Get the free W-8ben

Get, Create, Make and Sign w-8ben

How to edit w-8ben online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben

How to fill out w-8ben

Who needs w-8ben?

W-8BEN Form How-to Guide

Understanding the W-8BEN form

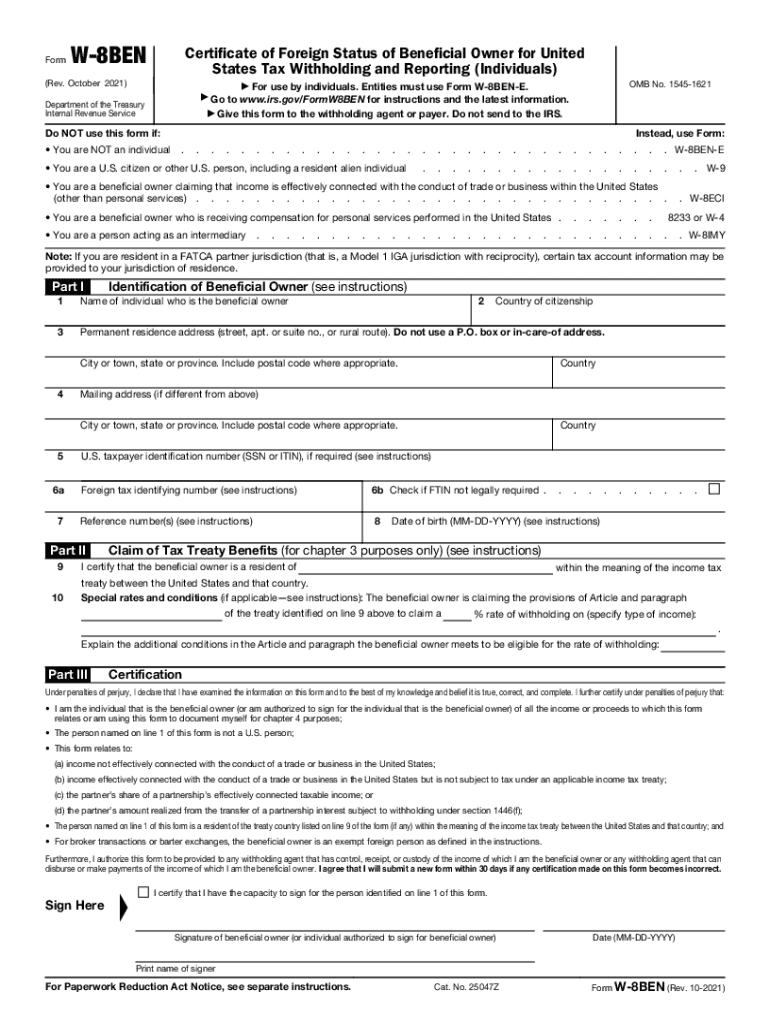

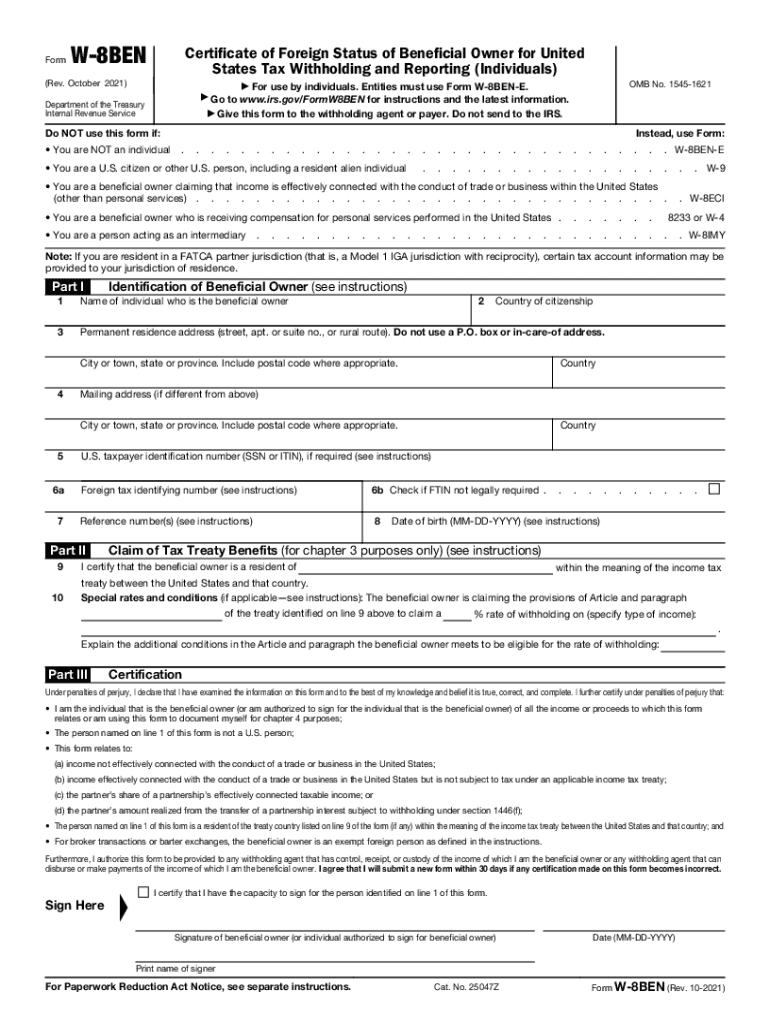

The W-8BEN form is a critical document used by non-U.S. persons to certify their foreign status for tax purposes. Specifically designed for individuals, it allows these individuals to claim tax treaty benefits and avoid higher withholding taxes on income derived from U.S. sources. By submitting this form to U.S. payers, foreign individuals can ensure compliance with U.S. tax regulations while maximizing their income from investments and other earnings.

For non-U.S. residents, understanding the W-8BEN form is vital for various reasons. It provides a clear recognition of their status and helps facilitate international transactions without unnecessary tax deductions. Not only does it reassure the U.S. payers of their non-residential status, but it also assists foreign individuals in navigating the complex landscape of international tax treaties.

Key features of the W-8BEN form

The W-8BEN form consists of several main components crucial for proper completion. Its structure can be broken down into three primary parts: identification of the beneficial owner, claim of tax treaty benefits, and certification. Each section is integral in establishing the relationship between the beneficiary and the U.S. income source.

Understanding the relevance of tax treaties is also essential. Many countries have entered into treaties with the U.S. to avoid double taxation, allowing foreign individuals to reduce their withholding rates on certain types of income. The W-8BEN form serves as the formal medium for individuals to assert these rights and seek advantageous tax terms.

