Get the free pdffiller christmas sale

Get, Create, Make and Sign pdffiller christmas sale form

How to edit pdffiller christmas sale form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller christmas sale form

How to fill out christmas saver account application

Who needs christmas saver account application?

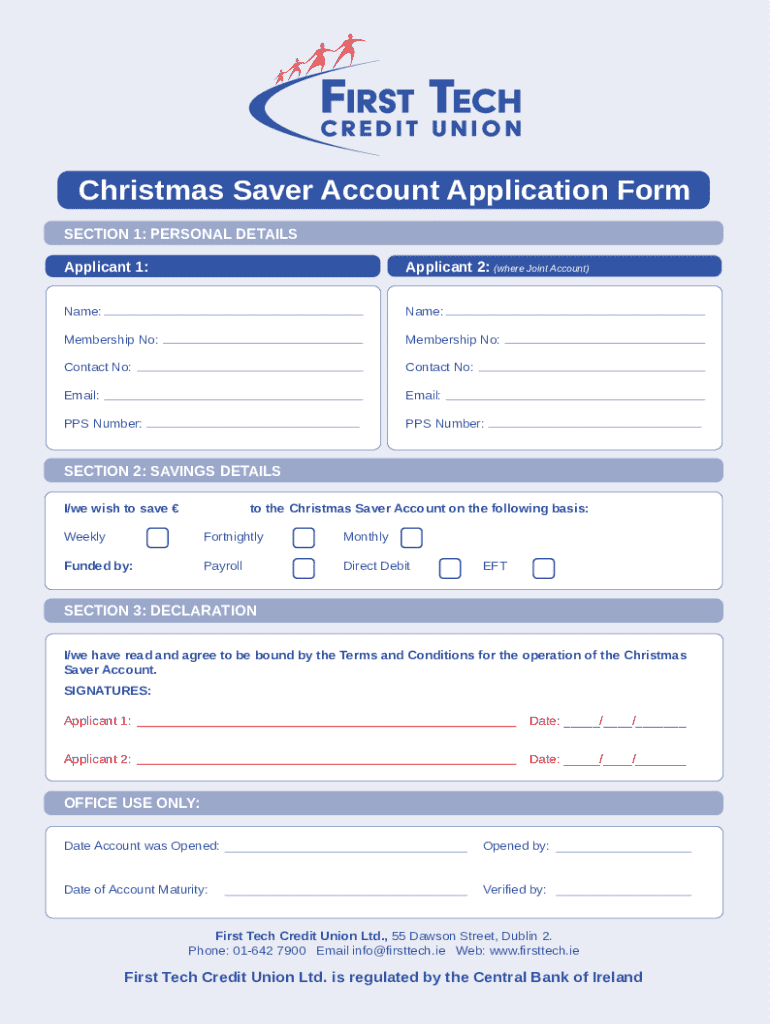

Your Guide to the Christmas Saver Account Application Form

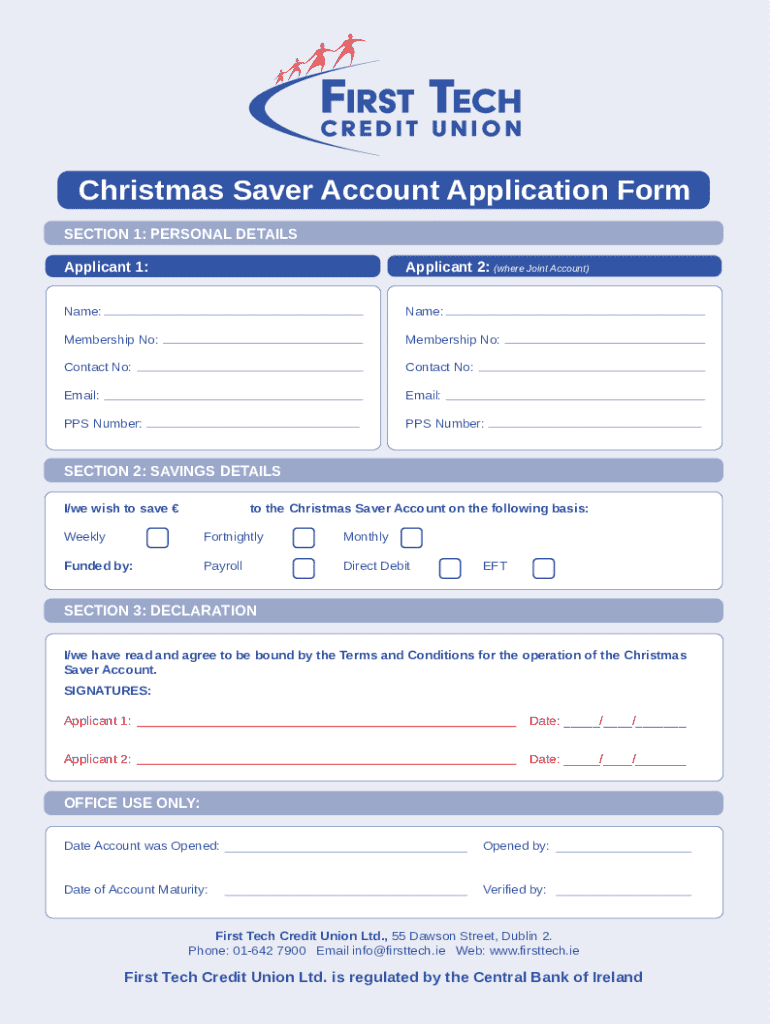

Understanding the Christmas Saver Account

A Christmas Saver Account is specifically designed to help individuals and families save for holiday expenses. It serves as a dedicated savings tool, enabling you to accumulate funds intentionally for seasonal spending, such as gifts, decorations, and festive travel. Unlike traditional savings accounts, which may have broader purposes, a Christmas Saver Account focuses primarily on the winter holiday season, encouraging disciplined savings.

