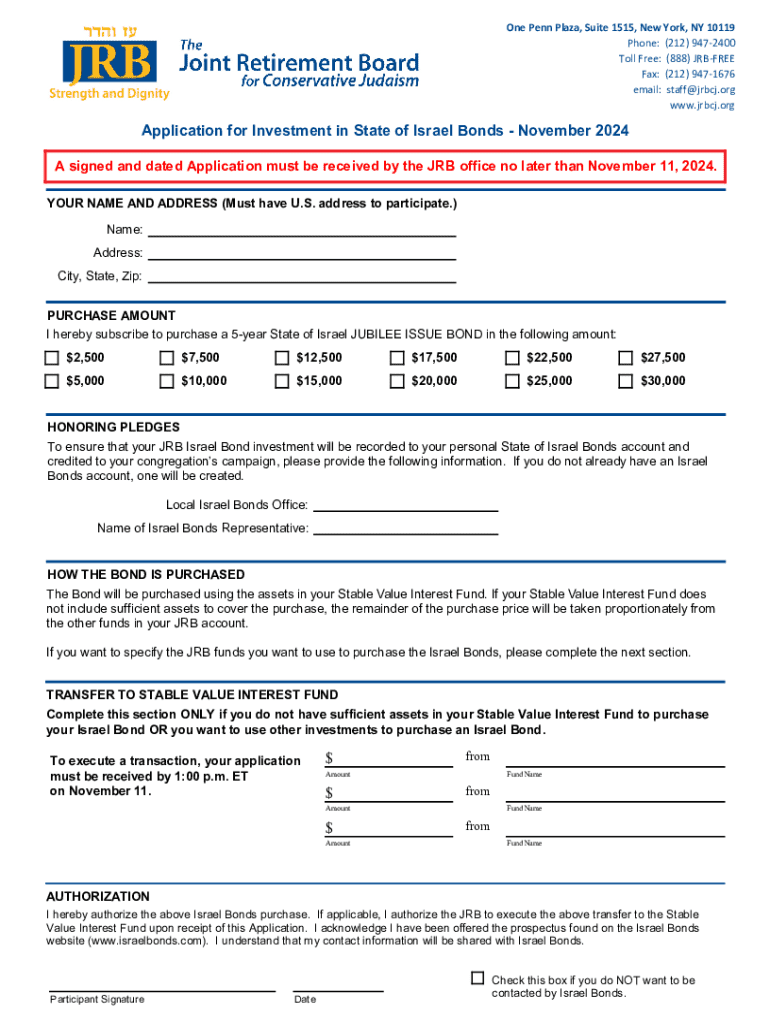

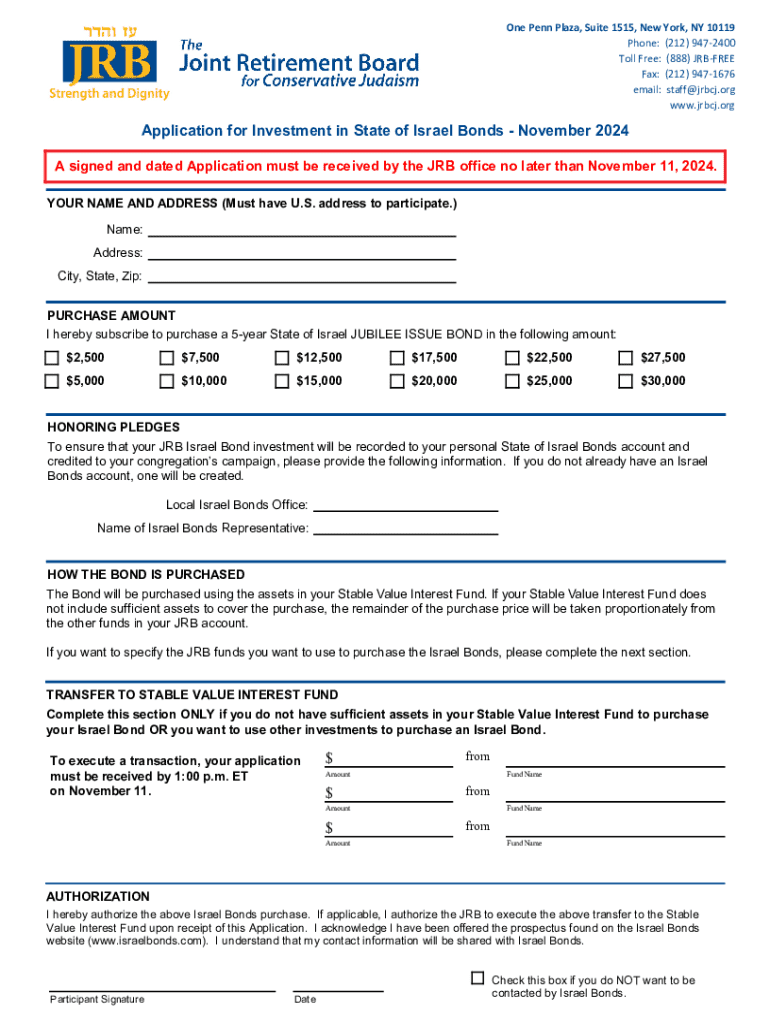

Get the free Application for Investment in State of Israel Bonds - November 2024

Get, Create, Make and Sign application for investment in

Editing application for investment in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for investment in

How to fill out application for investment in

Who needs application for investment in?

