Get the free a bereavement instruction form is a crucial document detailing everything from funeral preferences to asset distribution msockid 2024471ed7ba650722e651bdd66d64fb

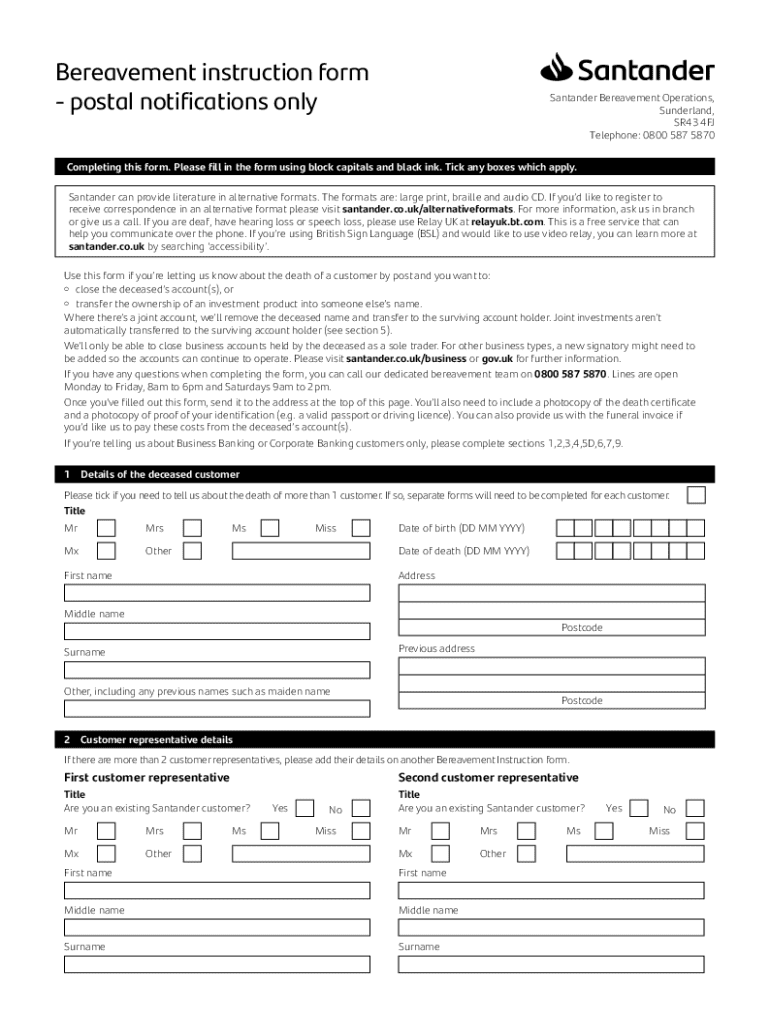

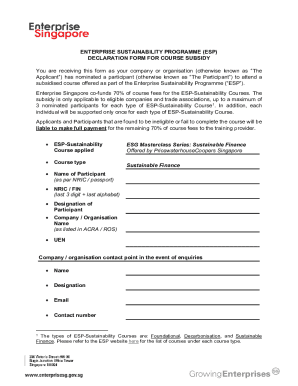

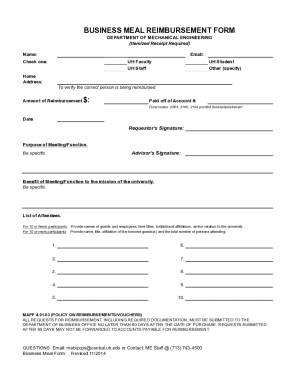

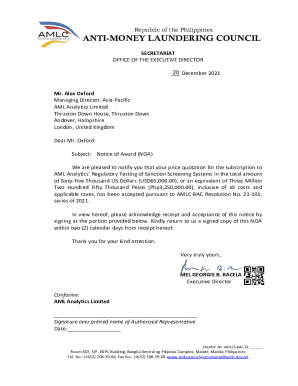

Get, Create, Make and Sign a bereavement instruction form

Editing a bereavement instruction form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a bereavement instruction form

How to fill out bereavement instruction form

Who needs bereavement instruction form?

