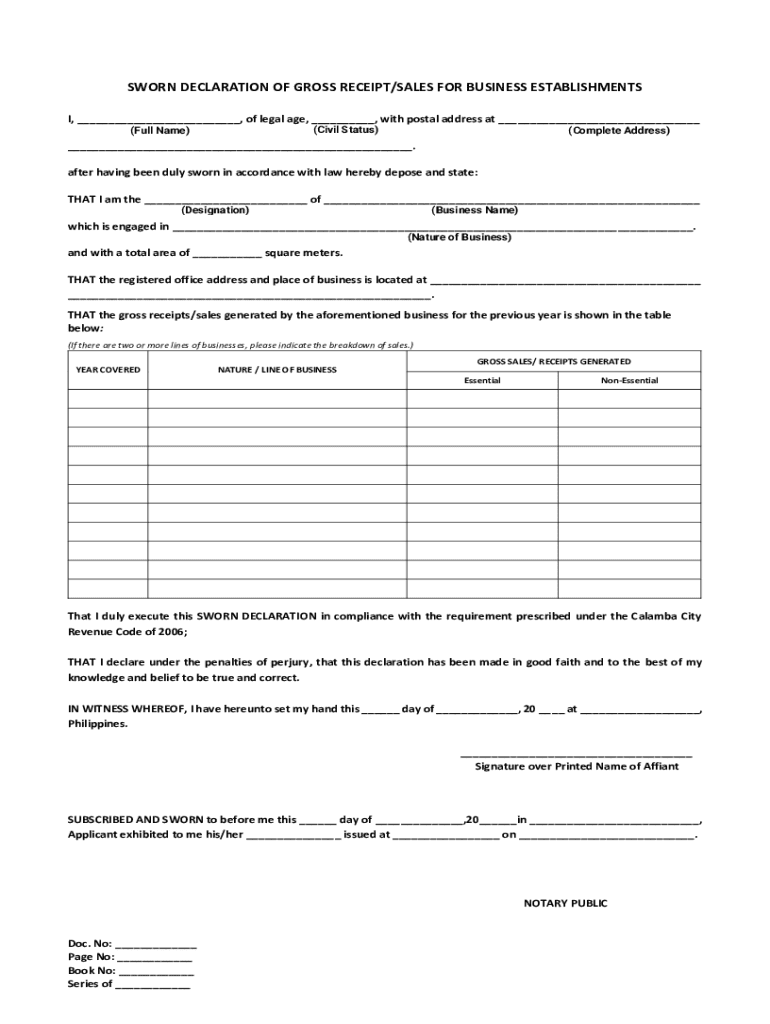

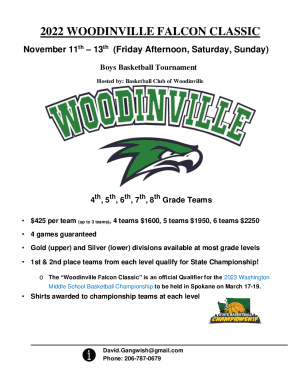

Get the free Sworn Declaration of Gross Receipt/sales for Business Establishments

Get, Create, Make and Sign sworn declaration of gross

Editing sworn declaration of gross online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sworn declaration of gross

How to fill out sworn declaration of gross

Who needs sworn declaration of gross?

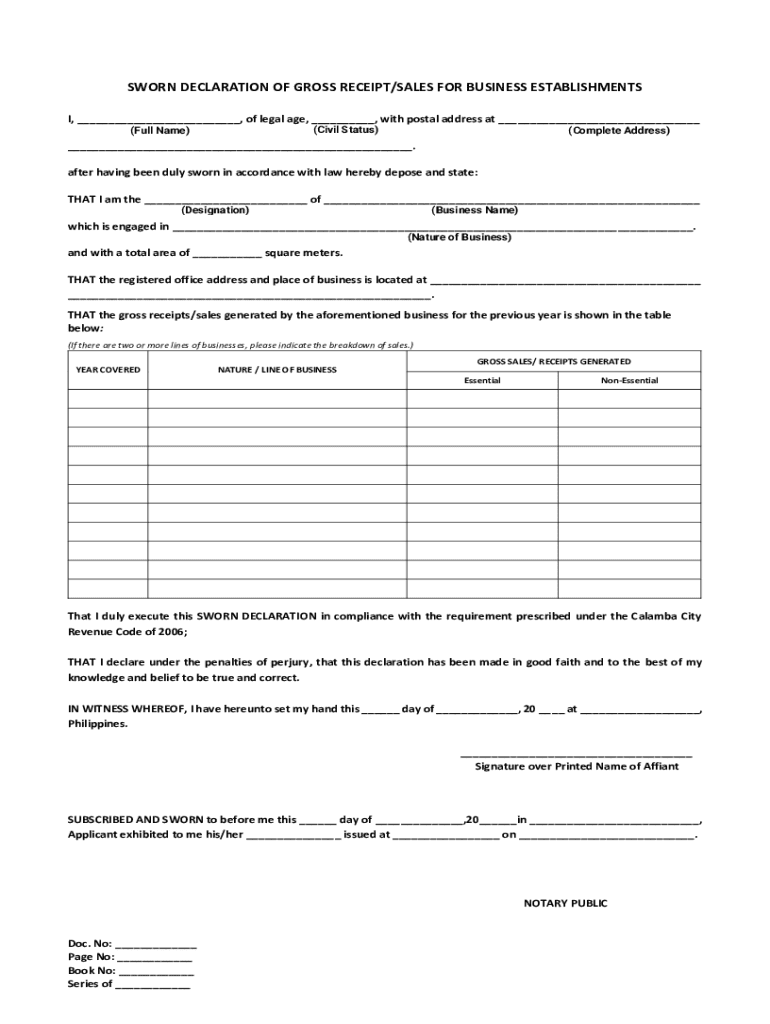

Understanding the Sworn Declaration of Gross Form

Understanding the sworn declaration of gross form

A sworn declaration of gross form is a vital document used by individuals and businesses to formally report their total income and associated financial information. This declaration serves not only as a record for taxation purposes but also plays a crucial role in various legal scenarios such as loan applications and government assistance programs.

