Get the free Ct-207k

Get, Create, Make and Sign ct-207k

How to edit ct-207k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-207k

How to fill out ct-207k

Who needs ct-207k?

CT-207K Form - How-to Guide Long-Read

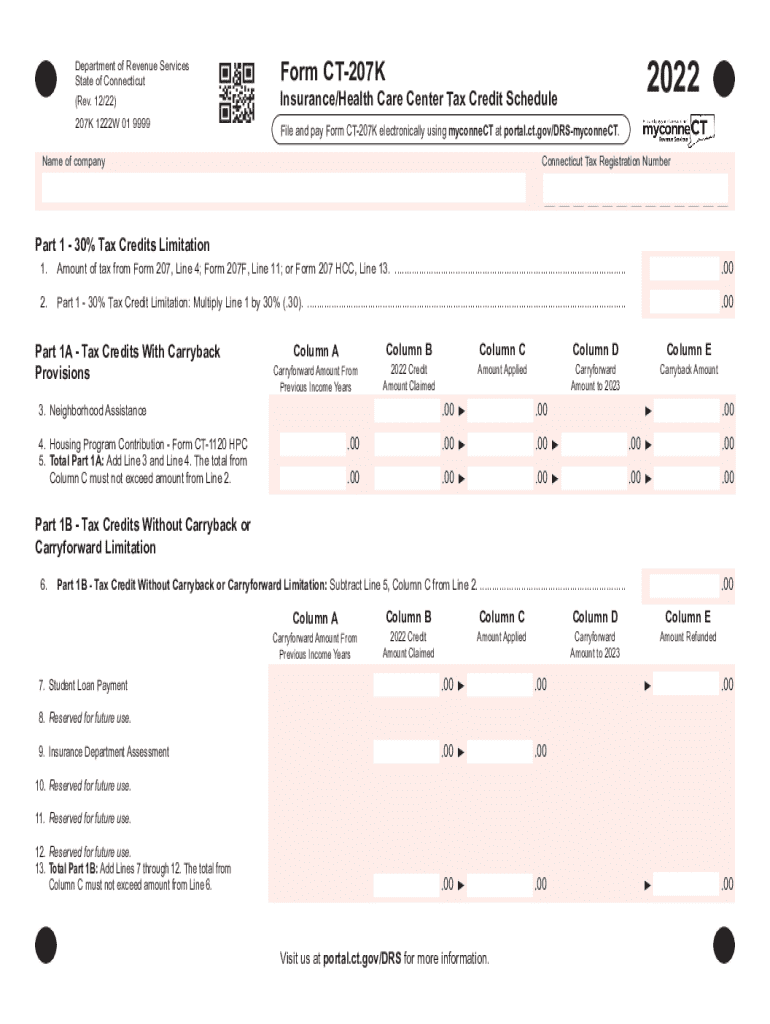

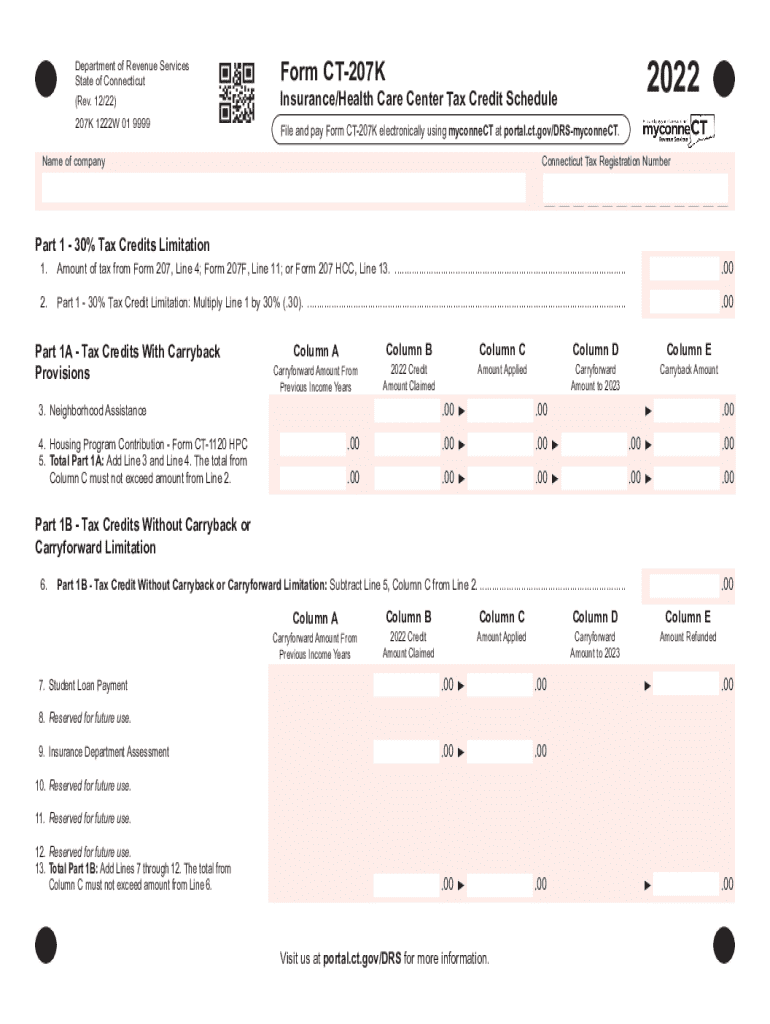

Understanding the CT-207K Form

The CT-207K form, also known as the Neighborhood Assistance Act (NAA) Tax Credit form, plays a crucial role in the Connecticut tax filing process. Its primary purpose is to enable taxpayers to claim tax credits for contributions made to specific charitable organizations eligible under the NAA. This form has significant importance for both individuals and businesses looking to support their communities while also benefiting from tax incentives.

