Get the free Business Tax Receipt Application

Get, Create, Make and Sign business tax receipt application

Editing business tax receipt application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax receipt application

How to fill out business tax receipt application

Who needs business tax receipt application?

A comprehensive guide to the business tax receipt application form

Understanding the business tax receipt (BTR)

A Business Tax Receipt (BTR), often referred to as a business license or permit, serves as an official acknowledgment from the local government granting permission to operate a business within a certain jurisdiction. This document is essential for maintaining compliance with local regulations and ensures that businesses operate within established legal boundaries. Without a BTR, business operations may be deemed illegal and subject to penalties, fines, or closure by local authorities.

Securing a BTR helps establish credibility with customers and investors, providing a sense of legitimacy while also meeting municipal requirements. It includes important information such as the business name, address, type of business, and owner details. Understanding the specific legal requirements for obtaining a BTR can save a significant amount of time and resources, making it a crucial step for anyone looking to start or operate a business.

Eligibility criteria for applying for a business tax receipt

Before starting the application process for a Business Tax Receipt (BTR), it's vital to determine whether your business is eligible. Generally, most traditional businesses, whether sole proprietorships, partnerships, or corporations, will require a BTR. This includes retail stores, restaurants, home-based businesses, service providers, and many others, reflecting a wide range of industries.

However, there are exceptions. Non-profit organizations and governmental agencies often do not need to apply for a BTR. Additionally, certain small businesses may qualify for exemptions based on factors such as size, revenue, or operational scope. Understanding these criteria can streamline the application process, preventing unnecessary delays or complications.

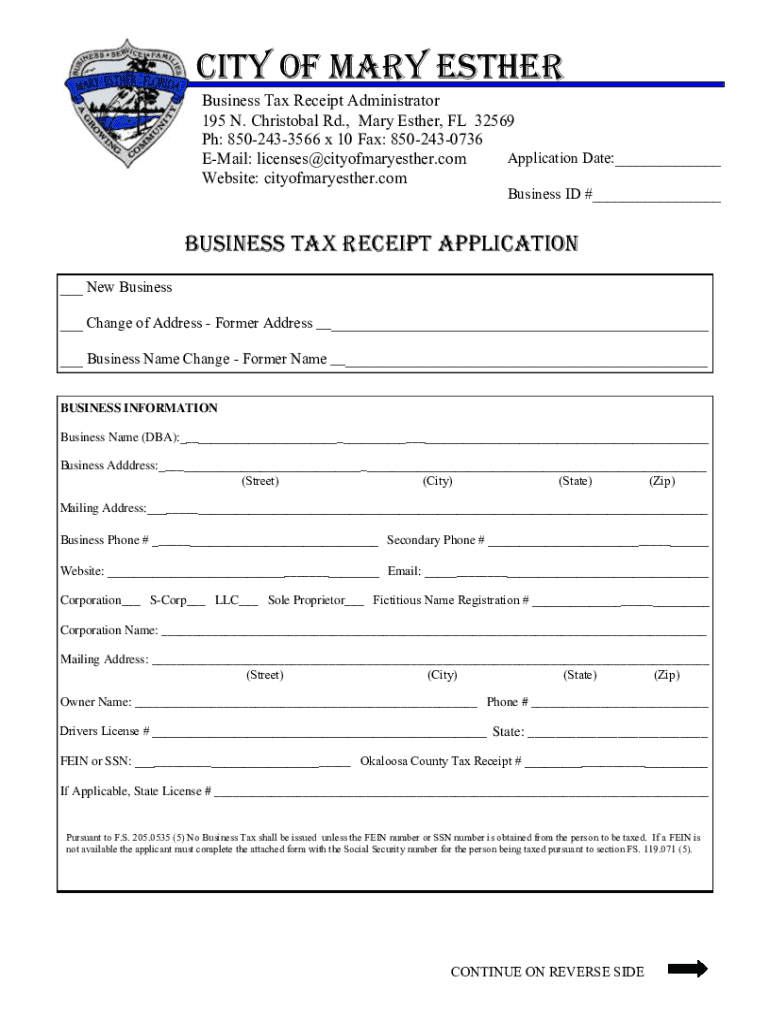

Collecting necessary documents for the BTR application

Gathering all necessary documents is a critical step in the business tax receipt application process. Ensure that you prepare and organize all relevant paperwork beforehand to facilitate a smooth application. The documentation requirements may vary slightly from one jurisdiction to another. However, several key documents are commonly required.

Typically, you will need identification documents for the business owner, proof of business ownership such as a business license or registration, and documentation verifying your business address, such as a utility bill or lease agreement. Organizing these documents efficiently can prevent delays in processing your application.

