Get the free Notice of 108 Lien Tl-108 (a)

Get, Create, Make and Sign notice of 108 lien

Editing notice of 108 lien online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of 108 lien

How to fill out notice of 108 lien

Who needs notice of 108 lien?

Understanding the Notice of 108 Lien Form: A Comprehensive Guide

Understanding the notice of 108 lien form

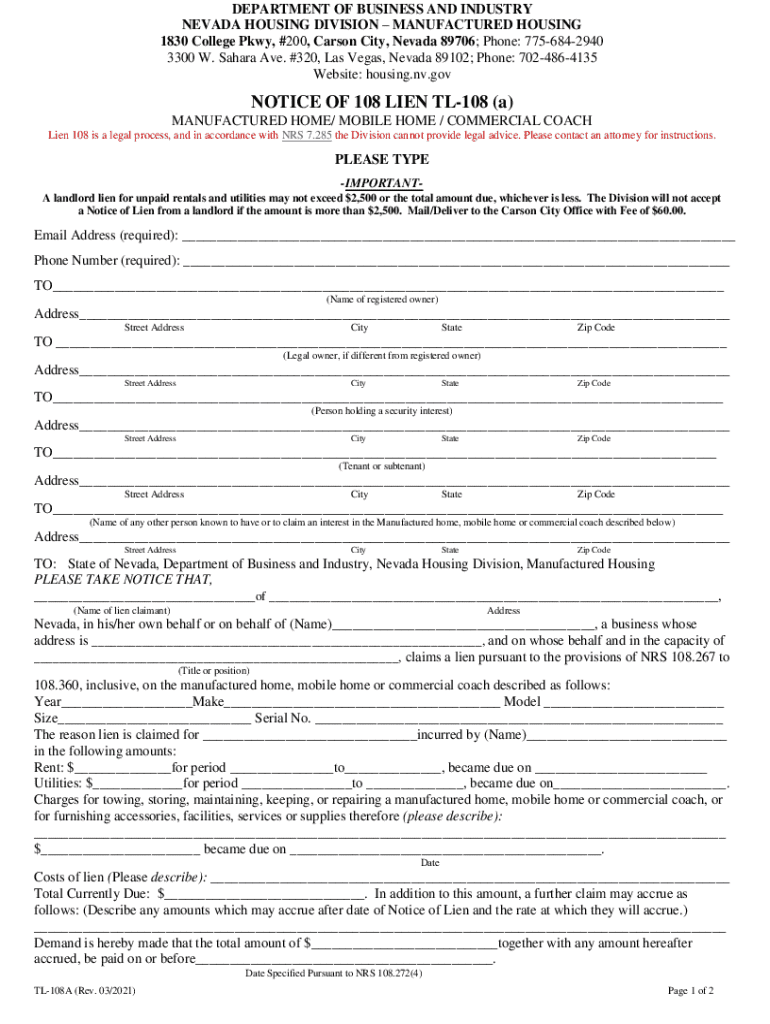

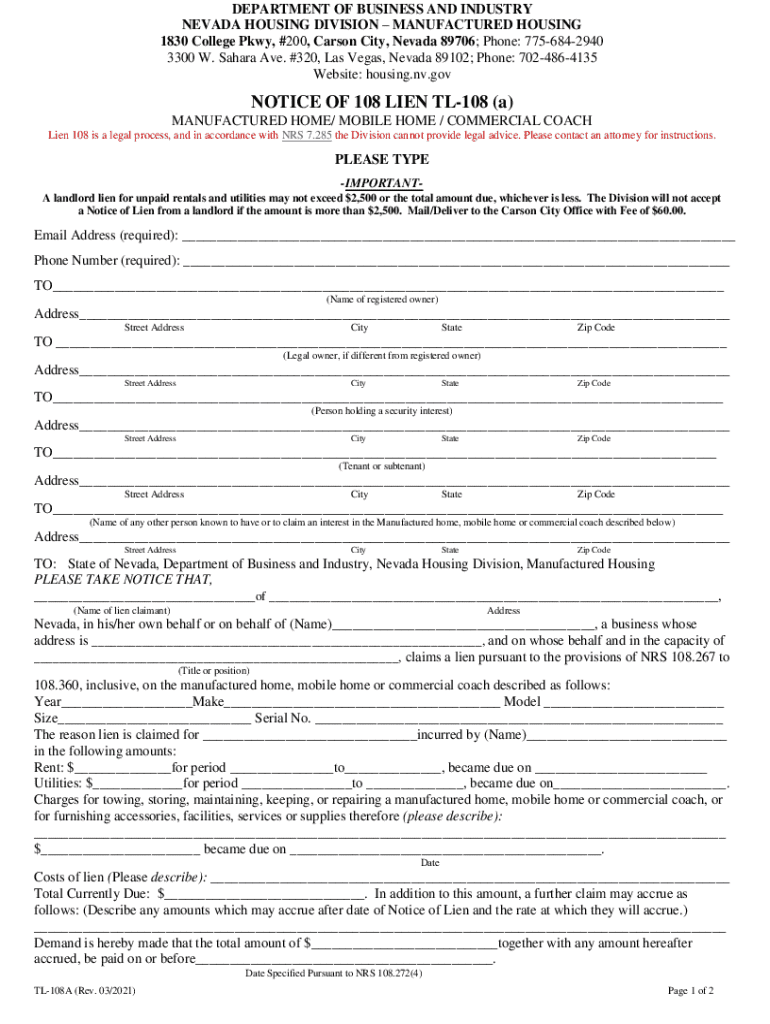

The Notice of 108 Lien Form is a pivotal document in real estate and property management, serving as a legal claim against a property. This form signifies that there is an outstanding debt connected to the property, which can impact the owner's rights to sell or refinance the asset. Understanding the nuances of this form is essential for both property owners and lienholders.