Who needs to file this form? Taxpayers in Connecticut who have made donations to 'neighborhood assistance organizations' are required to file the CT-207K form to claim the tax credits associated with their contributions. Understanding the eligibility criteria and the overall process of this form is essential for making the most of these available tax benefits.

Key terms and definitions

When dealing with the CT-207K form, several key terms and definitions come into play. Familiarizing yourself with these can enhance your understanding of the form, ensuring that you fill it out correctly and efficiently.

Steps to complete the CT-207K Form

Completing the CT-207K form can seem daunting at first, but by breaking it down into manageable steps, it can become a straightforward process. Start by gathering all required information and documents, which are essential for completing the form accurately.

Gathering required information

Before you begin filling out your CT-207K form, ensure you have the following essential documents:

Step-by-step guide to filling out the form

Once you have all necessary materials, here's how to navigate the CT-207K form across its various parts:

Part : Basic information

In this section, you'll provide your name, address, and SSN or EIN. Accuracy is vital here to avoid processing delays.

Part : Eligibility criteria

This part focuses on determining if your contributions meet the state-defined income thresholds and eligibility criteria. Be sure to check your income level to confirm that it qualifies you for the tax credit.

Part : Calculation of tax credits

In this section, you will calculate the tax credits. Keep in mind that Connecticut may apply different percentages for various types of contributions, so be thorough in your calculations.

Part : Signatures and declaration

Finally, ensure that you and any other required signatories sign the form. An unsigned form may lead to delays or disqualification of your submitted tax credits.

Editing and signing the CT-207K form with pdfFiller

After filling out your CT-207K form, it’s important to ensure accuracy before submission. pdfFiller provides interactive tools that make it easier to edit your document efficiently.

How to edit your completed form

Using pdfFiller's platform, you can make necessary edits to your CT-207K form by:

eSigning the CT-207K form

Signing the form electronically simplifies the process significantly. Here's how to add your digital signature using pdfFiller:

The advantages of signing electronically include speed, convenience, and a clear audit trail to verify your submission.

Submitting your CT-207K form

Once your form is ready, the next step is submission. You have several options available, depending on your preference for convenience and speed.

Options for submission

Taxpayers can submit their CT-207K form in two primary ways:

Important deadlines to remember

Be aware of important submission deadlines to avoid penalties or missed credits. Typically, the CT-207K form needs to be submitted by the tax filing deadline, which aligns with the federal tax deadlines. It’s crucial to stay updated with any changes to these dates annually.

Confirming submission and follow-up

After submission, it's prudent to confirm that your CT-207K form was received. If you submitted online, you may receive immediate confirmation. For mail submissions, consider following up via phone or checking online for updates.

If there are issues or corrections needed, being proactive will help resolve them swiftly, ensuring that your claimed tax credit is not jeopardized.

Managing your CT-207K form with pdfFiller

Once submitted, managing your CT-207K form becomes essential for future reference or revisions. pdfFiller provides a user-friendly platform for this.

Storing and accessing your form

PdfFiller’s cloud storage capabilities allow you to securely store and access your CT-207K form anytime, anywhere. This can be particularly useful during tax season when you may need to reference or modify documents rapidly.

Future amendments and revisions

In case you need to amend your CT-207K form post-submission, pdfFiller makes it easy to modify your document. You can simply access the stored version, make required changes, and resubmit if necessary.

Understanding the implications of amendments on filings can protect you from potential penalties while ensuring you benefit from the available tax credits accurately.

Additional context and related topics

The CT-207K form extends its relevance into broader tax topics, particularly concerning credit programs established under the Neighborhood Assistance Act.

Connecting the CT-207K to broader tax topics

The NAA Tax Credit Program encourages individuals and businesses to contribute to charitable projects, facilitating community development. Other forms and documentation related to this program often become intertwined with the CT-207K. It's vital to be aware of related documents, such as the CT-207 form, which may arise during the tax process.

Recent updates and changes to the CT-207K

Tax regulations often see annual revisions; therefore, referring to the latest information regarding the CT-207K is essential. Notable revisions may include changes in eligibility criteria, donation limits, or the types of organizations that qualify for credits. Keeping updated on these changes helps taxpayers maximize their credits effectively.

Frequently asked questions about the CT-207K form

Taxpayers often have concerns regarding the process of filing the CT-207K form. Addressing these common misconceptions can clarify the requirements and improve compliance.

Common concerns and misconceptions

Many individuals believe that filling out the CT-207K form is overly complex or that they do not qualify for the credits available. Understanding the straightforward requirements and that even small contributions can make one eligible can alleviate these worries.

Resource links for further assistance

For individuals looking for additional help with the CT-207K form, resources such as the Connecticut Department of Revenue Services website and local tax assistance programs are invaluable. Engaging with professionals can also clarify doubts and ensure that your filing is accurate and complete.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ct-207k online?

Can I create an eSignature for the ct-207k in Gmail?

How can I edit ct-207k on a smartphone?

What is ct-207k?

Who is required to file ct-207k?

How to fill out ct-207k?

What is the purpose of ct-207k?

What information must be reported on ct-207k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.