Get the free 10-k

Get, Create, Make and Sign 10-k

Editing 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-k

How to fill out 10-k

Who needs 10-k?

10-K Form How-to Guide

Overview of the 10-K form

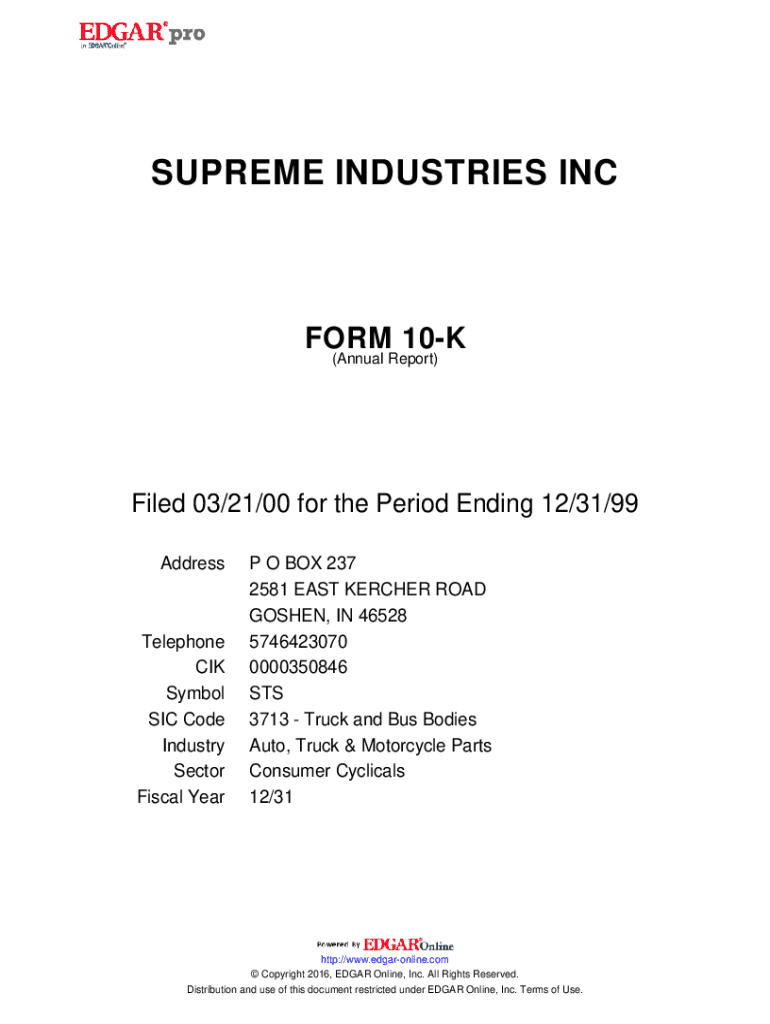

A Form 10-K is a comprehensive report filed annually by publicly traded companies to the Securities and Exchange Commission (SEC). This document provides a thorough overview of a company’s financial performance, operations, and plans, serving as a critical tool for investors, stakeholders, and analysts. Unlike quarterly reports, the 10-K gives a detailed snapshot of a company’s financial health, encompassing everything from income and expenses to risk factors and future strategies.

The importance of the 10-K extends beyond financial disclosures. It offers insights into management’s perspective on business operations, significant challenges faced, and how these challenges are addressed. For investors, the 10-K is invaluable for making informed decisions, as it contains essential data that can impact stock prices and investment strategies.

Companies required to file a 10-K include those traded on national exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ. Each company must file within a specific timeframe based on its size; larger companies generally have 60 days post-fiscal year-end, while smaller reporting companies have 90 days. Understanding these deadlines is crucial for maintaining compliance.

Structure of the 10-K form

The structure of a 10-K form is standardized by the SEC, comprising four main parts. Each part provides vital information that varies in focus, catering to diverse stakeholders' needs. Below is a breakdown of the components commonly found in a 10-K filing.