Interactive tools and resources

Filling out the W-8BEN form can be simplified with interactive tools offered by pdfFiller. With its user-friendly platform, individuals can access step-by-step guided tools for completing the form correctly. This means no more confusion over fields and requirements; pdfFiller walks users through the entire process, ensuring accuracy and compliance.

Using pdfFiller provides notable advantages, including the ability to save your progress, edit your responses later, and collaborate easily if multiple parties are involved. Such features significantly enhance the experience of preparing tax documents like the W-8BEN form.

Filling out the W-8BEN form: A step-by-step guide

Step 1: Preparing your information

Before filling out the W-8BEN form, it’s important to gather necessary documents and identification. Essential key information required includes your full name, residential address, and foreign tax identifying number. Having these on hand eases the process, ensuring all critical information is readily available to enter into the form.

Step 2: Part - Identification of beneficial owner

The first section of the W-8BEN form focuses on identifying the beneficial owner. This includes fields for your name, country of citizenship, and permanent address. It’s important to accurately complete these fields to avoid any issues or delays in processing.

Understanding who qualifies as the 'beneficial owner' is crucial in this step. Essentially, the beneficial owner is the person who ultimately owns the income being claimed and has the rights to receive it. Proper identification helps U.S. authorities and payers confirm that the income is being processed according to tax regulations.