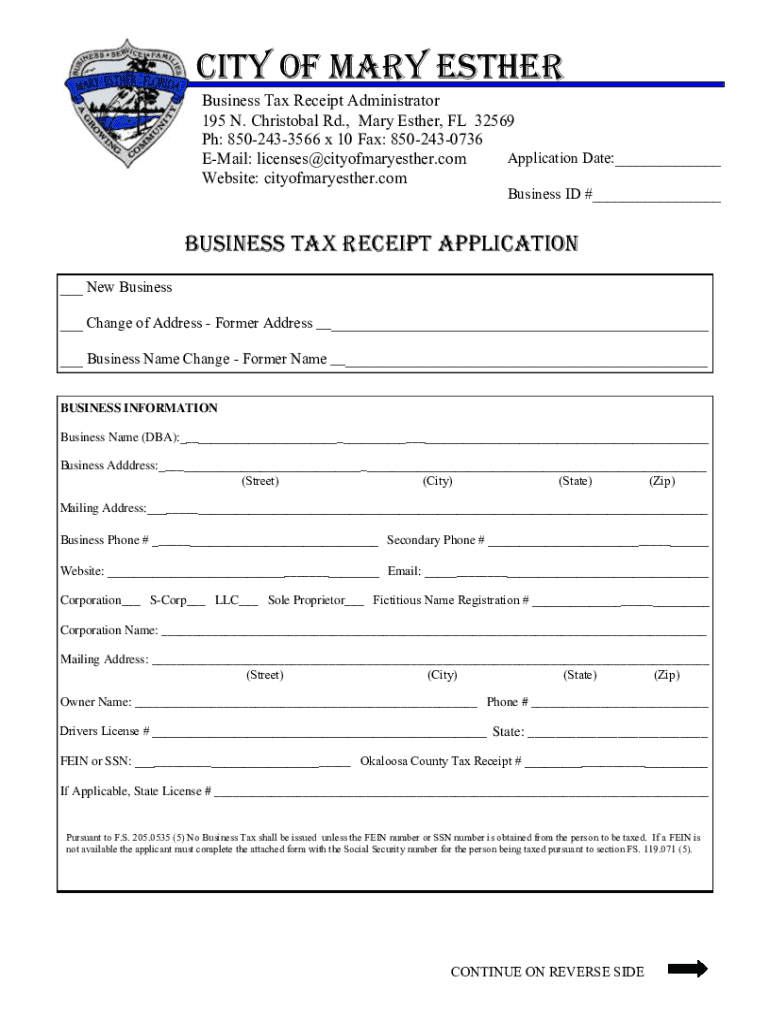

Preparing your information for the application form

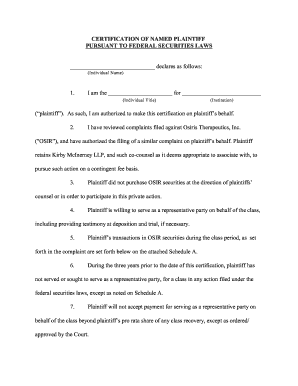

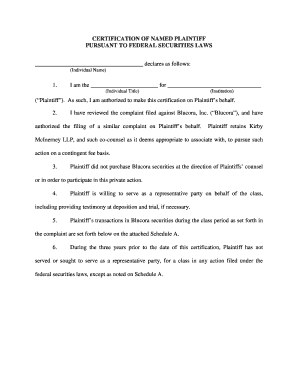

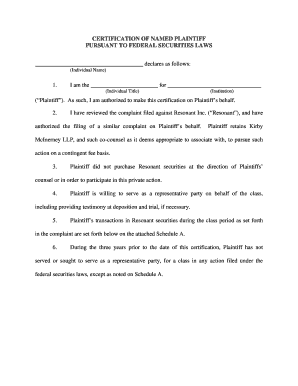

Filling out the business tax receipt application form correctly is crucial. You will typically need to provide specific information about the business, including the business name, its legal structure, the type of services offered, and the principal place of business. It’s essential to ensure that all details are accurate and consistent with documents you’ve prepared.

Common application fields may also require personal details, such as the owner's contact information and background. Additionally, be prepared to provide your business’s operational nature. Being thorough and precise in this section will not only expedite the process but also reduce the likelihood of application rejection due to inaccuracies.

Step-by-step guide to completing the business tax receipt application form

The process of submitting a business tax receipt application form can be conducted both online and offline, depending on the local government’s procedures. One efficient way to apply is through platforms like pdfFiller, which provides an easy-to-navigate application portal that streamlines the online process.

