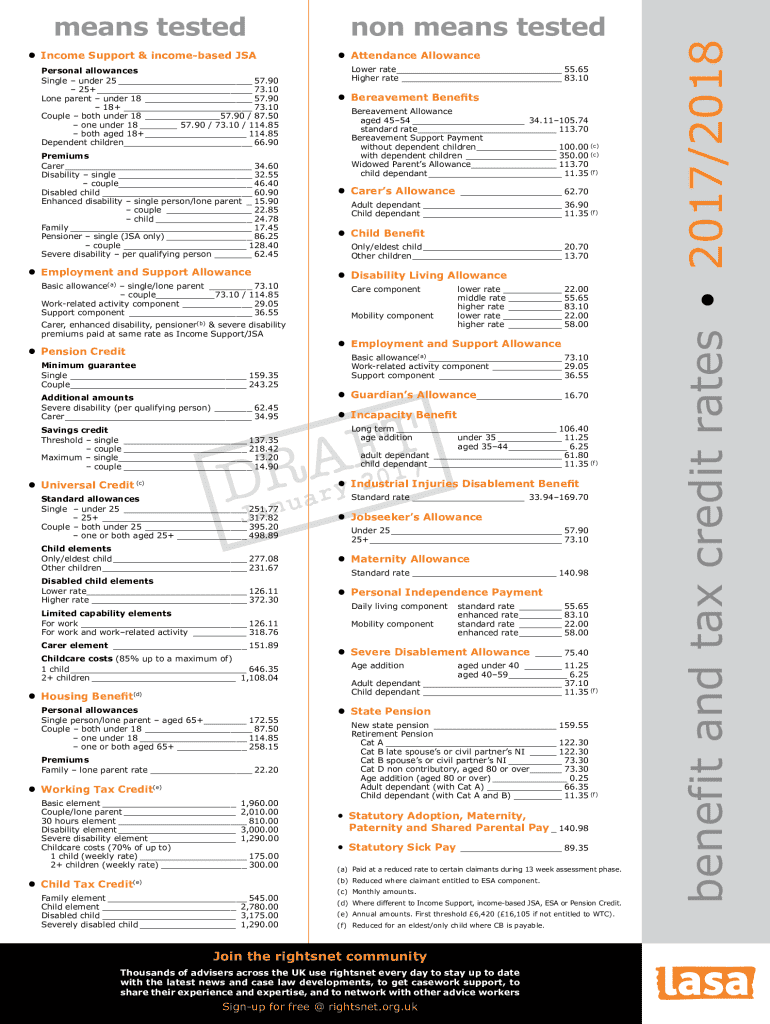

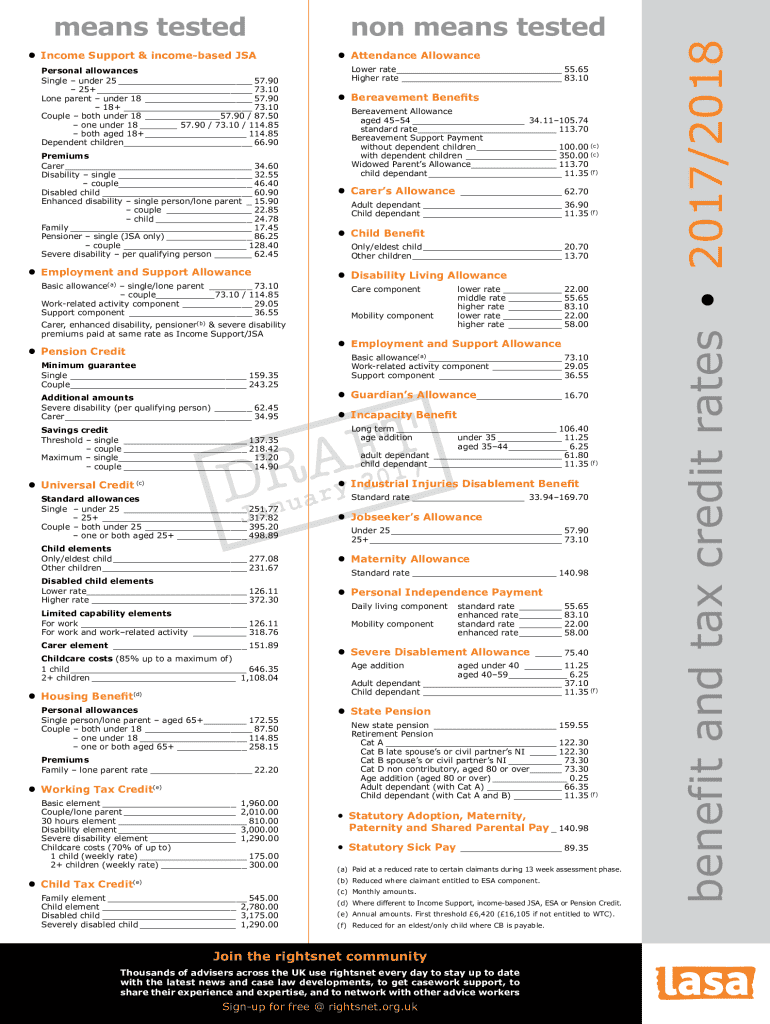

Get the free Benefit and Tax Credit Rates • 2017/2018

Get, Create, Make and Sign benefit and tax credit

How to edit benefit and tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out benefit and tax credit

How to fill out benefit and tax credit

Who needs benefit and tax credit?

