Get the free Municipal Application for Credit

Get, Create, Make and Sign municipal application for credit

Editing municipal application for credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal application for credit

How to fill out municipal application for credit

Who needs municipal application for credit?

Municipal Application for Credit Form: A Comprehensive Guide

Understanding the municipal application for credit

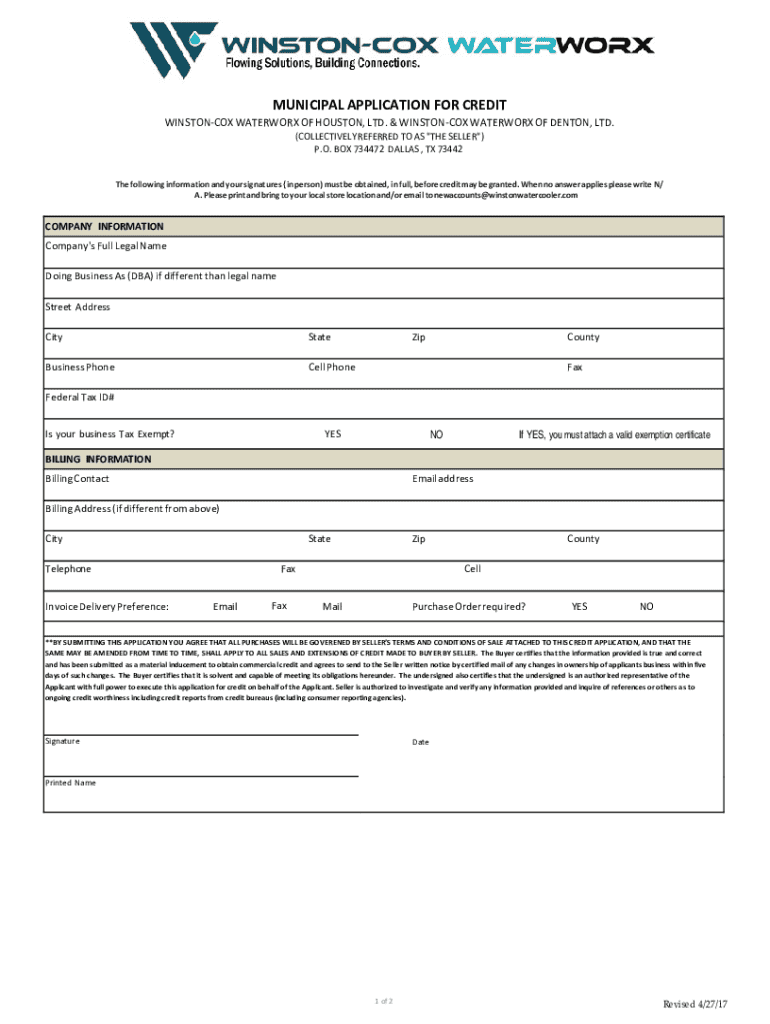

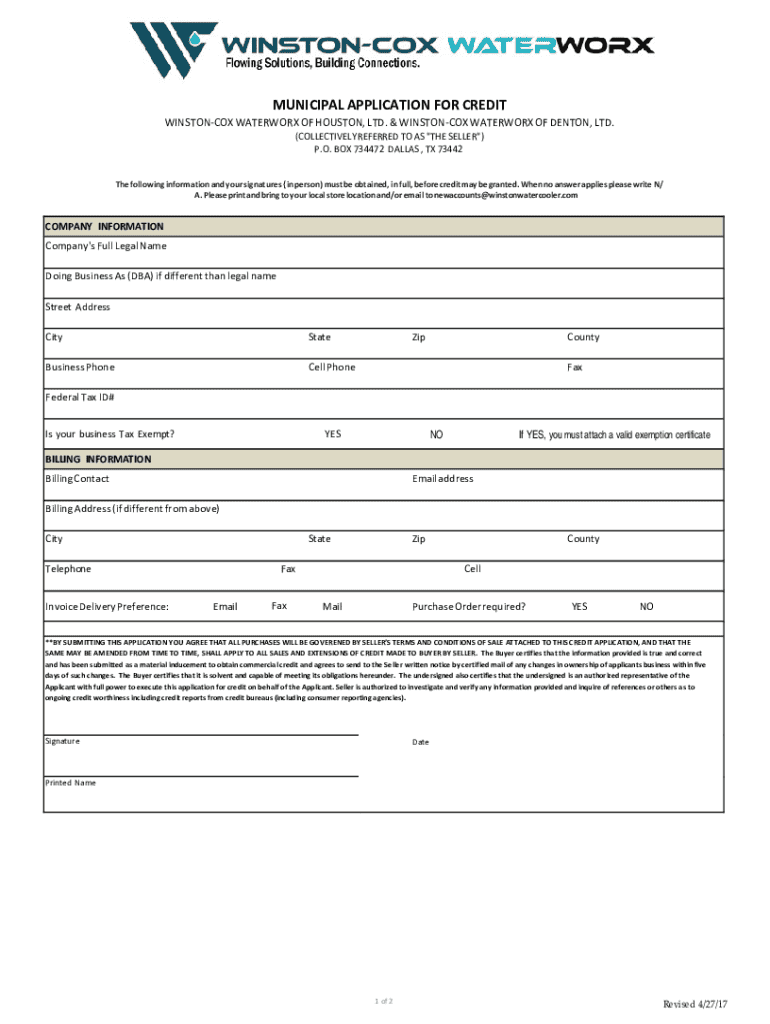

A municipal application for credit form serves as a financial tool that allows individuals or organizations to seek credit from local government bodies. This form is a crucial part of the credit approval process, assisting both municipal authorities in evaluating borrowers' financial standings and applicants in gaining potential access to funds for projects such as infrastructure development or community improvements. Accurate and thorough completion of this application can significantly affect the outcome of a credit request, reflecting its importance for both individuals and teams.

Utilizing a municipal application for credit form can open doors to various financing opportunities supported by local governments. Understanding its function reduces the complexity and uncertainty of municipal credit processes, making it vital for applicants to comprehend the nuances involved.

When and why to use the credit application form

The municipal application for credit form is commonly utilized during projects involving community development or improvements that require financial backing from local authorities. Scenarios such as funding for parks, public safety enhancements, or facility renovations necessitate this application. Engaging with municipal credit can enhance project viability and spur local economic growth.

