Get the free Dso Form (rev. 2-25)

Get, Create, Make and Sign dso form rev 2-25

Editing dso form rev 2-25 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dso form rev 2-25

How to fill out dso form rev 2-25

Who needs dso form rev 2-25?

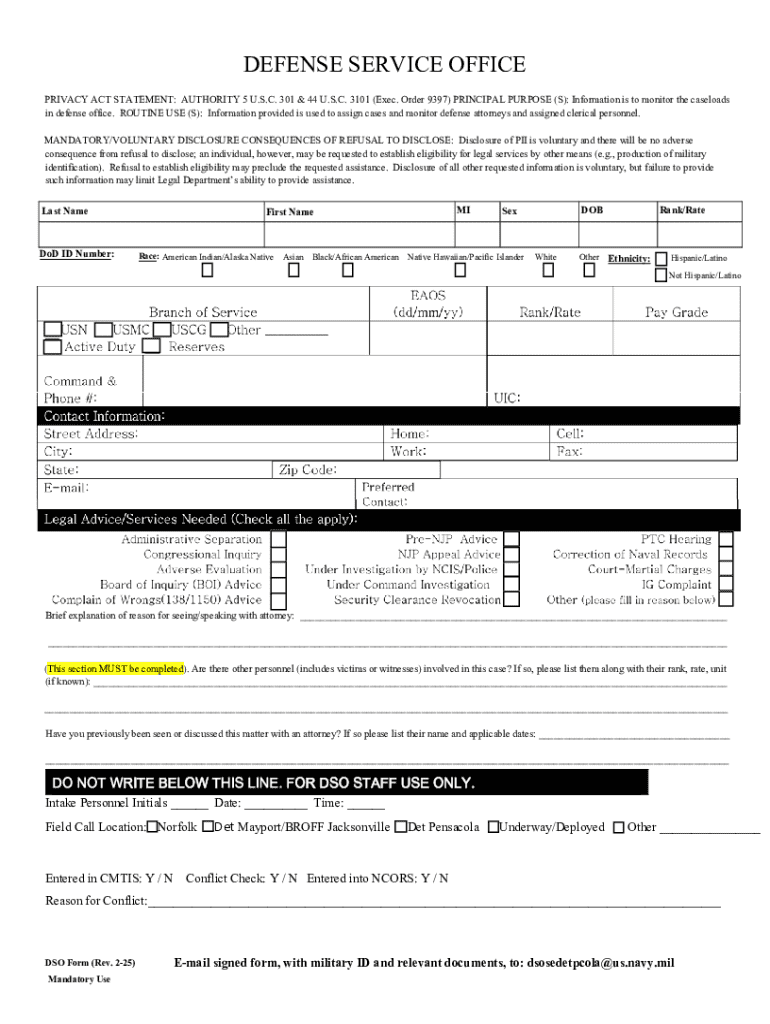

A Comprehensive Guide to the DSO Form Rev 2-25 Form

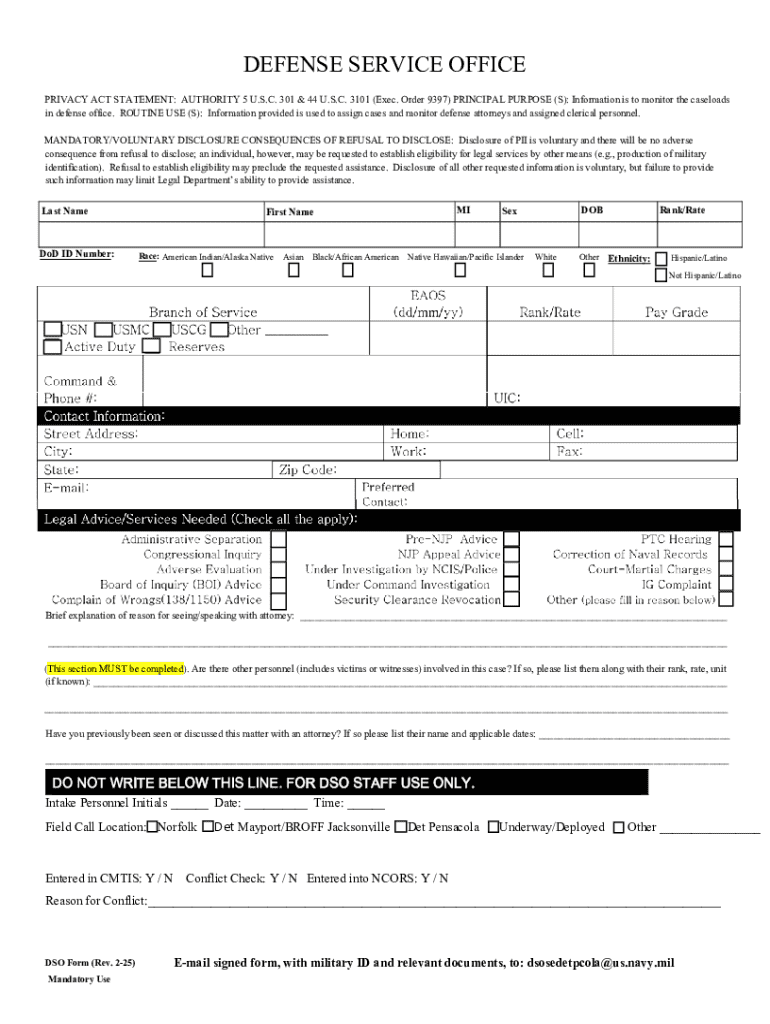

Understanding the DSO Form Rev 2-25

The DSO Form Rev 2-25 is a crucial document utilized in tax documentation, especially for individuals and organizations that need to report specific financial information to the IRS. This form allows filers to provide necessary declarations related to their tax status, ensuring compliance with federal regulations. The primary purpose of the DSO Form is to categorize and report income accurately, enabling both the tax authorities and the taxpayers to maintain transparent and effective financial records.

The DSO Form Rev 2-25 is a cornerstone for accurate tax submissions, impacting how both individuals and organizations manage their tax liabilities. It serves as a formal declaration mechanism for reporting financial standing, which is essential for maintaining good standing with the IRS. By completing this form, filers help the IRS verify their tax returns against reported income and expenses, reinforcing the integrity of the tax system.

Who Needs to Complete the DSO Form Rev 2-25?

Various individuals and entities may be required to complete the DSO Form Rev 2-25, particularly those involved in freelance work, independent contracting, or any situation where income must be reported to the IRS. This includes self-employed individuals, small business owners, and even certain non-profit organizations that receive specific forms of revenue. Moreover, teams within larger corporations may need to use this form to consolidate financial data related to independent contractors or various compliance needs.

In essence, anyone whose financial information must be officially documented and reported falls under the category of needing this form. It is imperative for such individuals and organizations to understand their responsibilities in regard to this form, ensuring that they adhere to the necessary tax regulations imposed by federal authorities.

Accessing the DSO Form Rev 2-25

Finding the DSO Form Rev 2-25 online is straightforward, as it is readily available on the IRS website and various other platforms that specialize in document management. pdfFiller offers a convenient option to access the form directly as a PDF, allowing users easy download and print capabilities. To locate the form, navigate to the IRS forms section or access pdfFiller, wherein you can fill, edit, and manage the document without hassle.

To access the DSO Form Rev 2-25 through pdfFiller, you simply need to visit their site and search for the form in their template library. This user-friendly interface ensures that you can find and utilize the form efficiently. Below are links to expedite your search, with direct access to the relevant PDF versions available online.

Overview of the Form Layout

The DSO Form Rev 2-25 is structured to capture key information in a precise manner. The layout comprises various sections that need to be filled out correctly to avoid any delays or rejection of your submission. Key sections typically include personal information, declaration of income, purpose of submission, and a verification section to ensure all statements provided are accurate.

