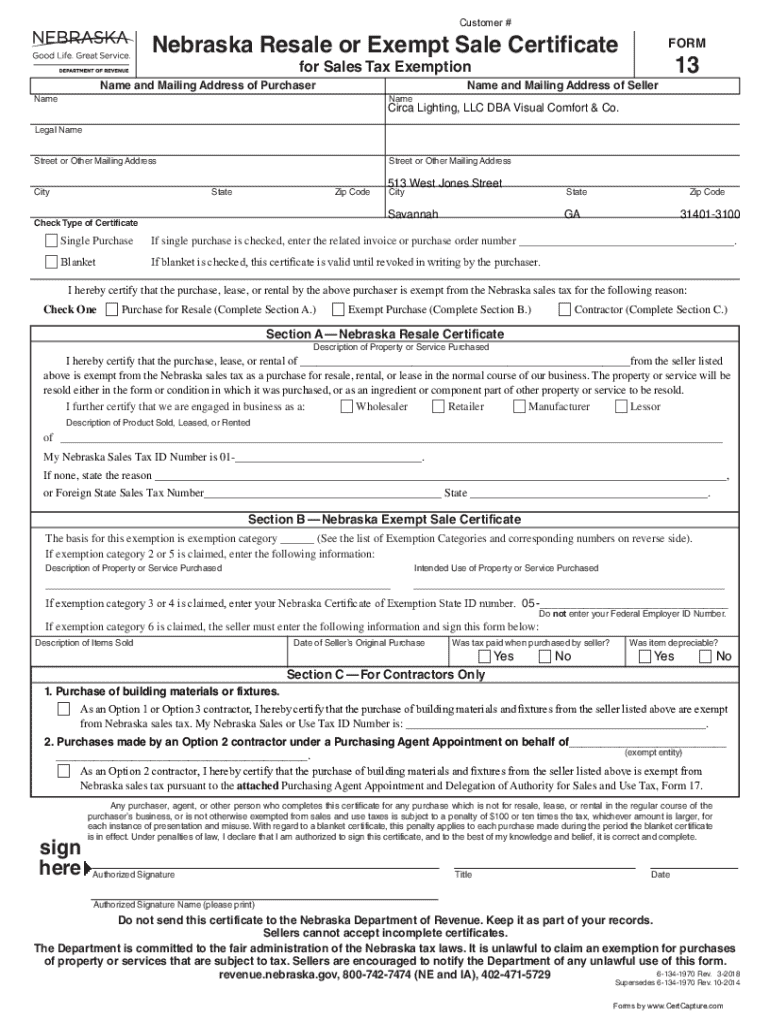

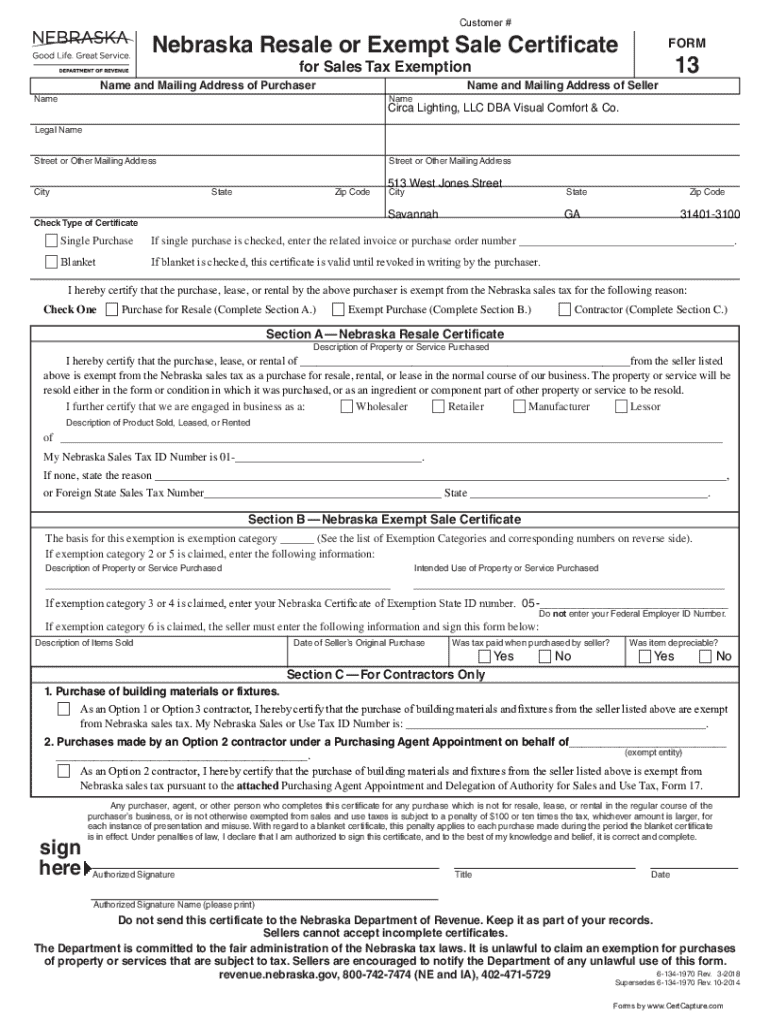

Get the free Nebraska Resale or Exempt Sale Certificate

Get, Create, Make and Sign nebraska resale or exempt

How to edit nebraska resale or exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska resale or exempt

How to fill out nebraska resale or exempt

Who needs nebraska resale or exempt?

