Get the free Mnp R

Get, Create, Make and Sign mnp r

Editing mnp r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mnp r

How to fill out mnp r

Who needs mnp r?

Understanding the MNP R Form: Your Complete Guide

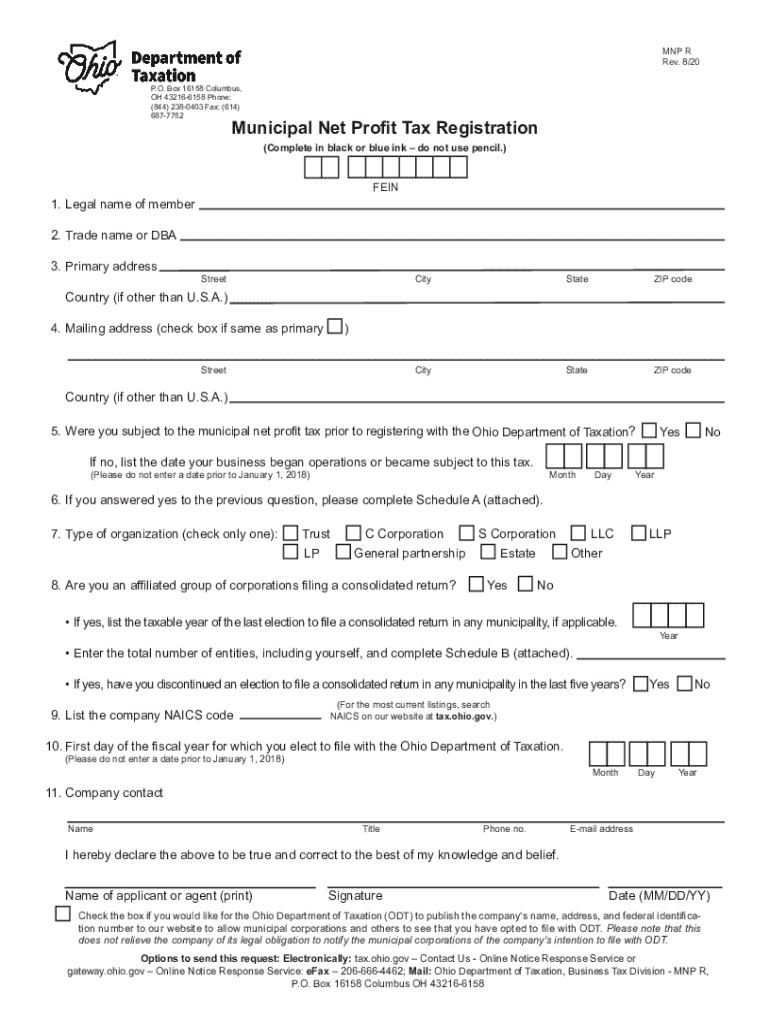

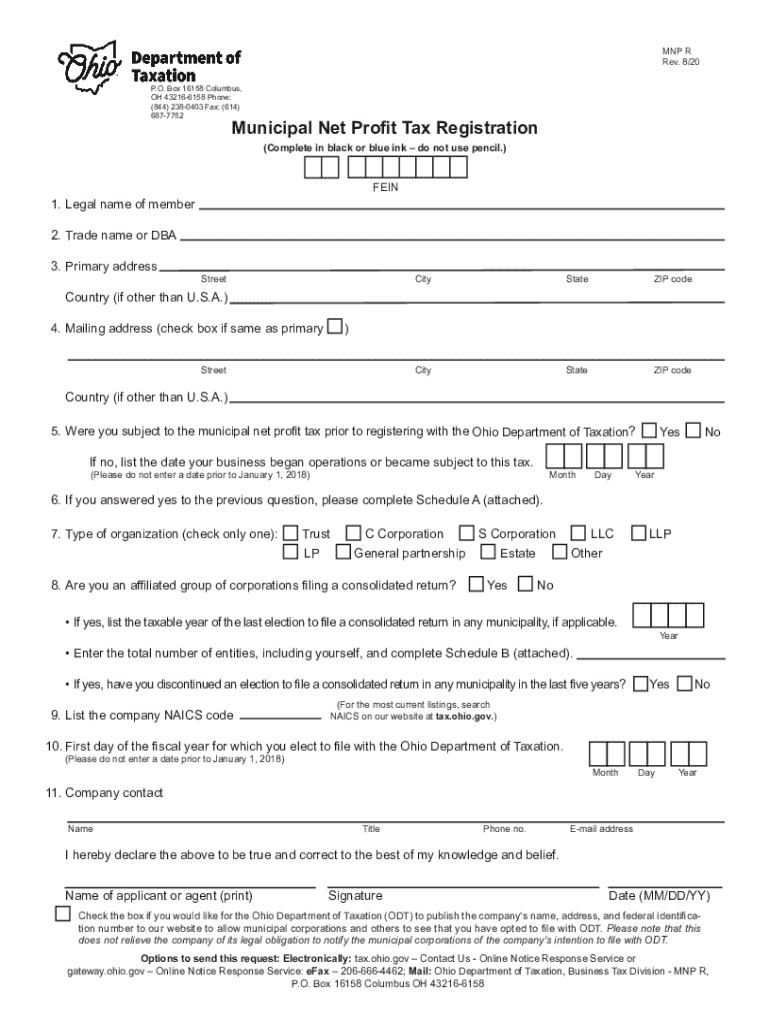

Overview of MNP R Form

The MNP R form serves a critical function in municipal tax compliance, specifically designed to streamline the reporting of financial activities for residents and businesses. This form collects essential data to ensure accurate tax levies, audits, and general transparency within local finance systems. By accurately completing the MNP R form, individuals and organizations contribute to their community’s fiscal health and planning.

