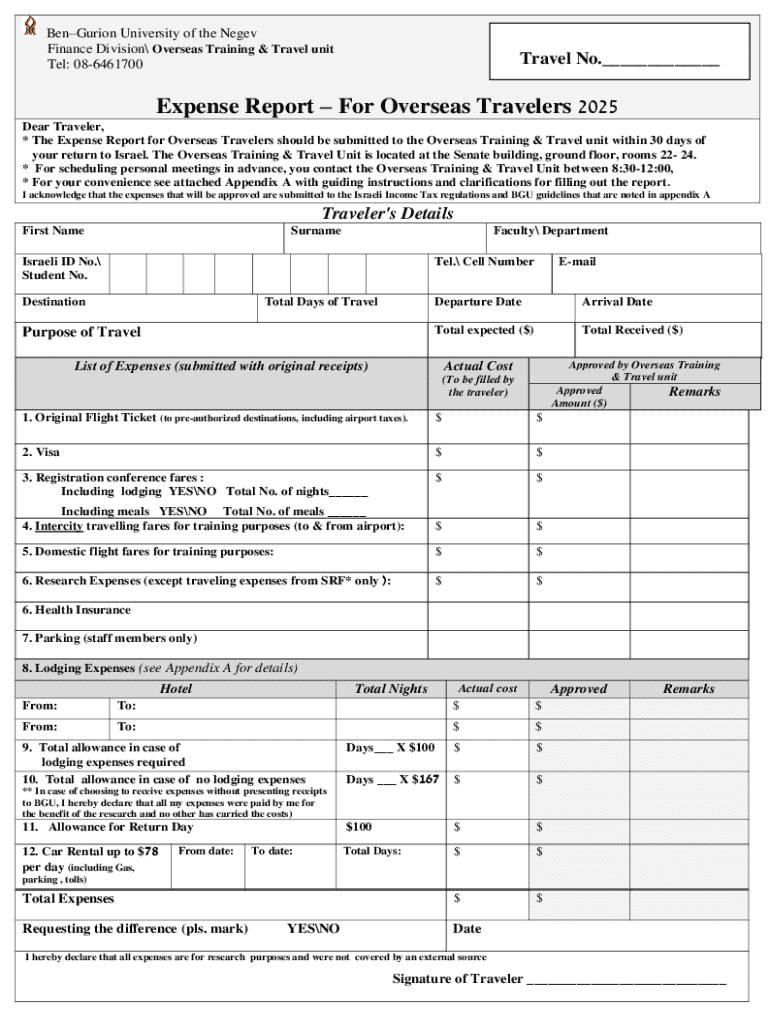

Get the free Expense Report – for Overseas Travelers 2025

Get, Create, Make and Sign expense report for overseas

Editing expense report for overseas online

Uncompromising security for your PDF editing and eSignature needs

How to fill out expense report for overseas

How to fill out expense report for overseas

Who needs expense report for overseas?

