Get the free Mf12515

Get, Create, Make and Sign mf12515

How to edit mf12515 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mf12515

How to fill out mf12515

Who needs mf12515?

mf12515 Form: A Comprehensive How-To Guide

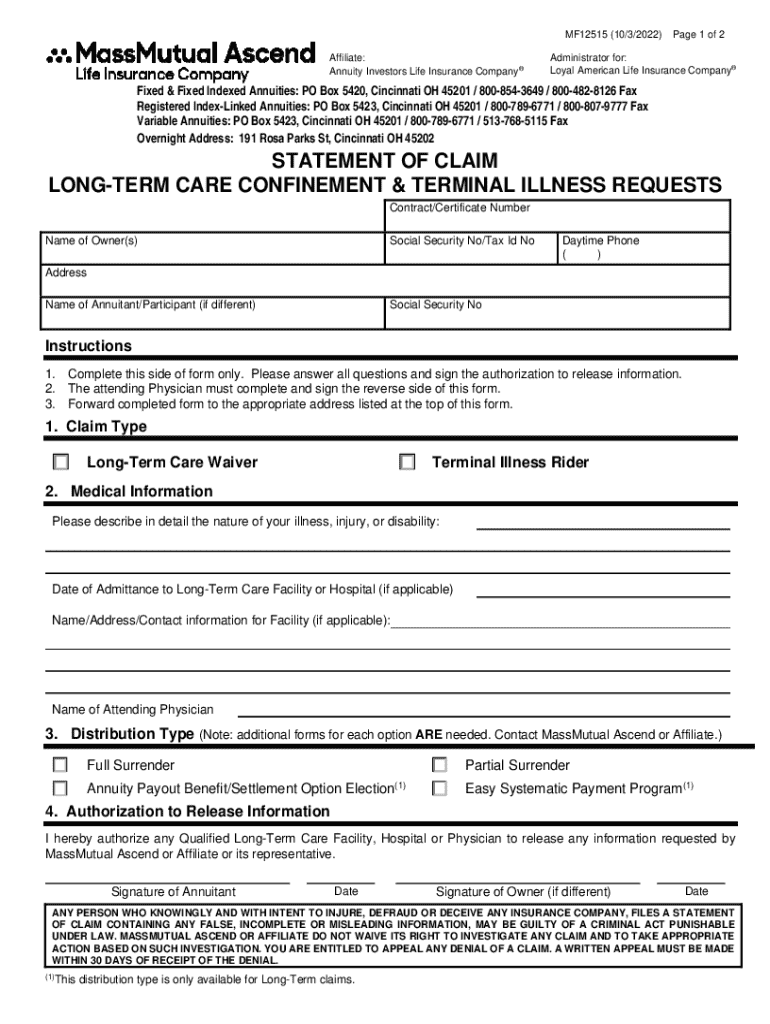

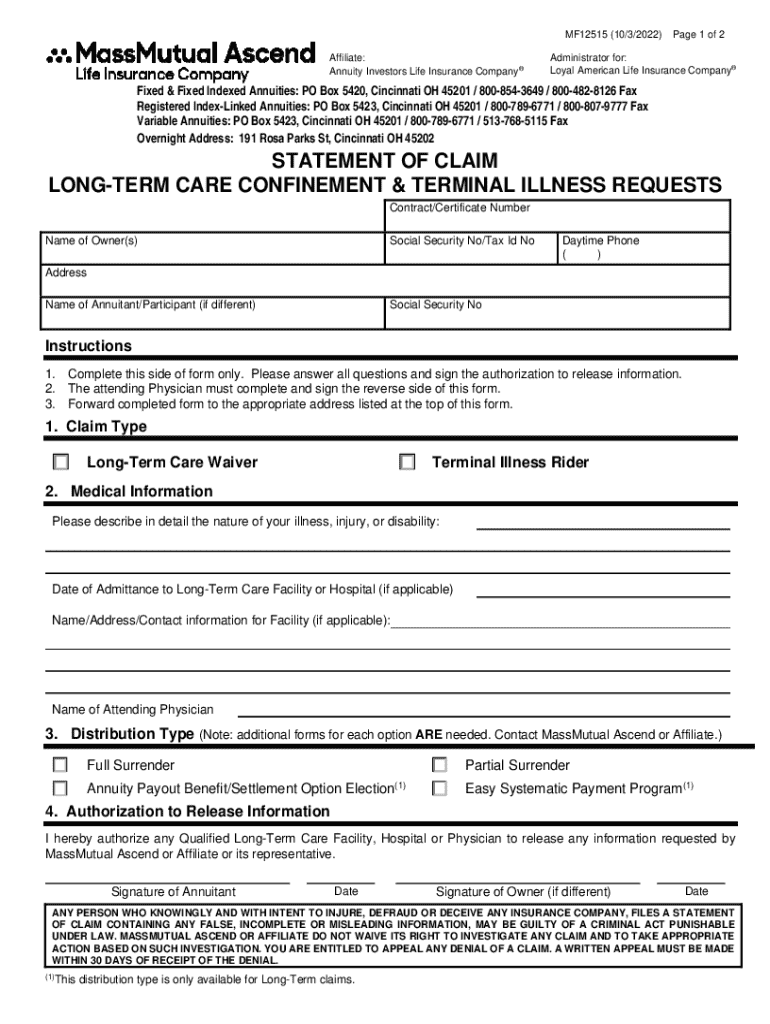

Understanding the mf12515 form

The mf12515 form is a specialized document that serves a crucial role in various administrative and legal transactions. Primarily utilized for specific financial reporting and declaration purposes, it allows individuals and organizations to formally communicate critical information to relevant authorities. Understanding its definition and function is essential for anyone looking to navigate the complexities of financial regulations or organizational compliance.

