Get the free Check Requisition Form – Asi Funding

Get, Create, Make and Sign check requisition form asi

How to edit check requisition form asi online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check requisition form asi

How to fill out check requisition form asi

Who needs check requisition form asi?

A comprehensive guide to the check requisition form ASI form

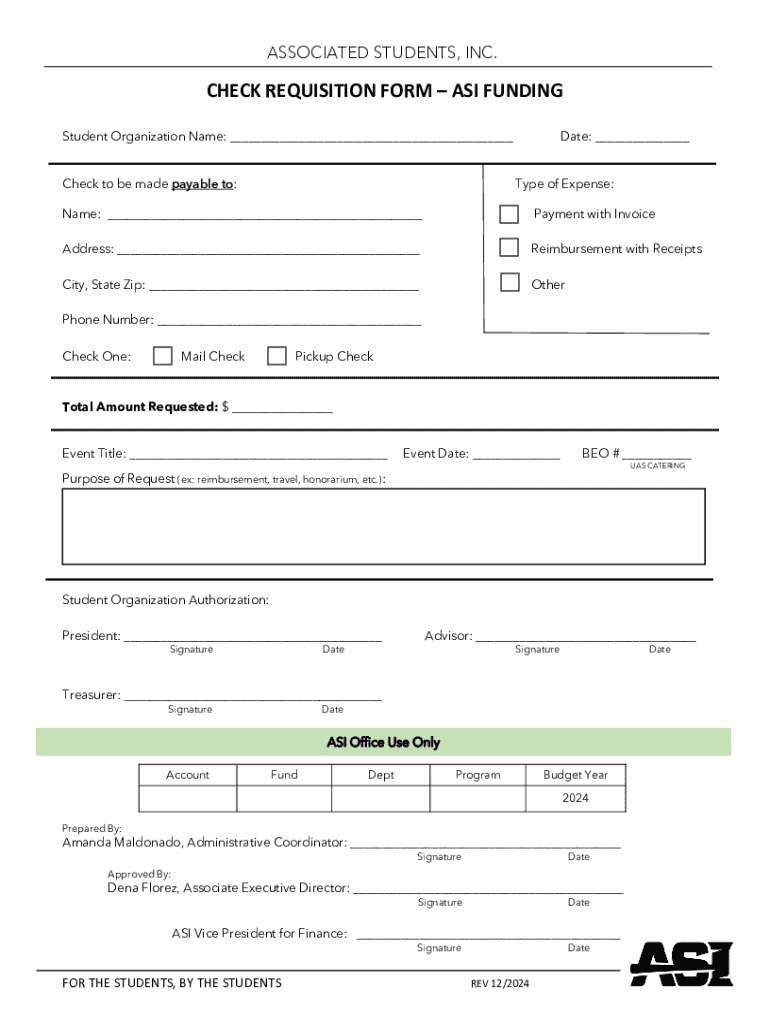

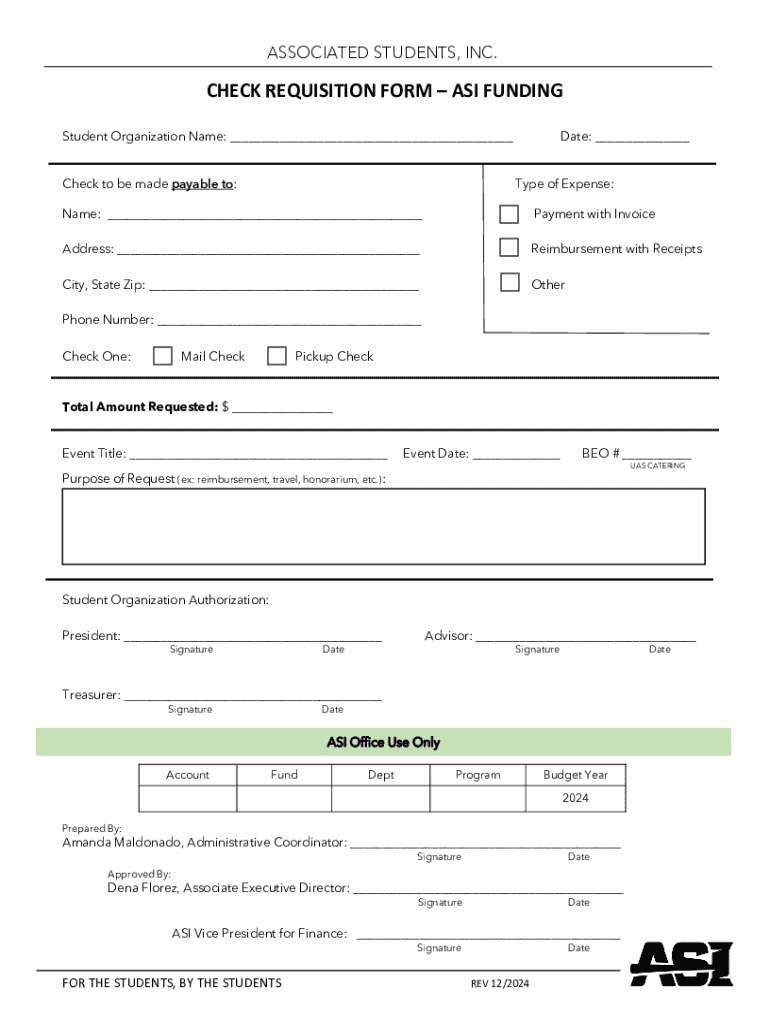

Understanding the check requisition form

The check requisition form is a critical document utilized by organizations to facilitate the internal request for funds. This form serves as a formalized method to ensure that payments are properly tracked, documented, and authorized. By submitting an accurate check requisition form, individuals and teams can ensure timely payment for services rendered, materials purchased, or reimbursements for expenses. Its importance lies not only in financial tracking but also in compliance with organizational policies and regulations, thereby preventing misunderstandings and mismanagement of funds.

Accurate submission of this form is paramount. Incomplete or erroneous submissions can lead to delays, denials, or even financial discrepancies. The key uses of check requisition forms range from approving expenditures on office supplies to covering costs for company events. They serve as a fundamental tool for budget management within organizations, helping maintain transparency in financial dealings while simplifying the approval process.

Purpose and eligibility

The check requisition form is available for use by various stakeholders within an organization. Primarily, employees who are authorized to incur expenses on behalf of their department or the organization can make use of this form. This includes individuals in administrative roles, project managers, and even team leaders who manage budgets for departmental activities.

