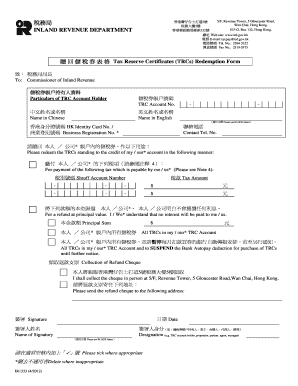

HK IR1333 2023-2026 free printable template

Get, Create, Make and Sign HK IR1333

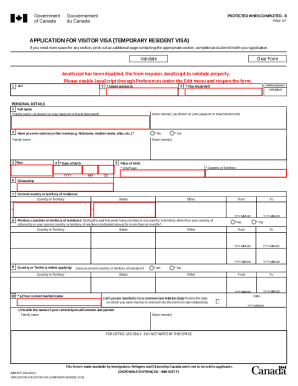

Editing HK IR1333 online

Uncompromising security for your PDF editing and eSignature needs

HK IR1333 Form Versions

How to fill out HK IR1333

How to fill out ir1333 - tax reserve

Who needs ir1333 - tax reserve?

IR1333 - Tax Reserve Form: A Comprehensive Guide

Understanding the IR1333 Tax Reserve Form

The IR1333 Tax Reserve Form is a crucial document designed for individuals and businesses to declare their estimated tax liabilities for the year ahead. Its primary purpose is to give tax authorities a preview of anticipated tax obligations, ensuring that taxpayers are prepared to meet their responsibilities in a timely manner. Utilizing the IR1333 effectively enables both individuals and organizations to maintain financial order and avoid potential penalties.

The importance of the IR1333 form cannot be overstated. By filling it out correctly, taxpayers not only fulfill legal obligations but also position themselves advantageously for negotiation and planning with tax advisors. Teams—especially those handling multiple stakeholders—benefit from a standardized approach to tax estimation, facilitating smoother operations and clearer communication regarding financial statuses.

Who needs the IR1333 form?

Individuals and businesses alike may find themselves in need of the IR1333 Tax Reserve Form. Personal tax implications arise primarily for those with fluctuating incomes, freelance workers, or those who may be underestimating their tax responsibilities in previous years. When there are significant changes to income, family status, or deductions, filing the IR1333 becomes essential.

Scenarios necessitating this form include new business owners projecting their income, freelancers anticipating changes in earnings, or even established corporations that intend to make significant investments or expansions. Stakeholders such as accountants, financial advisors, and business owners play vital roles in the completion of the IR1333 since they can provide the necessary insights and documentation essential for accuracy.

Key features of the IR1333 Tax Reserve Form

Understanding the structure of the IR1333 Tax Reserve Form is essential in maximizing its efficiency. Each section serves a distinct purpose, from personal and financial details to tax calculations. Familiarity with these sections can prevent mistakes and ensure precise filings.

Mandatory information typically includes personal identifiers, income figures, and tax deductions. Conversely, optional data may involve additional financial projections or notes regarding special circumstances. Being thorough yet concise is vital as incomplete forms can lead to processing delays or misunderstandings with tax authorities.

Technical specifications

The IR1333 Form is available in both PDF format and through online submission tools. When filling out the form digitally, it's crucial to confirm that your submission process aligns with the requirements outlined by your local tax authority. Some forms permit digital signatures, which can significantly speed up the submission process.

Step-by-step guide to filling out the IR1333 form

Before diving in, preparation is key to successfully completing the IR1333 form. Gather all necessary documentation, which might include previous tax returns, income statements, and any essential financial records. Addressing common challenges—like understanding the required calculations or knowing where to find forms—can help streamline the process.

Each section of the form has specific requirements that require careful attention. The personal information section demands accurate name, address, and identification numbers. Mistakes here can result in issues with processing. For the financial details section, ensure you include complete and precise figures, as rounded numbers may lead to discrepancies down the line.

Detailed instructions for each section

After completing the IR1333 form, it’s critical to review your work. Create a checklist of the required elements to ensure everything is filled accurately. Proofreading with a fresh perspective can uncover errors that may be overlooked during initial completion.

Editing, signing, and submitting your IR1333 form

Editing the IR1333 Form can be streamlined using tools like pdfFiller. This platform offers a range of interactive features, allowing users to fill in, edit, and revise documents with ease. Team members can collaborate on the same document, ensuring that input from multiple stakeholders is incorporated effectively.

Once the form is completed, it must be signed to validate the document. pdfFiller provides various electronic signature options, maintaining compliance with applicable e-signature laws. This modern approach not only expedites the submission process but also offers a convenient way to manage your documents securely.

Submitting the form

Submission guidelines are often determined by location, so users should be aware of where to send their finalized IR1333 forms. Keeping an eye on deadlines is crucial, as late submissions can attract penalties. Ensure that you send your form to the correct address and confirm it was received to avoid further complications.

Frequently asked questions (FAQs) regarding the IR1333 form

As with any tax-related form, questions are bound to arise during the process. Common queries may include how to rectify mistakes or what steps to take if the form has already been submitted. Always consult updated guidelines as these can change yearly based on fiscal policies.

Understanding your tax responsibilities following the filing of the IR1333 is vital. If changes in income occur or new deductions become applicable, adjustments might need to be made in future submissions to prevent complications.

Related forms and resources

The IR1333 form often coincides with various other tax forms that help detail different aspects of a taxpayer's financial picture. Forms such as the IR1 (Income Tax Return) and various deduction-related forms are typically associated with the IR1333. Links to these resources can provide additional support during tax season.

Additional tools

Utilizing interactive calculators and tools available on platforms like pdfFiller can significantly assist with tax calculations. Integration with popular accounting software can further streamline processes, making the management of finances a less daunting task.

Navigating tax-related online services

Various top online tax services and platforms are available to assist in the documentation and submission process. pdfFiller stands out by providing a comprehensive solution for document management that features editing capabilities, esigning, and collaboration tools, all in one cloud-based platform.

Managing tax forms electronically centralizes documentation and makes this essential process more efficient. Success stories from users showcase testimonials of how pdfFiller has simplified tax filing, showing that organized management can yield significant time savings.

Contact support

If questions regarding the IR1333 form arise, reaching out for support is an excellent step to ensure compliance and correctness. Many platforms, like pdfFiller, offer dedicated assistance to help guide users through challenges they may encounter when completing their forms.

Stay updated with tax news

Encouraging readers to follow updates on tax laws ensures that they remain informed about any changes that may affect future filings. pdfFiller continuously adapts its features and offerings based on current regulations, fostering an environment of awareness that can greatly benefit users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my HK IR1333 directly from Gmail?

How do I edit HK IR1333 straight from my smartphone?

How do I fill out HK IR1333 on an Android device?

What is ir1333 - tax reserve?

Who is required to file ir1333 - tax reserve?

How to fill out ir1333 - tax reserve?

What is the purpose of ir1333 - tax reserve?

What information must be reported on ir1333 - tax reserve?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.