Get the free Mcfn Housing Loan Program Application

Get, Create, Make and Sign mcfn housing loan program

How to edit mcfn housing loan program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mcfn housing loan program

How to fill out mcfn housing loan program

Who needs mcfn housing loan program?

MCFN Housing Loan Program Form - How-to Guide

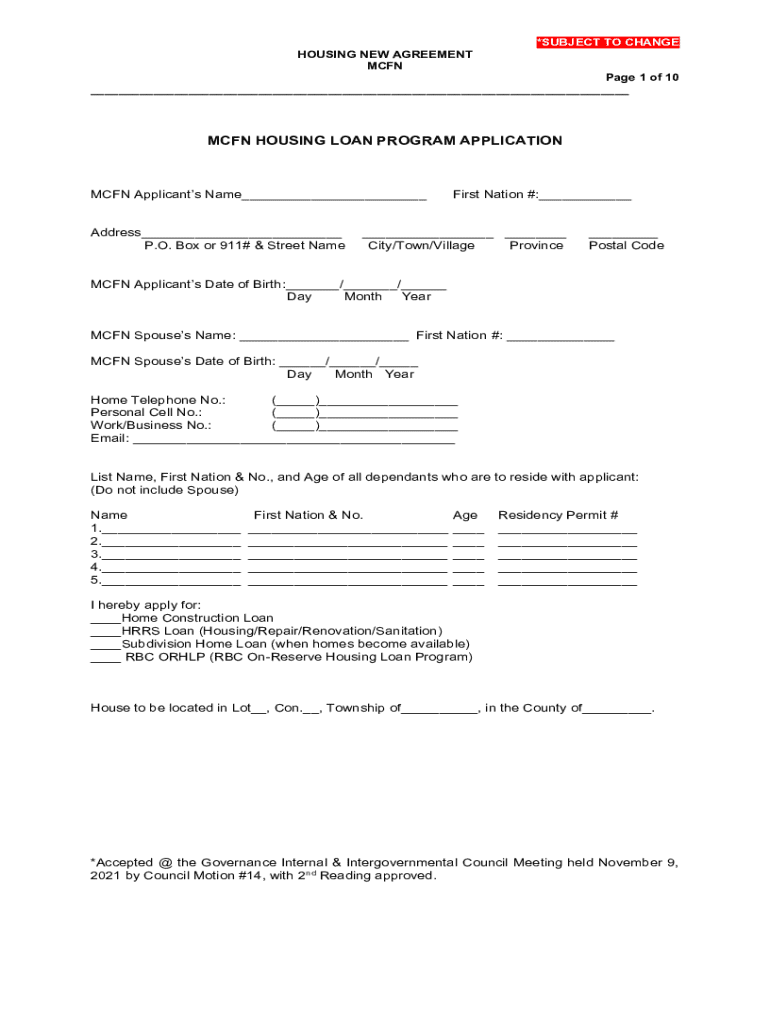

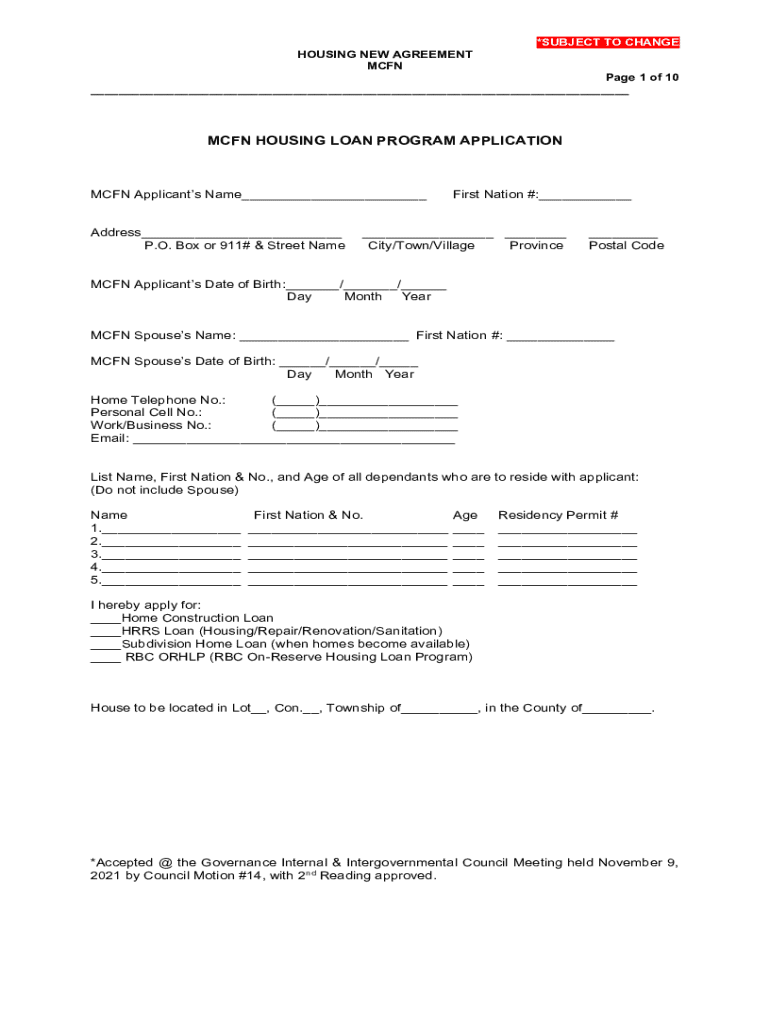

Understanding the MCFN Housing Loan Program

The MCFN Housing Loan Program is a vital initiative offered by the Mississaugas of the Credit First Nation, aimed at promoting homeownership among its members. This program provides financial options tailored to meet specific housing needs, enabling families to purchase new homes, renovate existing properties, or build on their own land. By offering competitive interest rates and flexible terms, the MCFN Housing Loan Program ensures that homeownership is accessible and affordable, ultimately contributing to community stability and prosperity.