Beyond its primary purpose, the MNP R form acts as a crucial tool for municipalities to gauge economic activities within their jurisdiction. When properly filled out and submitted, it allows municipal authorities to configure tax bases, allocate resources responsibly, and make informed decisions regarding budgetary allocations.

Who needs to use the MNP R Form?

The MNP R form is primarily required for individuals and businesses operating within municipal boundaries. Most commonly, this includes homeowners, renters, small business owners, and larger enterprises, all of whom are typically subject to local tax regulations. Anyone who earns income or generates capital gains is advised to consider filing this form to avoid issues with local tax authorities.

Certain exemptions may apply to specific groups. For instance, non-profit organizations or those earning below a specific threshold might be exempt from filing or can achieve simplified reporting.

Key features of the MNP R Form

The MNP R form comprises various key components designed to collect vital information efficiently. These components include personal identification details such as name, address, and tax identification number, alongside sections for income reporting, deductions, and credits. Each field requires accurate completion to ensure that municipalities can properly assess tax liabilities.

Common errors while filling out the MNP R form can include numerical inaccuracies and omissions. Ensuring that all sections are completed and validating calculations carefully can help to minimize such discrepancies.

How to access the MNP R Form

Accessing the MNP R form is a straightforward process. Individuals can find and download the form online through municipal tax office websites or centralized forms platforms like pdfFiller. Below is a step-by-step guide to streamline the process.

pdfFiller not only offers direct access to the MNP R form but also hosts various resources that can aid users in understanding related documentation.

Filling out the MNP R Form

Filling out the MNP R form accurately is crucial. Below are three detailed steps to guide you through the process.

Step 1: Gathering required information

Before filling out the form, gather required information such as personal identification details, including name, address, and tax identification number. Additionally, collect all necessary income reports and pertinent deductions. This can involve documents related to pay stubs, investment income statements, or property income records.

Step 2: Completing each section of the form

As you proceed to fill out each section of the MNP R form, follow specific instructions for clarity. Use accurate figures for income, ensuring any deductions you claim are permissible under local tax regulations. It can help to work through each section methodically, using a pen for paper forms or clicking through pdfFiller for online submissions.

Step 3: Double-checking your entries

Once you believe the form is complete, take time to double-check your entries. Common mistakes include transposed numbers, omitted fields, or incorrect calculations. Verify that all provided information is not only accurate but also neatly presented before submission to avoid delays in processing.

Editing and signing the MNP R Form with pdfFiller

Utilizing pdfFiller for the MNP R form adds significant functionality. Users can leverage a variety of editing tools to correct information, fill missing fields, or adjust numerical entries in real time. This online platform not only simplifies the editing process but also enhances collaboration through an intuitive interface.

These features make pdfFiller an invaluable asset for teams working together in creating or filing the MNP R form.

Submitting the MNP R Form

Once satisfied with your MNP R form, it’s time to submit. You’ll have options for submission, either electronically or via traditional paper filing. Understanding which method is preferable is essential for timely processing.

Additionally, be aware of submission deadlines, as late filings can incur penalties. After submission, remember to retain copies for your records along with any confirmation from the filing method used.

Managing your MNP R Form documents

pdfFiller also streamlines document management following the submission of your MNP R form. Utilize their user-friendly interface to store and organize all submitted forms. Keeping digital copies can help maintain organization and allow for easy retrieval in case of audits or future submissions.

Frequently asked questions about the MNP R Form

As you navigate the complexities of the MNP R form, various questions may arise. Below are some frequently asked queries.

Mistakes can happen, but most municipalities allow for corrections to be filed. Understanding the amendment process will ensure that you remain compliant with local tax regulations and address any errors quickly.

Related documents and resources

Filing the MNP R form may necessitate additional documents or forms. Links to supplementary resources on municipal tax obligations, proposed timelines, and other relevant templates can be found through your local tax authority or direct resources at pdfFiller.

Having multiple forms available at your fingertips ensures a comprehensive approach to municipal tax compliance.

Interactive tools available via pdfFiller

pdfFiller is equipped with interactive tools designed to enhance the user experience while filling out the MNP R form. Utilizing these features can significantly streamline the process of completing and submitting forms securely.

Additional insights

Recent updates in municipal tax regulations may impact how the MNP R form is used, particularly in regards to allowable deductions or changes in filing frequency. Staying informed about these updates ensures you remain compliant and can take advantage of benefits under the new rules.

Additionally, understanding how the MNP R form compares to similar tax forms can provide context for its use and importance in municipal tax compliance. Awareness of these distinctions allows for more efficient resource allocation when filing taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mnp r in Gmail?

How can I modify mnp r without leaving Google Drive?

Can I edit mnp r on an Android device?

What is mnp r?

Who is required to file mnp r?

How to fill out mnp r?

What is the purpose of mnp r?

What information must be reported on mnp r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.