Get the free Superannuation Standard Choice Form

Get, Create, Make and Sign superannuation standard choice form

Editing superannuation standard choice form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out superannuation standard choice form

How to fill out superannuation standard choice form

Who needs superannuation standard choice form?

How-to Guide for the Superannuation Standard Choice Form

Understanding superannuation and the importance of the standard choice form

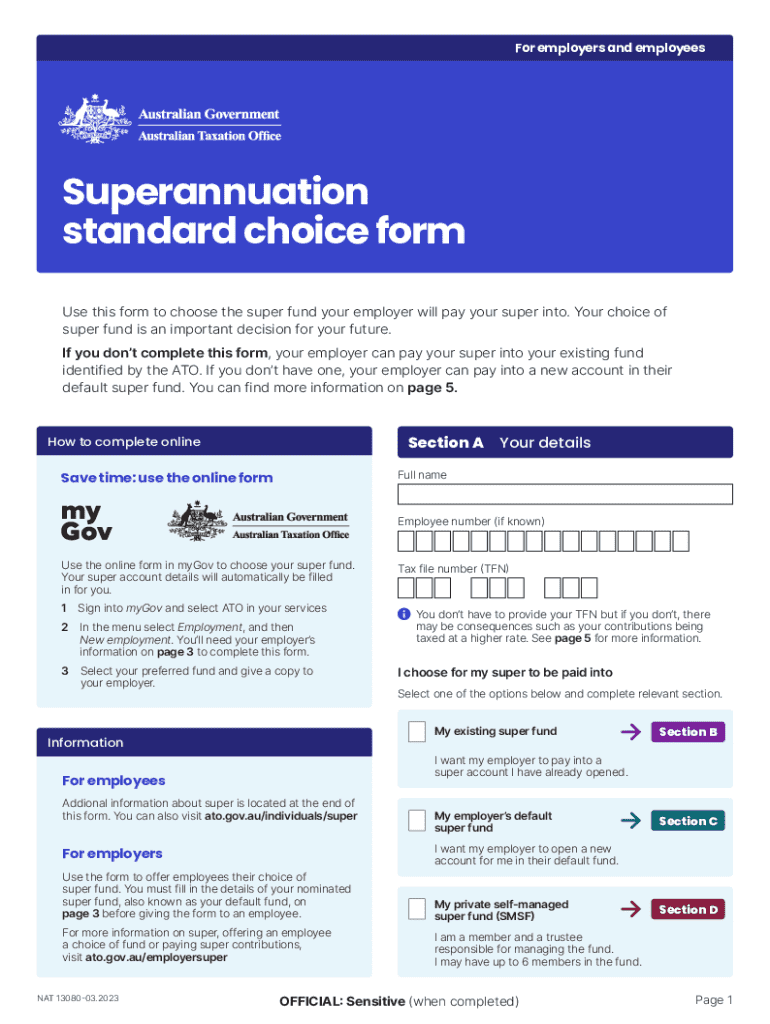

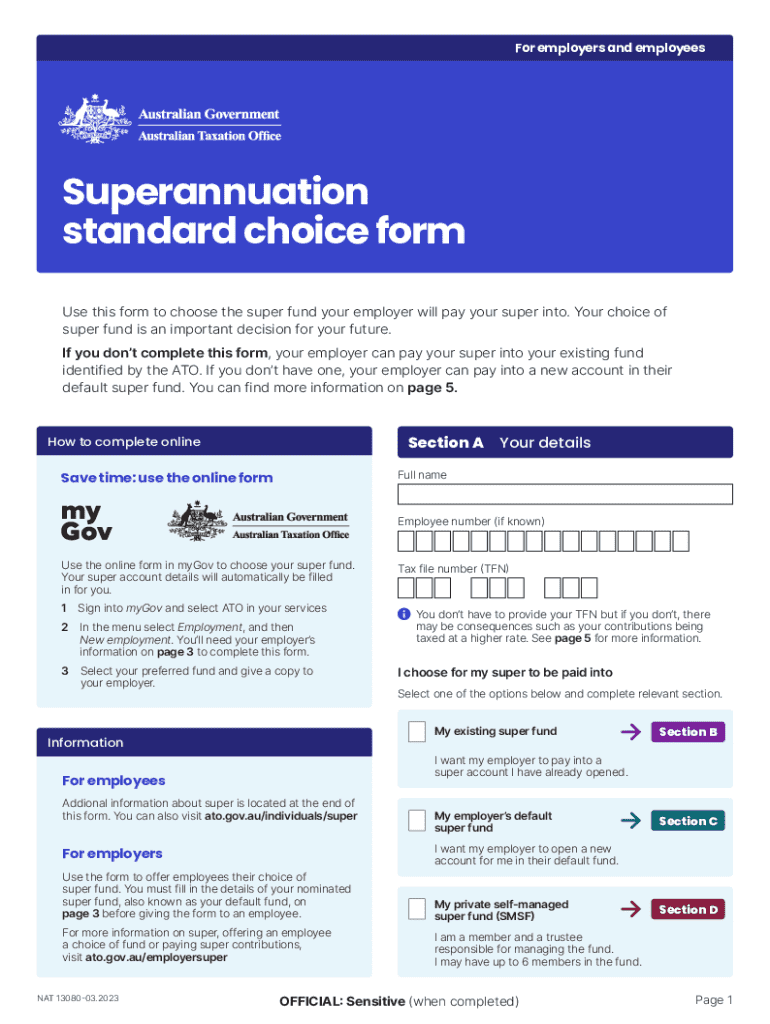

Superannuation, commonly referred to as 'super,' is a crucial component of Australia's retirement savings system. It requires employers to contribute a percentage of an employee's earnings into a super fund, providing financial security in retirement. Each employee has the right to choose their preferred super fund, making the Superannuation Standard Choice Form an essential document. This form serves as a formal notice to employers about an employee's super fund choice, ensuring contributions are allocated correctly.

