Get the free Community Reinvestment Act

Get, Create, Make and Sign community reinvestment act

How to edit community reinvestment act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out community reinvestment act

How to fill out community reinvestment act

Who needs community reinvestment act?

Community Reinvestment Act Form - How-to Guide Long-read

Understanding the Community Reinvestment Act (CRA)

The Community Reinvestment Act (CRA) was enacted in 1977, aimed at combating redlining and ensuring that financial institutions serve the credit needs of their local communities, particularly low- and moderate-income neighborhoods. The act requires banks to demonstrate their commitment to reinvesting in these communities, effectively bridging gaps in access to credit and fostering economic vitality.

Over the decades, the CRA has undergone various amendments and regulatory adjustments to adapt to shifting economic landscapes and community needs. Its significance has not waned; rather, it remains a vital tool in promoting equitable banking practices and accountability among financial institutions.

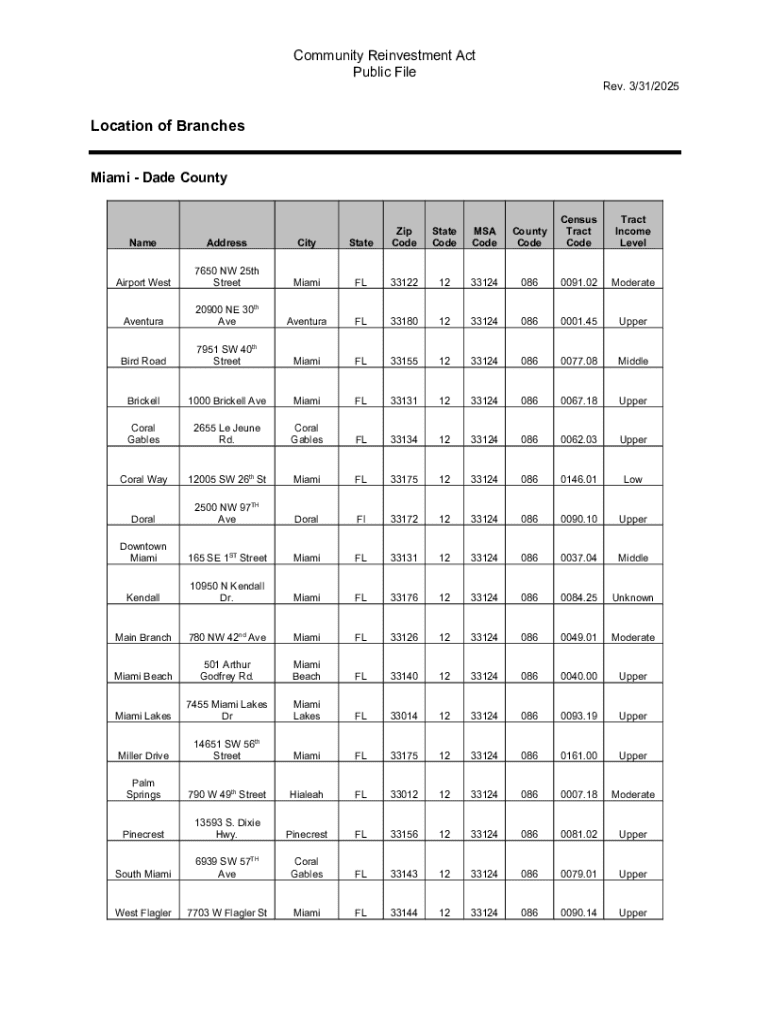

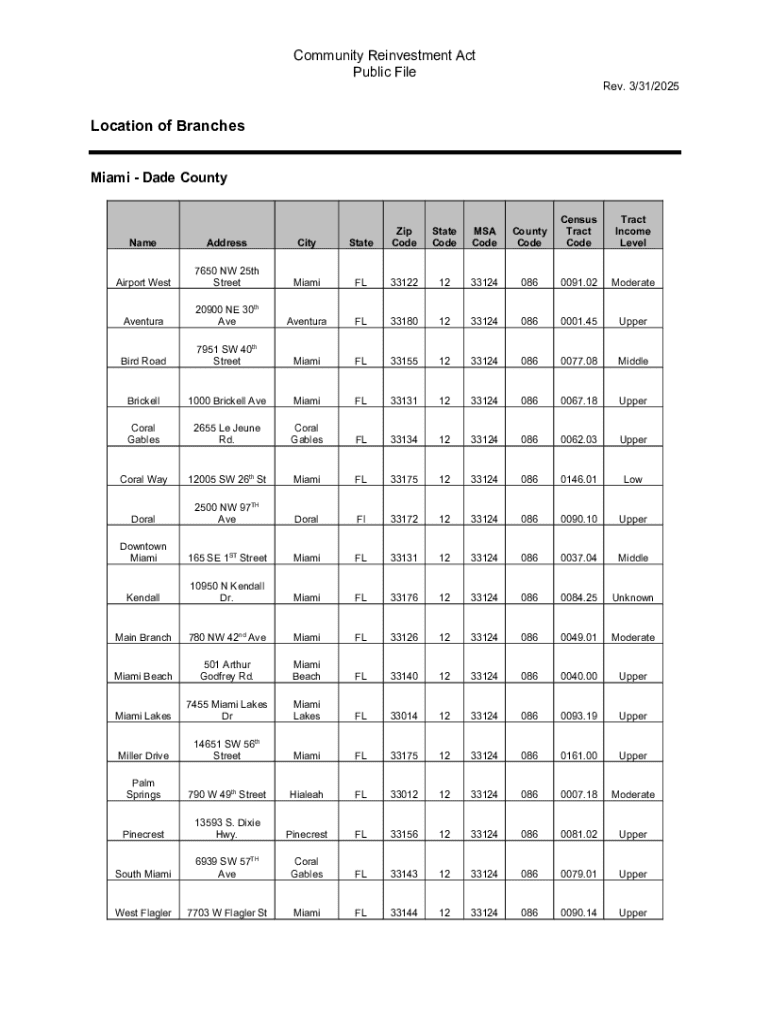

The CRA form is a critical element of this act, functioning as a formal mechanism by which banks report their community reinvestment efforts. Completing this form accurately and comprehensively is essential for banks to maintain their CRA ratings, which can influence their ability to expand or merge.

Key components of the CRA form

The CRA form is designed to capture a bank's reinvestment activities in detail. Typically, it includes sections that solicit essential information about the institution, its lending activities, community outreach, and impact metrics. Understanding the structure of the CRA form is crucial for accurate completion.

