Get the free My All Fund Budget Detail Report - Trophy Club, TX

Get, Create, Make and Sign my all fund budget

Editing my all fund budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out my all fund budget

How to fill out my all fund budget

Who needs my all fund budget?

Comprehensive Guide to My All Fund Budget Form

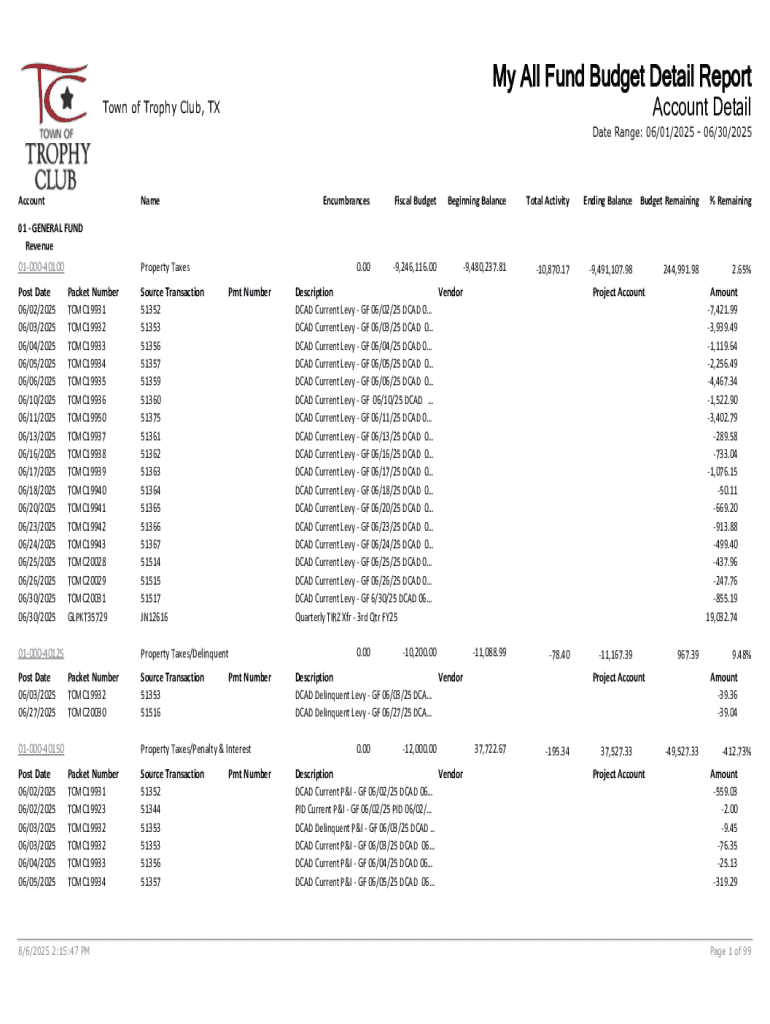

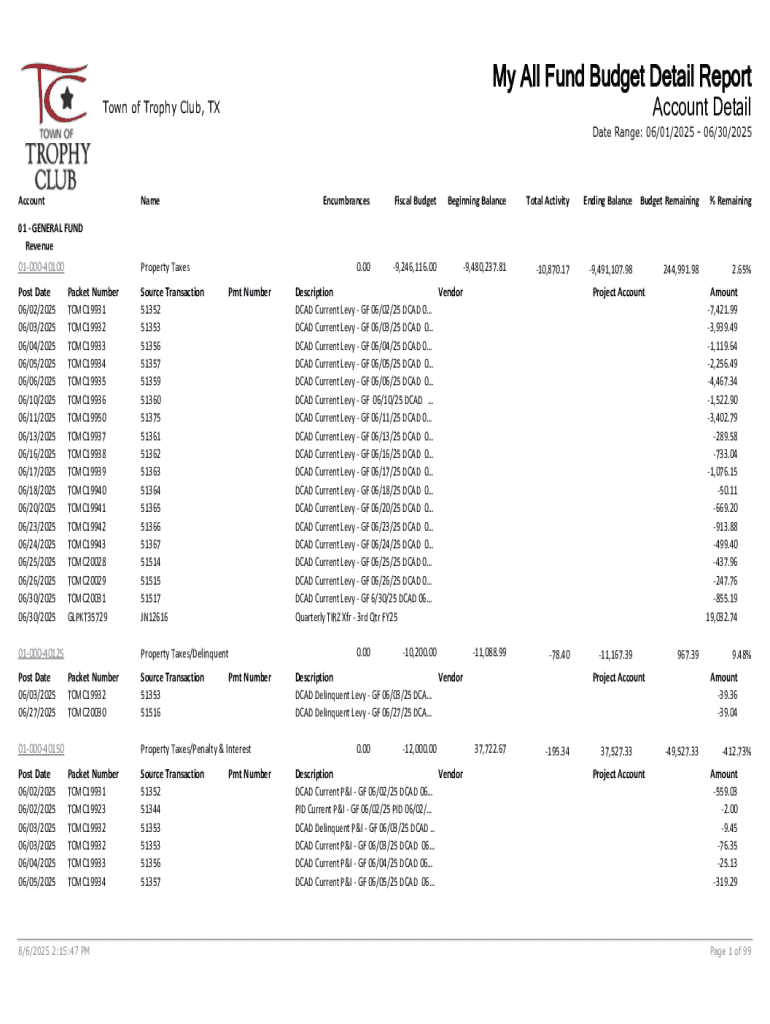

Overview of the My All Fund Budget Form

The My All Fund Budget Form is a crucial tool designed for meticulous financial tracking and planning. Its primary purpose is to provide individuals and teams with a structured format to compile their income, expenses, savings, and debt, ultimately guiding them toward better financial management. By clearly outlining these components, the form aids users in visualizing their financial status, crafting informed decisions, and setting realistic goals.