Each field is designed to capture specific data, prompting users with questions or statements to guide their entry. This logical sequence helps streamline the process, making it easier for both first-time and experienced users to navigate. Below are highlighted sections of the form layout that users should pay close attention to:

Filling Out the DSO Form Rev 2-25

Completing the DSO Form Rev 2-25 requires attention to detail. Start with the personal information section, ensuring you accurately provide your name, address, and any identifying numbers required. This foundational information is vital for the IRS to process your submissions correctly without any inaccuracies arising from misidentification.

Following the personal information, it's critical to clearly articulate the purpose of the form, which dictates the specific financial data you need to report. Whether you're declaring earnings, documenting expenses, or filing for credits, clarity at this juncture can save significant time and hassle down the line, resulting in fewer inquiries from the IRS.

Next, you should provide specific financial data, breaking down income sources, expenditures, and any other relevant figures as requested within the form. This section often leads to errors due to incorrect or incomplete entries, so thoroughness is essential.

Lastly, before submitting, a review and verification step is indispensable. It’s advisable to carefully check all entries for accuracy and completeness, possibly involving a second set of eyes to ensure no detail has been overlooked. This final step is crucial in avoiding common pitfalls that can invalidate your submission, such as mismatched numbers or missing signatures.

Common mistakes to avoid

When filling out the DSO Form Rev 2-25, several common mistakes can occur that may lead to complications during processing. One of the top errors is incorrect personal information, which can cause delays or even rejection of your form. Always ensure that your name, address, and identification numbers are accurate.

Another prevalent issue lies within the financial declaration section, where users often misreport income or fail to document all necessary figures. It's critical to cross-reference income statements, invoices, and any other financial records to ensure all entries match precisely.

One major issue can arise from neglecting to sign the form, which can render it incomplete. Always remember to provide signatures where necessary and verify that no sections have been overlooked. Taking the time to carefully review the filled-out DSO Form Rev 2-25 can save you from unnecessary complications when it reaches the IRS.

Editing the DSO Form Rev 2-25 with pdfFiller

pdfFiller offers a range of tools and features that make editing the DSO Form Rev 2-25 not only simple but also efficient. With its robust editing capabilities, users can easily fill out the form on their devices without the need for extensive paperwork. The text editing feature allows you to make necessary changes to the fields, and the form field management helps ensure accurate data entry.

Additionally, pdfFiller provides users with the ability to collaborate on the form, allowing multiple team members or advisors to provide input and comments. This collaborative effort ensures that the completed form benefits from collective oversight, which can substantially reduce the chances of error.

Collaborating on the form

Working collaboratively on the DSO Form Rev 2-25 is straightforward with pdfFiller. You can easily share the document with others, whether they are colleagues or tax advisors, to gather necessary inputs before finalizing the submission. This feature encourages an interactive editing process, where suggestions can be made in real time, significantly enhancing the quality of the completed form.

To facilitate collaborative efforts, utilize the commenting feature integrated into pdfFiller. Users can highlight sections and leave comments for others, fostering a constructive environment for revisions. This level of interaction helps maintain clarity and tracks changes made throughout the editing process, ensuring that everyone involved is aligned and informed.

Signing the DSO Form Rev 2-25

Signing the DSO Form Rev 2-25, particularly through electronic means, provides efficiency and convenience. The benefits of electronic signatures include significant time savings, as documents can be signed and submitted instantly, without the wait for physical delivery or appointment scheduling. Moreover, electronic signatures are legally recognized and carry the same weight as traditional handwritten signatures, ensuring adherence to legal standards.

Using pdfFiller for electronically signing the form is remarkably straightforward. Follow the platform's intuitive steps to sign the document digitally, ensuring your signature is clear and accurately reflects your name. It’s essential to ensure that not only your signature is complete but that other parties requiring signatures are also included, depending on your submission's requirements. This step ensures full compliance and expedites the overall filing process.

How to eSign the form using pdfFiller

To electronically sign the DSO Form Rev 2-25 using pdfFiller, begin by uploading the completed form to the pdfFiller platform. Navigate to the 'Sign' feature where you’ll see several options for placing your signature—either by drawing, typing, or uploading an image of your signature. Select your preferred method and place the signature in the designated spot on the document.

