Get the free February 15 - St. Dunstan Catholic Church

Get, Create, Make and Sign february 15 - st

Editing february 15 - st online

Uncompromising security for your PDF editing and eSignature needs

How to fill out february 15 - st

How to fill out february 15 - st

Who needs february 15 - st?

February 15 - ST Form How-to Guide

Overview of the February 15 ST Form

The February 15 ST Form is a crucial document that facilitates compliance with specific tax regulations and obligations. This form is typically required for certain entities in order to report sales tax information accurately. Understanding its purpose is essential for both individuals and businesses alike, as failure to adhere to the requirements can lead to penalties and complications.

The significance of the February 15 deadline cannot be overstated. Submitting the ST Form on or before this date ensures that stakeholders fulfill their tax responsibilities timely, avoiding any unnecessary fees or interest that may accrue for late submissions. Therefore, it's paramount to be well-versed in the form’s requirements and to prioritize its completion as the deadline approaches.

Key features of the February 15 ST Form

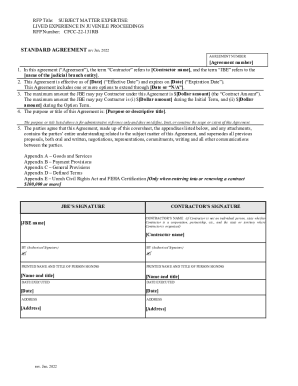

The February 15 ST Form contains several essential components that ensure its effectiveness as a reporting tool. Notably, these components include accurate identification of the business, details of sales transactions, and a breakdown of sales tax collected. Each section plays a critical role in painting a comprehensive picture of a business's tax obligations.

To complete the ST Form accurately, specific information is required such as the business’s tax identification number, sales figures for the reporting period, and jurisdictions where sales tax was collected. Providing precise data is vital as inaccuracies can cause delays and complications in processing the form.

Step-by-step instructions for completing the February 15 ST Form

Completing the February 15 ST Form can be accomplished effectively by following these step-by-step instructions.

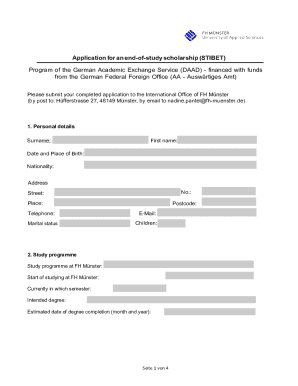

Step 1: Gather necessary information

Start by gathering all necessary documentation to support your submission. Required documents include:

These documents are typically found in your accounting software, tax records, or financial spreadsheets.

Step 2: Accessing the ST Form on pdfFiller

To access the February 15 ST Form, head to the pdfFiller platform, where you can find the form easily. Using pdfFiller is advantageous because it provides secure access and enhanced tools for fillable documents that can be tailored to your needs.

Step 3: Filling out the form

When filling out the form, pay close attention to each section. Begin with your business identification details and move through the sales information. It's common for users to leave out specifics or misinterpret fields; therefore, clarity is vital. Double-check your math and ensure that you're inputting accurate sales figures.

Step 4: Editing your form

pdfFiller provides excellent editing tools for correcting data. Take advantage of these tools to revise any mistakes and ensure the accuracy of your submission. Review the document thoroughly before proceeding to the next steps.

Step 5: Digital signing options

Once you have completed the form, you will need to sign it. pdfFiller allows you to securely eSign your ST Form digitally. This process enhances security and expedites submission, eliminating the need for printed documents.

Step 6: Submitting the ST Form

Finally, consider your submission options. You can submit the ST Form electronically through pdfFiller or by mailing a printed copy. If submitting electronically, ensure you keep a confirmation receipt as proof of submission. For mail submissions, always use certified mail to avoid the risk of missed delivery.

Common questions about the February 15 ST Form

Users often have questions surrounding the requirements for the February 15 ST Form. One commonly asked question is whether an amended form can be filed after submission. The answer is yes; you can file an amended ST Form if errors are identified post-submission without incurring severe penalties.

Another frequent inquiry pertains to what constitutes a valid signature on the form. Electronic signatures are accepted in most instances, provided they meet the regulatory requirements for securing digital forms.

Important deadlines and compliance information

In order to stay compliant, be aware that the deadline for submitting the February 15 ST Form is crucial. Failure to submit by this deadline can result in penalties that vary depending on jurisdiction. It's essential to familiarize yourself with local regulations as they may have unique implications.

Key dates to remember include not just the February 15 submission date, but also any potential pre-filing deadlines set forth by tax authorities. Be vigilant and proactive to ensure all submissions are timely and to avoid potential punitive measures.

Resources and tools available on pdfFiller

pdfFiller offers various interactive tools designed to enhance form management. Users can leverage collaborative features that allow teams to work together on documents in real-time, improving efficiency and clarity.

Additionally, pdfFiller provides access to relevant templates and forms that can streamline your workflow when needing common business documents. This comprehensive resource center is invaluable for any individual or team aiming to manage document needs effectively online.

Real-world examples of form usage

Understanding the practical use of the February 15 ST Form can be helpful. For example, a small retail business successfully submitted their ST Form using pdfFiller’s eSignature feature, which drastically reduced their processing time and ensured compliance without unnecessary delays.

From user feedback, many report that being able to track the submission digitally through pdfFiller's platform provided peace of mind, knowing they had successfully filed by the crucial February 15 deadline.

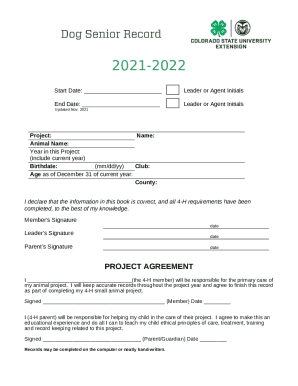

Tips for efficiency and best practices

To maximize efficiency when filling out the February 15 ST Form, consider these best practices. Organize your documentation ahead of the deadline, so everything is in one easily accessible place. Using pdfFiller’s integrated tools can save time and streamline the process by allowing you to edit and sign all from a single platform.

Additionally, set reminders for key deadlines leading up to February 15. This proactive approach can prevent last-minute scrambles that often lead to mistakes. By creating a timeline with tasks outlined for when to gather documents and fill out the form, you can navigate the process smoothly.

Troubleshooting common issues

As with any form preparation, issues may arise. One common problem users face is difficulty in accessing the form online. If this occurs, verify your internet connection and try refreshing the page or clearing your browser's cache. Furthermore, ensure that you're entering the correct URL on pdfFiller.

For any technical difficulties, pdfFiller provides user support. Familiarize yourself with their help center where you can find solutions to frequently encountered issues, ensuring a smoother experience while filling out the February 15 ST Form.

Additional tools and features from pdfFiller

pdfFiller continuously evolves its functionality to meet user needs better. Features like cloud storage and secure sharing options enhance document management significantly. Moreover, the platform's user-friendly interface allows for seamless navigation, making form management an intuitive experience.

By highlighting exclusive solutions, pdfFiller empowers users to handle the February 15 ST Form and other documents efficiently. Keeping up with the latest updates and improvements ensures you are always equipped with the best tools available for handling forms and documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send february 15 - st for eSignature?

How do I edit february 15 - st straight from my smartphone?

Can I edit february 15 - st on an iOS device?

What is february 15 - st?

Who is required to file february 15 - st?

How to fill out february 15 - st?

What is the purpose of february 15 - st?

What information must be reported on february 15 - st?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.