Benefit and Tax Credit Form - How-to Guide

Understanding benefits and tax credits

Benefits and tax credits are essential aspects of the financial landscape, designed to provide support and relief to individuals based on certain eligibility criteria. Benefits generally refer to direct financial assistance, while tax credits reduce the amount of tax owed, often resulting in a refund. It's crucial to understand how these concepts work together to optimize financial situations, particularly when filing taxes.

Documenting benefits and tax credits accurately is vital for tax purposes. Inaccurate reporting can lead to audits or missed financial support opportunities. Therefore, familiarity with the types of benefits and tax credits can significantly impact one’s financial obligations and potential refunds.

Types of benefits

Benefits can be categorized into various types, including:

Overview of tax credits

Tax credits are powerful financial instruments that can effectively reduce your taxable income. They come in two main types: refundable and non-refundable tax credits. Refundable credits allow taxpayers to receive a refund even if they do not owe any taxes, while non-refundable credits can only reduce the tax owed to zero.

Common types of tax credits include the Child Tax Credit, education credits for tuition expenses, and the Earned Income Tax Credit for low- to moderate-income working individuals and families.

Key components of the benefit and tax credit form

The benefit and tax credit form is a crucial document designed to report appropriate benefits and tax credits to the relevant tax authority. This form is significant for anyone eligible for tax credits or benefits as it determines the amount of tax liability or refund.

Anyone who has received benefits or believes they qualify for tax credits should fill out this form. It's particularly important for freelancers, low-income earners, or anyone with specific qualifying circumstances.

Sections of the form

The benefit and tax credit form typically consists of several sections:

Step-by-step guide to completing the form

Completing the benefit and tax credit form correctly is essential. Here’s a step-by-step guide:

Step 1: Gathering necessary information

Start by collecting all necessary documentation, such as previous tax returns, current income statements, and any certificates of eligibility for benefits. A comprehensive checklist might include:

Step 2: Filling out personal and income information

Enter your personal information carefully. Double-check names, addresses, and Social Security numbers to ensure accuracy. Common pitfalls include typos or incorrect entries, especially in numerical information.

Step 3: Identifying and claiming eligible benefits

Next, determine which tax credits you qualify for. Common credit categories include:

Step 4: Review and finalization

After completing the form, revisit each entry for accuracy before submission. Pay attention to submission deadlines to ensure your application is processed timely.

Editing and managing your benefit and tax credit form

Managing your benefit and tax credit form is simplified with online tools like pdfFiller. This cloud-based solution makes filling, editing, and managing documents seamless. You can access the platform anywhere, making collaboration with team members easier.

Key features of pdfFiller that enhance the filing process include:

Common issues and troubleshooting

While filling out the benefit and tax credit form, you may encounter various challenges. Recognizing these common issues can help you avoid delays and mistakes.

Some frequently encountered problems include:

FAQs regarding benefits and tax credits

Frequently asked questions about benefits and tax credits can help you better understand your rights and responsibilities. Here are a few common inquiries:

Real-life examples of benefits and tax credits

Real-life applications of benefits and tax credits showcase their impact. For instance, individuals who effectively utilized the Child Tax Credit saw significant reductions in their tax liabilities.

Case studies reveal how diverse communities have benefited from education credits, enabling them to afford college tuition and pursue higher education.

Lessons learned from successful claims

Insights from successful claims emphasize the importance of meticulous documentation. Victories often stem from providing comprehensive records that support claims, underscoring the power of accurate reporting.

Next steps after submission

Once the benefit and tax credit form has been submitted, understanding the review process is essential. You can expect a timeline for responses based on the type of claim and the jurisdiction.

Tracking your claim status is possible through the IRS or relevant tax authority websites. Should there be a need to make amendments, understanding how and when to amend your submission is crucial to avoid losing entitled credits.

Additional considerations

Tax laws are in constant flux, and staying updated on legislative changes impacting benefits and tax credits is vital. Recent changes may offer new opportunities for potential claims or affect existing credits, so monitoring proposed tax reforms is advisable.

Utilize resources such as government websites, tax seminars, and associations dedicated to tax education to stay informed.

Community support and resources

For those seeking assistance with their benefit and tax credit claims, community support networks can provide valuable resources. Local organizations often host events, offering free preparation services and information sessions regarding your claims.

Engaging with online forums and community groups can also help share experiences and insights with others navigating similar situations, fostering a sense of community and knowledge-sharing.

Additionally, utilizing pdfFiller for ongoing document management empowers users to streamline future submissions, ensuring they remain compliant and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find benefit and tax credit?

Can I edit benefit and tax credit on an iOS device?

How can I fill out benefit and tax credit on an iOS device?

What is benefit and tax credit?

Who is required to file benefit and tax credit?

How to fill out benefit and tax credit?

What is the purpose of benefit and tax credit?

What information must be reported on benefit and tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.