After signing, press the 'Finish' button, which will allow you to download the signed document or send it directly to recipients via email. If there are additional signatures required, pdfFiller enables you to add more signers, specifying their email addresses to send out requests directly, thereby streamlining the entire signing and submission process.

Managing the DSO Form Rev 2-25 post-submission

Once you’ve submitted the DSO Form Rev 2-25, it is important to understand what happens next. Typically, it takes a few weeks for the IRS to process submissions, during which time you can verify your submission status. Utilizing pdfFiller simplifies tracking, as you can store copies of submitted forms and any related correspondence securely.

To effectively manage your submitted documents, pdfFiller offers cloud storage solutions, allowing you to access your forms from anywhere. This capability ensures that your files are organized and easily retrievable, which becomes invaluable come tax season or if required for audits. Keeping a well-structured digital filing system in place ensures that managing forms like the DSO Form Rev 2-25 is straightforward and hassle-free.

Storing and retrieving your DSO Form

When dealing with forms like the DSO Form Rev 2-25, proper storage is vital. Using pdfFiller’s storage features enables users to not only keep the form secure but also categorize documents logically, making retrieval effortless. Consider setting up folders based on years or types of forms, ensuring that everything related to your tax documentation is structured and easy to find.

Furthermore, with pdfFiller’s search functionality, specific forms can be located quickly, saving time and reducing frustration. This ease of access is particularly beneficial during tax season when several documents may need to be referenced concurrently. Structuring your document management in this way not only saves time but also creates a stress-free organization for your important tax filings.

Frequently asked questions (FAQs)

Many users have queries regarding the DSO Form Rev 2-25, particularly concerning its completion and submission. One of the frequently asked questions is regarding the necessity of the form; numerous individuals wonder if they truly need it based on their income situations. Understanding whether your financial circumstances require submission of the DSO Form can help alleviate confusion.

Another common query pertains to troubleshooting, where users report errors while filling out the form. pdfFiller's support team is available to assist users experiencing difficulties and can provide guidance on common errors and how to fix them. Accessing help via pdfFiller's resources ensures that all users can complete their DSO Form Rev 2-25 accurately and efficiently.

Success stories and best practices

Real-life scenarios highlight the effectiveness of accurately completing and submitting the DSO Form Rev 2-25. Numerous users have reported successful processing of their forms thanks to proper adherence to guidelines and utilizing resources like pdfFiller. Such success stories emphasize the importance of following best practices, which can significantly reduce anxiety during tax season.

Incorporating organization and collaboration can further enhance your document management strategy. Teams that utilize pdfFiller for sharing forms have noted improved communication, leading to more accurate submissions and fewer revisions required. Developing a workflow that integrates document management tools with conventional practices can tremendously streamline the completion of the DSO Form Rev 2-25, making the process not only effective but also less daunting.

Pro tips for efficient document management

Employing efficient document management strategies can enhance overall productivity when dealing with forms such as the DSO Form Rev 2-25. Utilizing pdfFiller for not just this form but across various other documents can cultivate a cohesive workspace where all paperwork resides in a centralized location. Regularly updating your digital files and keeping them categorized makes retrieving critical documents a breeze and ensures that you are always prepared, especially during filing seasons.

Further, integrating document management solutions into personal or organizational workflows can facilitate greater collaboration while reducing errors. Encourage the use of digital signatures, comments, and shared access to create an environment where contributions from various members can result in better quality submissions. By adopting these best practices, you position yourself and your team for success with the DSO Form Rev 2-25 and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get dso form rev 2-25?

Can I edit dso form rev 2-25 on an iOS device?

How do I fill out dso form rev 2-25 on an Android device?

What is dso form rev 2-25?

Who is required to file dso form rev 2-25?

How to fill out dso form rev 2-25?

What is the purpose of dso form rev 2-25?

What information must be reported on dso form rev 2-25?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.