Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

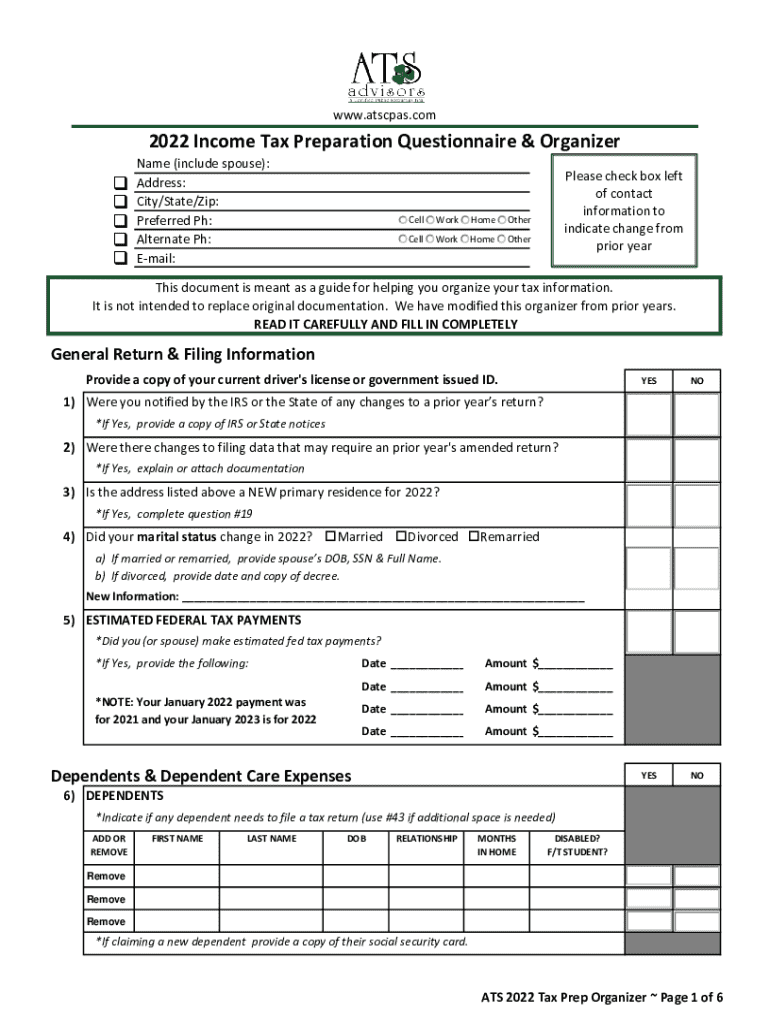

How to fill out engagement letter 2022 tax

Who needs engagement letter 2022 tax?

Understanding the Engagement Letter for the 2022 Tax Form

Understanding the engagement letter for 2022 tax return

An engagement letter is a crucial document that outlines the professional relationship between tax preparers and their clients. It formally establishes the responsibilities, expectations, and scope of work for both parties involved in preparing tax returns. In 2022, the significance of engagement letters has grown, primarily due to evolving tax regulations and the complexities introduced by recent global events.

With the financial landscape altered by factors such as new tax laws, the implications of COVID-19, and heightened scrutiny by tax authorities, a well-structured engagement letter helps safeguard both the preparer and the client. It ensures the client understands what services will be provided and outlines the fees involved, while also delineating the tax preparer's responsibilities, making it an indispensable part of the tax preparation process.

Key components of a 2022 engagement letter

To create an effective engagement letter for the 2022 tax form, several key components are essential. These elements not only ensure clarity and transparency but also protect both parties involved in the engagement. Here’s what your engagement letter should include:

Additionally, specific language adjustments are necessary for 2022 due to recent tax law changes and the continued impact of COVID-19. Tax preparers should include references to the implications of these changes, ensuring clients are aware of potential tax benefits or risks that have arisen from the recent economic climate.

Crafting your engagement letter

Writing an engagement letter can be straightforward if you follow a structured approach. Here’s a step-by-step guide to crafting your 2022 engagement letter:

Additionally, it's important to tailor the language to match the client's needs. This may involve adjusting the tone to be more professional or friendly, depending on the relationship with the client. Customization conveys attentiveness and can strengthen client engagement.

Editing and finalizing your 2022 engagement letter

Once your engagement letter is drafted, thorough editing is essential to ensure professionalism and clarity. Utilize platforms like pdfFiller to enhance your document. Here are some best practices for document editing:

In addition to editing, considering electronic signatures can simplify the signing process. eSigning has numerous benefits over traditional methods, such as convenience and speed. Using pdfFiller, the workflow for securing signatures can be streamlined with a few easy steps, ensuring both parties can access and sign the document remotely.

Managing your engagement letter post-creation

The management of your engagement letter doesn’t end once it’s signed. Effective tracking and updates ensure that both parties remain aligned throughout the tax preparation process. Here are strategies to manage your engagement letter:

Furthermore, collaborating with clients post-engagement is vital. Utilize tools available in pdfFiller for interactive feedback to help monitor document progress and address any client concerns as they arise. Implement strategies for ongoing communication to facilitate a smooth tax preparation experience.

Common pitfalls to avoid when drafting an engagement letter

Even seasoned tax preparers can overlook critical aspects when drafting an engagement letter. Here are common pitfalls to avoid:

By acknowledging these common pitfalls, tax preparers can ensure they provide their clients with a comprehensive and effective engagement letter that meets expectations.

Examples and templates of 2022 engagement letters

Having examples and templates can streamline the process of creating your own engagement letter. For various tax preparation scenarios, here are some sample engagement letters:

Interactive template tools on pdfFiller can assist in customizing these documents, ensuring they meet client needs while adhering to legal standards. This enables a hassle-free approach to document creation.

Compliance and ethical considerations

Engagement letters play a vital role in legal compliance within the tax preparation field. By formally outlining the terms of engagement, tax preparers can better navigate potential legal complications. Compliance isn’t just about fulfilling legal requirements; it’s also about upholding ethical standards.

Tax preparers have ethical obligations to ensure clarity with clients. This includes making sure clients understand their tax situation, the scope of services, and any risks. By utilizing engagement letters effectively, tax preparers can foster transparent relationships, thus enhancing trust and professional integrity.

Frequently asked questions about the 2022 tax form engagement letter

Clients often have questions about engagement letters and their implications. Addressing these queries can enhance the client’s understanding and comfort level. Here are some common concerns:

Clarifying these points not only alleviates client anxiety but simultaneously solidifies the professional relationship between taxpayers and preparers. It promotes a holistic understanding of what the engagement entails.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

Can I create an electronic signature for the pdffiller form in Chrome?

How do I fill out pdffiller form on an Android device?

What is engagement letter tax?

Who is required to file engagement letter tax?

How to fill out engagement letter tax?

What is the purpose of engagement letter tax?

What information must be reported on engagement letter tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.