Understanding the importance of the standard choice form extends beyond mere compliance; it empowers individuals to make informed choices about their retirement savings. With numerous super funds available, each offering varied investment strategies, fees, and benefits, employees should familiarize themselves with their superannuation options. Missing critical deadlines for submitting this form can lead to unintended consequences, such as automatic default fund contributions. Therefore, both employers and employees need to understand their responsibilities regarding the standard choice form.

Preparing to fill out the superannuation standard choice form

Before filling out the Superannuation Standard Choice Form, it’s essential to gather all necessary information. This includes personal details such as your name, address, and tax file number. If you have an existing superannuation fund, be ready to provide those details as well. If you’re opting for a new superannuation fund, research and identify your choice.

Evaluating your superannuation needs is also pivotal. Take into account various factors when selecting your super fund, including management fees, investment performance, and insurance coverage options. Compare these elements among different superannuation funds to determine which one aligns best with your retirement goals. Accessing the Superannuation Standard Choice Form is straightforward; it can be found on the Australian Taxation Office's (ATO) website or through employers. Utilizing tools like pdfFiller can streamline this process, enabling users to access and complete the form easily.

Step-by-step guide on filling out the form

Filling out the Superannuation Standard Choice Form involves several sections. In Section 1, you provide your personal information. Fill in your name, address, date of birth, and tax file number accurately, as this information is critical for your fund to track contributions. Ensure that the spelling is consistent with your identification documents to avoid administrative issues.

In Section 2, if you have an existing superannuation fund, include its details. This may involve contacting your current fund to confirm the fund’s name and number. For Section 3, when selecting a new superannuation fund, be prepared to enter the fund’s name and the unique superannuation fund identifier (SFN). It's advisable to double-check this information with the fund’s website to ensure accuracy.

Finally, Section 4 includes a declaration and signature area. It's crucial to read and understand the declaration terms before signing. Tools like pdfFiller allow for easy electronic signatures, streamlining this process further.

Editing and customizing the superannuation standard choice form

Using pdfFiller’s editing tools, you can customize the Superannuation Standard Choice Form efficiently. The platform enables you to add or remove text, making adjustments easy and precise. Such flexibility is vital, especially when dealing with evolving personal circumstances or when you need to update incorrect information.

Accuracy and readability are paramount when it comes to documentation. A well-completed form not only prevents processing delays but also presents a professional image. pdfFiller ensures your document maintains a clear and organized layout, contributing to an effective presentation. After making your edits, reviewing the entire form is essential to confirm that all necessary changes have been made.

Submitting the superannuation standard choice form

There are various methods available for submitting the Superannuation Standard Choice Form, each with its pros and cons. Electronic submission via email or online forms optimizes convenience and allows for quicker processing times. On the other hand, paper submission might be preferred by those who favor traditional methods, although it may cause delays due to postal services.

Whichever submission method you choose, utilizing pdfFiller’s management tools can help monitor the submission process. After submitting your form, tracking its status becomes straightforward; you can follow up with your employer or superannuation fund as needed to confirm receipt and processing.

Common mistakes to avoid when completing the form

When completing the Superannuation Standard Choice Form, it’s easy to make oversights. A frequent mistake is overlooking required information, which can lead to delays in your superannuation setup. Ensure all mandatory fields are completed and accurate.

Another common pitfall is neglecting to review and edit the form before submission. Taking the time to proofread can prevent minor errors from becoming significant issues. Additionally, failing to keep a copy of the submitted form for personal records can leave you without proof of your submission, which could create complications down the line.

Frequently asked questions (FAQs)

If you fail to submit the Superannuation Standard Choice Form, your employer will likely direct contributions to a default super fund, which may not be the most beneficial for your needs. To change your superannuation fund later, you will need to complete the required processes, including possibly filling out another choice form. Self-employed individuals can also establish their own super accounts through tools provided by various super funds, ensuring they secure their retirement savings.

For assistance regarding your super fund, it’s advisable to contact the fund directly. Most super funds have dedicated customer service teams equipped to help you navigate your needs.

Leveraging pdfFiller for ongoing document management

In addition to the Superannuation Standard Choice Form, pdfFiller offers a cloud-based solution for all your document management needs. This platform enables easy document creation, editing, and signing from anywhere, making it particularly suitable for individuals and teams handling multiple documents. The ability to collaborate in real time enhances productivity and ensures everyone involved has access to the latest version.

Using pdfFiller’s extensive features, you can streamline your workflow and prevent bottlenecks in documentation processes. Integrating these tools helps ensure that your superannuation choices, as well as other essential financial documents, are efficiently managed.

Interactive tools and resources

To aid in understanding superannuation better, pdfFiller provides access to interactive calculators that help estimate your retirement savings needs. Utilizing these tools can significantly enhance your financial planning, ensuring you know how much you need to save for retirement. Additionally, pdfFiller offers various templates for managing other financial documents, making it a versatile solution for all document-related needs.

Should you require additional support, pdfFiller's customer service is available to help navigate any challenges you may encounter. With their expertise, you can confidently manage your superannuation and other essential documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in superannuation standard choice form without leaving Chrome?

Can I edit superannuation standard choice form on an iOS device?

How do I fill out superannuation standard choice form on an Android device?

What is superannuation standard choice form?

Who is required to file superannuation standard choice form?

How to fill out superannuation standard choice form?

What is the purpose of superannuation standard choice form?

What information must be reported on superannuation standard choice form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.