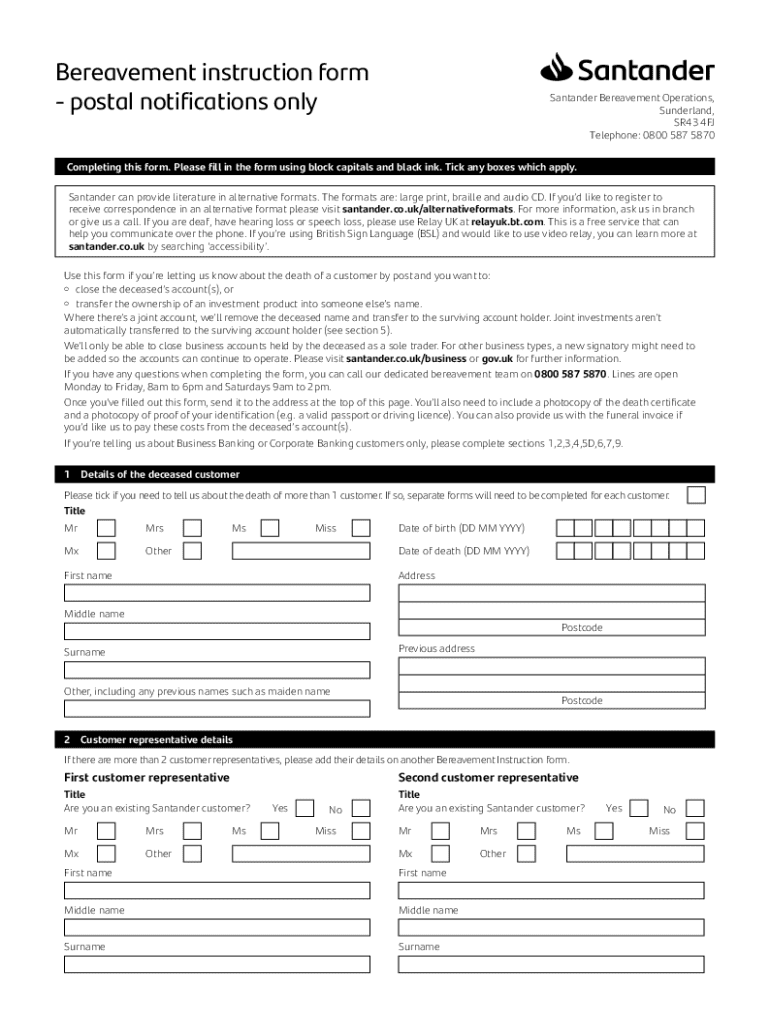

Comprehensive Guide to Completing a Bereavement Instruction Form

Understanding bereavement instruction forms

A bereavement instruction form is a crucial document that outlines your wishes and instructions regarding the arrangements after the passing of a loved one. It serves as a guide for executors and family members, detailing everything from funeral preferences to asset distribution. Having this form is essential as it can prevent confusion and ensure that the deceased’s wishes are honored. During a time of loss, emotions run high and decisions can be quite overwhelming. This form provides a structured way to navigate these difficult choices.

Initial steps to take upon a death

Upon the death of a loved one, several key steps should be taken immediately. The first is to notify the relevant authorities and contacts, such as family members, close friends, and local or state officials if necessary. Collecting essential documents is also crucial, starting with the death certificate, which is needed for legal processes. Additionally, gather identification documents for the deceased and yourself. Familiarize yourself with terms like 'executor', 'probate', and 'intestate' to better understand the proceedings ahead.

Completing your bereavement instruction form

Filling out a bereavement instruction form requires careful attention to detail. Begin by entering personal details of the deceased, including their full name, date of birth, and social security number. Next, designate the executor of the estate, a critical role responsible for administering the estate according to the deceased’s wishes. Include relevant financial information, such as bank accounts, assets, and liabilities. It's essential to read each section thoroughly and provide complete information to avoid delays in processing.

Submitting your bereavement instruction form

After completing the bereavement instruction form, it’s vital to ensure that supporting documentation is included. This primarily includes proof of death—usually the death certificate—along with any additional documents many financial institutions may require. When ready, send your form securely; using tools like pdfFiller can facilitate the submission process and reduce errors during email or online uploads.

After submission: what comes next?

Once your bereavement instruction form is submitted, expect confirmation of receipt from the institutions involved. Timelines for responses can vary, but generally, you can anticipate initial communications within a few weeks. During this period, start managing outstanding accounts and debts. Bank accounts typically get frozen temporarily, while you should contact credit card companies to discuss next steps—each financial institution will have a process related to the deceased’s accounts.

