Get the free Accident Insurance Claim Form

Get, Create, Make and Sign accident insurance claim form

How to edit accident insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accident insurance claim form

How to fill out accident insurance claim form

Who needs accident insurance claim form?

Accident Insurance Claim Form: How-to Guide

Understanding accident insurance claims

Accident insurance is designed to provide financial protection for individuals when they suffer an injury due to an accident. This type of insurance can cover various expenses, including medical bills, lost wages, and other related costs. It is crucial for policyholders to understand their rights and procedures for filing a claim to ensure they receive the benefits they are entitled to.

Filing a claim promptly is essential. Many insurance policies have strict deadlines for claims submission; missing these deadlines can result in a denial of benefits. For instance, some insurers may require claims to be submitted within a certain period after the accident occurs, which can vary from 30 days to several months.

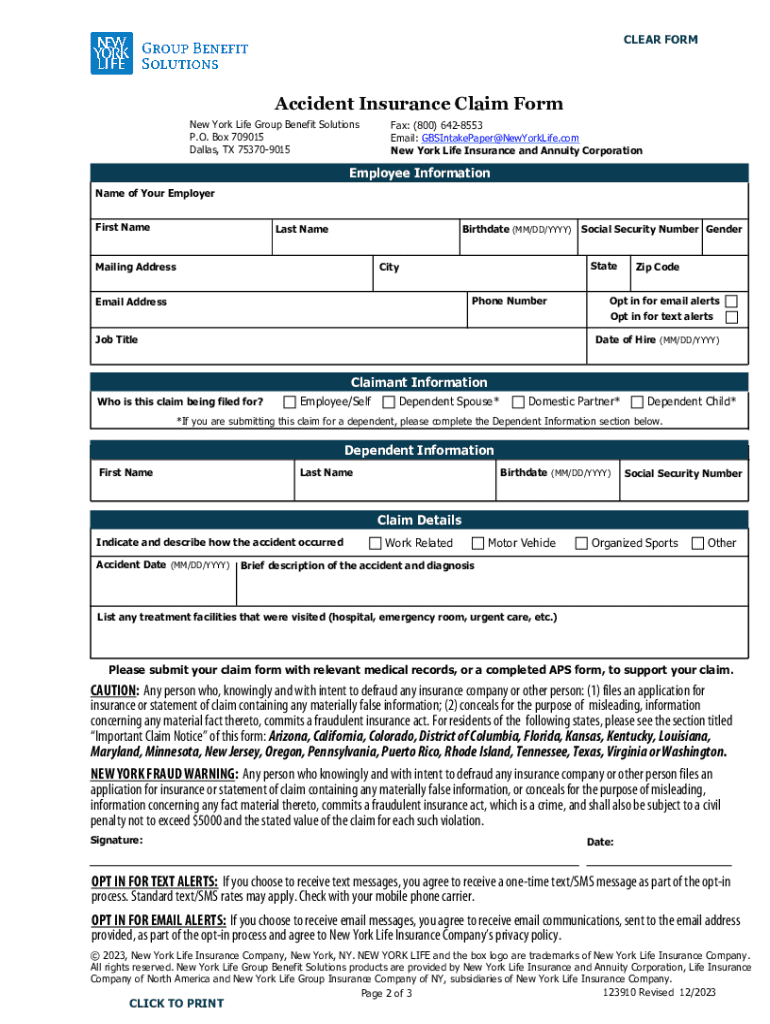

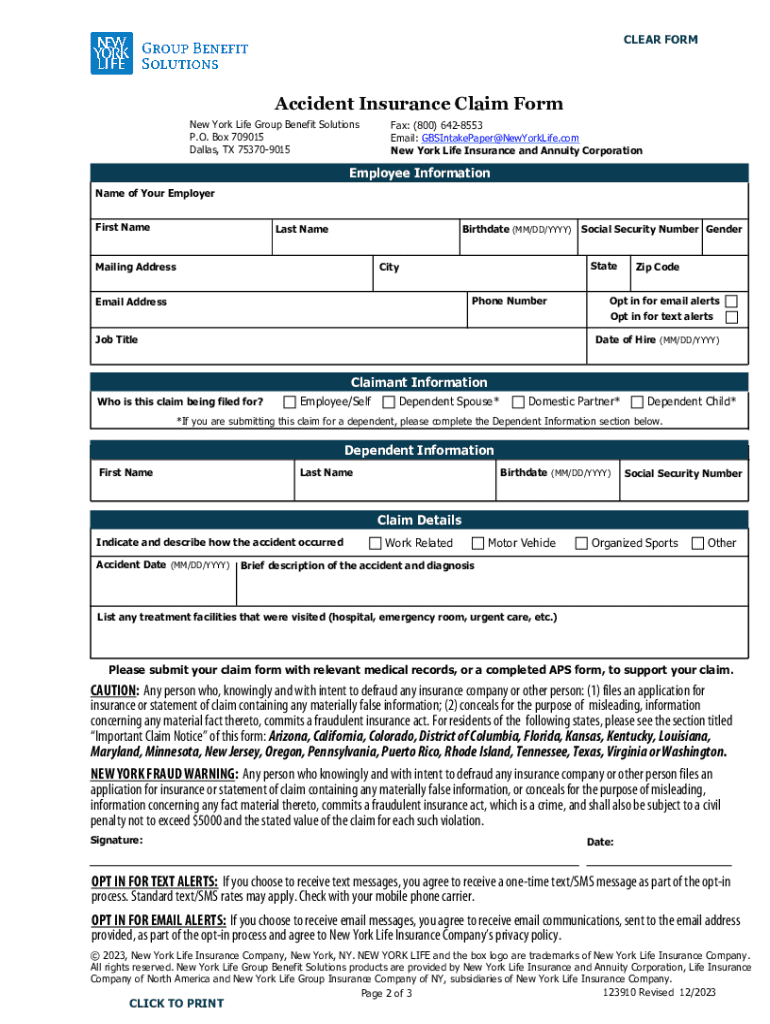

Key components of an accident insurance claim form

An accident insurance claim form typically requires several important pieces of information. Completing the form accurately is vital to avoid claim delays. The first section usually involves basic information about the claimant. This includes personal details such as the claimant's name, address, and contact information, as well as relevant details about the insurance policy, including policy number and coverage type.

In addition to basic information, detailed accident descriptions are critical. Clearly outlining the accident's circumstances, including date, time, location, and contributing factors, can greatly influence the claims process. Accuracy in this section is key, as ambiguous or incorrect details can complicate claims.

Step-by-step guide to filling out your accident insurance claim form

Before filling out the form, gather all necessary information to ensure a smooth submission. This includes personal identification, accident-related documents, and any relevant evidence. Create a pre-claim checklist to keep track of what you need, making the process more organized.

Filling out the form involves addressing several sections methodically. Start with your personal information, providing accurate and updated contact information. Follow this with accident details, succinctly summarizing what happened, the parties involved, and the witnesses present. Lastly, make sure to include any supporting evidence related to your claim, which enhances its credibility.

Editing and managing your claim form with pdfFiller

Once you’ve filled out your accident insurance claim form, utilizing pdfFiller can enhance the editing process. This platform allows users to edit forms seamlessly, adding or removing information as needed. You'll find options to insert signatures and comments directly onto the document, streamlining your workflow.

Moreover, collaborating with stakeholders like insurance agents is easier with pdfFiller. The platform enables secure sharing of your claim form, ensuring that necessary parties have access for review or further documentation without compromising security.