The importance of this declaration cannot be overstated. It functions as a legally binding affirmation of the accuracy and honesty of the information provided. Accuracy is paramount, especially given that discrepancies can lead to severe penalties, including legal repercussions or financial audits.

Who requires a sworn declaration of gross form?

Many individuals and businesses find themselves needing to complete a sworn declaration of gross form under specific circumstances. These scenarios often include filing taxes where accurate income reporting is essential to determine liability and deductions. Additionally, legal entities involved in litigation or applying for permits may use this form to verify financial status.

Moreover, organizations engaging in significant financial transactions, such as loans or grants, often require a sworn declaration to assess the financial reliability of the applicant. Such documentation helps institutions mitigate risk and ensure compliance with financial regulations.

Key components of the sworn declaration of gross form

Every sworn declaration of gross form comprises essential information that needs to be clearly stated. At the outset, individuals must fill in their personal details, including their name, address, and contact information. The inclusion of accurate financial details follows, which typically breaks down income sources and potential deductions.

The element of legal affirmation transforms a sworn declaration into a document of trust and seriousness. By signing this declaration, individuals assert the truthfulness of their statements and acknowledge that submitting false information may lead to significant penalties, including fines or legal prosecution.

Step-by-step guide to completing the sworn declaration of gross form

Completing a sworn declaration of gross form may seem daunting, yet it can be accomplished effectively with careful preparation. Here’s a step-by-step breakdown: First, gather all necessary documents such as income statements, previous tax returns, and any supporting financial records.

Next, access the correct template through pdfFiller. The user-friendly interface allows you to find the right form quickly. Following that, fill out the form meticulously, ensuring every section is completed accurately.

After filling in the form, take time to review the information for accuracy. It's crucial to cross-check calculations and details. Lastly, finalize the declaration by eSigning it through pdfFiller’s cloud-based platform, which is designed for secure and efficient signing processes.

Editing and managing your sworn declaration of gross form

Editing your sworn declaration of gross form is seamless with pdfFiller. Utilizing various tools, users can modify text, add signatures, or make necessary changes quickly and effectively. The platform offers a streamlined process to manage document revisions and ensure that all updates are current.

Once the edits are made, it's important to save the document securely. pdfFiller provides options for cloud storage, ensuring that your document remains accessible yet protected. Sharing the completed form is also straightforward, with multiple secure options to ensure sensitive data is appropriately handled.

Common challenges and solutions

Filling out a sworn declaration of gross form can present challenges, such as missing information or misunderstanding legal terminology. Many users struggle to collect all the details needed, which can result in incomplete declarations that invite scrutiny from tax authorities or lenders.

To tackle these issues, it is beneficial to start the process early and reach out for assistance when necessary. pdfFiller offers robust support options where users can connect with customer service representatives to clarify questions and obtain the right resources for overcoming obstacles.

Implications of the sworn declaration of gross form

Understanding the implications of a sworn declaration of gross form is crucial. Submitting false information intentionally can have drastic legal consequences, leading to penalties, fines, or even criminal charges in severe cases. The legal system takes such declarations seriously, as they directly impact financial responsibility and trust in the taxation process.

From a financial perspective, accurate declarations influence tax liability and can uncover potential savings through applicable deductions. Keeping accurate records ensures individuals and businesses do not overpay in taxes and helps maintain strong financial health.

Interactive tools for your sworn declaration of gross form

pdfFiller offers a suite of interactive tools that enhance the experience of completing a sworn declaration of gross form. Features like interactive fields promote user engagement while reducing the likelihood of error by allowing users to input information directly into pre-defined sections.

Moreover, options for team collaboration empower multiple users to work simultaneously on the same document, streamlining the process and ensuring that all inputs are captured and addressed efficiently. This functionality is of immense benefit for teams handling complex financial documentation.

Real-life examples and case studies

Exploring real-life examples sheds light on the practical benefits of correctly completing a sworn declaration of gross form. Individuals who have submitted this form accurately often report more favorable treatment from financial institutions, such as better loan rates or quicker approvals based on the reliability of their declared financial information.

Conversely, case studies reveal common pitfalls. For instance, some applicants experienced delays in financing due to minor inaccuracies in their declarations. These instances underscore the necessity of thorough verification and attention to detail throughout the process.

Further customizations with pdfFiller

pdfFiller allows users to customize their sworn declaration of gross form according to specific needs and local regulations effectively. The tool’s versatility enables users to tailor the form for compliance with different state laws or organizational requirements.

Additionally, pdfFiller’s features, like template creation or bulk sending capabilities, provide even more substantial document management functionality. This dynamic approach not only enhances efficiency but also makes navigating through diverse documentation needs straightforward for both individuals and businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sworn declaration of gross directly from Gmail?

How do I make edits in sworn declaration of gross without leaving Chrome?

Can I edit sworn declaration of gross on an iOS device?

What is sworn declaration of gross?

Who is required to file sworn declaration of gross?

How to fill out sworn declaration of gross?

What is the purpose of sworn declaration of gross?

What information must be reported on sworn declaration of gross?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.