Get the free W-4

Get, Create, Make and Sign w-4

How to edit w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4

How to fill out w-4

Who needs w-4?

Complete Guide to the W-4 Form: Understanding, Completing, and Managing Your Tax Withholding

Understanding the W-4 form

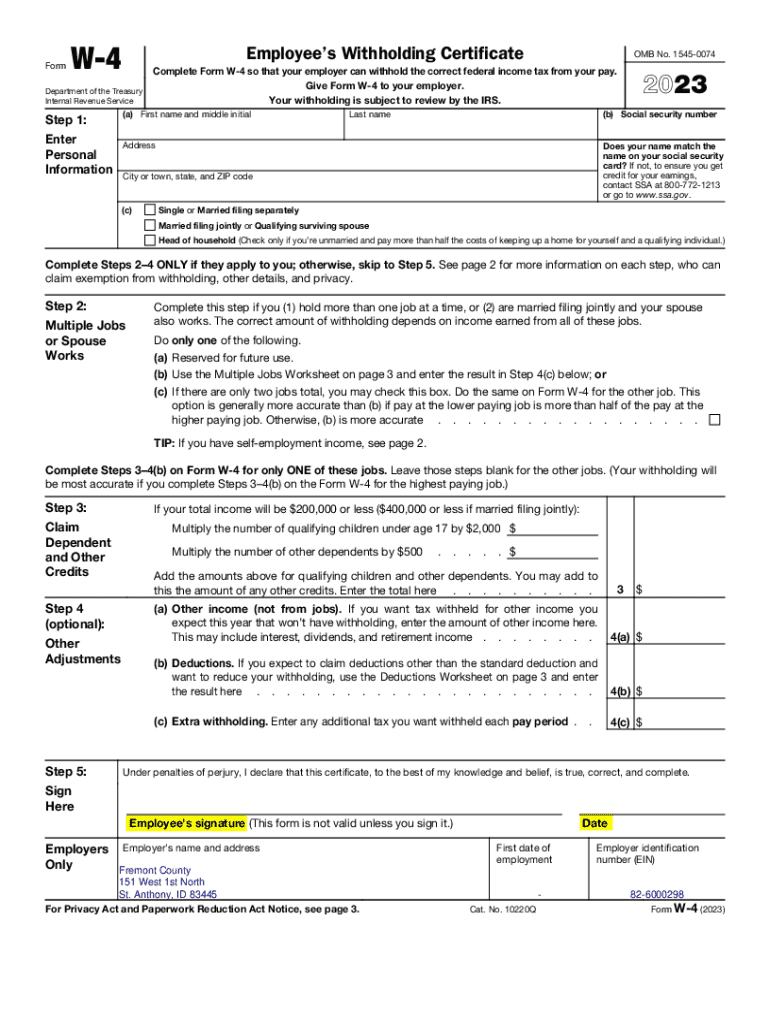

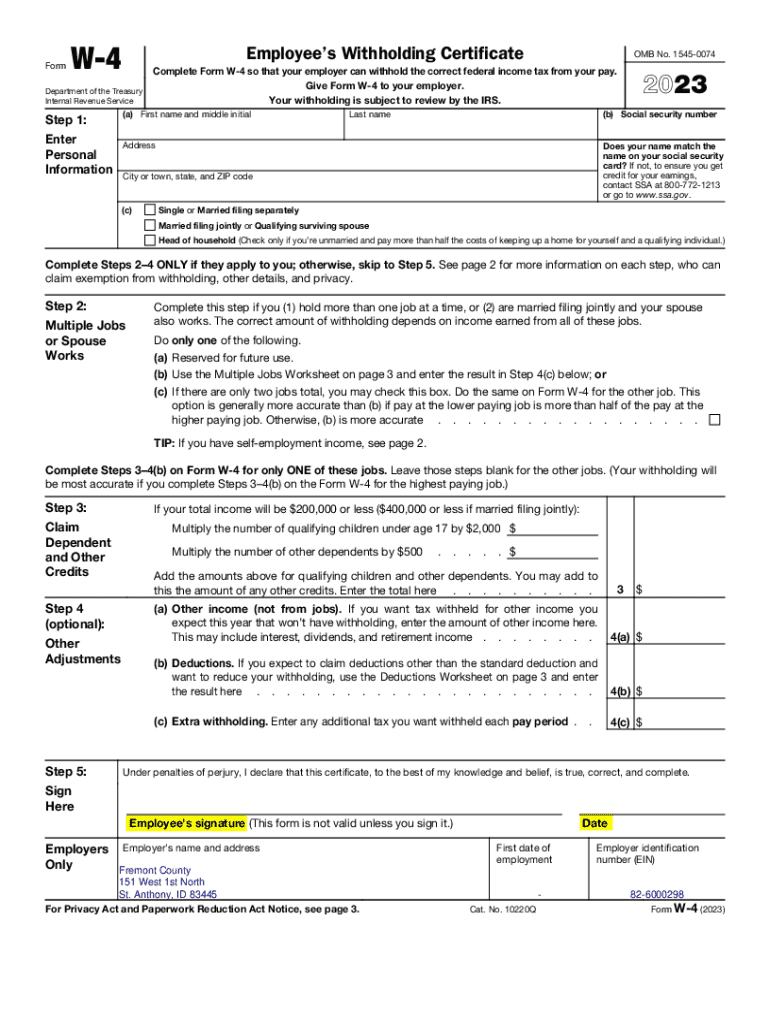

The W-4 form, officially titled the Employee's Withholding Certificate, is a crucial document used in the United States to inform employers of how much federal income tax to withhold from an employee's paycheck. This form directly influences your take-home pay and impacts your tax liability at the end of the year. Completing the W-4 accurately is vital to avoid under-withholding or over-withholding, which can lead to unexpected tax bills or refunds.

The purpose of the W-4 form is to provide the IRS with the necessary information to ensure that employers withhold the appropriate amount of federal taxes from employees' wages. Understanding how to fill it out correctly is essential for effective tax planning and financial management.

Importance of the W-4 form

Filling out the W-4 form correctly not only affects your paycheck but also your financial peace of mind. An accurate W-4 ensures that you pay the right amount of tax throughout the year, minimizing the risk of owing money or receiving a large refund. Each person’s tax situation is unique, influenced by variables like marital status, number of dependents, and extra income, making it crucial to evaluate your withholding needs periodically.

Understanding this form's importance can help you strategize for your financial future, ensuring you use your earnings to their fullest potential without unnecessary tax surprises.

Is the W-4 form mandatory?

The W-4 form is mandatory for employees who earn wages subject to federal income tax withholding. This includes full-time and part-time employees whether they are new hires or existing employees who need to make changes to their tax withholding status. If you do not submit a W-4, your employer may withhold taxes at the highest rate, resulting in more taxes being withheld from your paycheck than necessary.

Common scenarios that require a new or updated W-4 include starting a new job, moving to a new state for work, getting married or divorced, having children, or experiencing other significant life changes. Each of these events can alter your withholding needs and should prompt a review of your W-4.

How to complete the W-4 form

Completing the W-4 form is straightforward when following these steps:

By following these steps methodically, you can complete the W-4 correctly, setting the stage for accurate tax withholding year-round.

Common mistakes when filling out the W-4

Filling out the W-4 is generally simple, but there are common pitfalls. Here are several areas where mistakes frequently occur:

Errors in these areas can cause under-withholding, resulting in a tax bill at year-end, or over-withholding, which effectively gives the IRS an interest-free loan of your money. Review your W-4 regularly to avoid these common pitfalls.

Where to submit your W-4 form

Once completed, the W-4 form should be submitted to your employer's payroll department. Depending on the company, this could be done either via hard copy or electronically. Check if your employer accepts electronic submissions, which can streamline the process significantly.

Make sure to submit your W-4 as soon as you start a new job or if you experience any life changes that would affect your withholding. Additionally, employers may require a new W-4 whenever an employee's situation changes unless specified otherwise.

Keeping your W-4 current

It’s vital to keep your W-4 up to date to reflect your current financial situation accurately. Circumstances that should trigger an update include getting married, having children, or significant changes in income.

To make changes, simply complete a new W-4 form and submit it to your employer. Even if your life circumstances do not change drastically, it’s good practice to review your W-4 at least annually to ensure it aligns with your current financial goals.

Contact information for payroll assistance

If you have questions about completing the W-4 form or your withholding status, reach out to your company's payroll administration team. They can provide guidance specific to your employment situation.

In addition to reaching out directly, consider these frequently asked questions to help clarify any uncertainties related to your W-4.

Leveraging pdfFiller features for managing your W-4

Managing your W-4 form is simplified with pdfFiller. This cloud-based platform allows you to easily fill out, edit, and submit your W-4 online streamlining the entire process.

Here’s how to use pdfFiller effectively:

The benefits of using pdfFiller enrich your experience, converting a daunting process into a swift and efficient task.

Advanced considerations

In some cases, it may be beneficial to work with a tax professional, especially if your financial situation is complex. Tax advisors can provide personal insights and recommendations tailored to your specific needs, helping you navigate your W-4 selections more effectively.

Moreover, understanding the tax implications of your W-4 choices can make a significant difference in your overall financial health. Different withholding statuses can influence your year-end tax return, affecting whether you receive a refund or owe taxes. A careful review with a tax expert can optimize your withholding strategy, ensuring that your financial goals are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-4 for eSignature?

How do I make changes in w-4?

Can I edit w-4 on an iOS device?

What is w-4?

Who is required to file w-4?

How to fill out w-4?

What is the purpose of w-4?

What information must be reported on w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.