Nebraska resale or exempt form: A comprehensive guide

Understanding the Nebraska resale certificate

A Nebraska resale certificate acts as a key document enabling businesses to purchase items intended for resale without incurring sales tax. This document verifies that the buyer intends to resell the goods, thereby exempting them from the upfront tax obligation usually applied at the point of sale.

Key features of a Nebraska resale certificate include its issuance to qualified retailers and wholesalers, clear identification of the seller, and specification of the type of merchandise being purchased. It’s crucial for retailers to understand the importance of this certificate in their operations, particularly in helping them manage cash flow effectively by deferring tax obligations.

Retailers often find that utilizing a Nebraska resale certificate streamlines transactions and simplifies accounting processes. By keeping comprehensive and updated records of these certificates, retailers can protect themselves during audits and maintain compliance with state tax regulations.

Eligibility for a Nebraska resale certificate

In Nebraska, several entities may benefit from obtaining a resale certificate. Primarily, these include retailers and wholesalers engaged in sales transactions that involve resale, as well as non-profit organizations that distribute goods for resale purposes. Each of these groups plays a pivotal role in maintaining the state's commerce standards.

To qualify for a Nebraska resale certificate, businesses typically need to demonstrate that they are actively engaged in purchasing goods with the intent to resell them. Some exceptions exist; for example, if the purchase is for personal use or not intended for resale, a resale certificate is not required.

How to obtain a Nebraska resale certificate

Obtaining a Nebraska resale certificate is straightforward and can be completed in a few essential steps. Businesses need to ensure that they meet the eligibility criteria before commencing the application process.

For a successful application, ensure all documentation is thorough and verify that the information matches the records available to the Department of Revenue. This reduces the likelihood of delays and complications.

How to use a Nebraska resale certificate

Using a Nebraska resale certificate involves accepting this document from buyers who are purchasing goods for resale. As a seller, it’s crucial to understand the guidelines surrounding the acceptance of these certificates to ensure compliance with state tax regulations.

Valid resale certificates provide sellers with assurance that they can avoid collecting sales tax for certain transactions. It's important to examine each certificate for validity, which includes checking the buyer’s information and ensuring that the form is properly completed and signed. Additionally, there are situations when an exemption certificate is required instead of a resale certificate, particularly when a transaction qualifies for a different type of tax exemption.

Managing Nebraska resale certificates

Effective management of Nebraska resale certificates is crucial for avoiding potential liabilities during audits. Retailers should employ best practices for document management, starting with maintaining organized records of all resale certificates received.

Consider implementing a digital storage solution such as pdfFiller to store, access, and manage these important documents securely. This not only simplifies retrieval during audits but also helps businesses keep track of expiration dates associated with certain resale certificates. Regularly reviewing these records will help ensure compliance and readiness for any potential inquiries from tax authorities.

Accepting out-of-state resale certificates

When dealing with transactions involving out-of-state resale certificates, businesses in Nebraska should be aware of compatibility with state regulations. Generally, Nebraska accepts resale certificates issued by other states, provided they comply with their respective laws.

However, retailers must remain cautious and verify that any out-of-state resale certificate is valid and properly completed as per the issuing state’s requirements. It’s advisable to check for any specific exemptions or stipulations regarding such transactions to prevent complications and ensure compliance with Nebraska’s tax laws.

Costs associated with resale certificates

One of the appealing aspects of a Nebraska resale certificate is that there is no fee directly associated with obtaining it. Businesses can apply for their certificate without incurring any application costs. This favorable condition encourages more retailers and wholesalers to take advantage of the benefits of the resale certificate.

However, businesses should consider any additional costs that may arise from processing exemptions related to specific transactions. For example, if a retailer handles complex sales tax exemptions or provides certain goods that fall into niche categories, they may require specialized guidance or services, which could incur fees.

Frequently asked questions

A common question surrounding Nebraska resale certificate pertains to its distinction from a sales tax permit. While both documents are crucial for businesses, the sales tax permit allows a business to collect sales tax, whereas the resale certificate serves to exempt buyers from paying upfront sales tax for resale purposes.

Another frequent misconception is that a business can use a resale certificate for personal purchases, which is inaccurate. The resale certificate should only be used for goods that are meant for resale, ensuring that businesses comply with tax obligations. Additionally, if a business needs to revoke a resale certificate, they must approach the issuing authority to process the revocation formally.

Additional resources & tools

For businesses seeking more information on Nebraska resale certificates, the Nebraska Department of Revenue’s website provides essential resources and guidance. An interactive tool can help users locate tax resources and assistance based on their specific location and needs.

Moreover, pdfFiller offers various forms and templates that are particularly valuable for sales and use tax management, enabling users to create, edit, and manage documents seamlessly. This cloud-based platform is designed to empower users with all the tools required to effectively handle their documentation needs.

Related posts on sales tax management

For further insights into sales tax management, check out our posts on managing sales tax exemption certificates and understanding economic nexus. Additionally, explore state-specific sales tax implications for digital products and SaaS offerings to keep your business compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nebraska resale or exempt?

How do I fill out the nebraska resale or exempt form on my smartphone?

How can I fill out nebraska resale or exempt on an iOS device?

What is nebraska resale or exempt?

Who is required to file nebraska resale or exempt?

How to fill out nebraska resale or exempt?

What is the purpose of nebraska resale or exempt?

What information must be reported on nebraska resale or exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.