Financial institutions required to fill out the CRA form include national banks, state-chartered banks, and certain credit unions. These entities engage in various activities that can impact their CRA evaluations, such as home mortgage lending, small business loans, and community development investments.

Preparing to complete the CRA form

Before tackling the CRA form, it's essential to gather all necessary documentation. This includes records of loans, investments made, previous CRA-related audits, and community engagement efforts. Organizing this information can streamline the completion process significantly.

Key metrics such as the number of loans issued to low-income individuals, dollar amounts of community development investments, and demographic data about the communities served are vital for the CRA form. Understanding precisely what data is required ahead of time can prevent last-minute scrambles and improve accuracy.

Filling out the CRA form: step-by-step guide

Completing the CRA form involves several key steps: First, provide personal and institutional information, including your bank's name, address, and the contact information of the main personnel involved. This sets the stage for the rest of the document.

Next, describe the qualifying activities your bank has undertaken over the reporting period. This may encompass various financial products, outreach programs, and partnerships with local organizations that support economic growth. Finally, report on the community impact, using quantifiable metrics where possible to showcase the effects of your activities on local development.

Avoiding common pitfalls is crucial. Incomplete or inaccurate information can lead to delays in processing or worse, a negative impact on your CRA rating. Attention to detail will enhance your submission's credibility.