For online applications, simply access the pdfFiller portal, select the business tax receipt form, and fill it out using the information you've prepared. The portal allows you to upload all necessary documents directly. For those preferring the offline method, you can download the form, fill it out manually, and submit it via mail or in person at local government offices.

Addressing common issues during the application process

During the application process, you may encounter various challenges, such as missing information or errors within the form. To avoid these problems, double-check the completion of each section and ensure all uploaded documents are correctly labeled. It’s also advisable to keep notes on the specific requirements of your local jurisdiction, as these can vary.

Should you face issues or have questions, don’t hesitate to reach out for assistance. Most local government offices have dedicated customer support systems in place, which can include phone lines, email support, and even online chat. Utilizing these resources can help clarify any uncertainties and facilitate quicker resolution of issues.

Finalizing your business tax receipt application

After completing the application, take the time to review the submitted information thoroughly. Check for any discrepancies that could lead to processing delays. Once satisfied with the information, submit your application according to your local protocol, whether online or offline. Be sure to retain a copy of your submission for your records.

Following submission, processing times can vary significantly depending on local workload and administrative efficiency. Typically, applicants can expect to receive confirmation via email or postal mail, outlining the status of their application and any further steps required, including payment deadlines or additional documentation if needed.

Payment for your business tax receipt

An essential component of the business tax receipt application is the payment of processing fees. These fees can vary widely depending on the type of business and jurisdiction, so it's important to familiarize yourself with the cost structure applicable to your situation. Depending on your area, fees may cover the initial licensing, annual renewals, and any additional permits required.

When it comes to payment methods, many jurisdictions now offer various options, including online payment through platforms like pdfFiller, which simplifies the process with secure transactions. For those preferring traditional methods, payments can also typically be made by mail with a check or in-person at local government offices.

Post-application steps: receiving and managing your business tax receipt

Once your application has been processed and approved, you will receive your business tax receipt. Understanding the nuances of your receipt is vital for compliance and operational use. Typically, this document outlines key details about your business and often includes a renewal date, ensuring that you can stay compliant moving forward.

Renewal of your BTR is usually required on an annual basis, although some jurisdictions may have longer intervals. Maintaining organized records will assist greatly with timely renewals. Utilizing a document management tool like pdfFiller can help keep your receipt and all relevant documents readily accessible, ensuring you never miss a renewal date or have to scramble to find necessary paperwork.

Frequently asked questions (FAQs) about the BTR application process

As with any bureaucratic process, the journey towards obtaining a business tax receipt can raise a multitude of questions. Understanding the common queries and answers can ease apprehensions and provide clarity regarding timelines, modifications, and renewals. Ensure you explore local government resources which often include comprehensive FAQ sections tailored to address concerns specific to your area.

Some frequent questions include application timelines, how to make changes to already submitted applications, and the renewal processes. Always ensure that you have up-to-date information from reliable sources, as regulations and requirements can vary significantly from one locality to another.

User stories and testimonials on using pdfFiller for BTR applications

Utilizing pdfFiller for your business tax receipt application has proven advantageous for many users. Testimonials showcase how the cloud-based platform simplifies document management, leading to expedited applications and overall user satisfaction. From those who previously agonized over cumbersome paperwork to new entrepreneurs embracing digital solutions, the feedback highlights a common theme: efficiency.

Users have reported that the ease of filling, signing, and submitting documents online not only saves time but also reduces stress related to government processes. By harnessing the power of pdfFiller, applicants streamline their experiences, making the challenging aspects of bureaucracy manageable.

Relevant links and resources for business owners

Business owners must navigate a landscape filled with regulations and requirements. It's invaluable to have access to useful resources that can address various needs related to starting and maintaining a business. In addition to local government resources, business owners may benefit from information on compliance, management tools, and support networks.

Whether it's legal compliance resources, training programs, or networking opportunities, understanding where to find reliable information can empower business owners to operate efficiently and stay informed about updates pertinent to their operations.

Engagement and social community

The business community thrives on interaction and shared experiences. Engaging on social media platforms can provide additional insights and support not just for your business tax receipt application journey but for your overall business operations. Sharing your experiences can foster a sense of community and encourage others facing similar challenges.

Participating in discussions and following relevant pages or groups can keep you informed about updates, regulatory changes, or tips shared by fellow business owners. Sharing your own journey can inspire others to navigate their own application processes with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tax receipt application for eSignature?

How do I execute business tax receipt application online?

How do I make edits in business tax receipt application without leaving Chrome?

What is business tax receipt application?

Who is required to file business tax receipt application?

How to fill out business tax receipt application?

What is the purpose of business tax receipt application?

What information must be reported on business tax receipt application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.