Its importance lies in protecting the interests of creditors, ensuring they have a claim to the owner's property if debts are not settled. This form is primarily utilized during financial transactions involving unpaid services or goods associated with property, thus acting as a safeguard for those who might not receive their due payments.

Components of the notice of 108 lien form

The Notice of 108 Lien Form comprises several essential elements that establish its validity and enforceability. Each component plays a critical role in clearly conveying the necessary information for all involved parties. The first major component is the identification of the debtor, which includes detailed information on the individual or entity responsible for the debt.

Next, the description of the property in question must be precise, including addresses and any relevant property identifiers. The amount of the lien must be calculated accurately to reflect the total debt owed. Lastly, the form must include the signature of the lienholder, signifying their agreement to the details stated within, alongside the date of signing, which establishes a timeline for the lien’s activation.

Understanding legal terminology is crucial when dealing with the Notice of 108 Lien Form. A lien itself is a legal right that a creditor has over the property of a debtor until the debt obligation is satisfied. The lienholder holds specific rights, including the ability to place a claim on the property, which can affect future transactions such as sales or refinances.

Step-by-step instructions for completing the notice of 108 lien form

Completing the Notice of 108 Lien Form requires careful attention to detail to ensure accuracy and compliance with legal standards. Begin by collecting all required information. It’s essential to have all necessary documentation at hand, including any agreements related to the debt, property deeds, and identification details of both the debtor and creditor.

Once you have the necessary documentation, proceed to fill out the form. The first section requires you to identify the debtor. This should include the full legal name, current address, and any relevant identification information. The next section is for describing the property. Ensure that you provide a complete address and any identifying information such as parcel numbers. Then, calculate the total amount of the lien, ensuring that it comprises all relevant charges and any applicable fees.

After filling out the form, it’s vital to review all entries meticulously. Errors can lead to delays or even rejections. Make sure all names are spelled correctly, numbers match supporting documents, and that you've met all required legal standards.

Editing and customizing the form

Once the form is complete, it’s equally important to ensure it meets your specific needs. pdfFiller offers a range of editing tools that enable you to customize your form easily. You can change the layout, modify sections to suit your needs, or even enhance your document by adding an eSignature functionality, making it more streamlined for digital transactions.

When making edits, ensure that all changes comply with legal standards required in your jurisdiction. Incorrect edits could compromise the validity of the form. Taking the time to fine-tune the document with pdfFiller’s tools ensures that your Notice of 108 Lien Form is professional and ready for submission.

Signing and submitting the notice of 108 lien form

After completing the form and ensuring all details are correct, the next step is signing the document. Various signing methods are available, including eSigning through pdfFiller, which allows for easy, secure, and quick completion of the process. This method is especially beneficial for those who need to submit documents urgently or remotely.

Alternatively, you may opt for traditional signing methods. Ensure that all signatories are present when the signing occurs to avoid potential disputes later on. Once signed, submit the form to the appropriate office, which varies depending on your locality. It's crucial to be aware of and ready for any potential fees associated with filing.

Managing and tracking your notice of 108 lien form

Once the Notice of 108 Lien Form has been submitted, effective management of the document becomes crucial. Utilizing platforms like pdfFiller can significantly ease the tracking process. You can efficiently monitor the status of your form post-submission, providing peace of mind that your claims are being processed appropriately.

It's also a good practice to maintain detailed records of all filed documents. Keeping a digital trail via pdfFiller enables you to access and manage files from anywhere. This method promotes greater organization and can serve as a valuable resource in case of future disputes regarding the lien.

Common challenges and solutions

Navigating the completion and submission of the Notice of 108 Lien Form isn’t always straightforward. One common challenge is understanding state-specific regulations, as different states may have varied requirements regarding lien types and submissions. Researching local laws or consulting with a legal expert can provide clarity and help navigate any complexities.

Additionally, issues such as denials or disputes over the lien amount can arise. Being prepared with supporting documentation and clear communication can mitigate many of these risks. Always remain proactive in understanding your rights and responsibilities as a lienholder to empower yourself in potential negotiations.

Frequently asked questions (FAQs) about the notice of 108 lien form

1. What happens if the form is filled out incorrectly? Incorrectly filed forms can lead to denials or invalidation of the lien, often necessitating re-filing the correct information. Always double-check your entries before submission.

2. Can the lien be contested, and what are the procedures? Yes, liens can be contested. The procedures often involve the debtor filing a dispute through legal avenues or communicating directly with the lienholder.

3. How long does the lien remain in effect? Lien duration can vary by state and type. Typically, it remains in effect until the debt is satisfied or formally withdrawn by the lienholder.

Final thoughts on using the notice of 108 lien form

Navigating the realm of property-related documents can be daunting, but managing your Notice of 108 Lien Form properly is crucial. Staying organized and proactive not only protects your interests as a lienholder but also aids in keeping clear documentation for future transactions.

With pdfFiller's comprehensive tools at your disposal, you can streamline the process of filling out, editing, and managing your documents. By taking control of your property documentation, you empower yourself to manage challenges effectively and maintain oversight of your real estate assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notice of 108 lien for eSignature?

How do I edit notice of 108 lien on an iOS device?

How do I complete notice of 108 lien on an iOS device?

What is notice of 108 lien?

Who is required to file notice of 108 lien?

How to fill out notice of 108 lien?

What is the purpose of notice of 108 lien?

What information must be reported on notice of 108 lien?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.