Submitting your claim form

After completing your accident insurance claim form, choose your submission method. Most insurers now allow online submissions via their portals, offering a swift way to send your documents. Alternatively, if you prefer traditional methods, you can mail a physical copy of your claim form. Ensure you use the correct address and send it via a reliable mailing service.

Once submitted, following up on your claim is crucial. Many insurers provide a tracking system so you can check the progress. Prolonged delays can often happen, so understanding the typical timeline for processing claims allows you to anticipate when to reach out for updates.

Common pitfalls and how to avoid them

Many claims face denial due to preventable errors. Incomplete forms are a major reason for rejection, making thoroughness in completion vital. It's important to review your form meticulously before submission, ensuring every section is filled out and no required documents are omitted.

Maintaining organization throughout the process can prevent critical oversights. Keep a record of all communications related to your claim, including dates and details of conversations, to assist if you need to contest a decision or provide additional information.

Enhancing your claim strategy with pdfFiller

Using a comprehensive document solution like pdfFiller can significantly streamline your claims process. The ability to create, edit, and manage documents in one place minimizes complications and maximizes efficiency. You can also customize templates for future claims, saving time and simplifying your workflow.

Interactive tools within pdfFiller further increase your efficiency. Features like collaborative editing allow multiple parties to contribute to the claim form simultaneously, fostering effective teamwork particularly beneficial for families or teams handling claims together.

FAQs about accident insurance claim forms

Often, individuals have questions regarding accident insurance claim forms that can lead to confusion. One common query is about the timeframe for claims processing, which can vary significantly based on the insurer and the complexity of the case. Understanding these nuances can help set realistic expectations.

Another frequently asked question pertains to what happens if your claim is denied. Knowing the appeals process ahead of time can prepare you for potential hurdles and allow you to act swiftly should you need to contest a decision. Individuals should be aware that additional documentation or clarifications might be required during this stage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my accident insurance claim form in Gmail?

How do I make edits in accident insurance claim form without leaving Chrome?

How do I edit accident insurance claim form straight from my smartphone?

What is accident insurance claim form?

Who is required to file accident insurance claim form?

How to fill out accident insurance claim form?

What is the purpose of accident insurance claim form?

What information must be reported on accident insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.