. One notable feature includes analysis capabilities that allow users to quickly summarize and evaluate travel expenses. Customize your entries further by using their specific features catering to business needs, enabling smooth integration with accounting software.

These enhancements not only streamline the process of logging travel expenses but also provide organizations with insightful data management capabilities. By harnessing these tools, users can ensure that their monthly transportation log forms are not only functional but also contribute to informed decision-making.

Key benefits of using pdfFiller for your monthly transportation log

Using pdfFiller for your monthly transportation log not only ensures convenience but also enhances collaboration and compliance. The all-in-one document management solution allows users to work alongside team members directly on the form, fostering collaboration and efficiency.

Moreover, pdfFiller assures that your transportation logs are securely managed and compliant with legal standards. This means that your digitally signed logs carry the same legal weight as their paper counterparts, providing peace of mind for users and businesses alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in monthly transportation log without leaving Chrome?

How do I fill out monthly transportation log using my mobile device?

How do I complete monthly transportation log on an Android device?

What is monthly transportation log?

Who is required to file monthly transportation log?

How to fill out monthly transportation log?

What is the purpose of monthly transportation log?

What information must be reported on monthly transportation log?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.