The underlying purpose of this program is to empower individuals within the Mississaugas of the Credit community through stable housing solutions. Beyond mere financial aid, the program fosters a sense of ownership and investment in the community, thereby enhancing the overall quality of life for all involved.

Eligibility criteria

To qualify for the MCFN Housing Loan Program, applicants must meet specific eligibility criteria. Primarily, individuals must be enrolled members of the Mississaugas of the Credit First Nation. Furthermore, applicants need to demonstrate financial stability, which typically involves proof of income and a good credit history.

These documents serve as crucial evidence for the loan approval process. It’s essential for applicants to gather all required documentation before proceeding with the application process to ensure a smooth experience.

Types of loans available

The MCFN Housing Loan Program offers various types of loans to suit diverse needs within the community. These include loans for home purchase, renovation projects, and land development.

Each type of loan has its unique features and terms. It’s important for applicants to evaluate their circumstances and select the loan type that best fits their financial capacity and housing goals.

The MCFN Housing Loan application process

Navigating the housing loan program application process can seem daunting, but it can be broken down into manageable steps. This step-by-step guide will help potential applicants complete the housing loan program form with confidence.

Step-by-Step Guide to completing the housing loan program form

Taking the time to follow these steps and verify all information entered will help avoid delays in getting your loan approved.

Common mistakes to avoid

Even with the best intentions, applicants may stumble upon common errors when completing their housing loan program form. Here are the top five pitfalls to watch out for:

To mitigate these mistakes, applicants should consider double-checking all entries and documentation before submission.

Interactive tools and resources for applicants

In today's digital age, applicants can leverage various tools to streamline the application process for the MCFN housing loan program form. One such resource is pdfFiller, which offers comprehensive document creation and editing solutions.

Document preparation tools

pdfFiller provides users the ability to easily create, edit, and fill forms directly online, eliminating the hassle of dealing with paper forms. Users can upload their documents, make necessary adjustments, and ensure every detail is accurate before submission.

Signing and collaborating on your application

Through pdfFiller, users can also electronically sign their loan applications, which adds a layer of convenience and security. Collaboration tools enable applicants to work with family members or advisors in filling out the form, ensuring that all perspectives and advice are considered.

Frequently asked questions about the MCFN housing loan program

As applicants navigate the MCFN housing loan program, numerous questions may arise. Here are some commonly asked queries that can provide clarity.

Tracking your housing loan application status

Understanding the status of your application is crucial. MCFN has made it easy for applicants to monitor their application progress effectively.

How to check your application status

Applicants can track their application status directly through the MCFN website. Here’s how:

For any inquiries related to the loan program or application status, applicants can contact the MCFN housing program office directly for assistance.

Financing options beyond the MCFN housing loan program

While the MCFN Housing Loan Program is an exceptional resource, it is equally important to know about additional financial resources available for potential homeowners. Various options can complement or serve as alternatives to MCFN loans.

Researching these finance options will grant homeowners the flexibility they need to find the best possible financial solution for their situations.

Tips for managing your housing loan post-approval

Once a loan is approved, managing the financial commitment is essential for long-term success. Here are best practices for effective loan management.

Best practices for loan management

Maintaining a proactive approach will not only provide peace of mind but also ensure that your investment in homeownership remains secure.

Utilizing pdfFiller for ongoing document management

After the initial loan approval, keeping track of loan-related documents is essential. pdfFiller offers tools to securely store and organize these documents for easy access.

Community support and resources

Navigating the housing loan process can be daunting, but various local organizations provide support and assistance. Engaging with community resources can provide valuable insights and aid during the application process.

Connecting with local housing resources

Many local organizations focus on assisting individuals with housing finance in Indigenous communities. Here are a few examples:

Utilizing these resources can significantly enhance the chances of successful home purchasing and enable applicants to make informed decisions.

Success stories from MCFN housing loan beneficiaries

Real-life experiences from individuals and families who have successfully navigated the MCFN Housing Loan Program provide inspiration and guidance to new applicants. These success stories often showcase hurdles faced, strategies used, and wisdom gained through the process.

Real-life experiences

For instance, one family used their MCFN housing loan to purchase a modest home that has since become a central hub for community gatherings. They faced hesitations at first but found the application process straightforward, especially with tools like pdfFiller that helped them manage their documents effectively.

These beneficiaries often highlight the importance of thorough preparation and awareness of resources, which can be invaluable to future applicants.

Final thoughts on the importance of the MCFN housing loan program

The MCFN Housing Loan Program is a critical resource that provides financial support, fosters community growth, and strengthens ties among members of the Mississaugas of the Credit First Nation. By following this comprehensive guide, applicants can navigate the MCFN housing loan program form confidently while utilizing tools like pdfFiller to streamline their experience. This guide will empower individuals to make informed decisions and successfully achieve the goal of homeownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mcfn housing loan program?

How can I edit mcfn housing loan program on a smartphone?

How do I fill out mcfn housing loan program using my mobile device?

What is mcfn housing loan program?

Who is required to file mcfn housing loan program?

How to fill out mcfn housing loan program?

What is the purpose of mcfn housing loan program?

What information must be reported on mcfn housing loan program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.