Financial matters after bereavement

Handling finances after a loss can be daunting, yet it is necessary. Initially, releasing funds to cover immediate costs like funeral expenses should be a priority. Bank accounts often require processes to allow access to funds for necessary expenses while managing ongoing costs like mortgage or rent. You may be able to claim funds through joint accounts or insurance policies, but it's essential to communicate with the right financial institutions to understand your options.

Legal and specialist support

When navigating bereavement, legal support may be necessary, especially in complex estates. Understanding the probate process—administrating a deceased estate and settling debts—is vital. This generally involves filing a petition with the probate court. Additionally, it's advisable to connect with specialized support services, which can assist in areas such as financial planning or emotional counseling during this challenging time, providing guidance tailored to individual needs.

Handling funeral arrangements

Funeral arrangements can be overwhelming, yet understanding different costs and financial support options can ease the burden. Planning this celebration of life involves crucial considerations, such as the location, type of service, and final resting place. In addition, it’s essential to research funeral providers and gather information about any services they offer to ensure they align with the deceased's wishes and your budget.

Managing property and estate

After a loved one's passing, handling real estate and property can be complex. Start by identifying whether properties are held solely in the deceased's name or jointly owned. Understand mortgages and the implications of joint vs. sole ownership; this will affect how you approach transfers and managing payments. Distribution of personal belongings should be conducted with care, based on the instructions laid out in the will or as agreed among heirs.

Specific considerations for financial institutions

Each financial institution will have policies in place regarding the handling of accounts post-death. For bank accounts, they may freeze access until the executor provides necessary documentation. Similarly, credit card accounts generally require contacting the issuer to explain the situation and understand the implications for joint or secondary cardholders. Important: be prepared to initiate claims for any life insurance policies to ensure financial responsibilities are met.

Practical and emotional support resources

As you navigate the bereavement process, numerous resources are available to provide emotional and practical support. Local grief counseling centers can offer services tailored to help cope with loss, while support groups allow you to connect with others experiencing similar feelings. Practical guides and online communities can also facilitate better decision-making during this challenging time, helping you find comfort and connection.

Useful contacts and tools

To make the bereavement process smoother, maintaining a list of useful contacts is essential. This should include numbers for banks, legal advisors, and funeral homes. Additionally, ensure you have all essential documents on hand during this period, such as the will, insurance policy details, and any relevant financial information. Utilizing digital tools, like those offered by pdfFiller, can help manage this paperwork effectively, allowing you to store and retrieve information securely.

Navigating your digital banking needs

Managing a loved one’s digital banking needs requires attention to several critical steps. Start by identifying which accounts are associated with the deceased, including email accounts related to banking. Assess how to securely manage or close these accounts, remembering that online financial institutions have specific protocols to verify identity and close accounts properly. Adhering to these protocols ensures that sensitive information remains secure and that access errors are minimized.

Pitfalls to avoid during the process

Many people encounter common pitfalls during the bereavement process. One major mistake is neglecting to double-check documentation; inaccuracies can lead to significant delays and complications. It's also crucial to ensure communication is clear among family members to avoid misunderstandings. Keep meticulous records of all actions taken and communications made to minimize confusion and maintain clarity throughout the process.

Frequently asked questions (FAQs)

During bereavement, many individuals have questions about specific procedures or legal matters. Common queries often revolve around how to manage debt, what to do with the deceased's online accounts, and the role of the executor. Understanding responses to these questions can provide clarity and assist in navigating the sometimes murky waters of estate management.

Expert guidance and support

Having expert guidance can make an immense difference during such a challenging time. Resources like pdfFiller simplify the process of creating and managing necessary documents, including the bereavement instruction form. By providing templates and tools for efficient management, pdfFiller empowers users to stay organized while making crucial decisions and allows for electronic signatures and document sharing, ensuring you’re supported every step of the way.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete a bereavement instruction form online?

How can I fill out a bereavement instruction form on an iOS device?

How do I edit a bereavement instruction form on an Android device?

What is bereavement instruction form?

Who is required to file bereavement instruction form?

How to fill out bereavement instruction form?

What is the purpose of bereavement instruction form?

What information must be reported on bereavement instruction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.