Understanding the structure helps stakeholders pinpoint relevant information efficiently, aiding in rapid decision-making. Each item within these parts serves specific stakeholder interests, from assessing risk to understanding a company’s market strategy.

How to access and review a 10-K form

Accessing a 10-K form is straightforward through several avenues. The most reliable source is the SEC’s EDGAR database, where these filings are publicly available. Additionally, companies often host their 10-K filings on their own websites, specifically within the investor relations sections, allowing for easy access.

When reviewing a 10-K, focus on key features like Management’s Discussion and Analysis (MD&A) and the financial statements. The MD&A offers context to financial data, explaining the 'why' behind numbers, while the financial statements provide the raw data necessary for analysis. Pay attention to the notes accompanying the financial statements, as these often reveal critical insights into accounting practices and future outlooks.

Filling out a form 10-K

Filling out a Form 10-K may seem daunting, but following a structured process can make it manageable. Begin by preparing the necessary documents and establishing a timeline to ensure timely filing. Gathering historical and current financial data, including income statements, balance sheets, and cash flow statements, is essential.

Each section of the Form 10-K poses unique challenges. For example, crafting risk factor disclosures may require foresight into potential industry threats and operational weaknesses. Presenting financial data effectively requires clarity and accuracy, ensuring that users can interpret figures quickly. Using visuals, such as charts or tables, can enhance data presentation, providing clear insights into financial performance.

Common challenges when filing a 10-K

Despite its structured format, filing the 10-K can present several challenges. Identifying and mitigating errors is crucial as mistakes can lead to regulatory scrutiny. Companies often struggle with complex financial disclosures, particularly those involving estimates and assumptions that require substantial justification.

To combat these challenges, thorough internal checks and reviews should be established, involving legal and financial experts. Team training on SEC guidelines and XBRL compliance can significantly mitigate risks associated with filing errors and misunderstanding financial disclosures.

10-K FAQs

Navigating the complexities of the 10-K filing can raise many questions, especially for new users. Understanding the distinctions between similar forms is vital. For instance, one might wonder about the difference between a 10-K and a 10-Q. While the 10-K offers a comprehensive year-end review, the 10-Q provides quarterly updates, generally being less detailed.

Interactive tools for managing your 10-K filing

Efficiently managing your 10-K filing process has never been easier, especially with resources like pdfFiller. This robust platform allows users to create, edit, and share documents in a seamless manner. The capability to access documents from any location ensures that involved stakeholders can collaborate more effectively.

With pdfFiller's automation capabilities, companies can save valuable time in the document management process. This can lead to enhanced accuracy and less manual work, alleviating stress during the busy annual filing season.

Further exploration

Exploring the broader landscape of financial reporting means understanding forms related to the 10-K. For example, the Form 10-Q is filed quarterly and focuses on interim financial data. It contains less detail than the 10-K, allowing companies to update their investors without the exhaustive review mandated for annual reports. Similarly, Form 8-K is used to report unscheduled events or corporate changes when they occur.

Staying updated on trends in 10-K filings is essential for companies adapting to regulatory changes and investor expectations. The financial landscape evolves constantly, and so must the practices around these filings.

Conclusion and best practices

Successfully navigating the various complexities of the 10-K filing process requires careful planning, teamwork, and an understanding of regulatory requirements. Implementing best practices such as preparing early, fostering a collaborative environment, and utilizing tools like pdfFiller alleviates most stress associated with the filing period.

By understanding the 10-K form inside and out, stakeholders reinforce their commitment to transparency and accountability, which in turn fosters trust among investors and the broader financial community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 10-k for eSignature?

Can I sign the 10-k electronically in Chrome?

How do I complete 10-k on an Android device?

What is 10-k?

Who is required to file 10-k?

How to fill out 10-k?

What is the purpose of 10-k?

What information must be reported on 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.