Common scenarios for utilizing the ASI form include requests for reimbursement for travel expenses, materials for departmental projects, and payment for contracted services. Eligibility criteria for submissions typically involve holding a role within the organization that allows for expense authorization, along with adherence to the organization's financial policy directives.

Components of the ASI form

Personal information

Personal information is the first component of the ASI form and includes critical details such as the requester's name, employee ID, department, and contact information. This section establishes accountability and facilitates communication regarding the request. Common errors in this section often stem from misspellings or outdated department names, which can lead to delays.

Expense details

The expense details section requires a breakdown of the costs being requested. This can include direct expenses such as supplies, travel costs, or service fees. It’s essential to itemize these expenses clearly; inaccurately listed costs can result in requests being flagged for clarification. Using categories for expenses not only organizes the request but also enhances the chances of quick approval.

Recipient information

Providing correct recipient information is crucial. The payment recipient's name and address must be accurate to ensure funds are directed to the right entity. Any discrepancies can cause errors in payment delivery, leading to unnecessary complications.

Supporting documentation

Most requests will require supporting documentation. This can include receipts, invoices, and contracts, which provide proof of the expenses being claimed. Documentation must adhere to specified format guidelines to be considered valid, such as being clear, legible, and correctly labeled.

Step-by-step instructions for completing the ASI form

Step 1: Downloading the form

The first step in the process of completing a check requisition form is to obtain the document itself. Users can access the check requisition form ASI form from their organization’s finance or administrative department's website or directly from pdfFiller, providing a convenient and centralized location to download necessary forms.

