Get the free W-9 - dps ny

Get, Create, Make and Sign w-9 - dps ny

How to edit w-9 - dps ny online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9 - dps ny

How to fill out w-9

Who needs w-9?

W-9 - DPS NY Form: A Complete Guide for New Yorkers

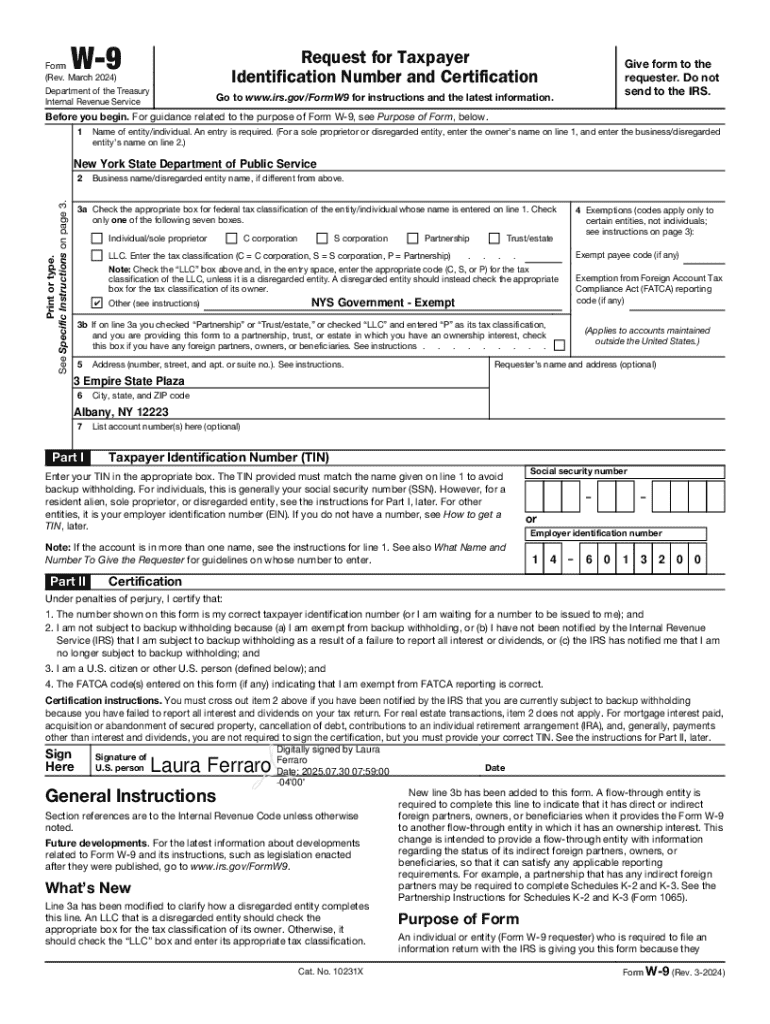

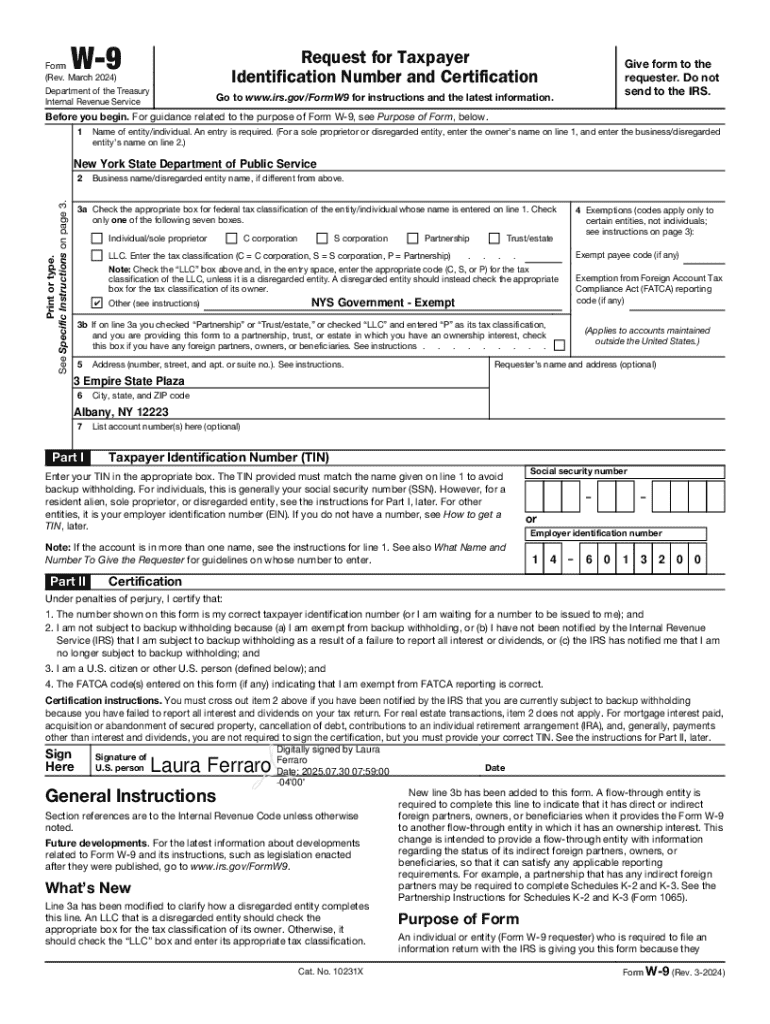

Overview of the W-9 Form

The W-9 form, officially titled 'Request for Taxpayer Identification Number and Certification', serves a critical function in the realm of tax reporting in the United States. This form is primarily used to provide necessary taxpayer identification information, such as Social Security Numbers (SSN) or Employer Identification Numbers (EIN), to entities that need to report payments made to an individual or business. Often associated with independent contractors and freelancers, the W-9 form preserves tax compliance and ensures that the right amount of tax is withheld at the time of payment.

Understanding its significance is paramount, as it lays the groundwork for proper income reporting. Clients and businesses relying on freelancers or contractors must obtain a completed W-9 form to effectively fill out subsequent IRS forms, such as the 1099.

Who needs to fill out a W-9 Form?

Various individuals and entities need to engage with the W-9 form, notably:

Understanding the W-9 Form Structure

The structure of the W-9 form is designed to collect specific data that enables accurate taxpayer identification. Key sections within the form include:

Common terms encountered when filling the W-9 include the 'Taxpayer Identification Number (TIN)' and various 'Exemption Codes', which serve to categorize the type of payer. Understanding these terms can significantly streamline the completion of the form.

Filling out the W-9 Form

Completing the W-9 form can seem daunting, but breaking it down into manageable steps simplifies the process:

Special considerations for New York residents

New York residents filling out the W-9 form should be aware of state-specific requirements. Beyond the standard federal W-9 requirements, New Yorkers may need to provide additional documentation for certain industries, particularly if they are utilizing specific exemptions that pertain to state taxes.

Additionally, individuals residing within New York City might face unique procedural differences, such as local tax codes, that could impact the completion and submission of the W-9 form. It's also essential for New Yorkers to know where to file the completed form. The W-9 is typically submitted to the requesting party and not directly to the IRS, though the IRS guidelines may require that the declaration be kept on file for tax records.

