Get the free Confidential Credit Application

Get, Create, Make and Sign confidential credit application

How to edit confidential credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confidential credit application

How to fill out confidential credit application

Who needs confidential credit application?

Confidential Credit Application Form: A Comprehensive Guide

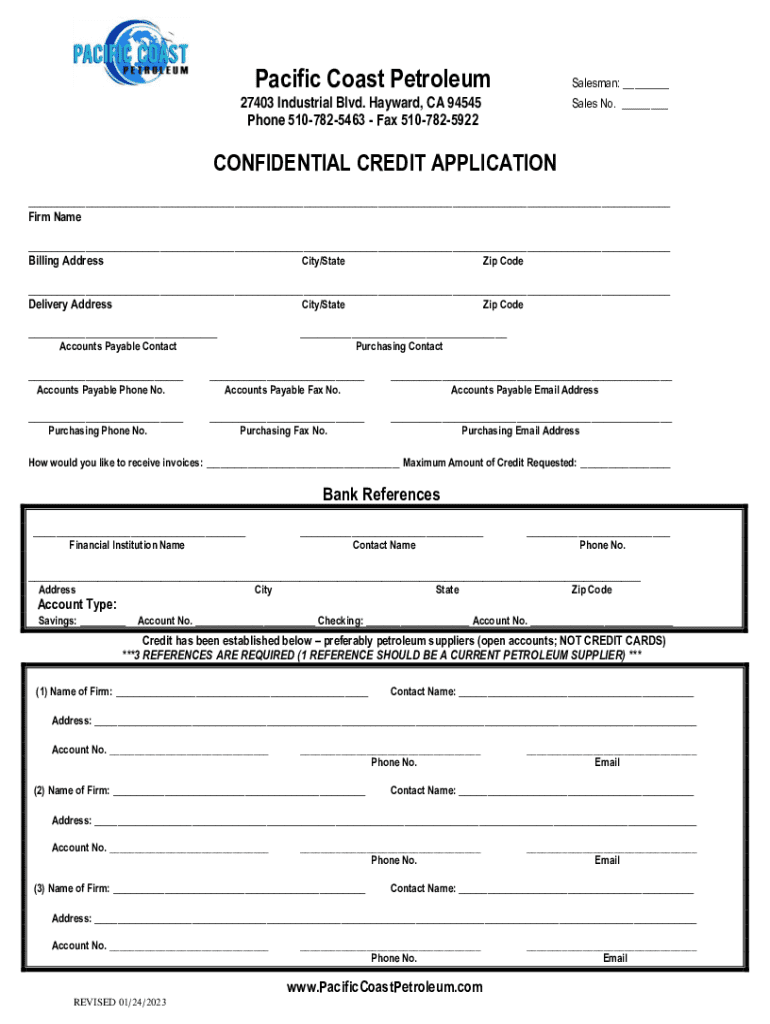

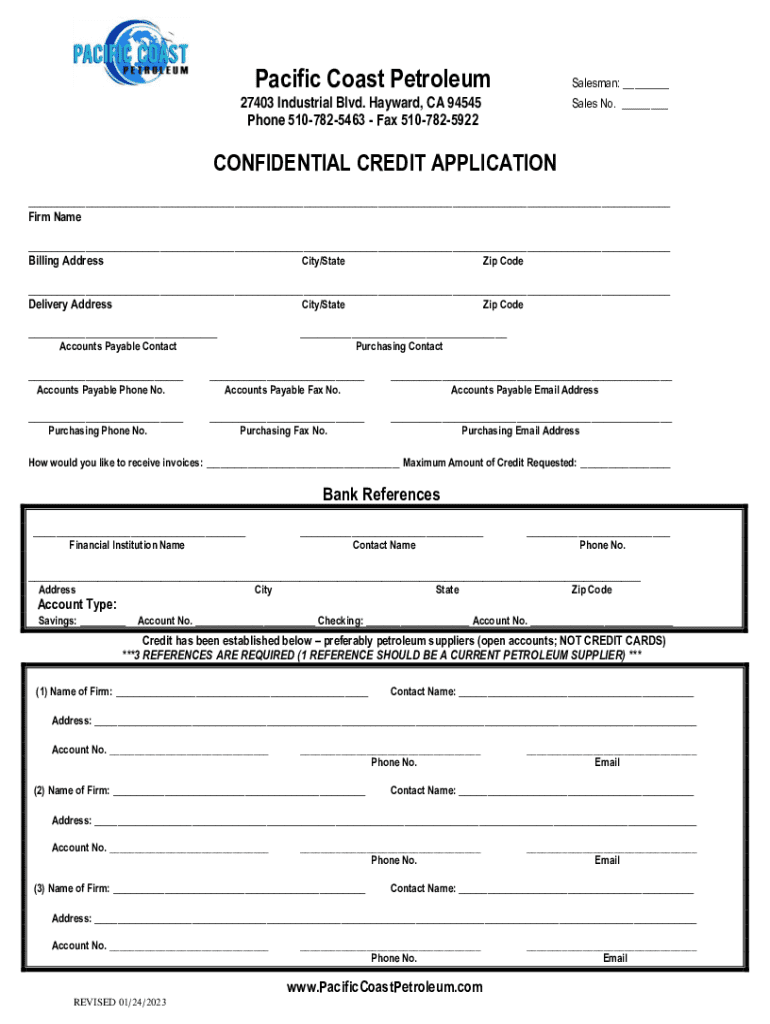

Understanding the confidential credit application form

A confidential credit application form is a crucial document used by both individuals and businesses when seeking credit or financing. Its primary purpose is to gather pertinent financial details in a secure manner that protects the applicant's sensitive information. Ensuring confidentiality is paramount, as the data collected on this form can include personal identification and financial history, vital for lender assessment.

Confidentiality is particularly significant in credit applications, where the disclosure of sensitive information could lead to identity theft or financial mishaps. By protecting this data, applicants can feel secure in the credit process, knowing that their information will not be misused or shared without consent.

Key components of the confidential credit application form

The confidential credit application form is structured into several key sections, each designed to capture specific information necessary for assessing an applicant's eligibility. Understanding these components will prepare applicants to fill out the form accurately and confidently.

Step-by-step guide to filling out the form

Before starting the application, it's crucial to prepare adequately. Gather necessary documents such as proof of income, identification, and details of current debts. This step ensures that all information provided is accurate and complete, which is vital for a successful application.

Each section of the form requires careful attention. When filling out personal information, ensure that names and addresses are accurate. For financial information, be transparent about your income and existing obligations, avoiding any omissions that could negatively impact your application. Understanding how to authorize credit checks is a must, as lenders will rely on this information to evaluate your creditworthiness.

Editing and customizing your confidential credit application form

When it comes to customization, pdfFiller offers robust editing tools that streamline the process of modifying a confidential credit application form. Users can easily make changes, add specific information, or remove unnecessary sections, ensuring that the document reflects their unique financial situation.

Utilizing templates can further enhance efficiency. Pre-designed forms help applicants avoid creating documents from scratch and ensure that all necessary fields are included. It's advisable to search for the best confidential credit application templates within pdfFiller to find a design that meets your needs.

Collaborating with your team on credit applications

Collaboration is key, especially if you’re filling out a credit application on behalf of a business or a team. Using pdfFiller’s collaboration tools allows you to share the form for internal review securely. Effective collaboration can enhance the quality and accuracy of the application.

