Get the free It-203

Get, Create, Make and Sign it-203

Editing it-203 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out it-203

How to fill out it-203

Who needs it-203?

Understanding the IT-203 Form: A Comprehensive Guide for Nonresidents and Part-Year Residents

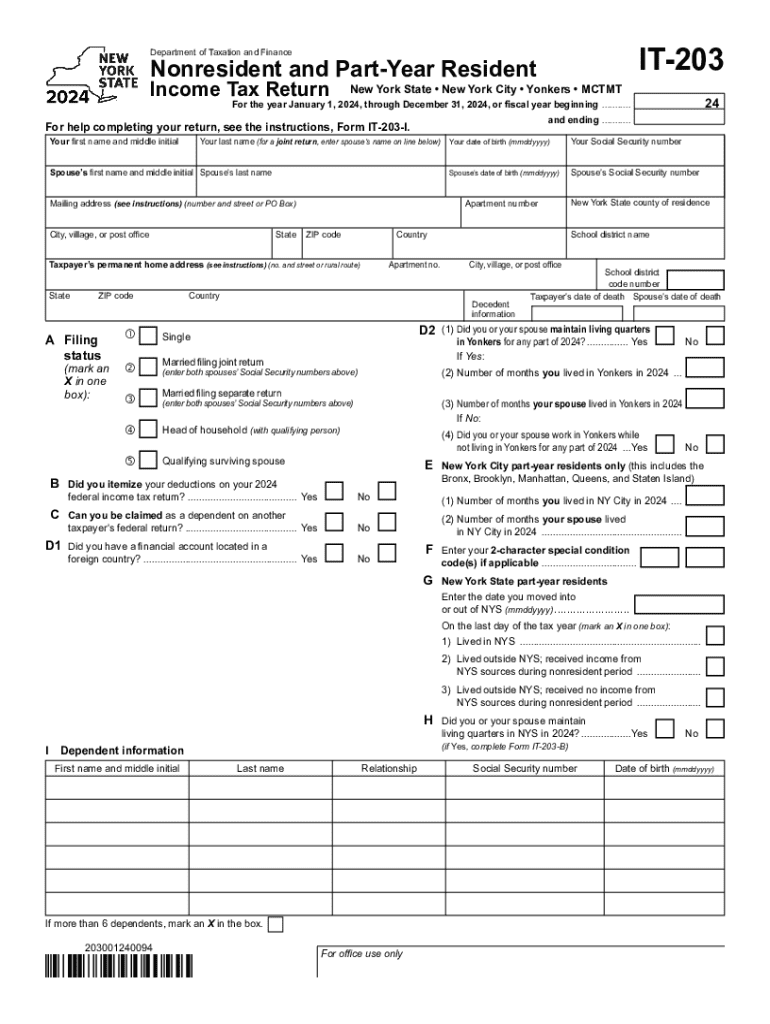

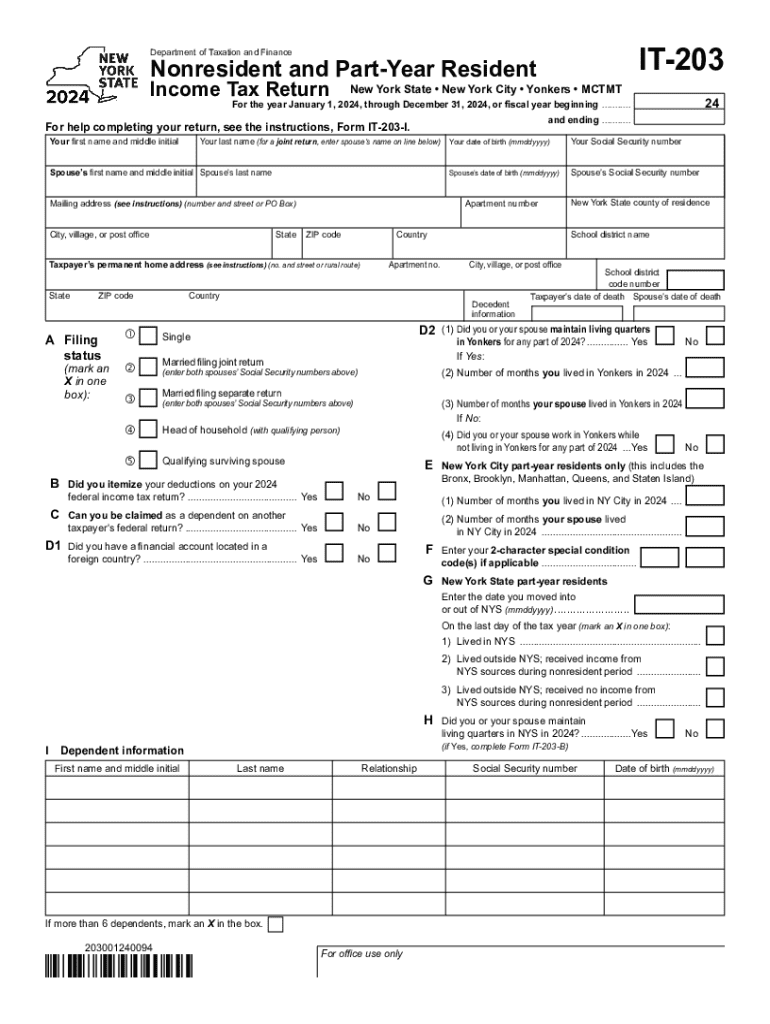

Overview of Form IT-203

Form IT-203 is a critical document for individuals classified as nonresidents and part-year residents who are required to file income tax returns in New York State. This form helps the Department of Taxation and Finance to assess the income earned by individuals not considered full-time residents of New York. By filing the IT-203, taxpayers ensure that they comply with state tax laws while accurately reflecting their income contributions.