Using pdfFiller tools for efficient form management

Leveraging pdfFiller can simplify the process of filling out the CRA form significantly. The platform offers interactive tools that allow you to edit forms directly online, ensuring you have the most up-to-date version available. Collaborating on document completion with your team members is seamless, enabling multiple stakeholders to contribute and review before submission.

Moreover, pdfFiller includes efficient eSigning capabilities, allowing for secure transmission of completed forms without the need for printing and scanning. This feature minimizes delays and errors associated with traditional methods of signing and sending documents.

Submitting your CRA form

Once the CRA form is fully completed, the next step is submission. You have various options for submission, including both email and postal mail. Emailing your form can often result in quicker processing by regulatory bodies, provided that you follow their specified electronic submission guidelines.

However, postal mail can sometimes feel more traditional and may lend a sense of formality to your submission. Regardless of the method chosen, ensuring that your form is complete, with all necessary sections filled out, is critical to avoid any delays in processing.

What happens after submission?

Following submission, your CRA form will enter into a review phase by the regulatory authorities responsible for monitoring compliance. They will scrutinize the information provided and assess your bank’s performance in terms of community reinvestment.

During this period, you may receive feedback or requests for additional information. It is vital to be prepared for such inquiries and respond promptly, as this ensures effective communication and can influence your bank’s CRA rating positively.

Troubleshooting common issues with CRA submissions

Errors in submission can pose significant challenges. Identifying error messages and understanding their meanings will help in quickly resolving issues. Common errors include missing signatures, incorrect data formats, or failure to include supporting documents.

Furthermore, maintaining effective communication with the regulatory agencies can smooth the resolution process for any disputed matters. Establishing a rapport with your agency contact will facilitate easier resolution of issues and clarify any ambiguities.

Frequently asked questions about the Community Reinvestment Act form

Many individuals and institutions have questions surrounding the CRA form, from specifics about completion to general procedures. Common queries focus on the timeline for submissions, how to accurately report qualifying activities, and what metrics are expected for assessing community impact.

Resources for further assistance can often be found in community banking forums, financial service organizations, and directly through regulatory agencies' help lines or websites.

Additional considerations for CRA engagement

Establishing strong relationships with the communities served is fundamental to the CRA process. Engaging with local stakeholders not only enhances a bank's understanding of community needs but also builds trust and accountability. This engagement can manifest through outreach programs, partnerships with local organizations, and transparent reporting on CRA activities.

Post-submission, best practices for compliance and ongoing reporting should be prioritized to ensure banks maintain transparency and accountability. Regularly updating community needs assessments and soliciting feedback can help institutions remain aligned with their community reinvestment goals.

Exploring related regulations and guidelines

An overview of 12 C.F.R. Part 25 outlines the regulations governing the CRA. Key sections detail compliance expectations for financial institutions, defining how they should conduct business in relation to community reinvestment. Familiarizing oneself with these regulations promotes accountability and helps institutions adhere to required practices.

Appendices included in these regulations, such as Appendix A concerning CRA ratings and Appendix B covering notice requirements, are equally critical. They provide insight into the specific metrics and standards that regulatory bodies utilize when evaluating CRA submissions.

Popular links for CRA resources

Accessing up-to-date resources is crucial for both banks and community organizations involved in the CRA process. Direct links to CRA databases, exam schedules, and detailed regulatory guidelines will provide comprehensive support throughout each phase from preparation to submission.

Utilizing online tools for tracking community reinvestment activities keeps institutions accountable while enabling them to highlight their efforts effectively. Establishing these digital resources as part of your compliance strategy can foster internal and external transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send community reinvestment act to be eSigned by others?

Can I create an eSignature for the community reinvestment act in Gmail?

How can I edit community reinvestment act on a smartphone?

What is community reinvestment act?

Who is required to file community reinvestment act?

How to fill out community reinvestment act?

What is the purpose of community reinvestment act?

What information must be reported on community reinvestment act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.