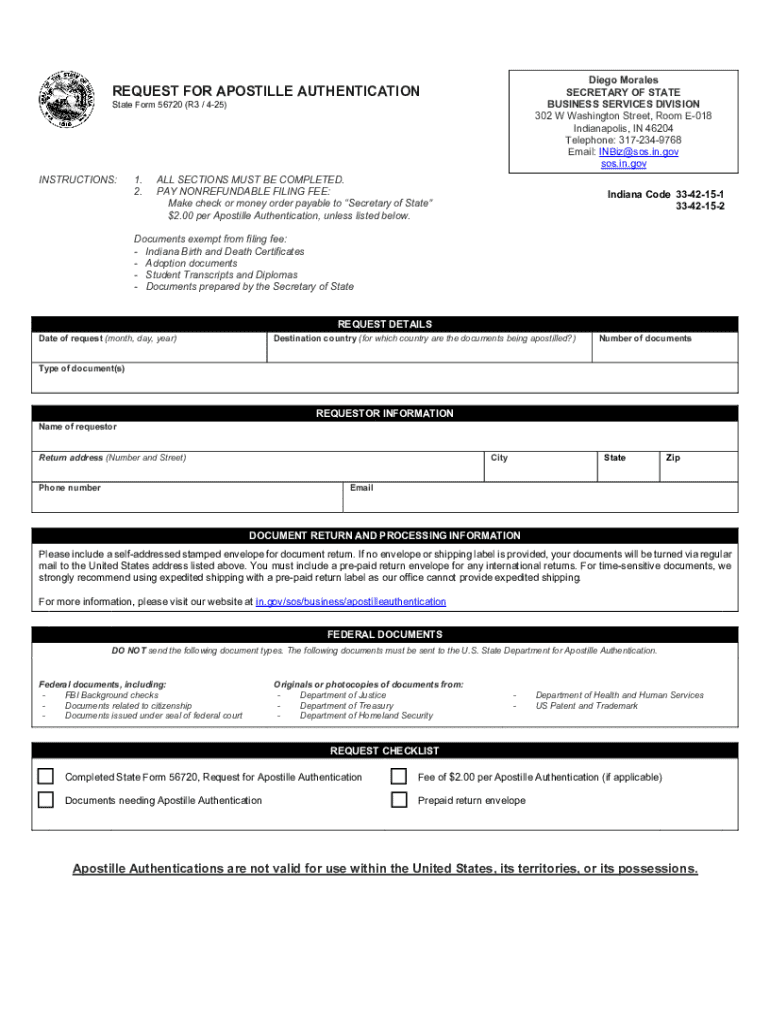

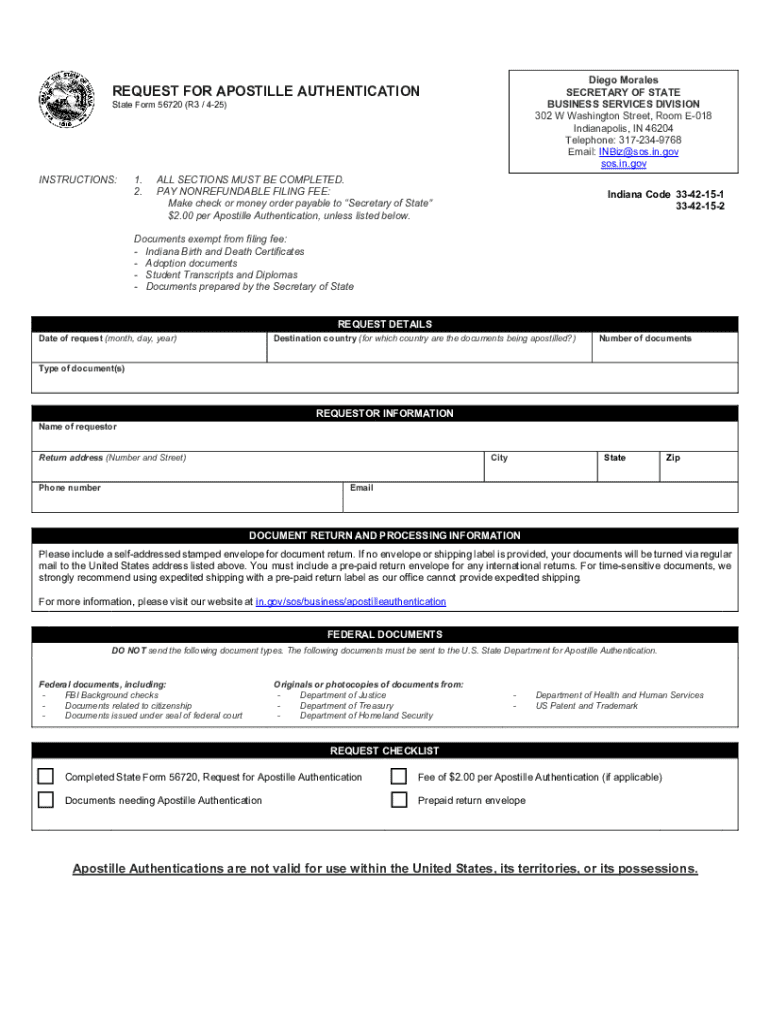

IN SF 56720 2025-2026 free printable template

Get, Create, Make and Sign IN SF 56720

How to edit IN SF 56720 online

Uncompromising security for your PDF editing and eSignature needs

IN SF 56720 Form Versions

How to fill out IN SF 56720

How to fill out state form 56720

Who needs state form 56720?

Understanding and Managing State Form 56720

Understanding State Form 56720

State Form 56720 is a critical document used primarily for [specific purpose, e.g., tax submissions, financial reporting, etc.]. It serves as a standardized piece enabling individuals and organizations to communicate with state agencies efficiently. This form ensures that relevant information is captured uniformly, allowing for smooth processing and record-keeping.

The importance of State Form 56720 cannot be overstated. It not only aids in compliance with state regulations but also provides a clear framework for declaring necessary information. Missing or incorrectly filled forms can lead to delays or rejections, which is why understanding the form thoroughly is essential for any individual or organization required to submit it.

Navigating the State Form 56720

The layout of State Form 56720 can initially seem overwhelming, but breaking it down into its main sections can simplify the process significantly. Each part of the form has its unique requirements and focus areas, making it essential to understand these sections thoroughly.

Common terminology associated with the form can also pose a challenge for users. Terms such as 'net income', 'filing status', and 'deductions' are prevalent and understanding their implications within the context of State Form 56720 is crucial for accurate completion.

How to fill out State Form 56720

Filling out State Form 56720 requires careful attention to detail. Ensuring each section is completed accurately not only facilitates smooth processing but also minimizes errors that could lead to complications.

Here’s a step-by-step approach to completing each section of the form:

As you fill out the form, here are a few tips to help you avoid common mistakes:

Editing and managing your State Form 56720

Utilizing platforms like pdfFiller can significantly enhance your experience of editing and managing State Form 56720. This tool allows users to make necessary adjustments seamlessly, ensuring that the final submission is both accurate and professional.

Collaboration is often key, especially if multiple stakeholders are involved in filling out the form. Using pdfFiller, team members can work on the document together, making real-time edits and comments. This collaborative tool can streamline the approval process as well, allowing for faster consensus on the final document.

Submitting State Form 56720