Expense Report for Overseas Form: A Comprehensive Guide

Understanding overseas expense reports

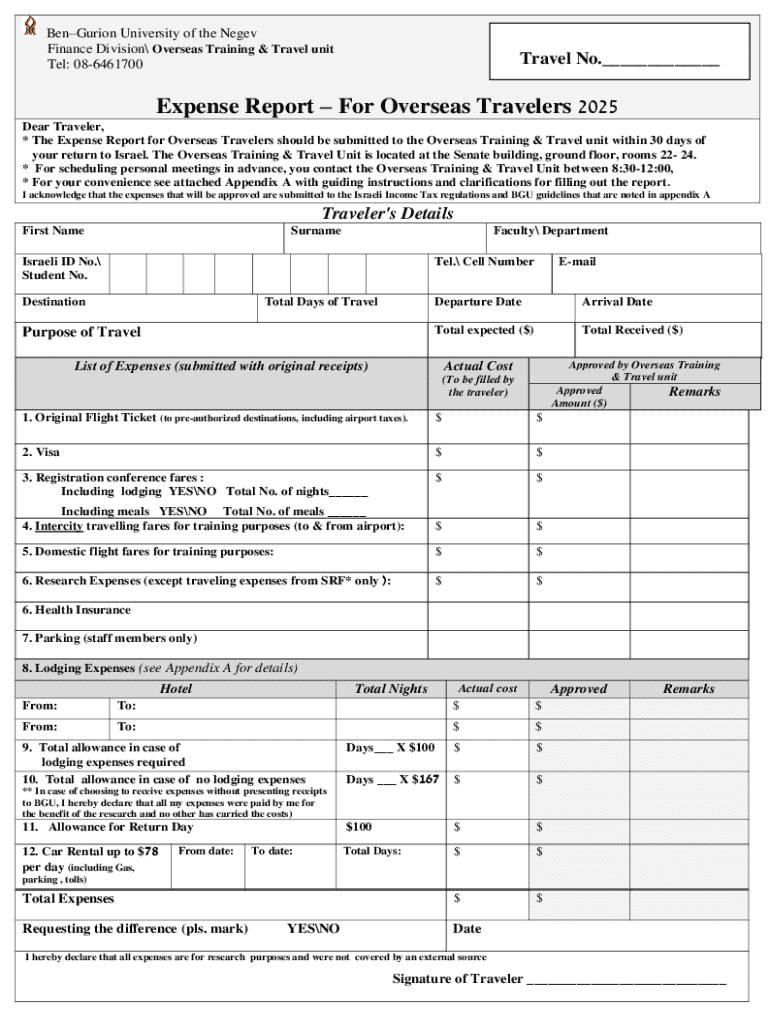

An expense report for overseas form serves a critical function in the documentation and reimbursement of international travel expenses. Designed to facilitate accurate reporting, these forms are crucial, especially when employees travel abroad for work-related purposes. With fluctuating currencies and diverse spending habits, handling these reports can be quite complex. This guide explores the components, processes, and best practices for efficient overseas expense reporting.

Accurate reporting is paramount. When employees submit their overseas expenses, it not only reflects on their integrity but also affects the company's financial health. Mistakes can lead to incorrect reimbursements, tax compliance issues, or budget mismanagement. Common challenges include understanding the rules surrounding deductions, currency conversions, and ensuring all expenses are documented properly.

Key components of an overseas expense report

Filling out an expense report for overseas form requires specific information to ensure a smooth approval process. Personal details must include the traveler’s name, position, and department along with the travel itinerary, showing the dates and locations of travel.

Maintaining documentation is key. For every transaction, receipts must be attached, as they serve as proof of expenses incurred. Itineraries and ticket stubs provide further context for travel purposes.

Step-by-step process for filling out the overseas expense report

Completing an expense report for overseas travel can be straightforward if approached methodically. Here’s a detailed breakdown of the steps involved.

Tools like pdfFiller can help enhance your form-filling experience. Their platform allows seamless edits, ensuring your report is professionally presented and compliant.

Utilizing pdfFiller for overseas expense reports

pdfFiller offers a set of interactive tools specifically designed for expense reporting. Its templates can be modified to cater to various reporting needs, enhancing user experience.

This convenience not only saves time but also improves accuracy and thoroughness in the reporting process.

Understanding tax deductible expenses for international travel

When traveling for business, certain expenses can be tax-deductible, which makes it essential to document everything properly. Understanding what qualifies for deductions helps travelers minimize taxable income effectively.

Accurate reporting not only ensures compliance with tax regulations but also maximizes potential rebates during tax season.

Additional templates and resources

Having access to diverse templates enhances the reporting process. pdfFiller offers a variety of templates suitable for different travel and spending contexts.

These templates streamline the process and ensure standardized reporting across teams.

Best practices for maintaining accurate overseas expense reports

Effective management of overseas expense reports requires discipline and organization. Regular updates ensure consistency and accuracy, and tracking expenses during travel is crucial.

Incorporating these practices can significantly elevate the efficiency and reliability of reporting.

Frequently asked questions (FAQs)

This section addresses common questions that arise when dealing with overseas expense reports.

Success stories: How pdfFiller streamlined expense reporting for teams

Many organizations have successfully utilized pdfFiller to enhance their expense reporting. Case studies reveal that streamlined processes elevate compliance and reduce discrepancies.

Testimonials highlight improved efficiency, collaboration, and overall satisfaction with the expense reporting process.

Troubleshooting common issues with overseas expense reports

Despite best efforts, issues can arise during the expense report process. Knowing how to troubleshoot helps maintain smoother operations.

Commitment to following the guidelines and understanding company policies ensures a smoother expense reporting experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete expense report for overseas online?

How do I edit expense report for overseas in Chrome?

How do I complete expense report for overseas on an iOS device?

What is expense report for overseas?

Who is required to file expense report for overseas?

How to fill out expense report for overseas?

What is the purpose of expense report for overseas?

What information must be reported on expense report for overseas?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.