Common use cases for the mf12515 form include financial disclosures, tax filings, and applications for permits or licenses that require detailed financial account information. Given its importance, failure to complete the mf12515 form accurately can lead to significant implications. Missing out on this form may result in delays, penalties, or even legal action in certain cases.

Importance of the mf12515 form

Completing the mf12515 form holds significant importance due to several key reasons. Firstly, it ensures compliance with legal and regulatory requirements, protecting individuals and organizations from potential infractions. Secondly, it aids in maintaining transparent communication with stakeholders, enhancing trust and accountability within business operations. Lastly, having this form filled out and submitted on time can streamline processes related to financial transactions, potentially speeding up approvals and responses from relevant authorities.

On the flip side, neglecting to complete the mf12515 form can have adverse consequences. Late or missing submissions may incur penalties, lead to a loss of credibility, and complicate the financial landscape for individuals or organizations. Thus, understanding the significance of the mf12515 form is critical for mitigating risks and ensuring seamless operational flow.

Preparing to fill out the mf12515 form

Before diving into completing the mf12515 form, it is essential to gather all the necessary information and documentation required for accurate completion. Typically, you'll need items such as financial statements, personal identification documents, and any prior correspondence relevant to the matter addressed in the form. Organizing this data beforehand can significantly ease the process and reduce the likelihood of errors during submission.

In addition, choosing the right platform to fill out the mf12515 form is fundamental to ensure efficiency and accuracy. Using pdfFiller, for instance, allows for a user-friendly experience where you can easily input your data into the interactive fields of the form. With pdfFiller’s extensive range of editing tools, you can effortlessly modify your form, ensuring it meets all necessary standards before submission.

Step-by-step instructions for filling out the mf12515 form

To start filling out the mf12515 form, first access the pdfFiller platform. You can locate the mf12515 form template through the search feature or directly by browsing through the available categories. Once located, open the template to begin the process.

The form consists of multiple sections that need to be addressed meticulously. Begin by filling out the Personal Information section, which typically requires details such as your name, address, and contact information. This is followed by the Financial Information dialogue, where you’ll provide necessary financial details pertinent to the context of the submission. Lastly, include any Additional Notes or Attachments that may help clarify or support your declarations. Ensuring accuracy and completeness in these sections is crucial as it reflects on the integrity of your submission.

If adjustments or corrections are needed later, pdfFiller offers a variety of editing options. Use the editing tools to strike out or modify content, ensuring that your final submission is both clear and professional.

Enhancing collaboration with the mf12515 form

Collaboration can make the process of filling the mf12515 form more efficient, especially when multiple parties need to review or contribute to the content. pdfFiller provides several methods for sharing your form, including via email or direct link, allowing others to access and edit depending on the permissions you set.

In addition, pdfFiller’s eSignature feature streamlines the process of collecting signatures efficiently. You can request signatures electronically, eliminating the need for physical paperwork, which can be both time-consuming and prone to loss or damage. Legal aspects of signatures collected this way are important as they hold the same validity as traditional handwritten signatures, ensuring your document remains robust and legally binding.

Managing your completed mf12515 form

Once the mf12515 form has been completed and submitted, managing the document becomes necessary for record-keeping. Within pdfFiller, you can easily save your form in a secure digital format, allowing for easy retrieval in the future. Best practices include tagging and categorizing your forms, making it simple to locate them later, especially if you have numerous forms to maintain.

If any updates or revisions are required in the future, returning to the mf12515 form for adjustments is straightforward. pdfFiller provides version control features that track changes and history, thus protecting integrity while allowing users to make necessary updates seamlessly.

FAQs about the mf12515 form

As you navigate through the process of using the mf12515 form, you may encounter common questions. For instance, many ask about the legalities concerning its submission and requirement in specific scenarios. It’s crucial to ensure you're submitting it to the correct authority and adhering to their deadlines, as each jurisdiction may have differing requirements.

Troubleshooting is another common aspect users face. Issues such as incomplete fields or lost data can arise during the process. Solutions often involve double-checking the form before submission and safeguarding your data by saving drafts on pdfFiller regularly. If difficulties persist, pdfFiller's support team is available to provide guidance.

Real-world examples and case studies

Examining success stories reveals how effectively using the mf12515 form can benefit various individuals and teams. For example, a small business owner reported that promptly submitting their mf12515 form helped secure funding from a government grant, greatly enhancing their business operation.

Another case involved a nonprofit organization utilizing the form to ensure transparency in their financial reporting, which subsequently garnered trust and donations from stakeholders. These instances showcase the positive impact of using the mf12515 form correctly and highlight the value of effective form management.

Additionally, professionals who frequently work with the mf12515 form suggest best practices such as maintaining an organized filing system, consistently updating information, and ensuring all collaborators are on the same page about their roles in the process.

Maximizing pdfFiller for document management

Utilizing pdfFiller goes beyond just filling out the mf12515 form. The platform provides advanced features that streamline overall document management. For instance, you can add annotations, make revisions, and utilize various templates available within the system that align with your specific needs.

Moreover, the access-from-anywhere capability is immensely beneficial, especially for teams working remotely. With pdfFiller’s cloud-based solution, users can access, edit, and manage documents from both mobile and desktop devices. This flexibility enhances productivity and ensures that teams can stay synchronized, regardless of their locations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mf12515 to be eSigned by others?

Can I create an electronic signature for signing my mf12515 in Gmail?

How can I fill out mf12515 on an iOS device?

What is mf12515?

Who is required to file mf12515?

How to fill out mf12515?

What is the purpose of mf12515?

What information must be reported on mf12515?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.