Individuals who earned income in New York but maintain residency elsewhere, or those who were residents for only part of the year, must navigate this tax obligation. For those preparing for the 2024 filing season, understanding the nuances of this form will enhance compliance and maximize allowable deductions and credits.

Significant tax implications exist for nonresidents. Income earned from New York sources is taxable, whereas non-New York income remains tax-exempt. Taxpayers must maintain clear records to substantiate their income sources and ensure accurate filings.

Eligibility criteria

To file Form IT-203, one must first ascertain their eligibility as a nonresident or part-year resident. Nonresidents are individuals who do not maintain a permanent residence in New York but earn income from sources within the state. Conversely, part-year residents are those who have moved to or from the state during the tax year.

General guidelines to determine eligibility include:

Special circumstances, such as students studying out of state or military personnel stationed away from their home state, may have different considerations. Always review the current guidelines to confirm eligibility.

Preparing to complete Form IT-203

Effective preparation is key to completing Form IT-203 accurately. Start by gathering all necessary documentation, as this will ease the filing process. Key documents include W-2 forms detailing wages, 1099 forms for other income, and specific state tax documents, such as the IT-203-V payment voucher if you owe taxes.

Creating a checklist can assist you in organizing all required information, ensuring nothing is overlooked. Essential items to consider include:

Having complete documentation ready will significantly expedite the filing process.

Step-by-step instructions for filling out Form IT-203

Completing Form IT-203 involves several steps. Here’s a comprehensive breakdown of each section:

Common mistakes often include misreporting income, overlooking deductions, or delaying submission due to incomplete information. Double-check all entries before submission to avoid unnecessary complications.

Editing and customizing Form IT-203 with pdfFiller

pdfFiller provides an efficient platform for editing and customizing Form IT-203. Its editing tools enable you to easily add or edit text, ensuring your form is accurate and compliant. You can leverage templates provided by pdfFiller, which can further streamline the process.

Compliance with filing requirements, such as signature requirements, is vital. pdfFiller offers eSigning capabilities that allow you to sign your documents digitally, eliminating the hassle of printing and mailing.

Collaboration tools within pdfFiller allow you to share the form with team members, customizing permissions and access levels to suit your needs. This is especially useful for organizational tax filings or when multiple individuals are involved in the preparation process.

Submitting Form IT-203

When ready to submit, taxpayers have the choice between e-filing and traditional mail. E-filing is often more efficient, typically resulting in faster processing times, while traditional submission may be preferred by those uncomfortable with online forms.

Timelines and deadlines for submitting Form IT-203 are crucial. For the 2024 tax season, the deadline remains April 15. After submission, confirmation notices will clarify the processing status. It is advisable to keep a record of the submission for your personal files.

Amending your return with Form IT-203-

If you discover an error after submitting Form IT-203, you will need to file Form IT-203-X for any amendments. This is essential for correcting income figures, deductions, or credits that were inaccurately reported.

Key differences between IT-203 and IT-203-X include:

To complete Form IT-203-X, follow a similar process as for the original form, being careful to highlight changes made. Situations requiring amendments often include missed income sources or additional deductions that were initially overlooked.

Frequently asked questions (FAQs)

Addressing common concerns can ease the filing process. Frequently asked questions include:

Connecting with the Department of Taxation and Finance

For further assistance, taxpayers can contact the New York State Department of Taxation and Finance. They provide critical resources, contact numbers, and online platforms for inquiries and support.

Additionally, seeking help from tax advisors can help navigate complex tax situations, while online resources can assist with basic questions regarding the IT-203 form and filing process.

User testimonials and experiences with pdfFiller

User experiences with pdfFiller illustrate how this platform can enhance your form management process. Many individuals have shared their success stories about completing tax forms efficiently using pdfFiller.

Feedback highlights include better document organization, ease of access, and collaborative tools that streamline workflows. This direct engagement encourages others to leverage pdfFiller for their tax-related document needs.

About pdfFiller and its mission

pdfFiller is dedicated to providing a user-friendly platform for document management. Its mission centers around streamlining processes, enhancing user experience, and ensuring secure handling of sensitive documents.

The commitment to simplifying tax processes is evident in the robust features available to users, allowing them to edit, sign, and manage documents just a few clicks away. pdfFiller's promise of security and accessibility ensures peace of mind for all users, regardless of location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send it-203 for eSignature?

Can I create an electronic signature for the it-203 in Chrome?

How do I edit it-203 straight from my smartphone?

What is it-203?

Who is required to file it-203?

How to fill out it-203?

What is the purpose of it-203?

What information must be reported on it-203?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.