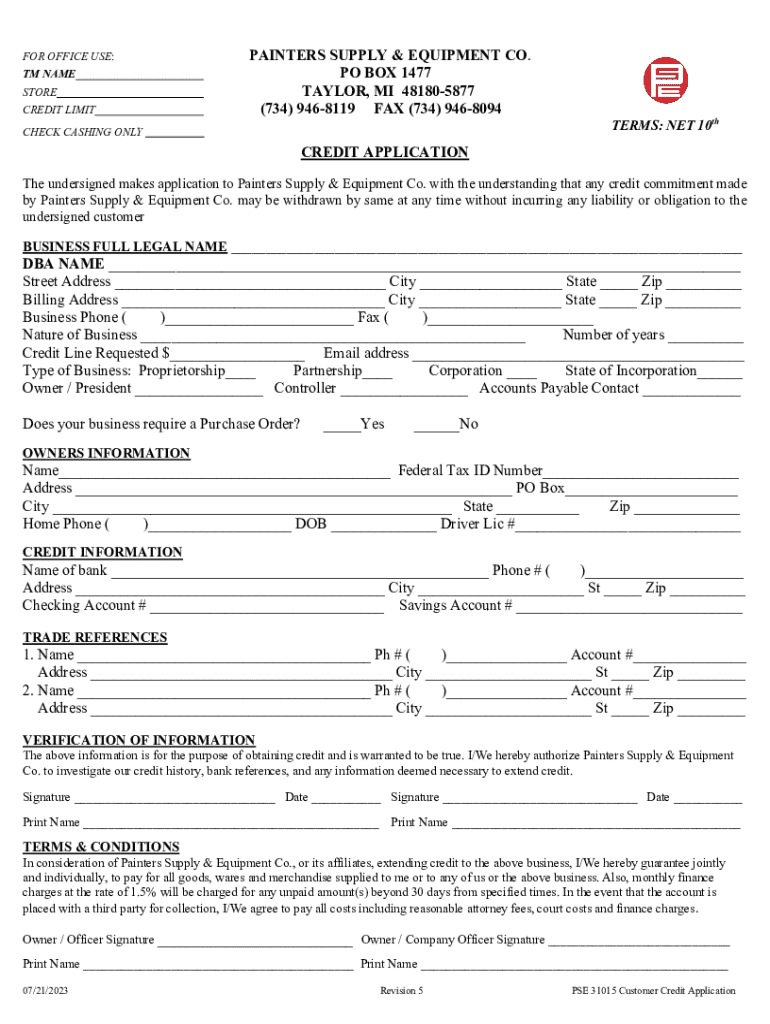

Get the free Pse 31015 Customer Credit Application

Get, Create, Make and Sign pse 31015 customer credit

How to edit pse 31015 customer credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pse 31015 customer credit

How to fill out pse 31015 customer credit

Who needs pse 31015 customer credit?

