Get the free Managing Your Savings Account: FAQs

Get, Create, Make and Sign managing your savings account

How to edit managing your savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out managing your savings account

How to fill out managing your savings account

Who needs managing your savings account?

Managing Your Savings Account Form: A Comprehensive Guide

Understanding your savings account

A savings account serves as a fundamental financial tool for individuals seeking to save money while earning interest over time. It is typically offered by banks and credit unions, providing a secure place to store funds compared to keeping cash at home.

The key benefits of maintaining a savings account include earning interest, capital preservation, and accessibility to funds without the risk of market volatility. Additionally, having a savings account encourages financial discipline, as it fosters a habit of saving rather than spending all disposable income.

There are various types of savings accounts available, such as traditional, high-yield, and online savings accounts, each tailored to meet different financial goals. Understanding the specific characteristics of each type can help you select the one that aligns best with your savings strategy.

Managing your savings account: The basics

Managing your savings account effectively begins with knowing how to access it. Online banking offers a convenient way to manage your account from anywhere, provided you have internet access. Setting up online banking typically involves creating a secure password and linking your account to an email address for notifications and security purposes.

For those who prefer mobile convenience, many banks offer mobile apps facilitating account management. Once downloaded, users can log in using the same credentials as their online banking. These apps often support deposits, fund transfers, and transaction monitoring.