The advantages of utilizing this type of account include higher interest rates, which are often attractive compared to standard savings accounts, and structured savings guidelines. You'll typically find that these accounts offer features tailored for holiday preparation, such as lower minimum balance requirements and specific withdrawal conditions that align with your holiday spending timeline.

Benefits of Utilizing a Christmas Saver Account

Utilizing a Christmas Saver Account has multiple benefits that can enhance your holiday experience. First, it encourages you to set precise savings goals. By establishing a target amount for your Christmas shopping funds, you can enhance your focus on saving, transforming what could be a stressful endeavor into an organized plan. The holiday season often brings financial anxiety, but having a dedicated account helps alleviate that, promoting a sense of achievement.

Moreover, the psychological benefits of seeing your savings grow cannot be understated. Regular tracking of your progress through budgeting tools or a simple savings chart helps maintain your motivation. Knowing you are working towards a specific financial goal can spark joy and anticipation as the holidays approach.

Steps to Complete the Christmas Saver Account Application Form

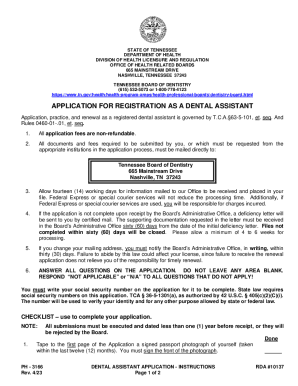

Filling out the Christmas Saver Account application form is a straightforward process. To begin, ensure you gather all the required documentation and personal information to facilitate the application smoothly. Typically, you'll need a valid ID, proof of address, and financial statements. Understanding what is required ahead of time can expedite the submission process.

Once you have the necessary documents, start filling out the application form. Here’s a brief guide:

Common mistakes to avoid include omitting necessary information, such as your current financial status, or failing to submit supporting documents with the application. It’s wise to adhere to submission timelines, as delays can affect your ability to start saving.

Managing Your Christmas Saver Account

Once your account is established, regular management is essential for maximizing your savings potential. Use available online banking tools to monitor your account activity continuously. Checking your statements and tracking your financial progress keeps you in tune with your savings goals. This way, you can make informed decisions as you approach the holiday season.

Consider setting up automatic deposits from your primary account. This strategy not only simplifies the savings process but also helps you establish a consistent savings habit. Beyond the automatic deposits, identifying additional savings strategies can significantly boost your account balance.

Utilizing pdfFiller for Your Application Process

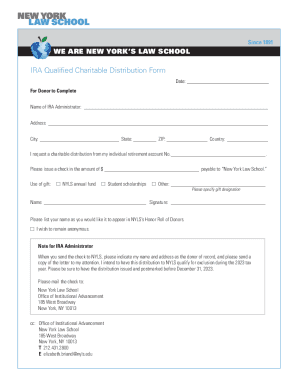

The application process can be greatly streamlined using pdfFiller. By accessing the Christmas Saver Account application form online, you can fill it out with ease. pdfFiller allows you to make edits, eSign your application, and share it securely without the need for paper. This digital approach simplifies the whole application process, enabling quick submission and easy access.

If you’re applying as a team or with family members, pdfFiller's collaborative tools are incredibly helpful. You can work together to manage holiday savings effectively by sharing and editing documents in real-time, ensuring everyone is aligned on savings goals.

Frequently asked questions (FAQs)

Common questions surrounding the Christmas Saver Account can help clarify any concerns you may have:

Testimonials and success stories

Positive user experiences illustrate how the Christmas Saver Account can make a difference. Many customers have shared their success stories about how this account empowered them to plan their holiday seasons efficiently. Whether it was funding a family vacation, purchasing gifts, or hosting festive gatherings, real-life examples show the account's effectiveness.

Moreover, local communities often take advantage of this financial tool together, pooling resources for larger group celebrations or community events. The collective savings strategies can reduce individual financial pressure and spread holiday joy more broadly.

Enjoying the benefits of your savings

With funds gradually accumulating in your Christmas Saver Account, it's time to start thinking about how to spend your savings wisely. Initiating an organized spending plan for holiday gifts, decorating, and travel will ensure that you allocate your available funds effectively. Prioritize what you need most, and don’t be afraid to consider experiences or moments that create lasting memories.

Additionally, smart spending during the holiday season means finding discounts and making strategic purchases to maximize the joy derived from your savings. Seasoned savers often create a checklist of essentials to prevent overspending and ensure that every dollar contributes to making the holidays memorable.

Conclusion: Taking the first step towards holiday savings

In conclusion, applying for a Christmas Saver Account can be one of the best financial decisions as you prepare for the holiday season. By following the detailed steps in the application process, and utilizing tools like pdfFiller, you can effectively manage your account and maximize your savings. Engage in a structured savings journey that will not only ease the financial burden of holiday expenses but also give you peace of mind as festivities approach.

With clear goals and a dedicated approach to your holiday savings, you're well on your way to enjoying a beautiful and stress-free holiday season, making it all the more special for you and your loved ones.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller christmas sale form in Gmail?

How do I make edits in pdffiller christmas sale form without leaving Chrome?

How do I complete pdffiller christmas sale form on an Android device?

What is christmas saver account application?

Who is required to file christmas saver account application?

How to fill out christmas saver account application?

What is the purpose of christmas saver account application?

What information must be reported on christmas saver account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.