Step 2: Filling out the form

When filling out the form, attention to detail is critical. Each section needs to be completed thoroughly. For example, ensuring that your name appears correctly and that all expense details are itemized and justified with necessary explanations will not only help in the processing of your request but enhance clarity for approvers.

Step 3: Attaching supporting documentation

After filling out the form, it’s time to assemble supporting documentation. Common acceptable documents include original receipts for expenditures, copies of invoices, and any contracts associated with the services provided. These documents should be clearly labeled and attached in a manner that allows for easy reference.

Step 4: Submitting the form

The final step is submission, which can typically be done online or via email. Ensure that you follow the specified guidelines provided by your organization. There are often critical deadlines for submission, especially around budget closure periods or specific project timelines, which should not be overlooked.

Common types of check requests and necessary documentation

Various types of expenses can be claimed through the check requisition form. Some of the most common categories include hospitality expenses, supplies and materials, travel expenses, and payments for outside services. Each category has distinct documentation requirements:

Frequently asked questions (FAQ)

A common concern arises when users misplace receipts. Organizations usually have policies in place to address lost receipts, often allowing for a verification form to be completed. Another frequent inquiry is related to the necessity of submitting a W-9 form, which is generally required for payments to individuals, especially freelancers or contractors, to ensure compliance with tax regulations.

Requests for funding for club events often depend on organizational policies regarding extracurricular activities, so checking with finance is essential. Additionally, when payments are to individuals, clarity on how to process these payments is crucial since they typically differ from payments made to corporations or businesses.

Policies and regulations

Organizations generally have a set of policies guiding the check requisition process. These include procedures for submitting requests, acceptable payment forms, and guidelines for the approval hierarchy. Understanding these policies is vital for anyone involved in managing payments to prevent violations and ensure adherence to compliance standards.

Additionally, organizations will frequently specify the types of expenses that are allowable and those that are prohibited. Recognizing these differences helps streamline the requisition process, resulting in higher approval rates and minimizing guesswork for employees making submissions.

Troubleshooting common issues

When a request for a check requisition is denied, it is essential to understand the reason behind the denial. This can often be remedied by contacting the finance department for feedback. Simply rectifying the reasons provided may expedite the resubmission of your request.

For further assistance, organizations typically provide dedicated contact points within the finance or administration team. These teams can assist you throughout the requisition process, making it less daunting while ensuring that all necessary steps are followed correctly.

The role of pdfFiller in completing your check requisition form

pdfFiller serves as an invaluable resource for users tackling the check requisition form ASI form. It empowers users to fill out, edit, and manage their documents seamlessly from a cloud-based platform, facilitating easier document handling. The platform's capabilities extend to eSigning documents, ensuring a robust, secure solution for conducting business.

Users benefit from document collaboration features that enable multiple team members to review and provide input on requisition forms. Furthermore, cloud-based accessibility allows documents to be accessed from any device, simplifying the process of completing and submitting check requisition forms.

Best practices for efficient check requisition submission

To ensure efficient check requisition submission, it's essential to maintain organized documentation before filling out the form. This preparation allows for smoother completion of required fields and minimization of errors. Double-checking form accuracy is equally important; verifying that all data is complete and correctly entered can prevent delays in processing.

Additionally, keeping track of your submission status through follow-ups is a good practice. Submitting requisition forms ahead of deadlines also allows for ample time to address any potential issues that could arise during processing.

Additional considerations

Different departments within an organization may have variations in their forms. Being aware of these differences can help prevent confusion. It is also advisable to keep recipient and contact information updated, especially when dealing with external vendors or services. Communication around these changes is key to maintaining smooth operations.

Special notes about events involving external vendors should include understanding the payment processes specific to those situations. Confirming with finance regarding appropriate forms ensures compliance and aids in the successful processing of payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the check requisition form asi in Gmail?

How do I fill out check requisition form asi using my mobile device?

Can I edit check requisition form asi on an iOS device?

What is check requisition form asi?

Who is required to file check requisition form asi?

How to fill out check requisition form asi?

What is the purpose of check requisition form asi?

What information must be reported on check requisition form asi?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.