The benefits of applying for municipal credit include access to lower interest rates, flexible repayment terms, and enabling participation in vital community programs that may otherwise lack funding. Overall, understanding when and why to use this form solidifies an applicant's readiness to engage with the municipal credit system.

Essential information required

Completing the municipal application for credit requires specific personal and financial information. The personal information section typically demands accurate details such as the applicant's name, address, and contact number. Providing precise personal details is crucial, ensuring the municipal office can reach the applicant for follow-up questions or notifications regarding the application status.

Furthermore, financial information is also a significant aspect of the application. This typically includes disclosures about income, existing debts, and overall financial stability. Applicants should prepare typical documentation such as income statements, tax returns, and balance sheets, which demonstrate financial health and readiness to undertake additional credit responsibilities.

In addition, municipal-specific requirements may include extra forms or documentation mandated by local authorities. Applicants should ensure they are aware of any deadlines that accompany these submissions to avoid delays in processing.

Step-by-step instructions for completing the form

Before filling out the municipal application for credit, it is essential to gather all necessary information. A well-organized approach not only expedites the process but minimizes the chances of omitting crucial details. Consider using tools like pdfFiller to enhance the application process with features such as document editing and signing, ensuring a smooth experience.

Step 1: Inputting personal information

When you begin filling out the form, ensure personal information is clearly and accurately entered. Double-check spellings and contact details to avoid complications later. A common pitfall is incorrect or outdated information, which may lead to delays or miscommunication.