Application for Investment in Form: How to Guide Long-read

Understanding the investment application process

An investment application form serves as a crucial document that individuals and organizations complete when seeking to invest capital. This form consolidates personal and financial information to assess the investor's suitability for specific investment products. From hedge funds to real estate investments, these forms are prevalent across diverse industries, defining the initial steps in creating a trusted partnership between investors and providers.

Completing the investment application form accurately is imperative. Inaccurate information can lead to application rejection, potential legal issues, or unfavorable investment outcomes. On the other hand, thorough documentation enhances trustworthiness and facilitates smoother processing, establishing a solid foundation for professional relationships.

Essential components of the investment application form

When filling out an investment application, precise sections must be completed, including personal information, financial information, and investment details. The personal information section collects essential identifying details such as your name, contact information, and residency status. Ensuring accuracy in this section is crucial, as misentering data can delay the process.

The financial information section requires you to document your income sources and previous investments. Providing detailed financial statements aids the reviewing body in evaluating your financial health, which is vital for investment decisions. Lastly, the investment details will necessitate you to specify the amount and type of investment, allowing you to articulate your risk tolerance and investment preferences clearly.

Step-by-step guide to filling out an investment application form

Before tackling the form, preparation is essential. Gather documents that reflect your identity, financial background, and investment goals. A checklist of typical documents might include: recent bank statements, pay stubs, tax returns, and existing investment portfolios. Organizing these documents ahead of time will streamline the application process.

As you begin filling out the form, focus on each section methodically. For instance, when completing personal information, ensure names are spelled correctly and all contact information is accurate. Similarly, in the financial information section, provide a breakdown of assets and liabilities — for instance, listing your property holdings, retirement accounts, and other securities. When specifying investment opportunities, reflect on your risk profile and select investments that align with your comfort level.

Common pitfalls during completion can significantly hinder successful submissions. Common errors include omitting required fields, providing inconsistent information, and submitting outdated financial statements. A quick review of your application can help you identify and rectify these mistakes before submission.

Editing and reviewing your application

Before you submit your application, thorough review is essential. Submitting inaccurate information can not only delay your application but also result in its outright rejection. Utilizing pdfFiller’s editing tools allows you to seamlessly revise your document, ensuring everything is up-to-date and accurate.

Having the ability to collaborate with others can also enhance the review process. pdfFiller offers various features that facilitate comments and suggestions, allowing for a well-rounded final document. This is especially useful if you're working as part of a team, as feedback from multiple perspectives can lead to a more robust application.

Completing the application with digital signature

Incorporating an eSignature into your application adds a layer of professionalism and is legally valid in most jurisdictions. The process of creating an eSignature with pdfFiller is straightforward. You can choose to draw your signature, upload an image, or use a pre-existing font that mimics a handwritten signature.

After crafting your signature, applying it to the document is typically streamlined. Ensure you place your signature in the appropriate section of the document, as misplacement can lead to delays and other complications.

Submitting your application

Upon completion, you have multiple submission methods. You can opt for online submission, which is usually faster and allows for immediate confirmation, or choose physical mailing, which may take longer but might be required under certain circumstances. Weigh the pros and cons: online methods generally allow tracking and immediate follow-up, while physical methods may feel more formal but can also risk delays.

Regardless of the method chosen, tracking your application status afterward is vital. Utilize digital tools provided by your investment platform to monitor submission status updates to ensure you are promptly informed of any changes or requirements.

Managing your submitted application

Once submitted, it's essential to understand the typical timelines for application processing. Depending on the nature of the investment, you may expect reviews to take anywhere from a few days to several weeks. Be prepared for communication and possible follow-up requests for further information.

pdfFiller also provides superb document management features post-submission. You can easily store, retrieve, and collaborate on documents directly within the platform, which simplifies ongoing management of your investment-related paperwork.

FAQs about investment application forms

As with any process, questions often arise. If your application happens to be rejected, it is essential to reach out to the investment firm to understand the reasons behind the rejection. Inquire about rectify any misunderstandings or gather insights on how to strengthen your application for resubmission.

Additionally, updating your application post-submission is generally contingent upon the policies of the investment firm. Familiarize yourself with these procedures beforehand to ensure compliance. For specialized assistance, contact your investment firm's customer support, who can guide you through specific processes.

Conclusion

Navigating the investment application landscape can seem daunting; however, with the right tools and guidance, it becomes manageable. pdfFiller simplifies the investment application form process, allowing you to focus on your financial goals rather than paperwork. Embracing these tools empowers you to take charge of your investment journey with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find application for investment in?

How do I complete application for investment in online?

Can I create an electronic signature for the application for investment in in Chrome?

What is application for investment in?

Who is required to file application for investment in?

How to fill out application for investment in?

What is the purpose of application for investment in?

What information must be reported on application for investment in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.