Step 3: Part - Claim of tax treaty benefits

In this section, users need to claim any tax treaty benefits. To qualify, the taxpayer must be a resident of a country that has a tax treaty with the U.S. The form requires detailing the treaty’s specifics and the type of income involved. Familiarity with applicable treaties is important—many countries offer reduced withholding tax rates on dividends and interest.

Highlighting common treaty examples can be helpful. For instance, Canada has a tax treaty with the U.S. that often allows its residents to benefit from reduced rates on dividends. Thus, understanding these treaties can significantly impact the tax obligations for non-U.S. residents.

Step 4: Part - Certification

Certification is the final step in the W-8BEN process. Users must sign and date the form, verifying that all information provided is correct. This certification is a legal assertion, making it imperative that you ensure all details are accurate before submitting.

Typically, only the beneficial owner can sign this form, aiming to maintain the integrity of the information provided. If a representative is signing on behalf of a corporation or trust, proper documentation confirming their authority to sign must accompany the form.

Common mistakes and FAQs

Completing the W-8BEN form can present challenges. Some frequent mistakes include using an incorrect foreign tax identifying number or neglecting to sign the form. To avoid these common pitfalls, ensure that you double-check all entries for accuracy and verify that all required fields are completed.

When navigating common FAQs, individuals often inquire about eligibility under tax treaties. Others worry about how long the form remains valid. It’s essential to note that the W-8BEN form is generally valid for three calendar years from the date signed.

Where to send the W-8BEN form

After completing the W-8BEN form, knowing where to send it is crucial. The form is typically submitted to the U.S. withholding agent or payer, not to the IRS. This could be a financial institution, an employer, or any U.S. entity from which you are receiving income. Ensuring that the correct person or organization receives the form is key to preventing delays.

Additionally, it's beneficial to be aware of any submission deadlines that may apply. For instance, if you are submitting the form in conjunction with a new income source, it's critical to complete it before the first payment is made to ensure the correct withholding rate is applied.

Need help completing the W-8BEN form?

pdfFiller stands out as an excellent resource for individuals needing assistance with the W-8BEN form. Offering 24/7 customer support, you can get real-time help whenever needed. Whether you have queries about specific sections of the form or require technical assistance, pdfFiller provides the support necessary to navigate the complexities of the form.

In addition to customer support, pdfFiller offers how-to videos that break down the process, ensuring users fully understand how to complete and submit their paperwork correctly. This comprehensive suite of assistance tools makes pdfFiller an ideal partner for managing the W-8BEN form and other critical documents.

Additional information on tax identification

Understanding Foreign Tax Identifying Numbers (FTIN) is important when completing the W-8BEN form. FTINs are used by foreign tax authorities to track taxpayers and their obligations. The use of a FTIN not only facilitates the process but helps ensure that the correct withholding tax rates are applied per treaties. Depending on your particular situation, this could be a personal tax ID issued by your local government.

Contextually, tax identification processes can vary widely for expats and individuals generating income in foreign territories. Therefore, an understanding of local tax laws and regulations becomes crucial for compliant international operations and the effective use of forms like the W-8BEN.

Navigating your documents with pdfFiller

pdfFiller's comprehensive document management features simplify not only the W-8BEN but any PDF-related tasks. The platform allows for seamless document creation, collaborative editing, and electronic signing, which streamlines the entire process of managing important tax forms.

With pdfFiller’s cloud-based platform, users can access their documents from anywhere. This flexibility, combined with user-friendly features, makes managing tax-related documents efficient and stress-free for individuals and teams alike. Navigating your important forms has never been easier than with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-8ben in Gmail?

How do I complete w-8ben online?

How can I fill out w-8ben on an iOS device?

What is w-8ben?

Who is required to file w-8ben?

How to fill out w-8ben?

What is the purpose of w-8ben?

What information must be reported on w-8ben?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.