Using pdfFiller for the W-9 Form

pdfFiller offers an innovative solution for managing the W-9 form. Its cloud-based platform allows users to access, edit, and store their documents anytime, anywhere. This is particularly advantageous for individuals and teams needing a comprehensive document management solution.

Some advantages of using pdfFiller include:

Moreover, pdfFiller's interactive features guide users step-by-step through filling out the W-9 form, ensuring that no detail is overlooked. Collaborative tools also make it easy to share and obtain signatures securely and efficiently.

Common mistakes to avoid

Even minor errors on the W-9 form can lead to significant complications down the line. Here are some common pitfalls to watch out for:

To ensure accurate submission, double-check all the information before sealing the envelope. If you're uncertain about any aspect of the form, consider reaching out to pdfFiller's support for assistance.

Frequently asked questions (FAQs)

As you navigate the complexities of the W-9 form, you might encounter several questions. Here are some of the most frequently asked questions regarding this important document:

Related forms and resources

Understanding forms related to the W-9 is also vital for proper tax reporting. For instance, the 1099-MISC and 1099-NEC forms are critical for reporting non-employee compensation and other types of income.

Additionally, you can find helpful resources directly from the IRS, including the official W-9 form. These resources can further illuminate the tax process and ensure you stay compliant.

Conclusion of the W-9 process

After completing the W-9 form, it's essential to keep a copy for your records. This ensures you have a reference in the event of discrepancies. Make sure to inform the requester that the form is filled out, allowing them to proceed with their reporting obligations efficiently.

Being thorough with your W-9 ensures you meet tax requirements while safeguarding against potential issues in the future. By leveraging tools like those offered by pdfFiller, managing and submitting your W-9 becomes a streamlined process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the w-9 - dps ny in Chrome?

How can I fill out w-9 - dps ny on an iOS device?

Can I edit w-9 - dps ny on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.