This is the time to select your preferred reviewers carefully. Assign individuals who have the expertise to provide constructive feedback. Clear communication within the team will ensure that everyone is on the same page and that the final version of the form is as robust as possible.

Signing and submitting your confidential credit application form

The signing step has never been easier, thanks to pdfFiller's eSigning capabilities. Users can eSign their confidential credit application form directly within the platform, ensuring that their consent and authorization are formalized without unnecessary delays.

It’s essential to follow best practices when submitting the form to lenders. Decide whether to submit a digital or paper copy based on the lender's preference. Regardless of the format, following up with the lender will help ensure that your application is processed efficiently.

Managing your confidential information post-submission

Post-submission, it's crucial to manage your confidential information wisely. pdfFiller makes it easy to store your application securely in the cloud, ensuring that your sensitive data remains accessible yet protected.

Monitoring your application status is also important. Keep track of its progress with your lender and know when to reach out if any issues arise. Being proactive helps you stay informed and engaged throughout the process.

Frequently asked questions (FAQs)

When it comes to confidential credit application forms, applicants often have questions regarding the overall process. For example, one might wonder what to do if their application is denied. In such cases, it’s advisable to request feedback from the lender to understand the reasons for denial and make necessary adjustments before reapplying.

Another common query relates to the time it takes for the credit application process. This can vary, but keeping an eye on your application's status and ensuring all documentation is complete will expedite things. Additionally, practicing good habits to maintain confidentiality even after submission, such as encryption and secure storage, can help protect sensitive information.

Conclusion: The advantage of using pdfFiller for confidential documents

Utilizing pdfFiller for your confidential credit application form offers distinct advantages. From seamless document editing and signing to secure storage and collaboration, pdfFiller empowers users to engage effectively with their credit applications. The importance of confidentiality and security in financial applications cannot be overstated, particularly in today's landscape where data breaches are prevalent.

Finally, embracing technology like pdfFiller allows individuals and teams to manage their documents efficiently and securely. By doing so, applicants can streamline their credit application processes, giving them more time to focus on their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my confidential credit application directly from Gmail?

How do I fill out the confidential credit application form on my smartphone?

How do I edit confidential credit application on an Android device?

What is confidential credit application?

Who is required to file confidential credit application?

How to fill out confidential credit application?

What is the purpose of confidential credit application?

What information must be reported on confidential credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.