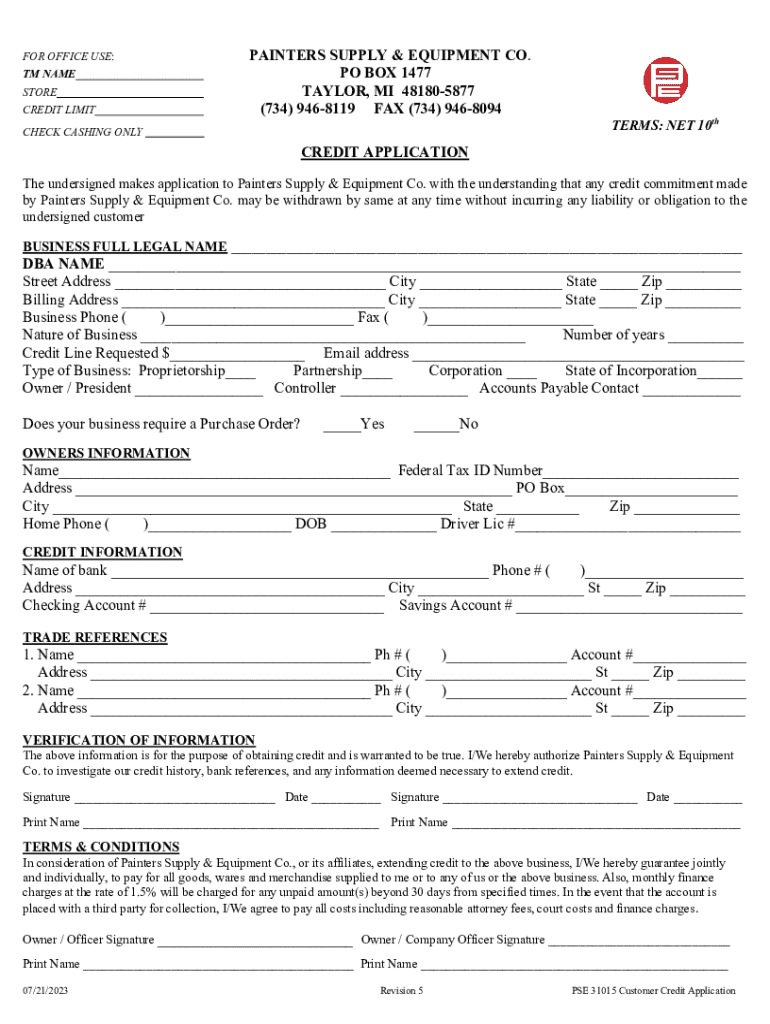

Comprehensive Guide to the PSE 31015 Customer Credit Form

Understanding the PSE 31015 customer credit form

The PSE 31015 form is a vital document utilized primarily in credit applications for both individuals and businesses. Its primary purpose is to assess the creditworthiness of applicants, enabling financial institutions and service providers to make informed lending decisions.

The significance of the PSE 31015 lies in its detailed format, which gathers comprehensive information on an applicant’s financial background. This, in turn, allows companies to manage their risk effectively while extending credit.

Who uses the PSE 31015 form?

The PSE 31015 form is utilized by a variety of users, both individuals seeking personal loans and businesses applying for larger credit facilities or lines of credit. Banks, credit unions, and independent lenders frequently require this form as part of their due diligence processes.

Also, many corporations need to fill out this form when applying for vendor financing or establishing credit with suppliers. Its widespread application underscores its importance in various financial transactions where credit is involved.

Key terminology

Familiarizing yourself with certain terms is crucial when dealing with the PSE 31015 form. Here are some key terms essential to understanding the document:

Preparing to fill out the PSE 31015 form

Before filling out the PSE 31015 form, it's essential to gather all necessary information and required documents to streamline the process. This preparation will not only make the completion more efficient but also reduce the likelihood of errors that could delay your credit application.

Key financial information needed generally includes your current income, credit history, employment status, and existing debts. Additionally, identification documents such as a government-issued ID, social security number, and proof of residence are also typically required.

Understanding the requirements

Eligibility criteria can vary based on the institution, but common requirements include being of legal age, having a stable income source, and possessing a satisfactory credit history. A thorough understanding of these requirements will help you prepare a strong application.

Moreover, avoid common pitfalls such as providing inaccurate financial information, missing documents, or failing to sign the form. Taking the time to review your information before submission ensures a smoother approval process.

Step-by-step instructions on filling the form

Filling out the PSE 31015 form requires attention to detail. Here’s a section-by-section breakdown to guide you.

For clarity, here’s an example of completing the personal information section: Ensure that your name is written exactly as it appears on your identification document, and verify the accuracy of your contact details.

Tips for accurate information entry

Precision in data entry on the PSE 31015 form is critical. Errors can lead to application delays or even rejections. Always double-check your information before submission to ensure accuracy.

important tips include verifying all numerical data against your supporting documents and cross-references. Utilizing pdfFiller can help streamline this process, as it offers interactive tools that guide you through the entries, minimizing the risk of errors.

Using pdfFiller for ease of completion

pdfFiller provides a user-friendly platform to edit and fill out the PSE 31015 form online. With its seamless design, you can navigate the document easily without worrying about lost data or formatting issues.

The service includes interactive tools, such as auto-fill features, that can save time and ensure you complete every section accurately. It minimizes frustration with a step-by-step process that allows you to focus on inputting your information correctly.

Editing the PSE 31015 form

Once you've completed the PSE 31015 form, you may need to make edits. With pdfFiller, editing the document is straightforward. You can easily navigate back to any section, modify the required fields, and save the changes without hassle.

Additionally, collaboration features allow you to work with your team. Everyone can make and track changes in real-time, ensuring that every input is reflected accurately before final submission.

Collaboration features

When working within a team, the ability to collaborate on the PSE 31015 form can streamline the credit application process significantly. Through pdfFiller, team members can comment on sections, make suggestions, and finalize the document collectively.