Once you have completed and reviewed State Form 56720, the next step is submission. Knowing where and how to submit the form is crucial as it affects processing times and compliance with deadlines.

Typically, submissions can be made online or via traditional mail. The preferred method might vary based on the specific state requirements. Understanding specific deadlines for submission is equally vital to avoid any penalties or complications.

Tracking and managing your submission

After submitting State Form 56720, it’s important to keep track of its status. Many states provide online tools that allow you to check the status of your form after submission. Additionally, leveraging pdfFiller can assist in keeping your records organized.

Utilizing online platforms for tracking offers peace of mind as you can know where your form stands in the processing queue, reducing uncertainty and anxiety.

Troubleshooting common issues

Though filling out State Form 56720 might seem straightforward, several common issues can arise. These may include mistakes in the provided information or failure to observe mandatory fields.

Handling mistakes swiftly is crucial, especially in a regulated timeframe. Understanding the corrective measures to take if complications arise can help mitigate potential delays.

State Form 56720 related documentation

In many cases, State Form 56720 might need to be submitted alongside other documentation. Knowing which forms complement this submission can save you time and ensure completeness.

Additionally, being aware of related state regulations can inform you of any compliance requirements necessary when submitting your form.

Frequently asked questions

Common inquiries regarding State Form 56720 can help clarify uncertainties and improve understanding of the process.

Conclusion: maximizing your document experience

Effectively managing State Form 56720 can significantly enhance your overall experience. By using tools like pdfFiller, you can ensure that your submission is accurate and compliant with state regulations. Furthermore, understanding each aspect of the process—from filling out to tracking your submission—contributes to a seamless experience.

In a world where document management systems are leveraged for efficiency, opting for a solution like pdfFiller empowers users to access, edit, and manage documents easily. This can lead to better long-term organization and readiness for any future submissions required by state authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IN SF 56720 for eSignature?

How do I complete IN SF 56720 online?

How do I fill out the IN SF 56720 form on my smartphone?

What is state form 56720?

Who is required to file state form 56720?

How to fill out state form 56720?

What is the purpose of state form 56720?

What information must be reported on state form 56720?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.