Step 2: Providing financial background

As you provide your financial background, ensure that all entries are complete and convey a clear overview of your financial situation. Segregate the information into sections as prompted by the form to maintain structure and enhance readability.

Step 3: Addressing additional requirements

Make sure to attach any supplementary documents that reinforce your application. This may include project proposals or plans for which the credit is sought. Both clarity and substantiation in these attachments are essential.

Reviewing your application

Before you submit your application, review it meticulously. Cross-reference the information provided with your supporting documents to ensure consistency. Confirmation of completeness and correctness can save applicants time and stress during the follow-up period.

Submitting your application

Submitting the municipal application for credit can often be done through various methods, giving applicants flexibility based on convenience. Common submission methods include online submissions via the municipal website, mailing a hard copy of the application, or visiting local government offices in person for submission.

Following submission, it's crucial to understand how to track your application. Local authorities might have specific channels for applicants to check their status. Understanding response times and protocol can alleviate anxiety during the evaluation phase.

Managing your credit after application

Understanding the approval process is a vital aspect of managing your credit after submitting the municipal application for credit. Typically, decisions can take anywhere from a few weeks to several months, depending on various factors including the complexity of the application and the municipality's workload. Having patience during this period is essential.

After receiving a response, applicants need to take appropriate actions based on the outcome. If approved, it’s important to familiarize oneself with the terms and conditions of the credit, including repayment schedules. Conversely, if the application is denied, request feedback to understand the reasons for the denial. This step can be pivotal for planning future reapplications or subsequent appeals.

Utilizing pdfFiller for document management

pdfFiller offers tools that streamline the municipal application for credit submission process, allowing users to edit, sign, and store documents seamlessly. One of the advantages of using pdfFiller includes easy access and flexibility in editing forms wherever you are, ensuring that you can make realtime updates and modifications.

Interactive tools like e-signatures enhance the authenticity of submitted documents, while collaborative features allow team members involved in projects to contribute their insights effectively. This collaborative approach is essential for larger projects requiring multiple stakeholders.

Lastly, pdfFiller simplifies storage and management of submissions. Keeping track of multiple applications is a challenge for many, and pdfFiller's cloud-based system offers robust organization solutions to ensure all your forms are well-arranged and easily retrievable.

Frequently asked questions (FAQs)

Navigating the municipal application for credit process often raises common inquiries. One frequently asked question pertains to credit eligibility criteria. Most municipal guidelines specify certain parameters concerning financial history and project necessity that applicants must meet. Understanding these can help streamline the application process.

Another common question revolves around the types of projects generally funded through municipal credits. Local municipalities may have specific criteria or priority projects they support, impacting the likelihood of approval based on alignment with their objectives.

Real-life examples and testimonials

Case studies of successful applications can provide invaluable insights into best practices and effective strategies when filling out a municipal application for credit form. Many applicants have shared their positive experiences, emphasizing the importance of thorough documentation and prompt submission to assure approval.

User testimonials often highlight how ready access to funding positively impacted their projects, facilitating community growth and infrastructural advancements. Such stories reinforce the potential impact of municipal credit when appropriately pursued.

Additional support and tools

Finding local municipal offices for assistance can be a straightforward process. Typically, municipalities provide contact information readily available on their websites. Engaging with local staff can clarify any doubts about the application process and provide additional support as needed.

For further queries, local offices often have dedicated personnel and resources aimed at assisting applicants throughout the credit application process. Taking advantage of these resources ensures applicants are well-prepared and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my municipal application for credit in Gmail?

How can I modify municipal application for credit without leaving Google Drive?

How do I complete municipal application for credit on an iOS device?

What is municipal application for credit?

Who is required to file municipal application for credit?

How to fill out municipal application for credit?

What is the purpose of municipal application for credit?

What information must be reported on municipal application for credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.