Key components of the form include income sources, expense categories, savings objectives, and debt management strategies. Each section is essential for comprehensive financial planning, ensuring that users can monitor both their financial inflows and outflows efficiently. The significance of the form cannot be overstated, as it lays the groundwork for effective budgeting, helping users avoid debt traps and achieve their financial aspirations.

Getting started with the My All Fund Budget Form

To start your budgeting journey, selecting an appropriate template from pdfFiller is the first step. pdfFiller offers a variety of customizable templates that cater to diverse budgeting needs, ensuring you find a version that aligns perfectly with your financial situation. The beauty of using pdfFiller is that you can access your form anytime and anywhere—whether at home or on the go—allowing you the flexibility required for modern budgeting.

Setting up your budget environment is equally important. Choose a peaceful location free from distractions, and gather all your financial documents. This includes pay stubs, bank statements, receipts, and any information pertaining to bills and debts. Having everything organized will streamline the process and lead to a more accurate budget form.

Essential elements of the My All Fund Budget Form

The My All Fund Budget Form is segmented into several essential elements that maintain balance in your financial planning.

Step-by-step instructions for filling out the form

Filling out the My All Fund Budget Form is straightforward but requires attention to detail to ensure accuracy. Start with your income data:

Interactive tools to enhance budgeting

pdfFiller provides several interactive tools that enhance the budgeting experience. Using its editing tools, users can easily modify and update their forms. Collaborating with team members further adds to the effectiveness of budgeting, especially in group settings or family finances. The collaborative features allow multiple users to access and update the budget simultaneously, making it easier to manage team budgets.

Moreover, the real-time updates and changes ensure that all users have access to the most current information. This boost in efficiency reduces the chances of miscommunication and enables timely financial decision-making.

Advanced budgeting techniques

For users looking to elevate their budgeting game, various advanced techniques come into play. The 60/30/10 budget technique allocates 60% of your income to needs, 30% to savings, and 10% to wants, promoting a balanced approach to financial management.

Budget review and adjustments

A budget is a living document that requires regular revisions to stay relevant. Regularly revisiting your My All Fund Budget Form is crucial to understanding your financial journey. Evaluating financial health over time involves examining changes in income, expenses, and savings goals.

It’s often necessary to adjust spending habits based on these evaluations. For example, if you consistently overspend in a certain category, reassessing your budget and cutting back on discretionary expenses might be essential. This adaptability keeps your budget aligned with your financial goals.

Common challenges and solutions

Budgeting is fraught with challenges, from overspending to unpredictable expenses. Being proactive in addressing these budgeting obstacles is vital for overall success. One common recommendation is to keep an emergency fund, which provides a financial cushion against unforeseen costs.

Best practices for managing your fund budget

Effective budgeting is largely about consistency. Track your finances regularly with pdfFiller’s user-friendly templates to ensure every detail is captured accurately. Setting realistic goals and milestones for income, savings, and debt repayment promotes a steady financial path.

Additionally, encouraging team participation in collaborative budgets fosters a shared sense of financial responsibility. Involving others in your budgeting process not only keeps everyone accountable but also brings diverse insights into achieving collective financial goals.

Frequently asked questions (FAQs)

The My All Fund Budget Form can sometimes bring forth questions from users, especially those new to budgeting. Clarifications on budgeting concepts, such as effective allocation strategies, or how to manage irregular income, are common inquiries.

Addressing these questions openly enhances user experience and knowledge, empowering users to feel more confident in their financial management. Referencing customer feedback and previous budgeters’ tips provide beneficial insights for new users.

User community and success stories

Sharing experiences around the My All Fund Budget Form enriches the user community. Real-life testimonials highlighting successful budgeting strategies serve as motivation for individuals facing challenges in their financial journeys.

The impact of collective knowledge can be substantial. Users exchanging their tactics and tips for success fosters encouragement, forming a support network that enhances overall budgeting effectiveness.

Related budgeting templates on pdfFiller

pdfFiller hosts a range of budgeting templates beyond the My All Fund Budget Form, each designed to cater to specific financial needs—be it personal finance, business expenses, or household budgeting. Transitioning between different budget types is seamless within the pdfFiller platform.

Exploring these other budgeting tools can further expand users' financial management skills, showcasing the versatility of pdfFiller as a comprehensive document creation solution. Stay proactive in experimenting with different templates to find what best suits your financial regimen.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit my all fund budget from Google Drive?

How can I get my all fund budget?

How do I edit my all fund budget straight from my smartphone?

What is my all fund budget?

Who is required to file my all fund budget?

How to fill out my all fund budget?

What is the purpose of my all fund budget?

What information must be reported on my all fund budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.