This collaborative environment ensures that everyone has input into the final product, enhancing the quality of the submission and mitigating the risk of missing social security numbers or financial inputs.

Saving and version control

Keeping track of document versions is crucial, especially when multiple edits occur. With pdfFiller, you can save different versions of the PSE 31015 form, making it easy to revert to earlier drafts if needed.

This feature ensures you never lose your work and can review previous versions for accuracy. Maintaining a clear version history also helps if any misunderstandings arise during the credit application process.

Signing the PSE 31015 form

Once the PSE 31015 form is completed, the next step is signing it. Digital signatures are legally binding, making them a convenient option for completing your application without the need for printing and scanning.

Using pdfFiller, you can add your eSignature directly onto the document, saving time while ensuring that your signature is properly aligned. Signers can also use mobile devices to authenticate and sign, providing flexibility.

Submitting the PSE 31015 form

After successfully filling out and signing the PSE 31015 form, it's time to submit it. Submission methods may include online uploads to lenders, email submissions, or in-person deliveries, depending on the institution's requirements.

Be sure to familiarize yourself with the specific submission instructions provided by the lender to avoid delays. Some institutions might even provide a tracking system, allowing you to confirm that your form has been received.

Tracking your submission

Once submitted, tracking is wise to ensure your application is moving through the lender's process. pdfFiller can assist you in maintaining communication to confirm receipt and manage follow-ups effectively.

Understanding the standard processing times can help set your expectations. It's typical for credit applications to take several business days to weeks, depending on the lender’s policies and the completeness of submitted documents.

What to expect after submission

After submitting the PSE 31015 form, it’s important to stay informed. Lenders may reach out for additional information or clarifications to support their decision-making process.

This stage can be a bit anxious, but maintaining open communication and being prompt in responding to inquiries can significantly enhance your chances of a smooth approval process.

Managing your customer credit application

Post-submission management involves keeping meticulous records of the PSE 31015 form and any correspondence related to your application. This is particularly important if questions arise or if you need to reference specific details during follow-up communications.

With pdfFiller, you can easily store and manage all documentation related to your credit application, ensuring you can access everything in one place when needed.

Addressing common issues

Sometimes, applications may face rejections or require further clarification. Identifying common issues—such as discrepancies in financial records or missing signatures—can help preempt potential problems.

By using pdfFiller, you gain access to comprehensive tracking tools that can help diagnose any issues before they escalate. Staying proactive is key.

Utilizing pdfFiller for document management

The cloud-based platform of pdfFiller empowers users to manage their credit documents effectively. With organized folders and search features, finding a specific submission or related document is effortless.

You have the option to set reminders for follow-ups or re-application dates, which enhances your ability to manage your credit processes seamlessly.

Frequently asked questions (FAQs) about PSE 31015 customer credit form

Addressing common concerns can demystify the process surrounding the PSE 31015 form. Many applicants worry about the implications of mistakes made on the form or the speed of processing.

One of the most common misconceptions is that minor errors can lead to outright rejections; however, lenders are often willing to work with applicants to rectify issues if approached promptly.

Troubleshooting tips

For typical problems such as delayed responses or a lack of updates post-submission, keeping clear communication lines with the lender is essential. Confirm which contact methods yield responses.

Additionally, utilizing pdfFiller’s tracking capabilities can help identify if submission confirmation was received, providing peace of mind during the waiting period.

Additional features of using pdfFiller

pdfFiller offers enhanced document protection for sensitive information while you’re completing the PSE 31015 form. Ensuring that your data remains secure is a priority, particularly in financial applications.

Beyond security features, pdfFiller’s cloud-based accessibility allows you to take your documents anywhere, with compatibility across various devices. This ensures that you can manage your application anytime and from anywhere, making it a more convenient solution.

Integration with other tools

Moreover, pdfFiller integrates seamlessly with other applications and platforms, streamlining the document workflow. By linking pdfFiller with your email client or digital storage solution, you can enhance your productivity.

These integrations ensure that you can efficiently manage your credit applications and related documents, consolidating your efforts into a single user-friendly ecosystem.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pse 31015 customer credit to be eSigned by others?

How can I get pse 31015 customer credit?

How do I edit pse 31015 customer credit online?

What is pse 31015 customer credit?

Who is required to file pse 31015 customer credit?

How to fill out pse 31015 customer credit?

What is the purpose of pse 31015 customer credit?

What information must be reported on pse 31015 customer credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.