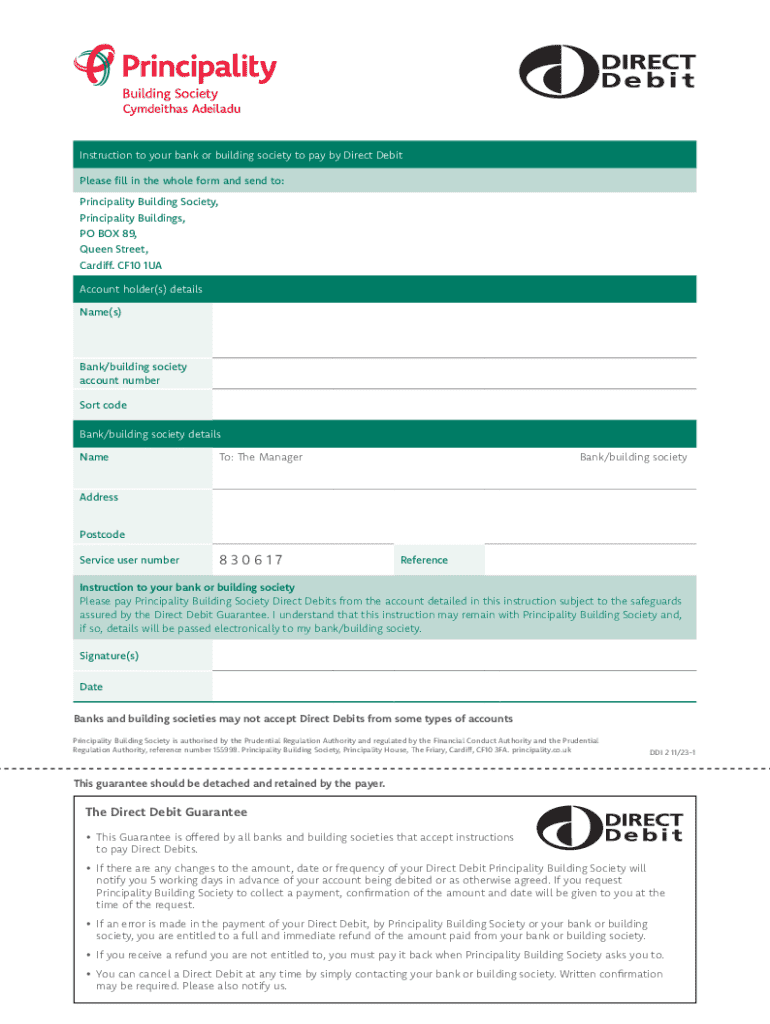

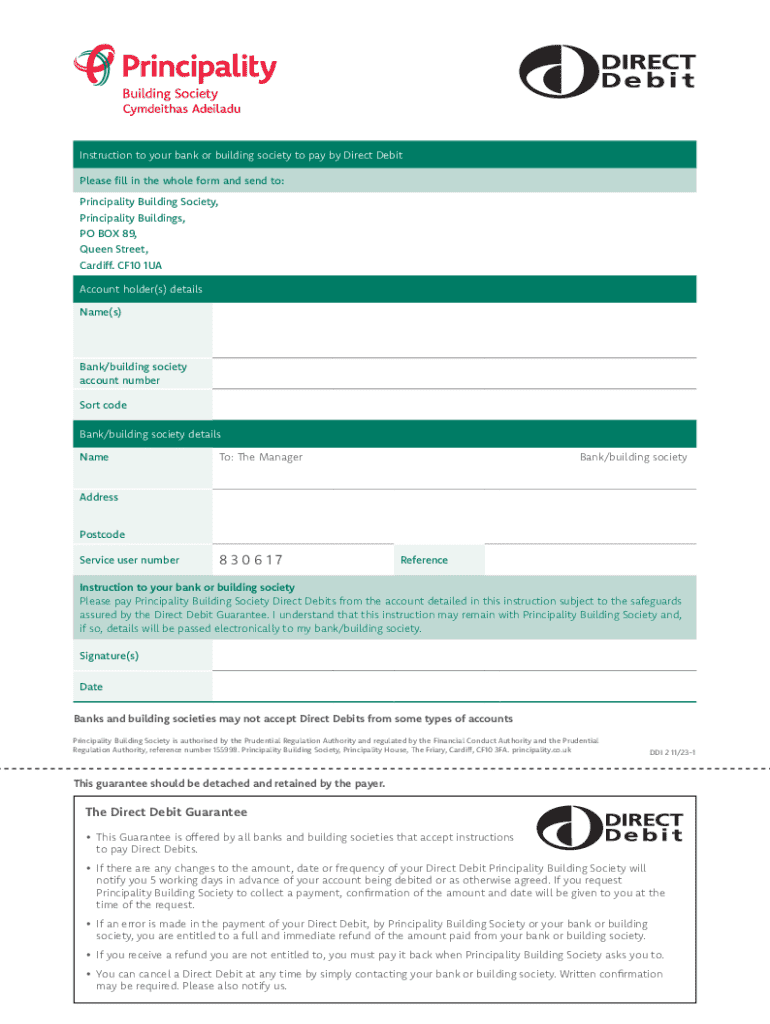

Essential forms for managing your savings account

When it comes to effective account management, several forms may be necessary. If you need specific information about your savings account, most banks provide a fillable request form, which can usually be accessed through their website or mobile app.

For immediate assistance, contacting customer support via phone or chat may yield quicker answers to your inquiries. Here’s a breakdown of forms you might encounter while managing your account:

Navigating popular savings account functions

With your savings account set up, knowing how to execute transactions and updates is crucial. To withdraw money from your savings account, start by logging into your online banking or mobile app. Navigate to the withdrawal section, choose your preferred account, and enter the amount. Understanding limitations is essential, as many savings accounts impose withdrawal limits to encourage saving.

If you need to update your personal details, locate the account settings area. You may be required to provide essential documents such as identification or proof of address to validate the changes.

Maximizing your savings experience

To make the most out of your savings account, you should employ effective management techniques. One such method is setting savings goals, whether they are short or long-term. This helps you determine how much you need to save and by when. Automating deposits can play a significant role in this strategy, where a set amount is transferred to your savings account each month without you needing to remember.

Fluctuating interest rates can impact the growth of your savings over time. Understanding how interest is calculated is key; typically, savings accounts earn compound interest, meaning that interest is earned on both the initial principal and the accumulated interest from previous periods.

Addressing common concerns and support

Losing access to your account can be stressful. The recovery process typically involves confirming your identity through security questions or additional verification methods. Customer support can guide you through regaining access efficiently.

Maintaining account security is also paramount. Most banks provide robust security features such as two-factor authentication and fraud alerts. If you encounter suspicious activity, report it immediately to minimize any potential damage.

Seeking additional help

Navigating complex financial matters can be daunting. If you find yourself needing additional assistance, customer service offers various channels to connect. Common options include phone support, email communication, and live chat functionalities. Knowing when to reach out can save you time and help get your issues resolved quickly.

Frequently asked questions provide clarity on common concerns regarding savings accounts. Answers to these queries can alleviate uncertainty and enhance your understanding, making management more straightforward.

Utilizing interactive tools

Utilizing budgeting and savings calculators can significantly enhance your ability to plan effectively. These tools allow you to input financial data and project potential growth over time, providing visual representations of your savings journey. Knowing how to use these tools helps you make informed decisions about your savings strategies.

Document management plays a crucial role in handling the forms associated with your savings account. Through pdfFiller, users can seamlessly edit, eSign, and manage various documents involved in account management. This cloud-based solution allows for collaboration with others while keeping your information secure and organized.

Conclusion of resources

Managing your savings account form effectively is about understanding the tools and resources available to you. PdfFiller provides a range of solutions to assist in managing documents related to your savings account, from eSigning capabilities to secure document sharing.

As you explore the features of your savings account and the pdfFiller platform, remember that diligent management and proper utilization of resources can significantly enhance your overall financial health and achieving your savings goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit managing your savings account from Google Drive?

How do I execute managing your savings account online?

Can I edit managing your savings account on an Android device?

What is managing your savings account?

Who is required to file managing your savings account?

How to fill out managing your savings account?

What is the purpose of managing your savings account?

What information must be reported on managing your savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.